Chandler IRS Negotiation Help

Chandler IRS Negotiation Help

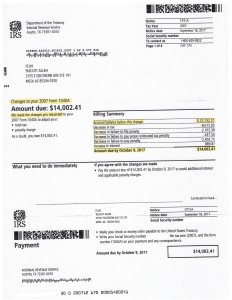

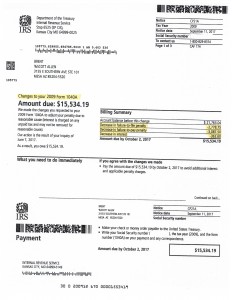

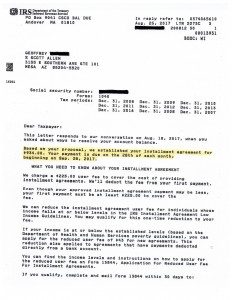

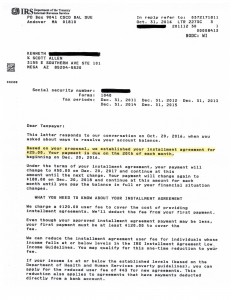

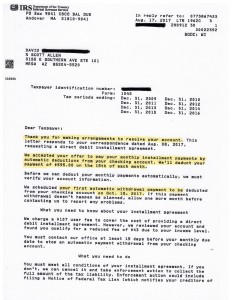

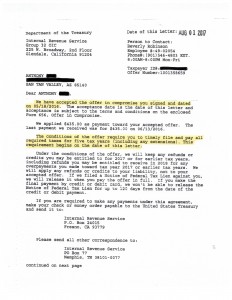

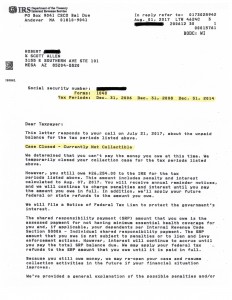

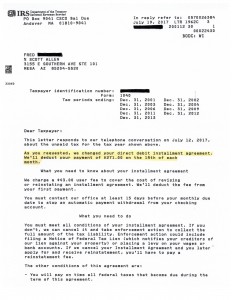

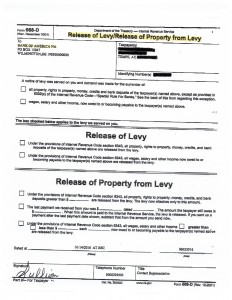

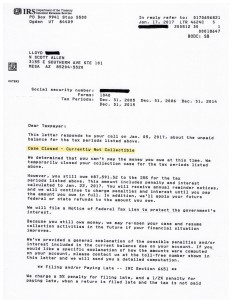

If you need Chandler IRS negotiation help seek to find local representation. You want to make sure you can meet with the person you hire to defend you against the IRS. Long distance representation simply just isn’t as effective. Scott Allen EA of Tax Debt Advisors is a local family owned company here in Arizona. Felix did just that. He gave Scott Allen EA IRS Power of Attorney and right away he got on the case. This representation stopped the IRS from pursuing any collection activity for a period of time. Just enough time to protest a balance due on his 2007 tax return. View the notice below to see the adjustment made. $13,000 in tax debt was abated from the account just by making a proper filing and challenging the IRS’s filing. In addition to this, Felix also has a few other tax return filings to get caught up on. As of this very week Scott Allen EA is preparing the back tax returns for him from 2011 through 2016 to get him into compliance. Once this is accomplished then they can move to getting a permanent negotiation settled for all the tax years.

There are many different ways to see Chandler IRS negotiation help. Filing protest tax returns is just one of them. Other options may include:

- Innocent spouse claim

- A payment plan

- Offer in Compromise

- Audit Reconsideration

- Currently not collectible status

- Seeking Taxpayer Advocate Service help

- Preparing back tax returns

That list is just a handful of the different ways one may resolve a tax matter. Consult with Scott Allen EA to seek out the best solution for you. Everyone has a unique tax situation which requires a unique tax solution.