Never too late to Release IRS Levy Scottsdale AZ

Release IRS Levy Scottsdale AZ

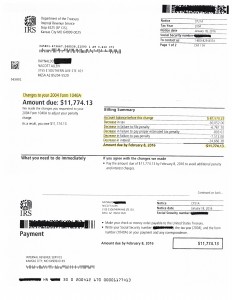

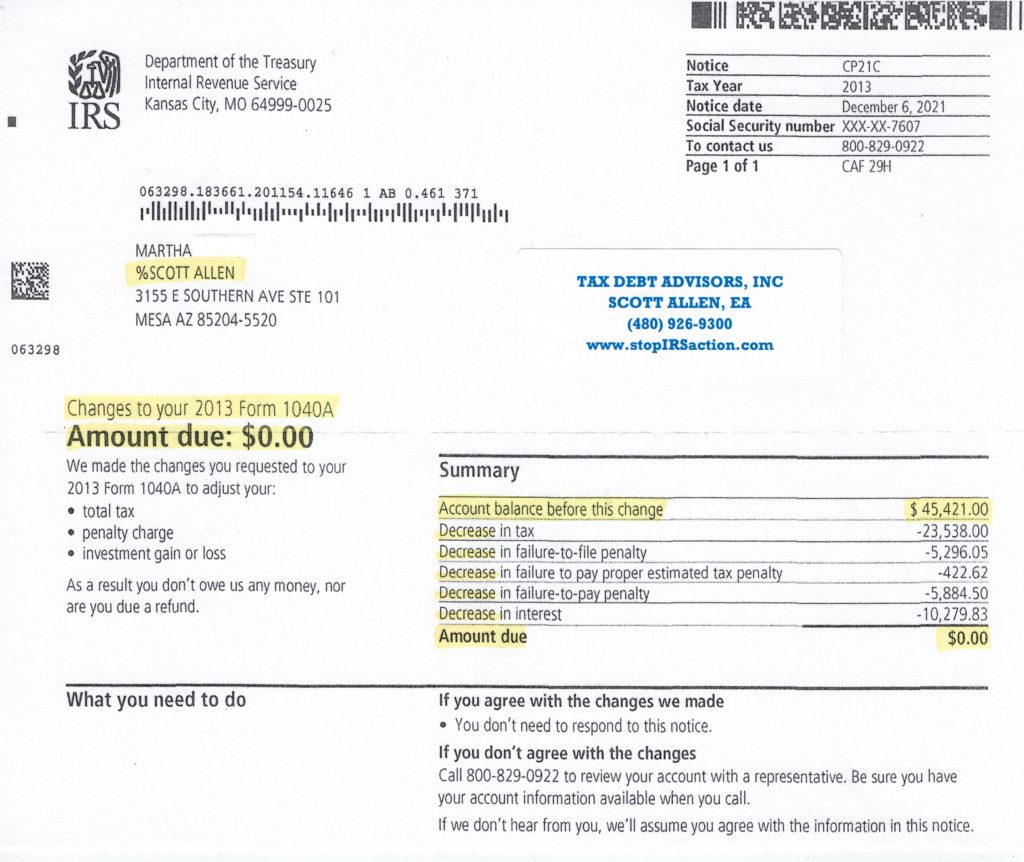

If you live in or near Scottsdale Arizona and need a release of your IRS levy Scott Allen EA can be of help. There are steps to take to get that accomplished. Scott will find out and go over all those steps with you in order to release IRS levy Scottsdale AZ. Raynaldo is a client who took Scott Allen EA as his IRS power of attorney. He was under a levy and had multiple years of back taxes that needed to be corrected and filed. The IRS had filed some tax returns for him, called Substitute For Returns (SFR). The notice below shows the acceptance of the protested tax return that was prepared by Scott Allen EA. By doing this Raynaldo’s debt was reduced by over $69,000. After getting this year and others correctly filed, along with stopping the levy, Raynaldo was back in the drivers seat. He is in compliance with the Internal Revenue Service and life feels good again.

If you find yourself in a similar situation don’t put it off any longer. Get Scott Allen EA of Tax Debt Advisors on your side representing you today. He will only take on your case if it is in your best interest.

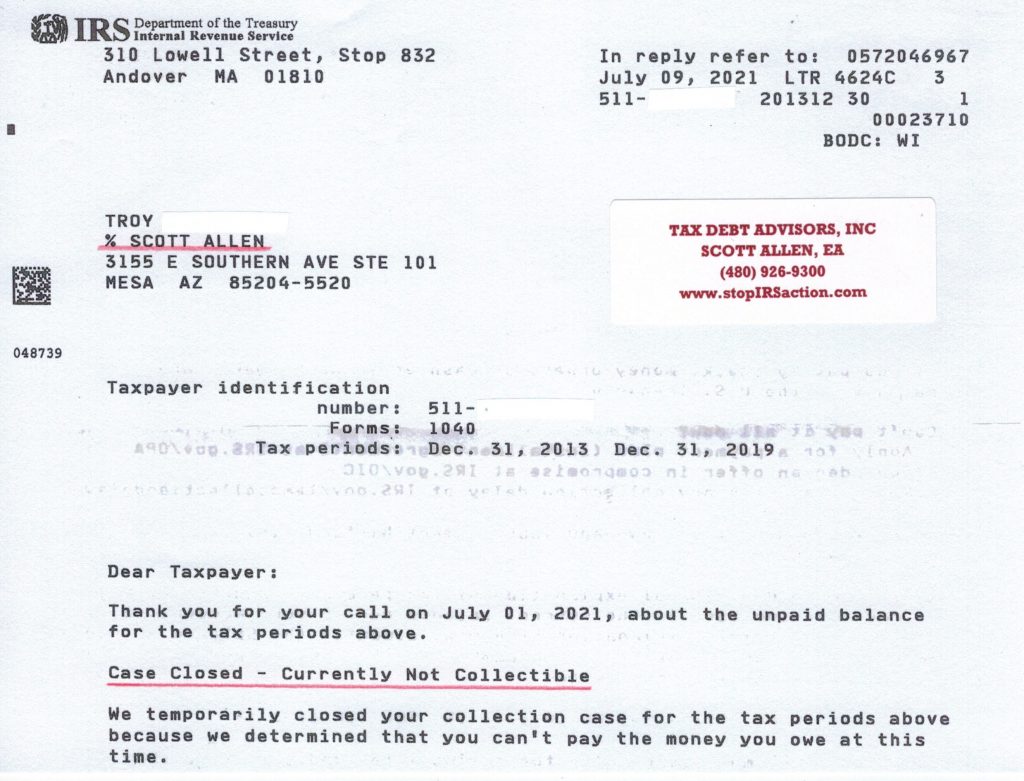

How did Scott Allen EA help Roger with his IRS levy Scottsdale AZ?

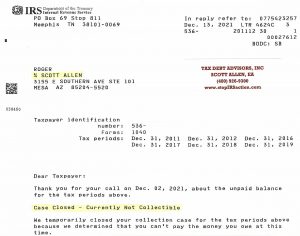

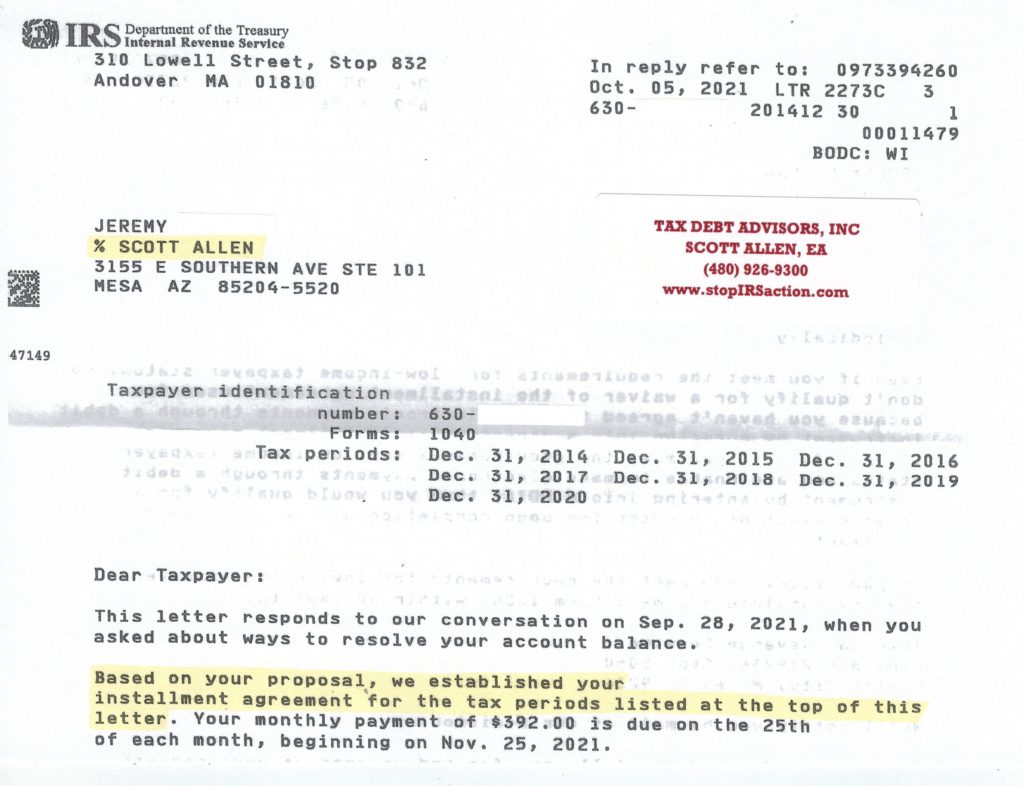

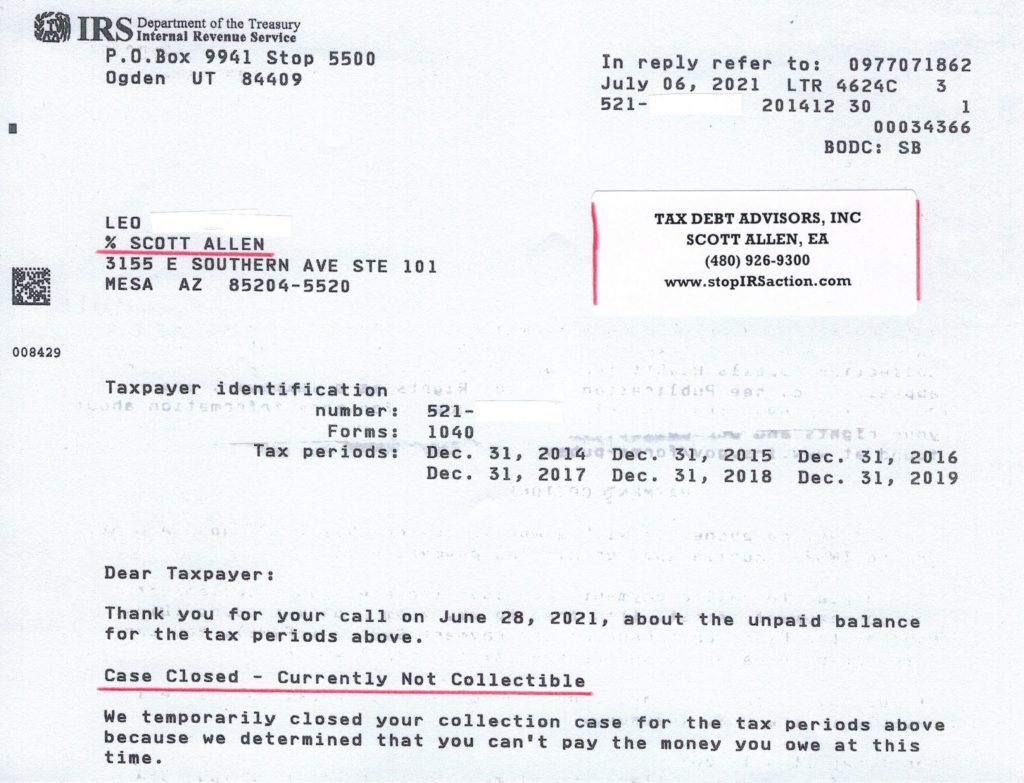

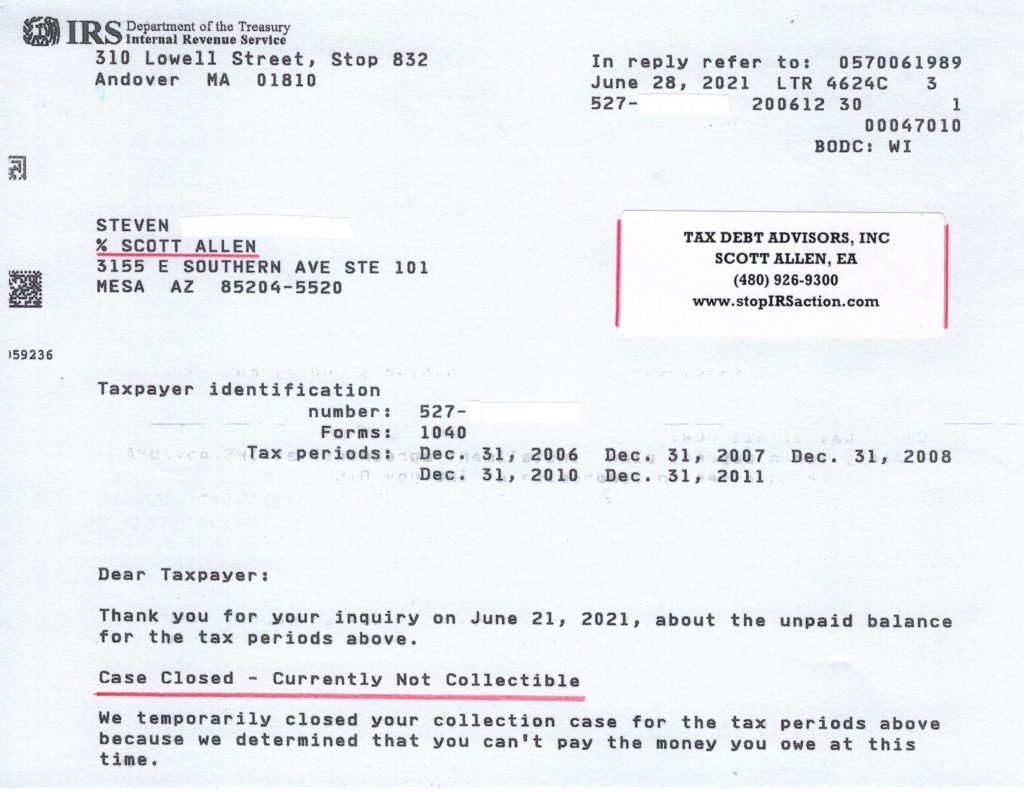

He negotiated all his back taxes into a Currently Non Collectible Status. That is correct – Roger doesn’t have to back a dime back on his back taxes as long as he files and pays his current and future taxes on time. You bet he will be in my office Feb 1st to prepare next years taxes on time. See his approved agreement with the IRS below.