Do I Need a Tempe AZ IRS Tax Attorney for my IRS Tax Debt Resolution?

Tempe AZ IRS Tax Attorney ?

No, you don’t need to be represented by a Tempe AZ IRS Tax Attorney. IRS tax debt resolution is not a legal matter 99% of the time.

IRS tax debt resolution in Tempe AZ is best done by a professional with many years of successful IRS tax debts. Tax Debt Advisors, Inc. has resolved over 113,000 IRS tax debts since 1977. Scott Allen E.A. of Tax Debt Advisors, Inc. can do whatever you need to resolve your tax problem. If you have delinquent tax returns, he has expertise in filing late returns—even if the IRS has already filed substitute for returns. If you are not able to pay your balance due, Scott can negotiate a payment plan that works within your ability to pay. If you are not able to pay at all Scott will file an Offer in Compromise or qualify you for a CNC (Currently Not Collectible) status. If you paycheck or bank account has been levied, Scott Allen E.A. (near Tempe AZ) will get those levies released. The only way to know is to talk, or better yet meet face to face with Scott Allen E.A. He is available for a free consultation at 480-926-9300. Let Scott Allen E.A. make today a great day for YOU!

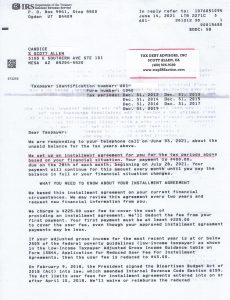

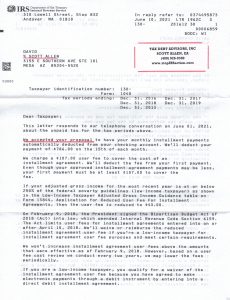

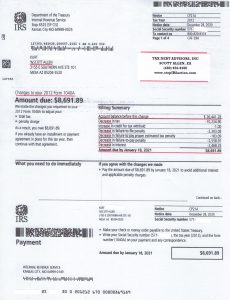

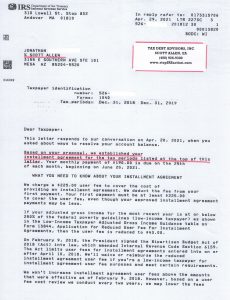

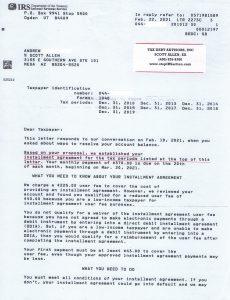

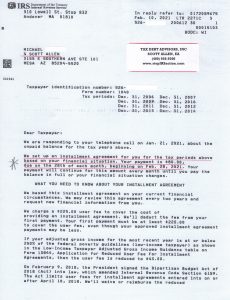

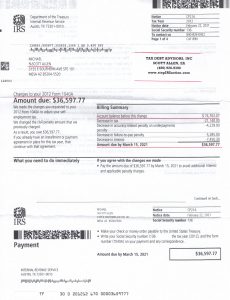

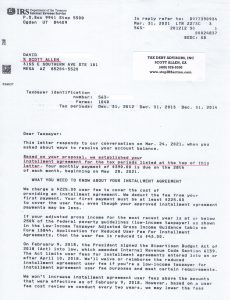

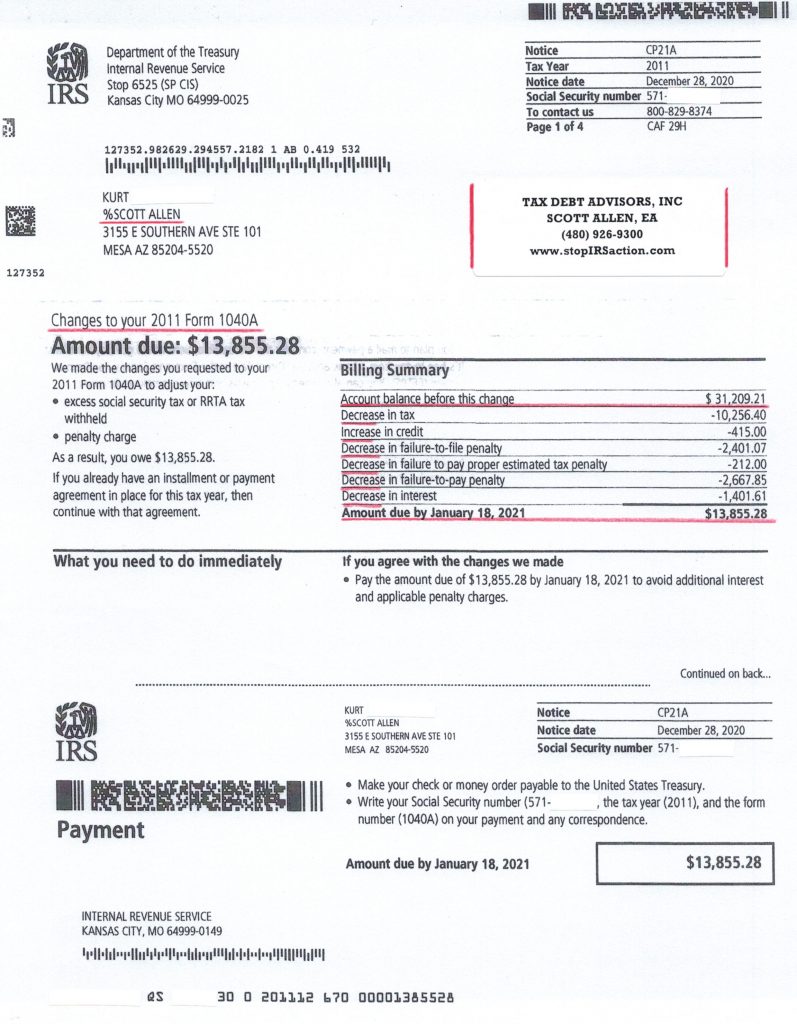

Candice settled her IRS Debt without using a Tempe AZ IRS tax attorney. Instead she used Scott Allen EA. Check out the settlement negotiated by clicking on the image below. That is the IRS agreement approval of a $400/month payment plan on seven years of back tax returns.