Chandler AZ Enrolled Agent vs. Chandler AZ IRS Tax Attorney

Does a Chandler AZ IRS Tax Attorney Have More Experience Than a Chandler AZ Enrolled Agent?

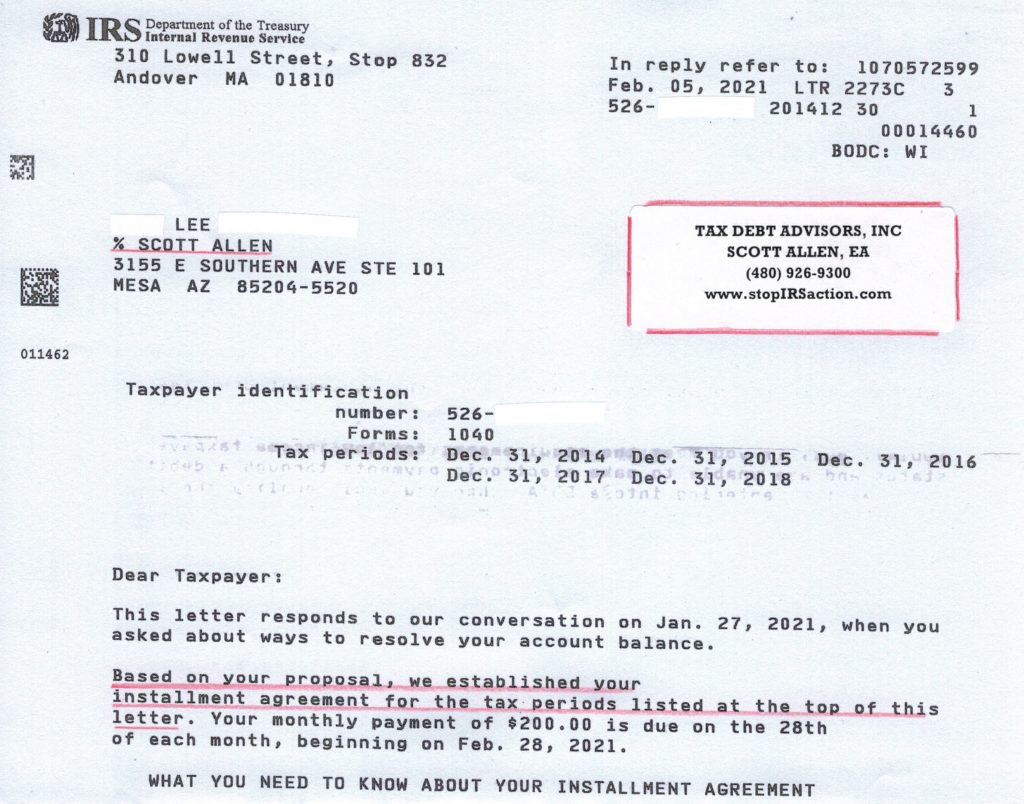

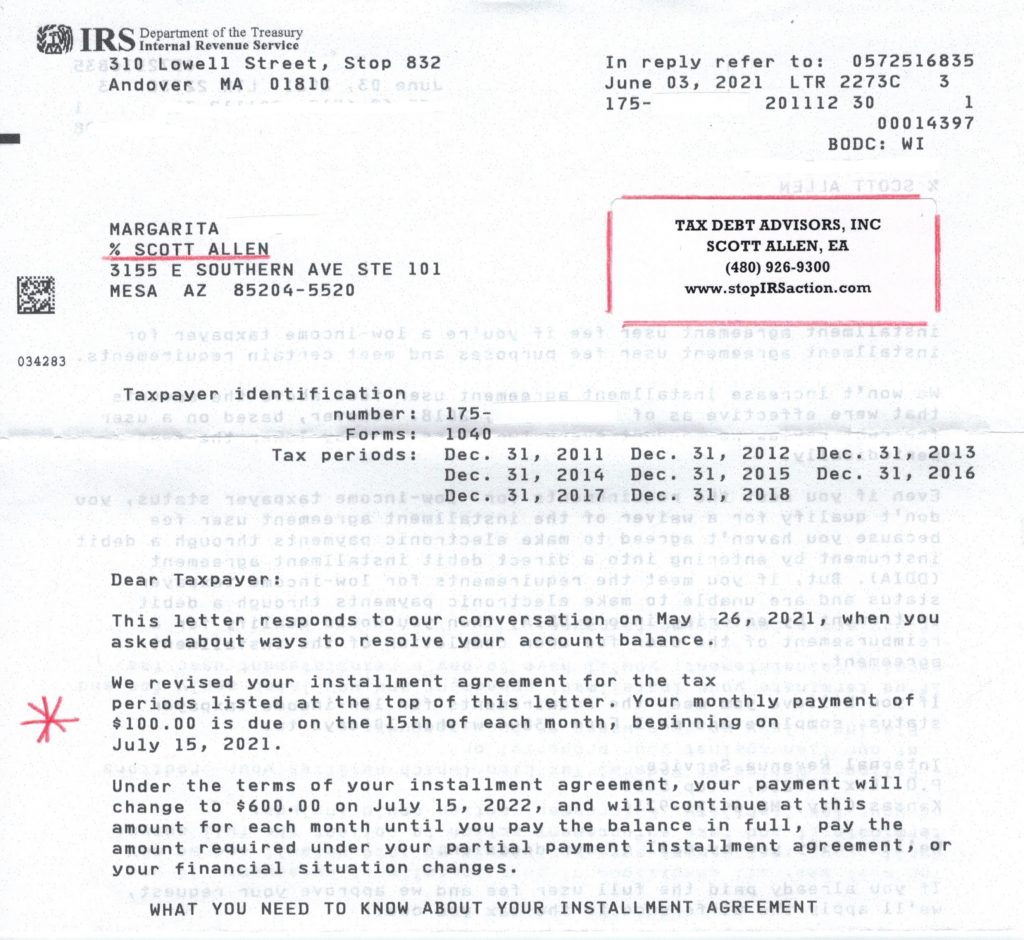

This is a very good question. Clients tend to confuse experience with educational background. It is true that a Chandler AZ IRS tax attorney has more education but that education is not in IRS resolution work. IRS resolution work is an expertise unto itself. It comes from years of working out IRS settlements for clients and from having a good relationship with local IRS agents and have their respect and cooperation.

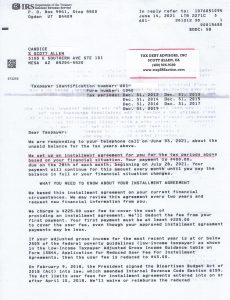

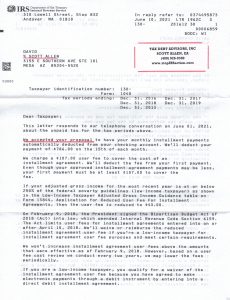

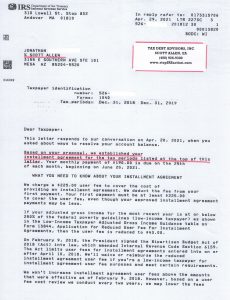

Our firm has over 40 years of experience resolving over 113,000 tax debts with the IRS. We have an excellent relationship with the local IRS officers and agents. Call Scott Allen E.A. for a free personal, private and confidential consultation. You will know before you leave that you have the right person, with the right level of experience, to resolve your IRS tax matter. And the best part is that your fee to settle your IRS problem will be significantly less than using a Chandler AZ IRS tax attorney

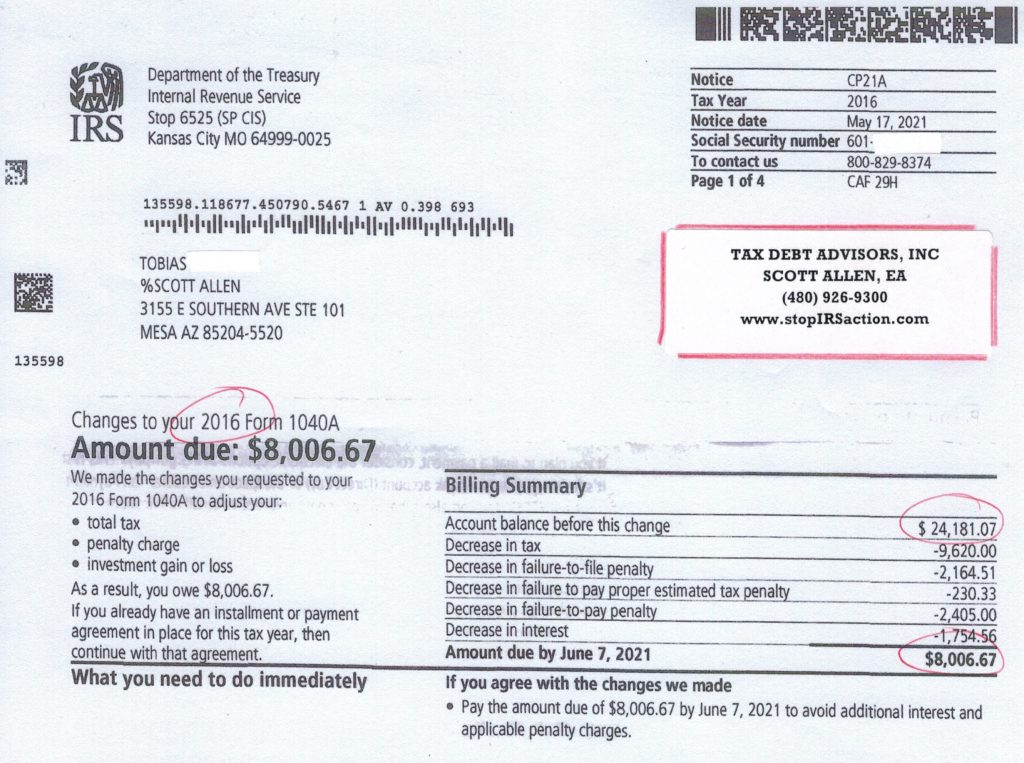

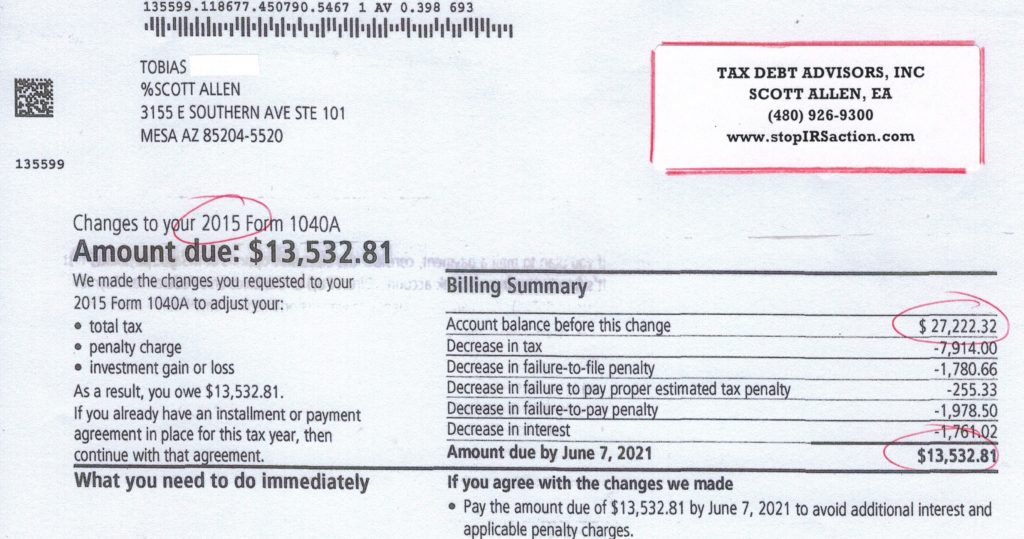

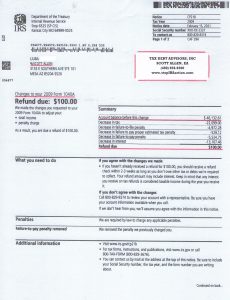

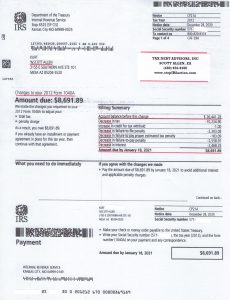

Settlement on a 2016 Tax Return

Over $16,000 was saved for a client on his 2016 tax return (see the notice below). If you have unfiled tax returns, facing an audit, or the IRS is filing SFR returns in your behalf then schedule a time to visit with Scott Allen EA. You always have options so make sure you are in the best possible option for you.