We are Mesa Arizona’s Top IRS Problem Solvers to Avoid Criminal Punishment

Scott Allen EA of Mesa Arizona’s Tax Debt Advisors

Truth—If you fail to file a tax return you can be punished with one year in jail for each year you did not file.

Failing to file a return is like a bad parking ticket. It is not a hit and run crime where you will go to prison. It is important that you work with an IRS Resolution Specialist in Arizona like Scott Allen E.A. who will tell you the truth and not try to scare or intimidate you into retaining his services. Tax Debt Advisors offers a free initial consultation and you can schedule your appointment with Scott Allen E.A. at 480-926-9300. You will only work with Scott. He does 100% of your IRS resolution work.

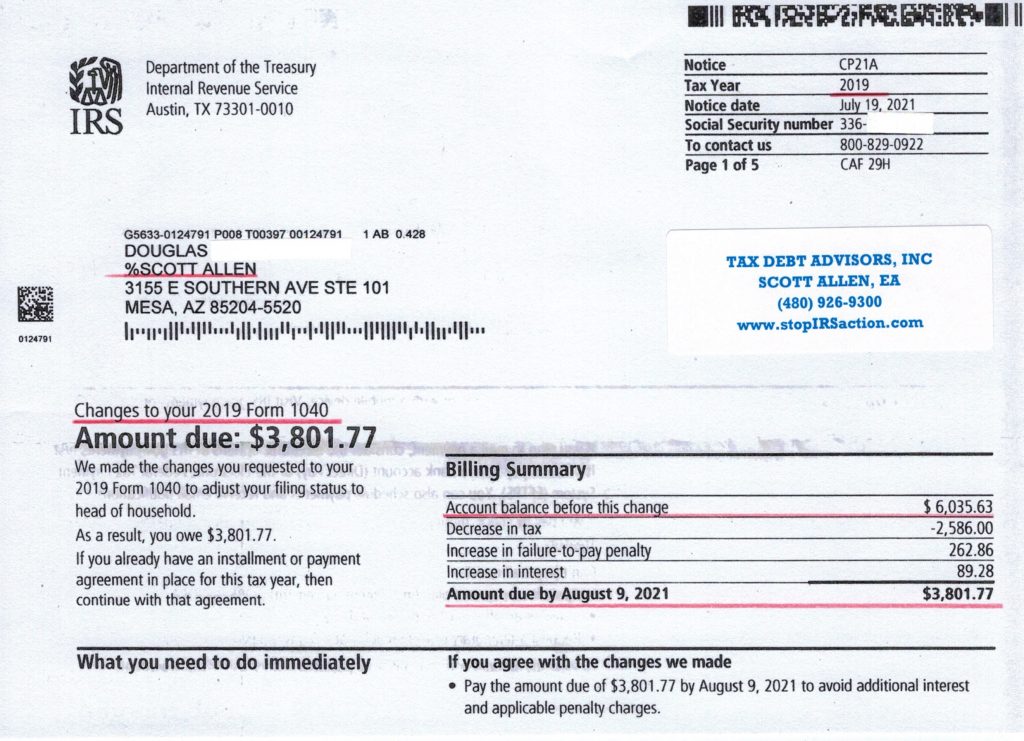

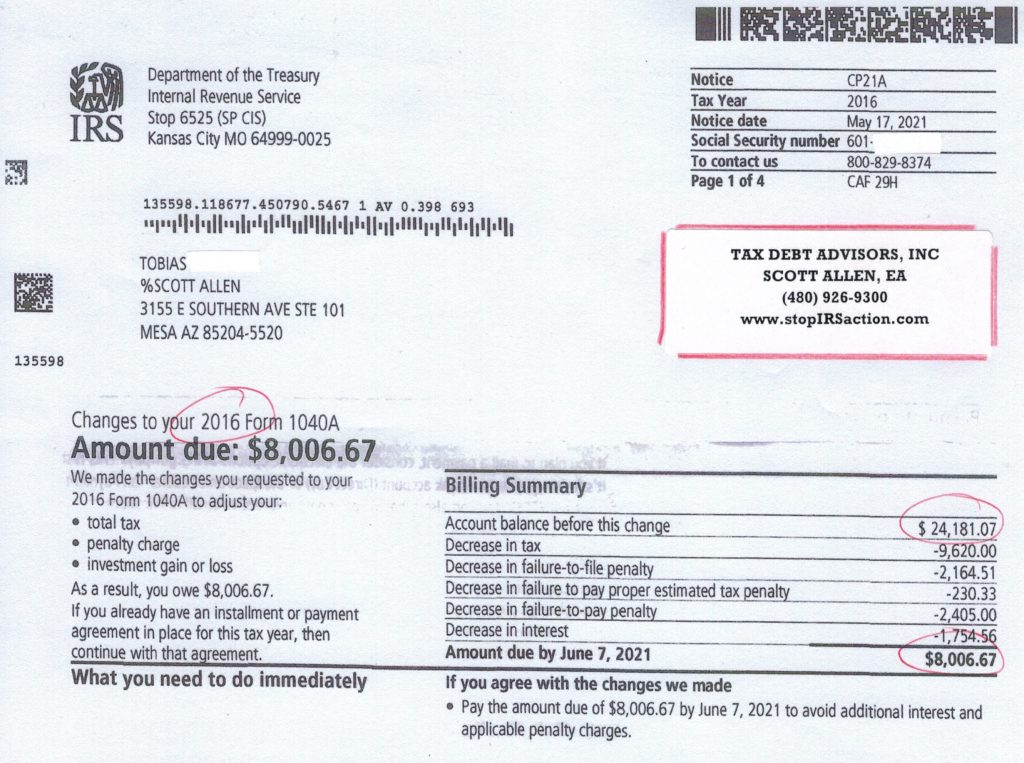

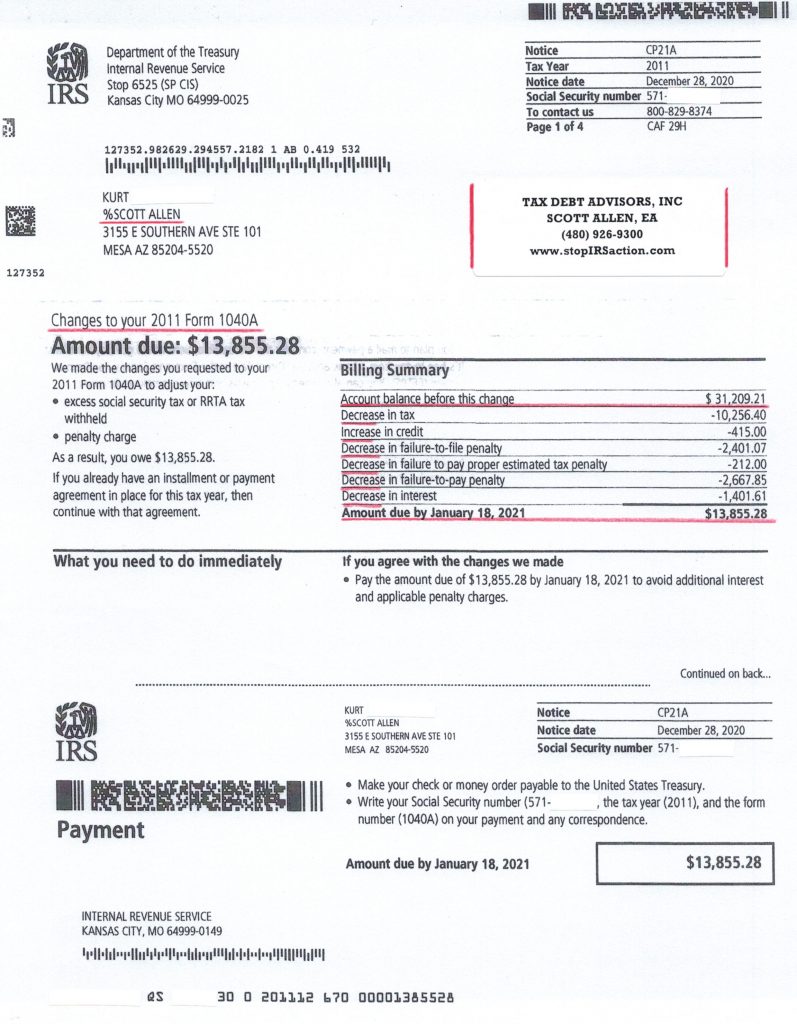

Here is an IRS Notice CP21A showing an adjustment made on a back tax return for a client. Scott Allen EA filed an amendment to correct the filing status that was done incorrectly by a previous preparer. Correcting this before negotiating a payment plan was important to do. As you can see it saved the client over $2,200 in back taxes owed.