Scott Allen E.A. for information on all of the IRS Tax Relief Programs

IRS Tax Relief Programs

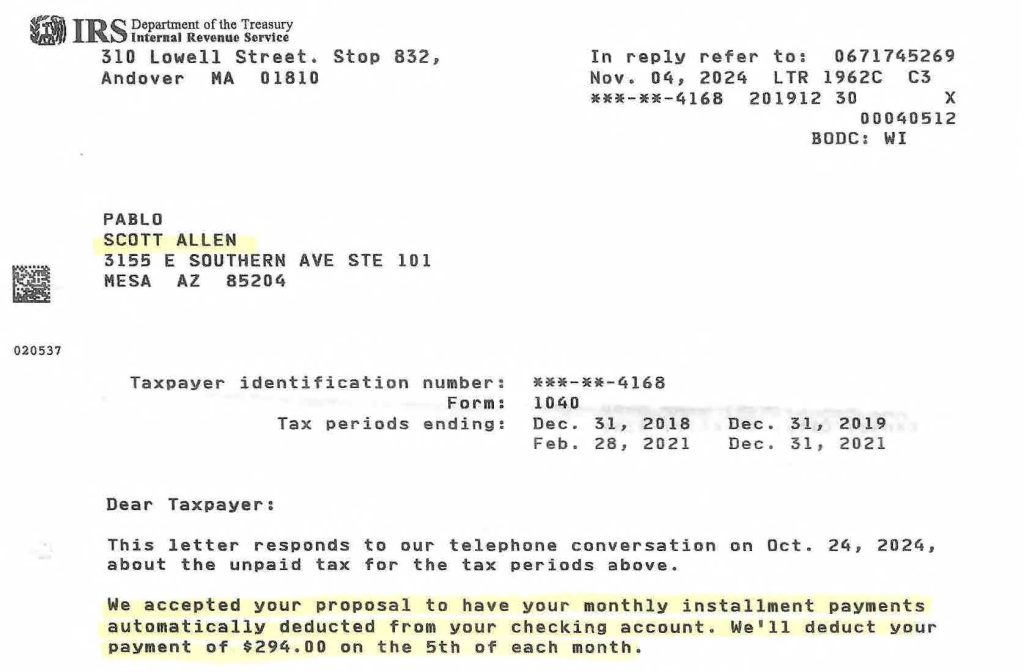

If you have an IRS tax debt in Gilbert AZ and are confused about how to get it resolved, call Scott Allen E.A. Scott offers a free consultation and can outline each of the options that apply to you and get that settlement option approved by the IRS. Scott will require some financial information that needs to be accurate and complete. Even minor omissions can make one option appear to be better than the right option. Scott Allen of Gilbert AZ promises follow through service but that is worthless unless you provide correct information in a timely manner. Only you can tie Scott’s hands—not the IRS. Scott can be reached at 480-926-9300 for an appointment. If you call from out of town, Scott will schedule a telephone appointment. Either way Scott Allen E.A. will make that appointment a great day for you!