Phoenix AZ IRS penalty abatement

Do taxpayers ever get Phoenix AZ IRS penalty abatement?

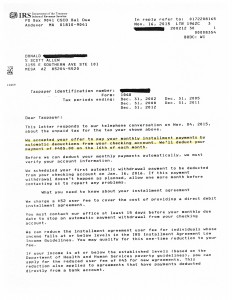

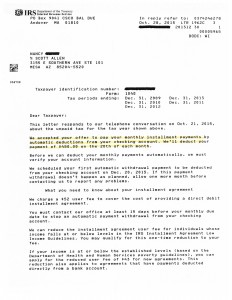

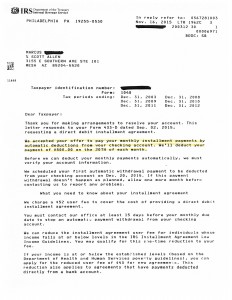

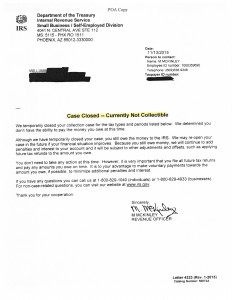

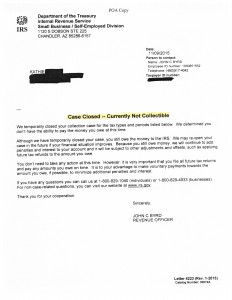

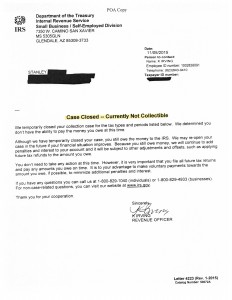

Yes, penalty abatement does happen but not as often as you hear advertised. By all the advertisements you hear via radio, TV, and internet you would think anyone and everyone qualifies. To received consideration you have to have an unusual set of circumstances that prevented you from filing or paying on time. Below you can view a Phoenix AZ IRS penalty abatement acceptance for a client of Tax Debt Advisors, Inc.

There is no harm in applying to Phoenix AZ IRS penalty abatement. Scott Allen EA often tells his clients, “the worst they will say is no”. Even after a no you can always appeal or apply again. Upon meeting with Scott Allen EA he will want to do a simple evaluation to determine if you are a good candidate in having success with a penalty abatement application. If there is only $300 of penalties it may no be worth your time or money in applying. However, if you have $3,000 of penalties on the account then its obviously worth while. It is a separate application process for each tax year or period and each case is unique unto its own. The best chance for success (other then having a reasonable cause) is to be organized and have supporting documentation to provide.

Call Scott Allen EA today to see if you are a candidate for IRS penalty abatement. In addition to penalty abatement Scott Allen EA offers tax preparation services for current and delinquent tax years. Once his clients are in compliance with their tax filings and a total debt amount has been established he is experienced in negotiating IRS settlements. Put his experience to work for you.