Call Scott Allen E.A. if the IRS Has Garnished Your Gilbert Arizona Pay Check

Gilbert AZ Levy Release

Wow, this can be the wakeup call of a lifetime when your paycheck is taken by the IRS. Before the IRS will grant a Gilbert AZ levy release of your paycheck, you have to have filed all back tax returns and entered into a settlement option. This process can take a few days, so contacting Scott Allen E.A. a day or two before your next paycheck is to be garnished by the IRS may be too late to save that paycheck. Once you have a problem with the IRS, taxpayers need to make good use of their time. Every day counts and that is why you need the services of an IRS resolution professional with specific expertise to get a quick and proper settlement with the IRS.

Scott Allen has the ability to work as quickly towards getting a settlement as anyone. He knows all the options that are available and will provide each one for you to decide which works best with your financial situation. Contact Scott Allen E.A. at 480-926-9300 as soon as your wages are levied. You will know before you leave your first appointment with Scott that you have selected the right person to help you with the IRS.

Your Gilbert Arizona IRS Representation Professional

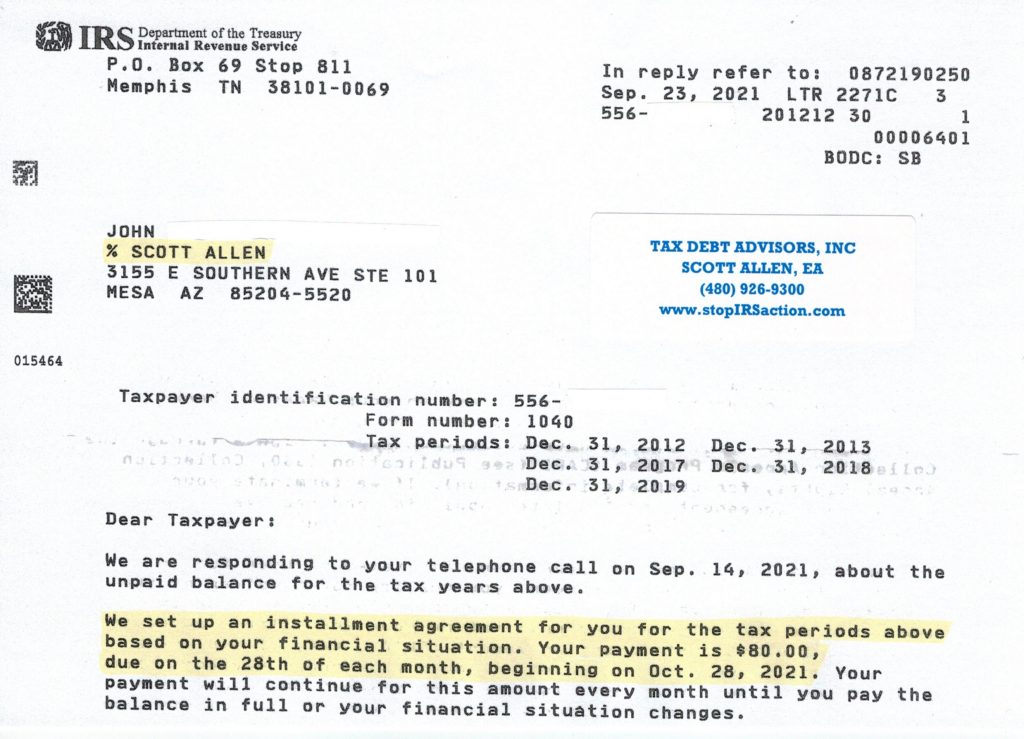

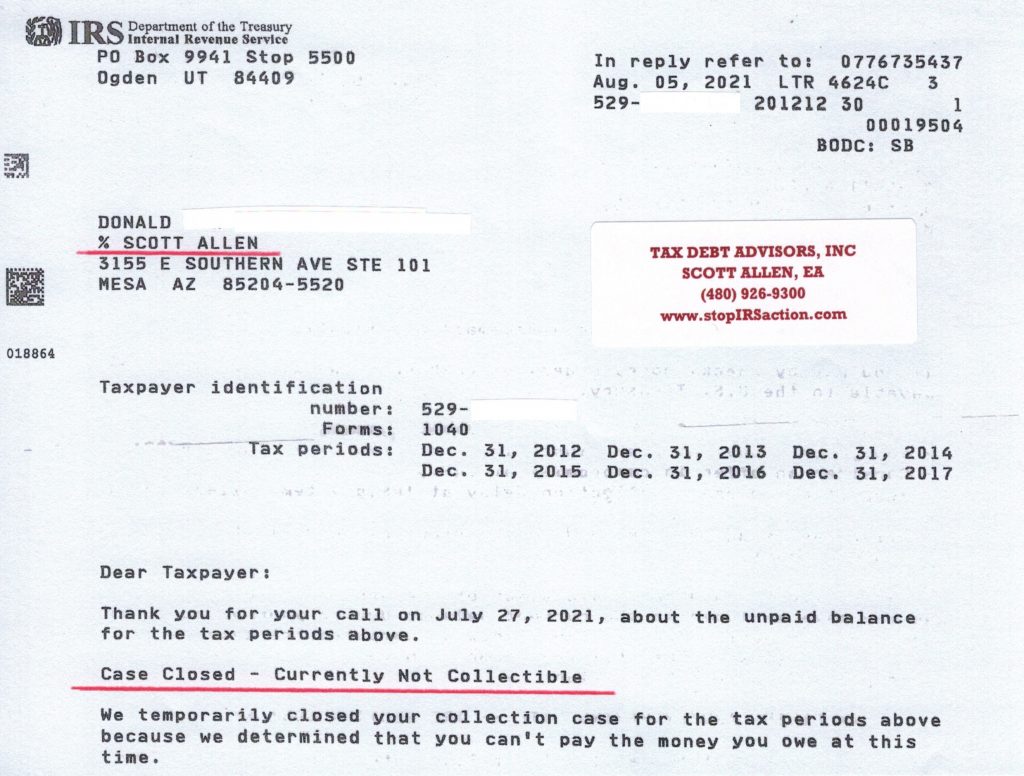

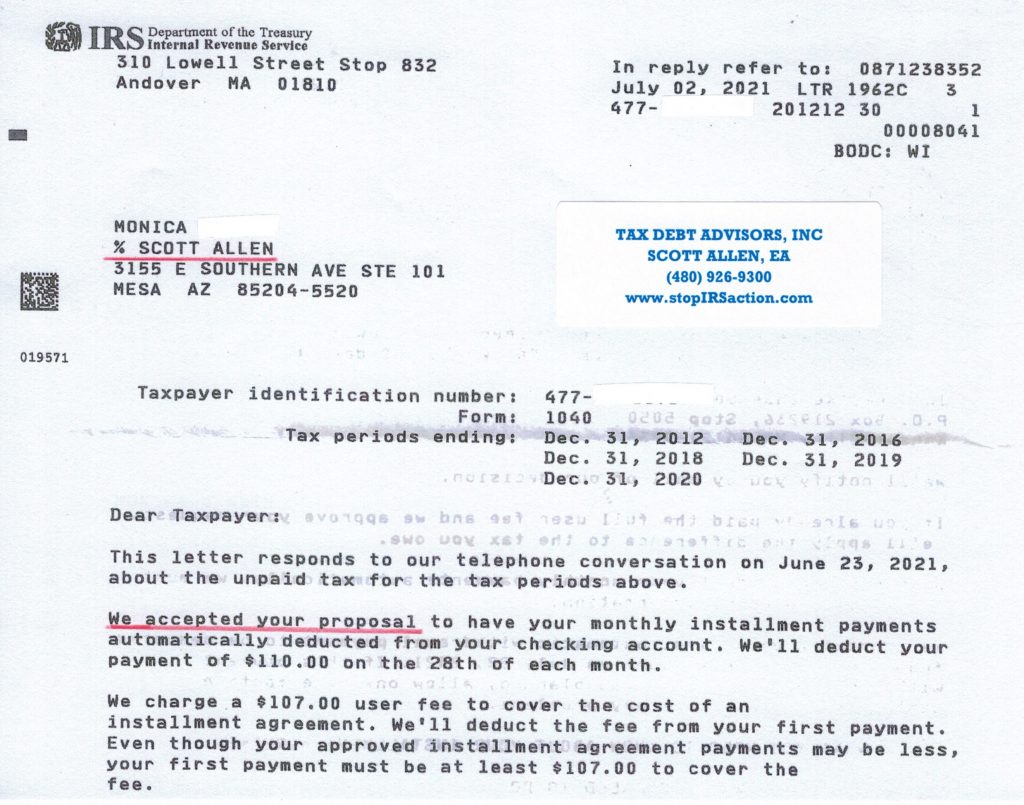

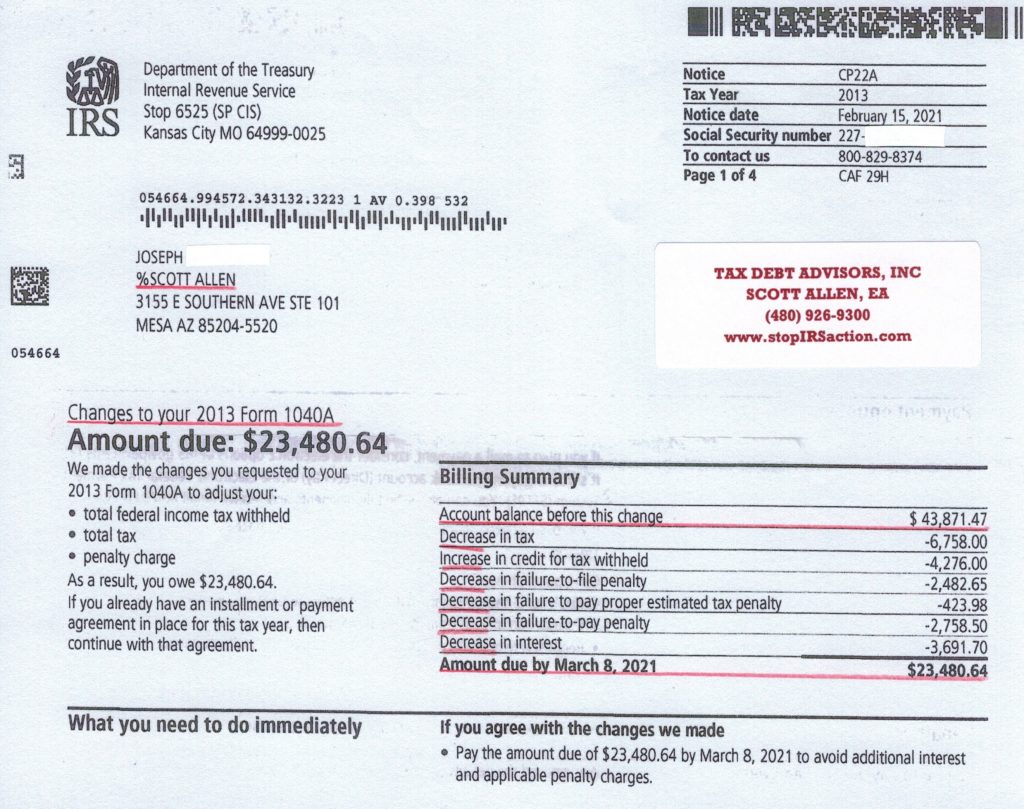

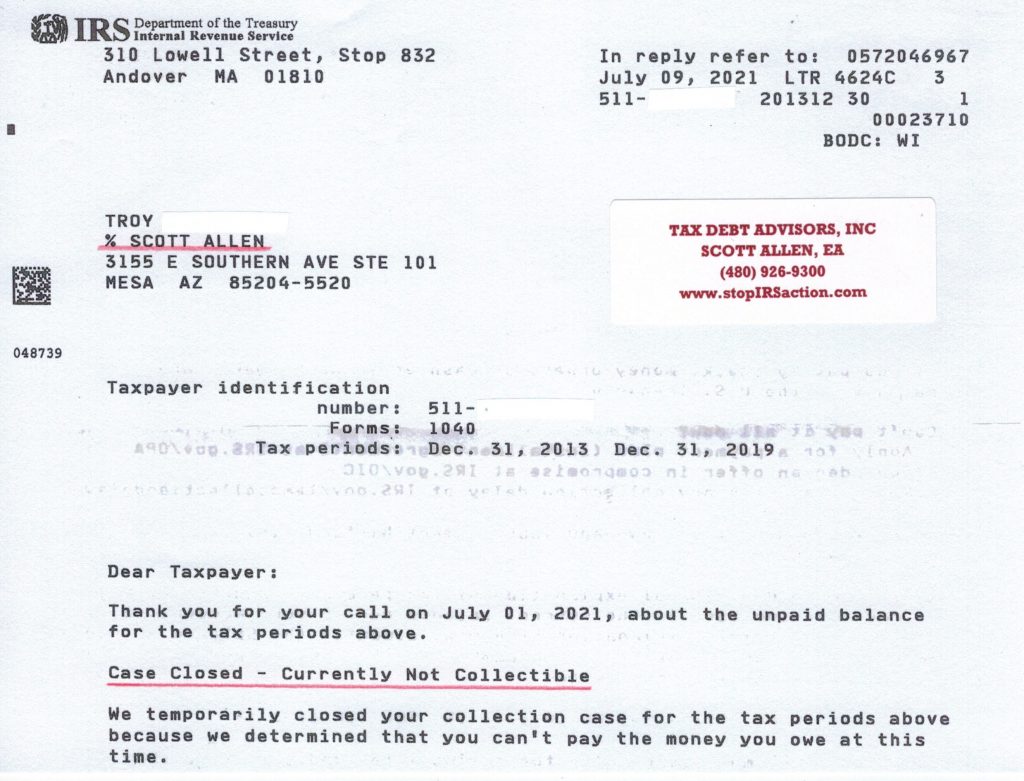

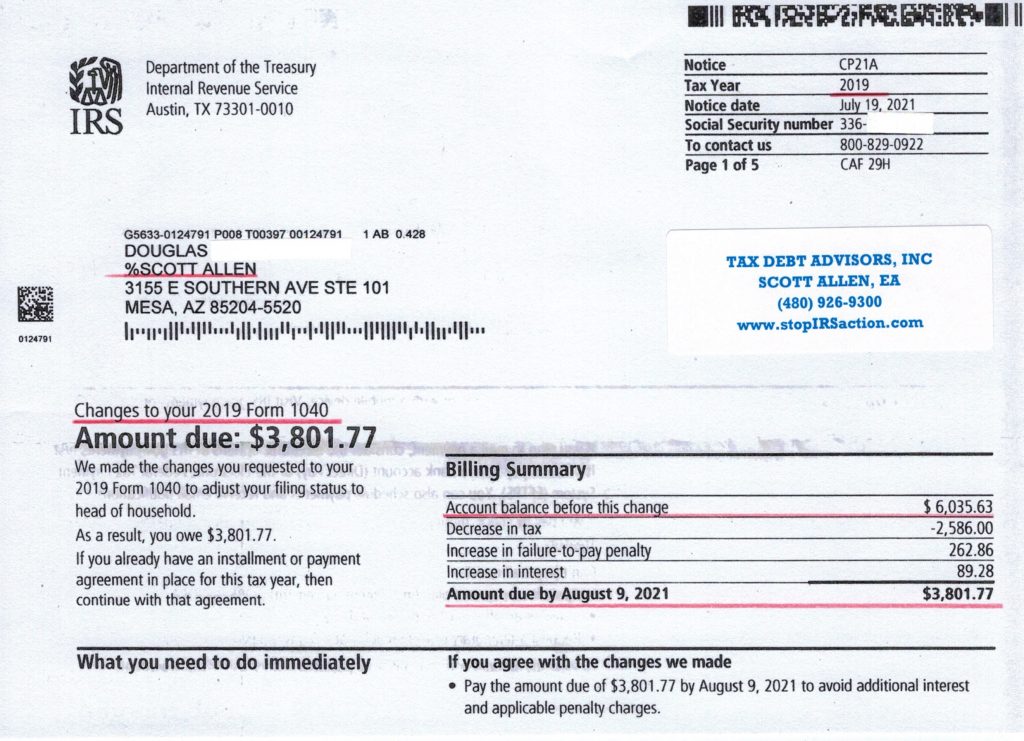

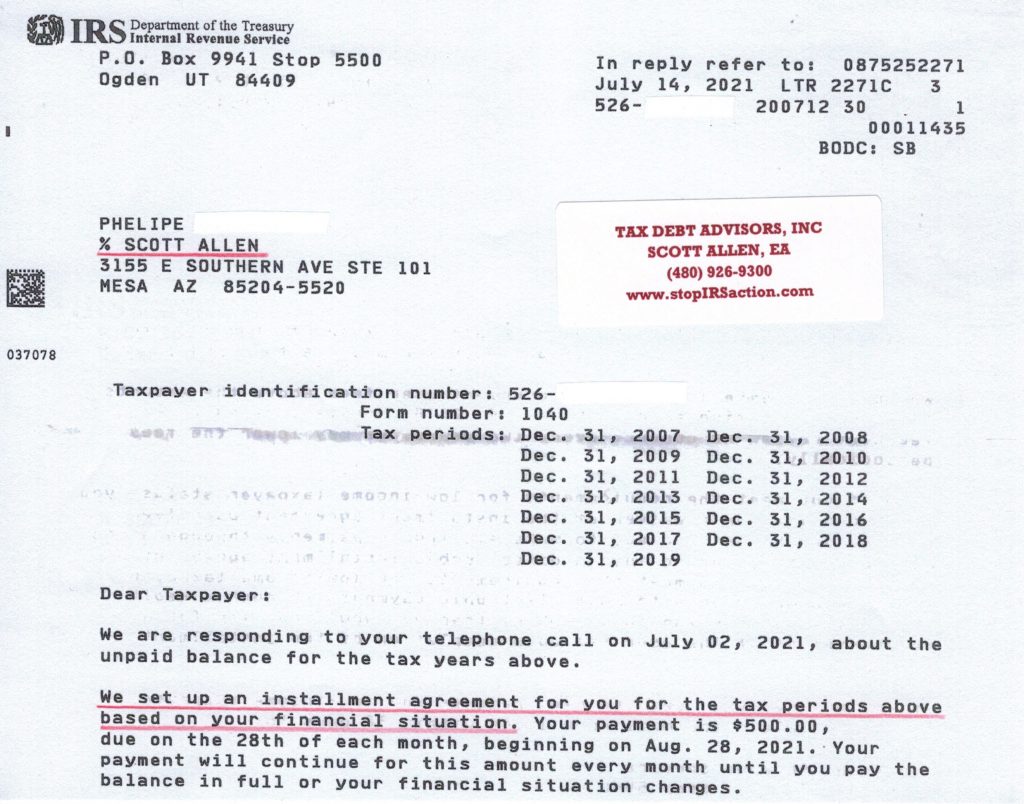

See a recent Gilbert AZ levy release by viewing the letter below. Scott Allen EA negotiated all the taxpayers IRS debts into one low $80 per month payment plan. The majority of the debt will expire in two years as well. Not a bad deal!