Read this IRS settlement in Phoenix AZ

Get your IRS settlement in Phoenix AZ before you get levied.

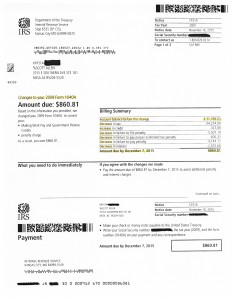

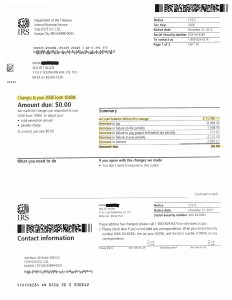

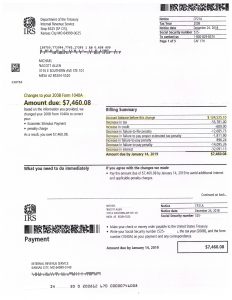

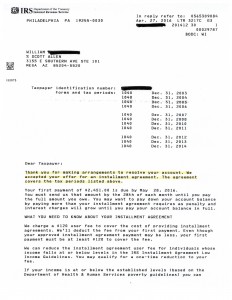

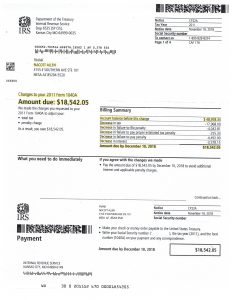

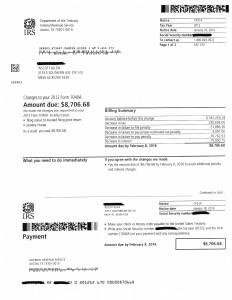

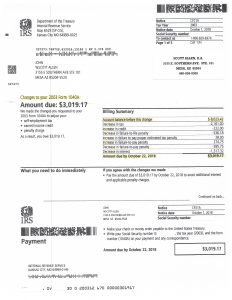

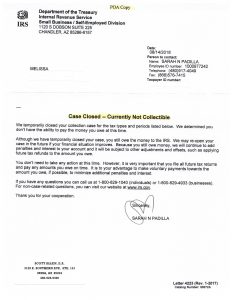

Krysta was a Phoenix AZ taxpayer who was behind on her tax filings. As a long distance truck driver she was rarely in town let alone with time to do her taxes. She missed one year and before she knew it she was several years behind. Krysta was so far behind she did not know where to begin until she met with Scott Allen EA of Tax Debt Advisors, Inc. As you can see by clicking on the image below Scott Allen EA was able to save Krysta $36,000 on her 2009 tax return.

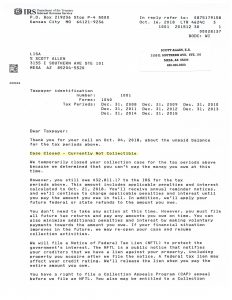

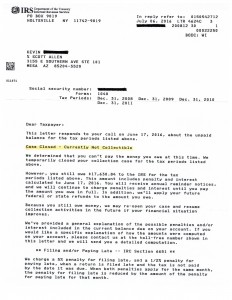

Many people are unaware but the IRS has the legal right to file tax returns for a taxpayer if he or she doesn’t. This was the case for Krysta. Due to not filing her 2009 tax return the IRS did so resulting in a $37,000 tax bill that the IRS was threatening to levy her income to pay it. Upon meeting with Scott and using him as her IRS power of attorney he was able to properly represent her before the Internal Revenue Service and put a stop to further negative damage. Over the next several weeks Scott Allen EA assisted Krysta in the tax preparation process. They are currently working on an IRS settlement in Phoenix AZ. Now that her 2009 and other tax returns have been filed a settlement is currently being negotiated on the reduced debt.

Don’t let the IRS be in the drivers seat with you taxes any longer. Contact Scott Allen EA today to schedule a free evaluation of your IRS problem. Whether you have back tax returns that need to be filed or not Scott Allen EA can represent you from beginning to end.

480-926-9300

2019 and still getting IRS Settlement in Phoenix AZ

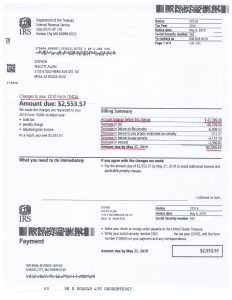

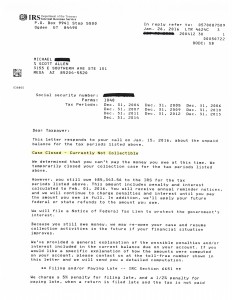

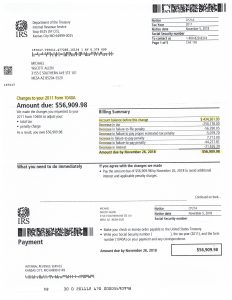

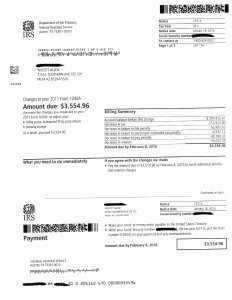

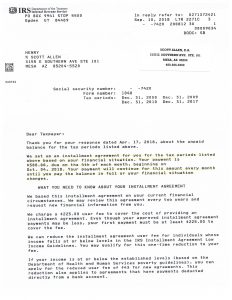

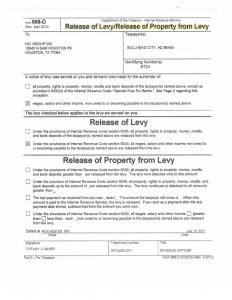

Stephen had the IRS coming after him for tax for tax debt that was eight years old. He never filed his 2010 return so the IRS did it for him generating a LARGE IRS debt that was not accurate. Upon meeting with Scott Allen EA it was decided to protest the IRS tax return. Go ahead and check out the notice below and see how he saved his client over $39,000 in tax debt.

Are you behind on your taxes or owe more then you can pay back? If so, meet with Scott Allen EA today. He will represent you as Power of Attorney and will put your mind as ease.