File Back Tax Returns in Mesa

Can I still file back tax returns in Mesa?

The answer is most definitely yes. Scott Allen EA receives calls all the time with taxpayers asking, “is it possible to file back tax returns in Mesa?” Just because you miss one year, three years, or eleven years of filing your taxes it doesn’t mean they wont let you file a current year tax return. Clients will also ask Scott Allen EA, “do you think the IRS forgot about me? I have not file a tax return in four years and I have not heard from them yet?” Trust this one rule, the IRS may be slow and inefficient at what they do but they will never forget about you. Eventually time catches up and the IRS will force a taxpayer to file back tax returns in Mesa by either:

- sending you a “lock-in” letter forcing you to withhold taxes from your current employer at the highest possible rate and unable to change it for three years

- filings a substitute for return (SFR) in your behalf giving you a balance due on back taxes owed

- filing a tax lien

- bank levy

- wage garnishment

- assigning your case to a local IRS Revenue Officer

Scott Allen EA of Tax Debt Advisors, Inc that whether you have to file back tax returns in Mesa for two years, four years, or ten years is it always better to reach out to the IRS before they reach out. Because by doing do we can prevent them from doing any of those negative actions against you mentioned above. Once an IRS wage garnishment has been started 1) it is difficult to get it stopped and 2) it is difficult to correct the matter when the IRS is taking 30% of your paycheck. With Scott Allen EA as your IRS Power of Attorney he can represent you and put a hold to any collection activity before it ever begins. Then once that hold is placed on the account it will remain on hold as long as the commitments are met to get the taxpayer fully compliant.

What does it mean to be fully compliant?

In addition to file back tax returns in Mesa a taxpayer also needs to be sure they are having proper W2 withholdings with the federal and state or making monthly or quarterly estimated tax payments if they are self employed. The IRS needs to be certain that if they are going to work out a payment plan or offer in compromise settlement that you will not owe on next years taxes when it is due April 15th. Scott Allen EA will be there for you next year by sending you a reminder letter in January and a phone call in February to come in a get your current year taxes prepared, filed and paid on time.

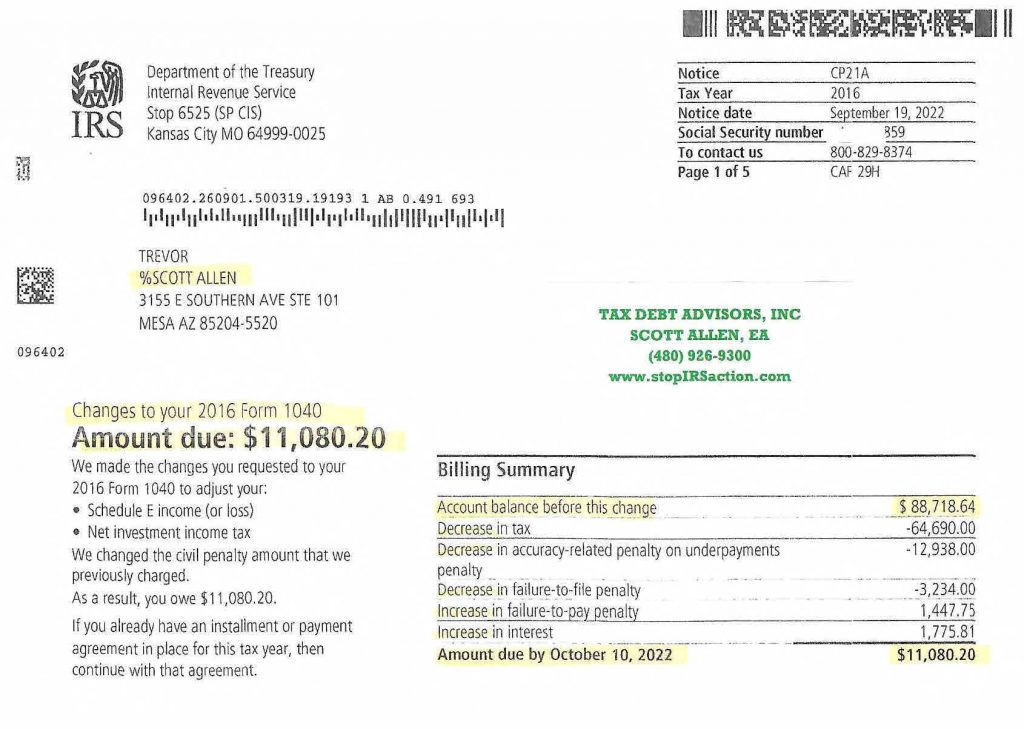

Tax Debt Advisors, Inc has been in business since 1977 and Scott Allen EA bought the family business in 2011. Together they have settled over 100,000 IRS debts. Below is just one recent example of a successful case where Scott Allen EA was able to file back tax returns in Mesa and save Trevor $77,638 on his 2016 tax return. It was a hard case to get thru (especially post Covid-19 and the IRS’s limited staff) but it was all worth it obviously. View the IRS approval notice below.

If you would like to meet with Scott Allen EA and see what he can do for you give him a call and schedule a free initial consultation.