Scott Allen EA: The IRS has levied your Bank Account in Chandler AZ

Don’t receive an IRS Levy Chandler AZ notice

Once you have delayed working out a settlement until your Chandler AZ bank account has been levied, you have painted yourself into a corner with fewer options. That is why you need to get professional help. The IRS is reluctant to return monies levied and in many cases those funds are going to be kept by the IRS unless you can prove it will cause a hardship or they should not have been taken in the first place. Once you have a settlement in place, the IRS will not levy any more funds from your bank account. If the IRS is levying your Social Security it may take 1-2 months before the IRS and the Social Security Administration will agree to release the levy. Fortunately the IRS is limited to levying 15% of your Social Security payment.

Scott Allen E.A. near Chandler AZ offers a free consultation to determine your best option once your bank account has been levied. Scott can be reached at 480-926-9300. Remember that the funds in your bank account are on hold for 21 days from the date of the levy. That gives you up to three weeks to determine what if any amount can be refunded. Call Scott Allen E.A. to give yourself and Scott enough time to make the best settlement possible.

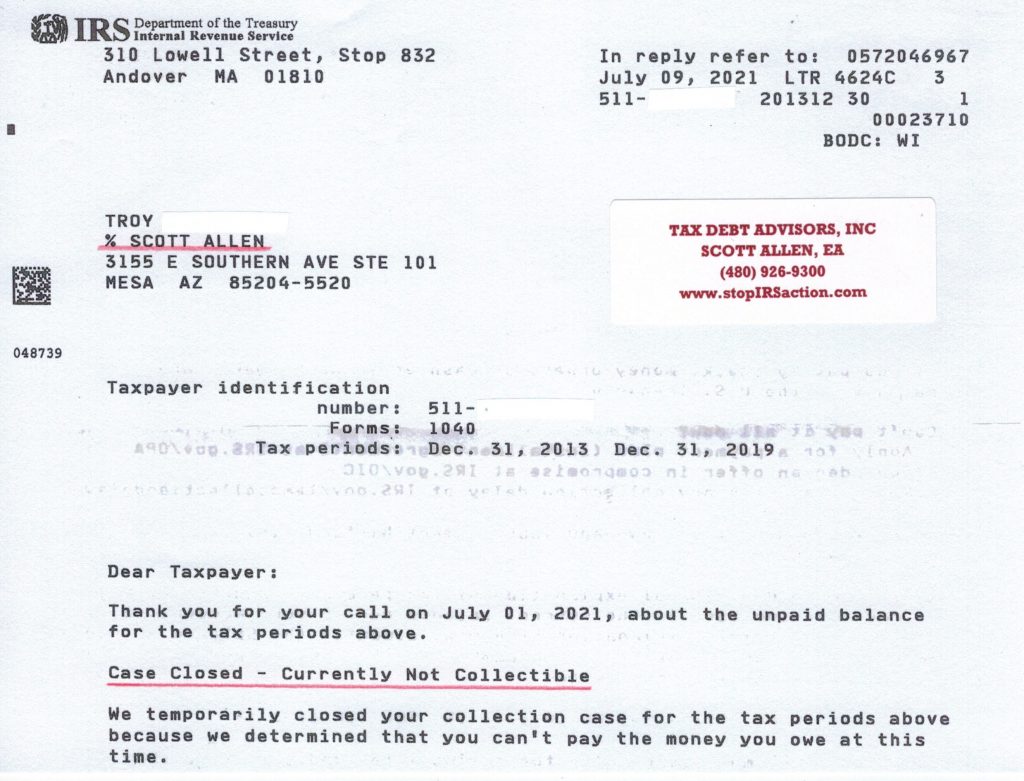

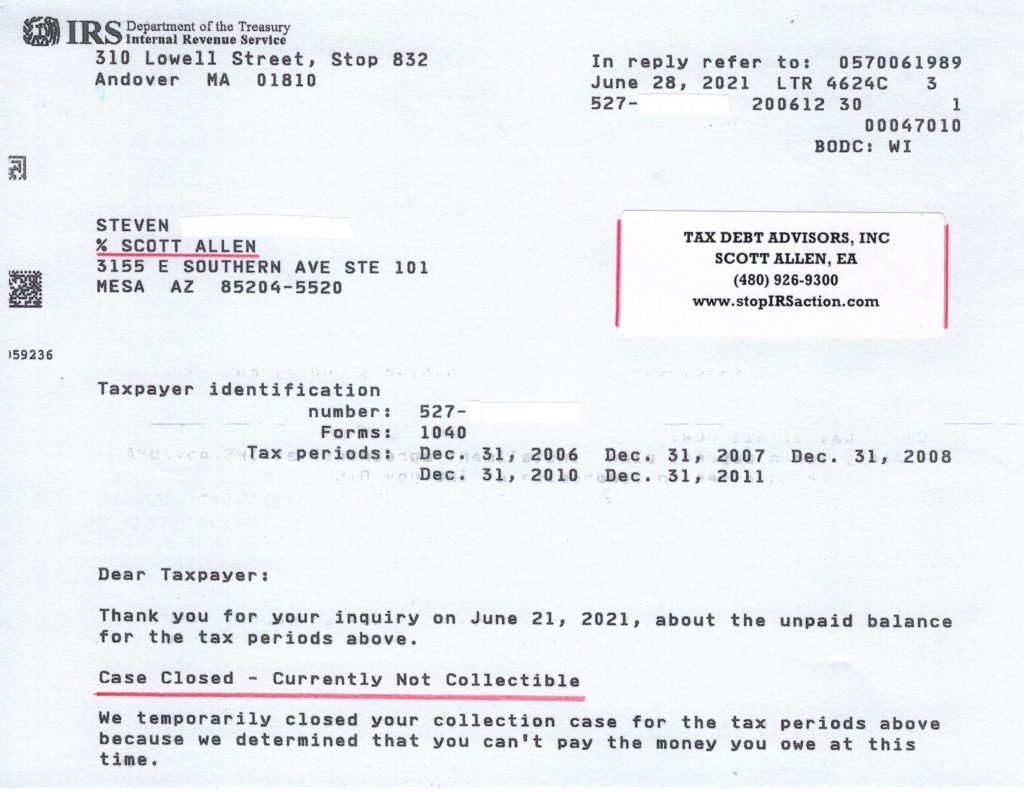

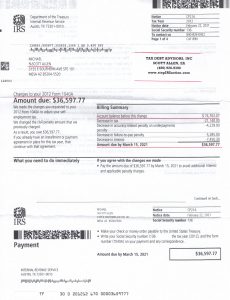

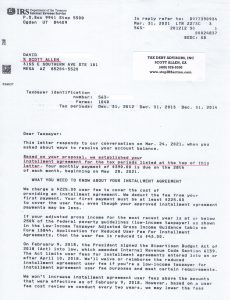

However, be like Troy and negotiate an agreement with the IRS before an IRS levy Chandler AZ happens. The agreement Troy qualified for was a Currently not Collectible status. Click here to learn more about that status. Below is his approval letter from the IRS to see it for yourself.