January 2016 Tax Debt Advisors Reviews

The best reviews are Tax Debt Advisors Reviews !

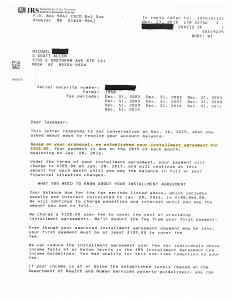

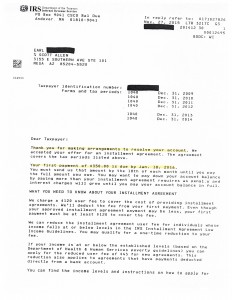

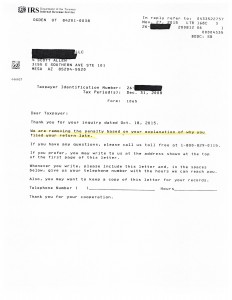

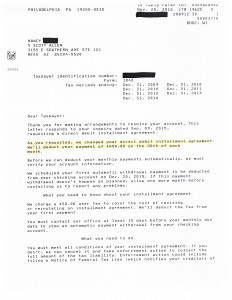

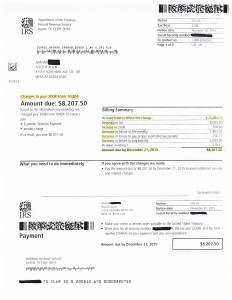

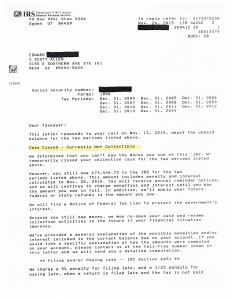

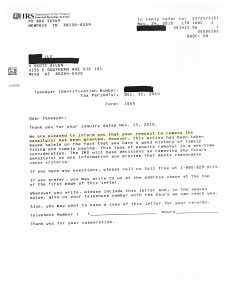

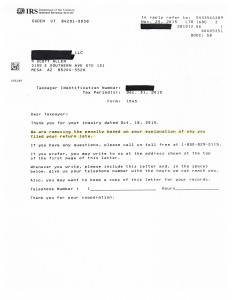

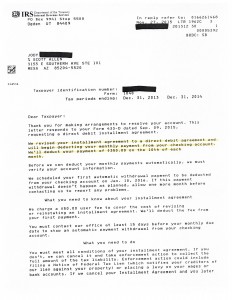

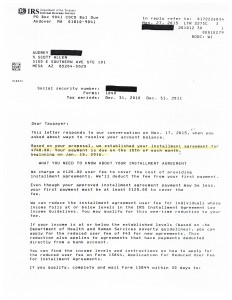

What is one way to evaluate the reputation of a tax debt settlement company? Scott Allen EA believes the best way is to provide actual results of recent successes. By view the IRS notice below you can see an actual settlement negotiated. Use this when looking for Tax Debt Advisors Reviews. You will find Scott Allen EA listed under the taxpayers name which means he was the authorized power of attorney in this process. Click here if interested in viewing other successes of Tax Debt Advisors.

Michael needed a payment plan and he needed it done quickly. Scott Allen EA and Michael were able to sit down and go through his financial situation to determine what the best settlement allowable by law would be. Paysubs and bank statements had to be brought forth to determine and prove his income. His monthly bills (rent, utilities, phone, insurance, etc…) also needed to be sorted through to determine what his monthly allowable expenses are. After going through that and making sure we maximize where we can and cut out where we have to, we knew before ever starting the negotiation with the IRS that we could secure a $210 a month settlement. And, as you can see that is exactly what Scott Allen EA was able to get done for his client.

Its important to remember when working through your financials with the IRS that just because you are spending it does not mean they will allow it. Scott Allen EA has had to tell a number of clients that they needs to sell their season ticket package with the Diamondback or Suns. They do not consider something like that to be reasonable or necessary. Everyone would probably agree with that though.

To talk with Scott Allen EA and see if he is the man to represent you before the IRS, give him a call today to schedule a free initial consultation.