Do I need an Arizona IRS Tax Attorney to file back tax returns?

No, filing delinquent tax returns is not a legal matter and shouldn’t require hiring an Arizona IRS Tax Attorney. Consider Hiring Scott Allen E.A. instead. However, you should be aware of some of the negative consequences of filing back tax returns:

- After three years past the due date, if you have a refund, it is lost and cannot be applied towards any balances due.

- The IRS has a 10 year statute of limitations in which to collect on assessed taxes. However, the statute does not start until your returns have been filed and assessed.

- If you refuse to file back tax returns there can be legal consequences—but even an Arizona IRS Tax Attorney is not going to be able to get the IRS to agree to not filing a back tax return.

- If you have not filed for a few years the IRS will file a Substitute for Return (SFR) which is prepared in the most negative way possible. If this has already occurred, it can be corrected by filing a correct return at the Service Center that prepared the SFR.

- The longer you wait to file a delinquent return the more penalties and interest will be added to the tax due. If you have a refund, there will be no penalties or interest added.

- You cannot qualify for any IRS settlement programs until you are in compliance with filing all of your back tax returns.

Scott Allen E.A. can be reached for a free consultation to discuss filing your back tax returns at 480-926-9300. Scott has filed many SFR protests that have reduced the tax liability as well as the interest and penalties. He will make today a great day for you.

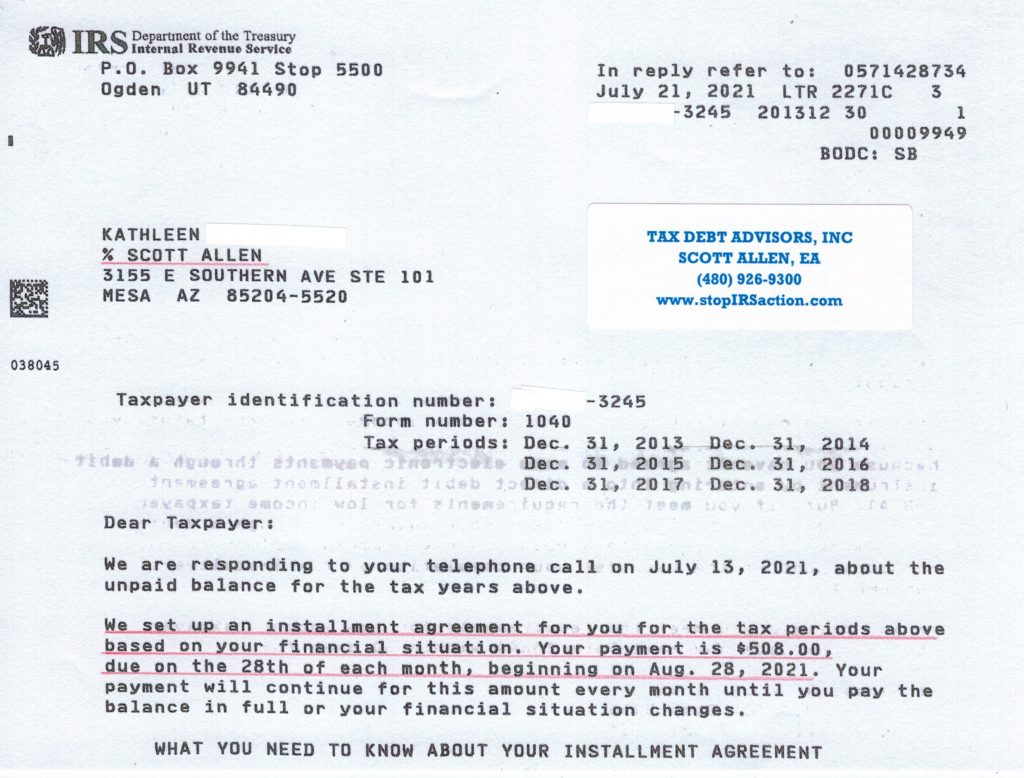

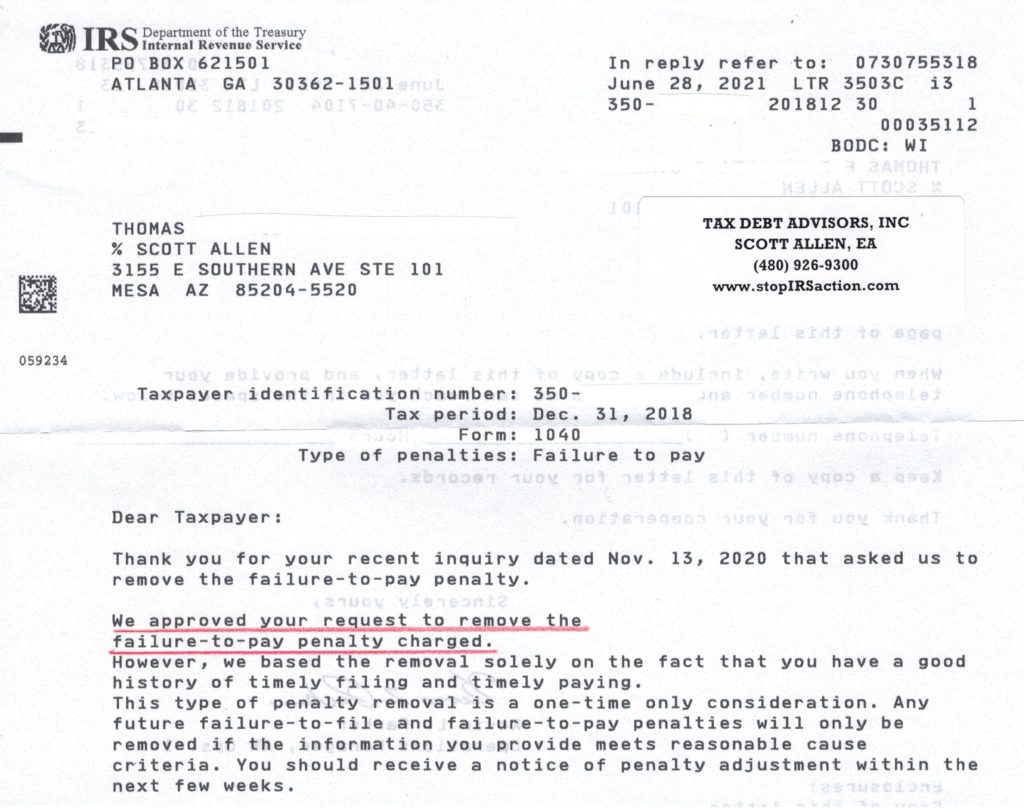

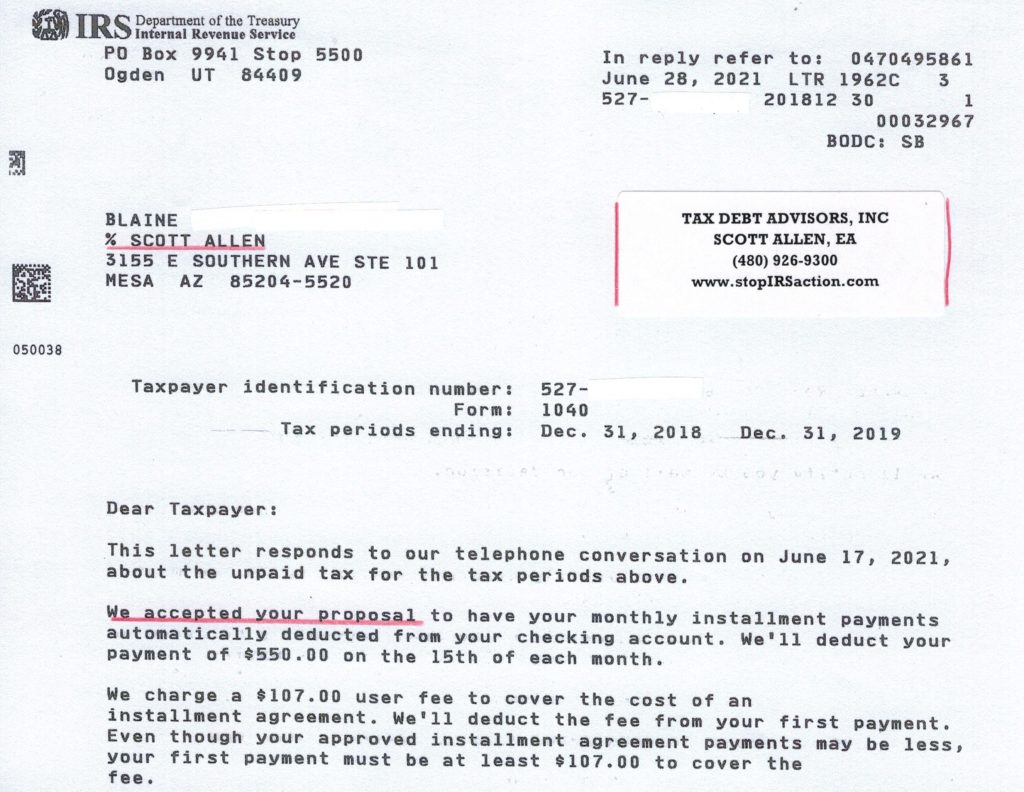

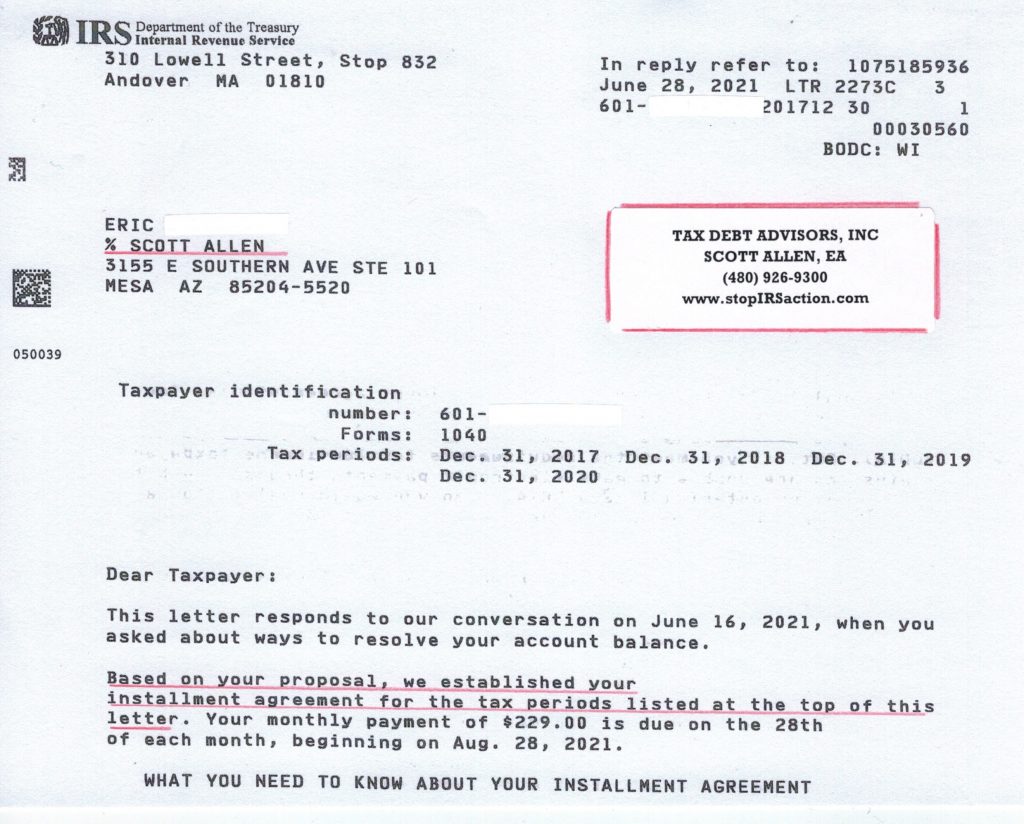

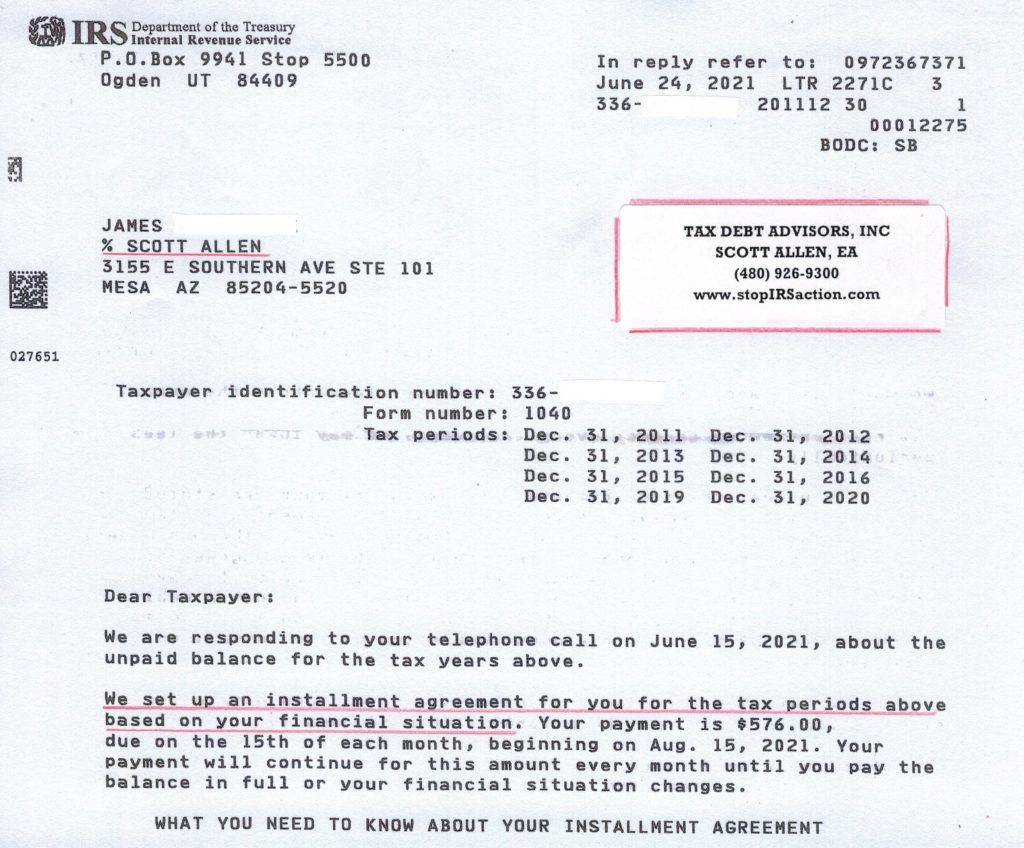

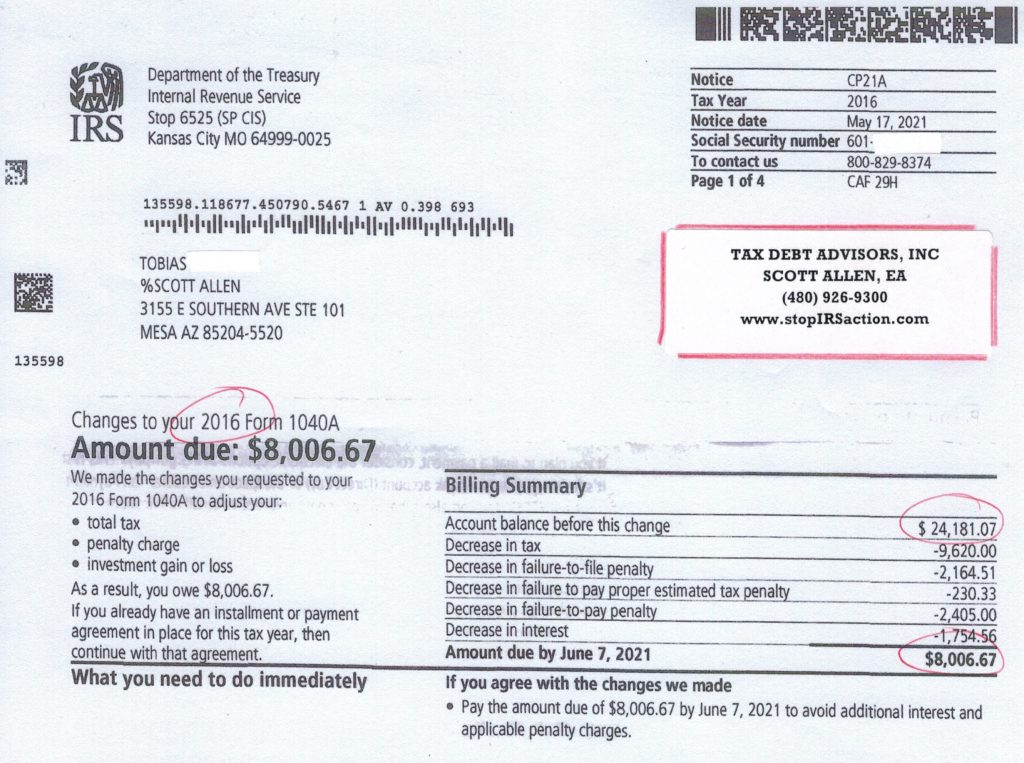

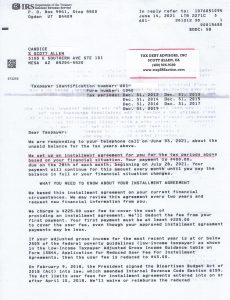

Below is a recent example of Scott Allen E.A. properly representing a taxpayer. Kathleen was several years behind on her taxes and Scott was able to assist in her getting those returns prepared and all caught up. Once she was filing compliant a payment plan negotiation took place. Her $100,000+ IRS debt was settled into one low monthly payment plan of $508 per month. How about that!