File Back Tax Return Mesa

How to File Back Tax Return Mesa

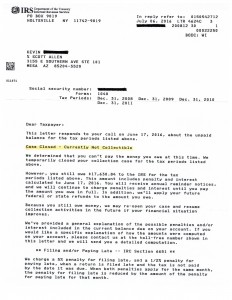

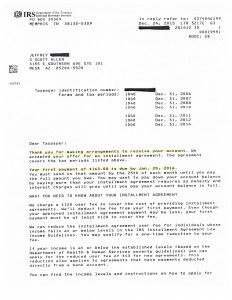

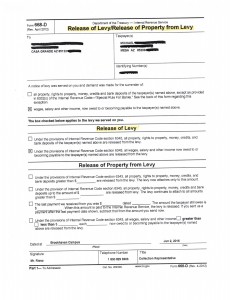

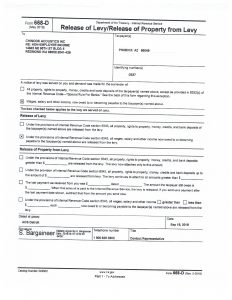

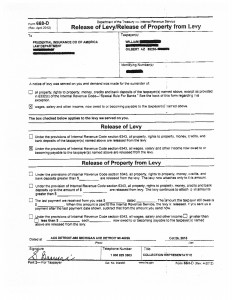

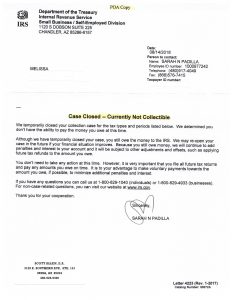

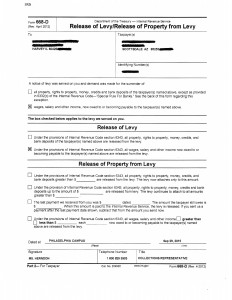

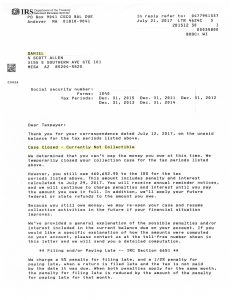

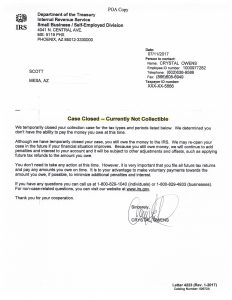

The best way to file back tax return Mesa is by hiring Scott Allen EA of Tax Debt Advisors. Kevin came in to visit with Scott with several years of back tax returns that needed to be prepared. Upon hiring him to be his IRS Power of Attorney Scott went to work. He got in contact with the IRS immediately to find out what needed to be done to get Kevin back into compliance again. He stopped all collection activity in the process. After getting all the back tax returns prepared it was time to negotiate a settlement with the IRS. After evaluating all the available option it was determined that a currently non collectible status was his best solution both short term and long term. As you can view from the notice below the case was closed out into a currently non collectible status with the IRS.

As long as Kevin does not incur any future tax debts or forget to file on time the IRS will keep in him currently non collectible. If you have to file back tax return Mesa you should also consider giving Scott Allen EA a call today. The best way to avoid a tax audit is “don’t forget to file“.

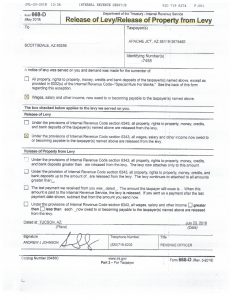

October 2018 case update:

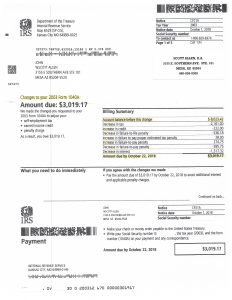

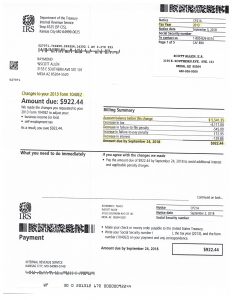

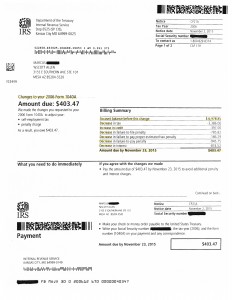

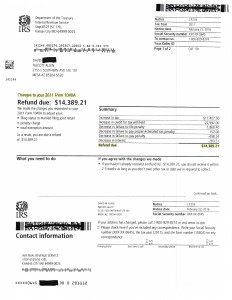

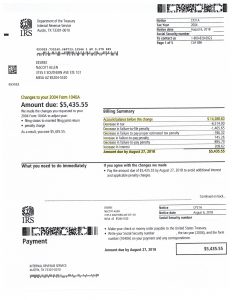

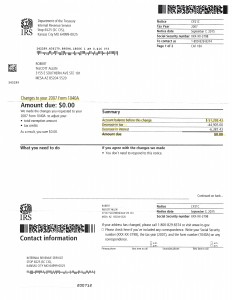

Just because you may have forgotten to file a tax return 15 years ago does not mean it can’t necessarily come back to haunt you later. That happened to John. He did not file a 2003 tax return. Here in 2018 he is still getting collection notices. Because he never filed a tax return that year the IRS filed the return for him. The IRS calls this a Substitute For Return and you do not want this to happen to you. Upon meeting with John, Scott Allen EA was able to prepare and protest the IRS filing. As you can see in the IRS notice below his tax bill went from $8,000 down to $3,000.

Don’t ever settle when it comes to your IRS situation. You don’t know what all the available options are available to you until you have the proper representative evaluate your situation. Scott Allen EA is that proper representative. Speak with him today.