Settle Phoenix AZ IRS Debt

Thomas settled his 2010 Phoenix AZ IRS Debt six years later

Just because you may have Phoenix AZ IRS debt that is several years old does not mean you cannot do something about it. Thomas owed the IRS over $100,000 for multiple tax years and many of which needed to be prepared and filed.

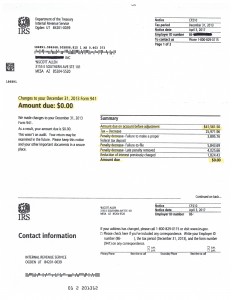

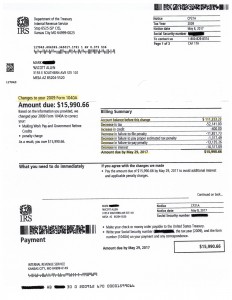

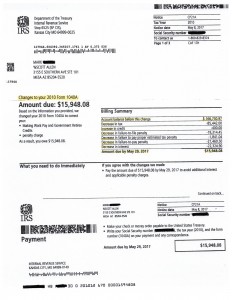

2010 was one of the tax years that Thomas did not file. Because he did not, the IRS went ahead and did it for him. Except they don’t file it in the taxpayers best interest; it gets filed in the simplest way possible which benefits the IRS 99% of the time.

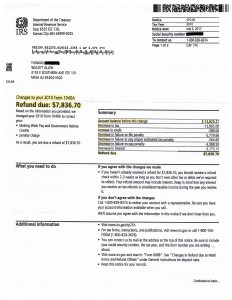

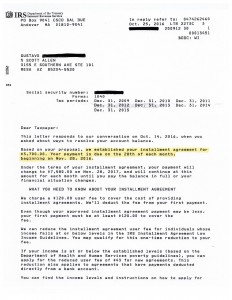

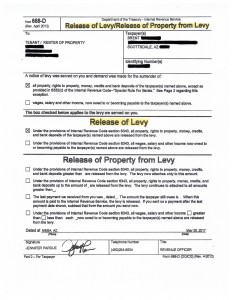

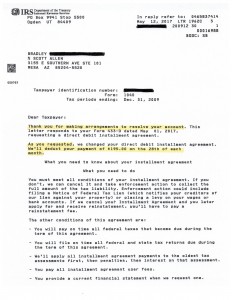

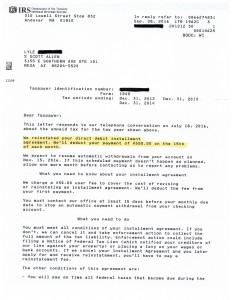

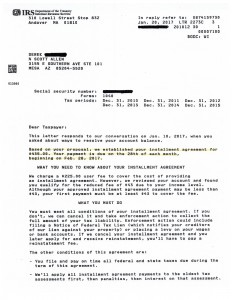

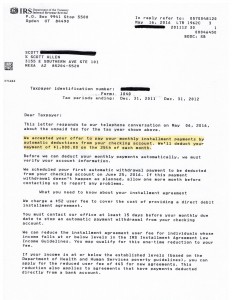

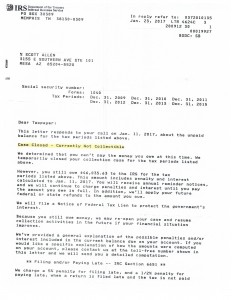

In this blog is just a recent example of the negotiation handled by Scott Allen EA of Tax Debt Advisors. View the notice below to see what was successfully accomplished. Scott Allen EA turned a $13,000 IRS tax filing bill into nearly an $8,000 refund for the client. Always seek a second professional opinion before giving up on the “big bad IRS”.

Tax Debt Advisors is a Phoenix Arizona company that specializes in most matters pertaining to the IRS. Some of those matters are: preparing unfiled tax returns, payment plan negotiations, offers in compromise, appeals, innocent spouse claims, and more. For professional help on your case call 480-926-9300 today and speak with Scott Allen EA personally.