2018 Scottsdale IRS Settlement by Scott Allen EA

A completed 2018 Scottsdale IRS Settlement

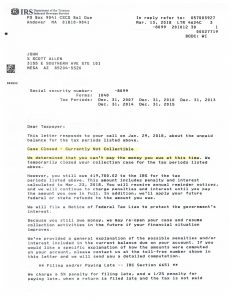

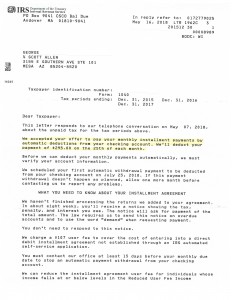

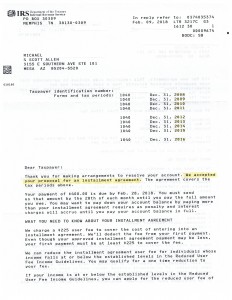

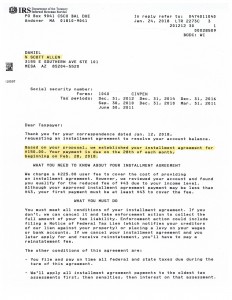

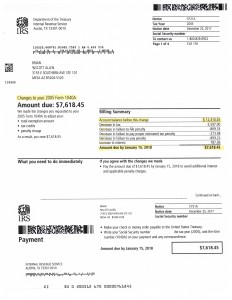

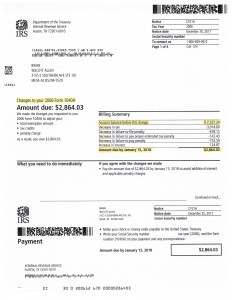

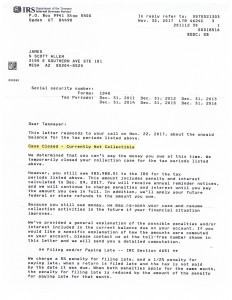

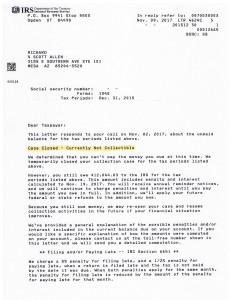

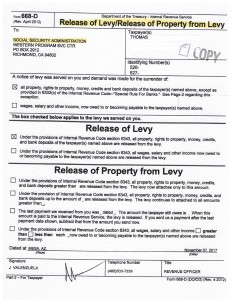

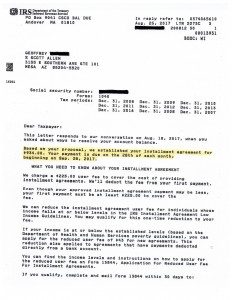

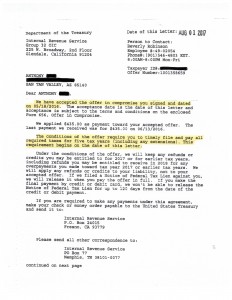

View the image below to see a 2018 Scottsdale IRS settlement that Scott Allen EA did for his client John.

If you came across this page you probably are in a similar situation to John. John had a handful of tax returns that were unfiled. He lost a lot of his tax records over the years due to moving and various job changes. Scott Allen EA was hired by John to represent hin before the Internal Revenue Service. This is where Scott did his “discovery” work. He found out exactly what John needed to file, where to file, and gather copies of his 1099’s and W-2’s for each year.

Next, the tax returns were prepared (also done by Scott). One by one they were filed timely with the IRS. While waiting for the IRS to process the tax returns a strategy was worked on to settle the IRS debt for John. Financial information was evaluated on his income and expenses. It was determined that John would indeed qualify for a non collectible status on his IRS debt.

What qualifies someone for a non collectible status? To summarize it into one statement its when a taxpayer has little or no money left over each month after paying for his or her basic living expenses. To qualify a taxpayer must live within the IRS’s national standard guidelines on expenses. If you spend too much money on a car payment or some other expenses the IRS could ask you to sell or adjust that expenses before qualifying for a non collectible status. This is when its important to have an Enrolled Agent on your side to guide you through this process so you can achieve the best that the law allows.

Meet with Scott Allen EA this week to evaluate your tax matter and get it resolved right the first time.