Does the IRS Offer One Time Forgiveness?

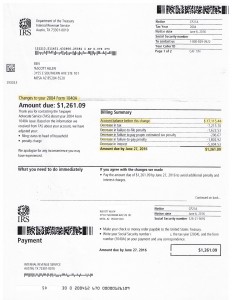

Yes, the IRS does offers one time forgiveness, also known as an offer in compromise, the IRS’s debt relief program. Have tax debt and wondering if one time forgiveness can help? If so, this post should help! Read below about programs the IRS has to help resolve your tax debt and what Tax Debt Advisors can do to help you get it done easily.

Does The IRS Offer A Tax Debt Relief Program?

The short answer is “Yes“! At any given time, there are nearly 1 million U.S taxpayers that owe the IRS. Although the IRS attempts to collect every cent that taxpayers owe the government, the reality is that they just do not have the resources for pursuing every individual person in debt. However, IRS collections remains a very stressful situation.

The IRS has tax debt relief programs, like the Fresh Start Program, available that taxpayers can take advantage of when owing back taxes. These programs not only provide a little help towards taxpayers, but it lightens the IRS’s workload. You may not be required to pay the entire amount owed, good news right?

Tax Debt Forgiveness

There are commercials that come on late at night promising to get you out of debt with tax debt forgiveness, even when thousands are owed to the IRS. Although, the reality is there is no straight debt forgiveness program.

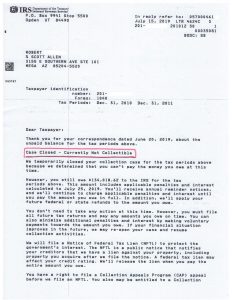

Although, depending on the criteria of your situation you may be able to wipe your tax debt, set up an offer in compromise or payback with an installment agreement. For instance, by law the IRS is unable to collect a debt older than 10 years. Therefore, if your tax debt is from over 10 years ago, it should be forgiven, as the government is not legally able to collect the debt.

In addition, the IRS typically does not collect a debt with a low Realistic Collection Potential (RCP). An account is stated to have low RCP if the following factors are true:

- Low income amount

- No way to make payments

- No assets that can be sized or liquidated, such as real estate or bank accounts

If any of the above criteria are met, you may find that your account is marked RCP. Although this is not technically a debt forgiveness, the IRS simply does not attempt to collect the debt owed, usually.

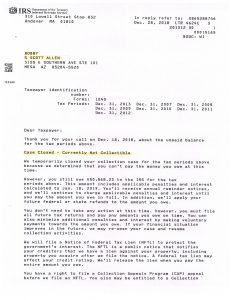

Also, the Non-Collectable Status restricts the IRS from collecting a debt, similar to the RCP. What this means is, you do not have the assets or money available to pay the debt. This program was designed with the concept of providing taxpayers enough time to earn the money or get a higher income to pay on the debt.

Can The IRS Collect After 10 Years?

“No“, once a non-collectible account reaches the 10-year mark, the debt can’t be collected. In some situations non-collectible status collides with the amount of time the IRS is able to legally collect the debt. Therefore, once a Non-Collectable account reaches the 10-year mark, the debt can no longer be demanded by the IRS.

Finally, when a taxpayer files for Chapter 7 bankruptcy, the IRS is unable to pursue a debt collection against the individual. Although rare, there are situations where bankruptcy allows for tax debt forgiveness.

The IRS cannot make contact with you or try to collect on a debt during a pending case. If a court rules a tax debt has to be forgiven, the IRS is no longer able to pursue future action against the past tax debt.

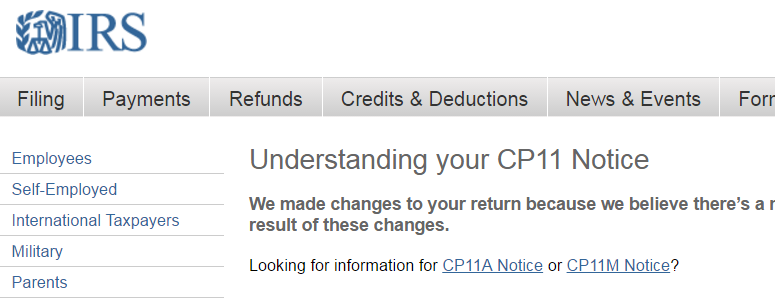

What Is The Fresh Start Program With The IRS?

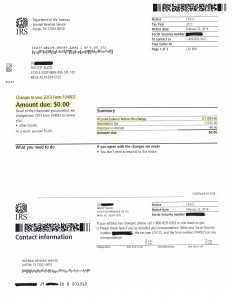

The Fresh Start Program is a collection alternative that allows individuals and businesses, in most cases, to settle their tax debt for less than they owe. This makes it easier for back tax payers to settle their tax debt and get a fresh start. Although, the required criteria to get debt fully erased can be very time consuming and stringent. For those wanting to settle debts in a timelier manner, the IRS’ Fresh Start Program is an option.

Under the Fresh Start Program, the Partial Payment Installment Agreement option is the most used. With the PPIA you are allowed to setup an affordable payment plan for your account, which runs until the debt is fully paid or the debt account has reached the 10-year mark.

IRS Fresh Start Program Qualifications

- Must be unemployed for 30 consecutive days

- If you are filing a joint return, you/spouse must meet 1 of the qualifications

- Self-employed individuals with a drop in income of 25% or more

- Tax debt must be less than $50,000

Read more about IRS Fresh Start Qualifications

Offer In Compromise Allows To Negotiate With The IRS

Another option you may also choose to pursue an Offer in Compromise, which enables you to settle a debt. The following factors are used to determine if an account qualifies:

- Are in compliance with IRS

- Owe new debt

- Cannot or have no intention to file for Chapter 7 bankruptcy

- Never turned down for OIC before

You can use the IRS website to file for an Offer In Compromise, or have a tax professional like Tax Debt Advisors assist you with the process. You can check the IRS website to see if your qualify for OIC.

The IRS acknowledges that they are unable to collect every amount of a delinquent account, with nearly a million taxpayers owing a debt. You have the potential for having your debt reduced, or possibly erased with one of the several debt relief programs available.

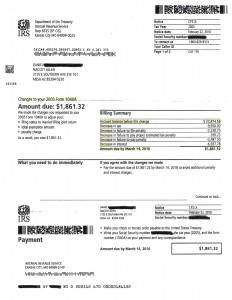

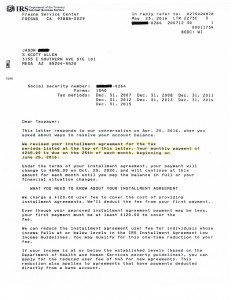

Installment Agreements Allow You To Set Up A Payment Plan

Most of the time the IRS will allow you to set up an installment agreement in order to pay back your tax debt over time. The terms of your payback agreement are determined by your budget to pay each month, how much you own and your previous filing history.

Before you accept any repayment plan, make sure that you can afford to pay it on time, every time. Late payments or missing payments can get your agreement canceled and you will have to start over again. You can only get installment agreement if you own less than $50,000 in 2017 and the maximum payback period is 6 years.

IRS Fresh Start Program Reviews

Scott Allen at Tax Debt Advisors Inc. has successfully represented me for the last 5 years. He has completely held the IRS off and successfully negotiated on my behalf. He is also done my tax returns at a very reasonable price saving me even more money. I highly recommend Scott and his highly capable staff! Bob R

Scott Allen is a true professional that can work for you to resolve your tax issues with integrity, knowledge and experience. I came to Scott after working for years with other tax professionals and listening way too much to the advice of family and acquaintances. During my initial meeting with Scott we were able to establish a plan to effectively resolve the tax debt that I had. Scott treated me with respect and understanding of my situation while detailing what works versus the falsehoods so many profess. Scott also performed within the time frame that I required. I am so satisfied with Scott’s work that he now handles all of my annual tax returns going forward. Robert M

Have Your Debt Reduced Today With Tax Debt Advisors

Need help with wiping out your old tax debt? Tax Debt Advisors has helped resolve over 108,000 debts. Receive a tax debt consultation today by giving Scott a call today at 480-926-9300. Tax Debt Advisors can help negotiate an offer in compromise on your behalf to finally settle your tax debt.