Do I need an Arizona IRS Attorney when I can’t pay what I owe the IRS?

Settle the IRS without using an Arizona IRS Attorney

No, your inability to pay the IRS is not a legal matter. What you do need is a highly trained tax professional. Most clients that owe the IRS will have a problem or inability to pay what the IRS says they owe them before the debt is fully paid off. Some of the options available include:

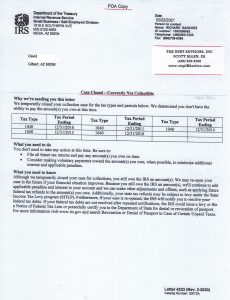

- Determine if you qualify for a non-collectible status.

- Determine if you qualify for an Offer in Compromise.

- Determine if you qualify to have your tax liability discharged in a bankruptcy.

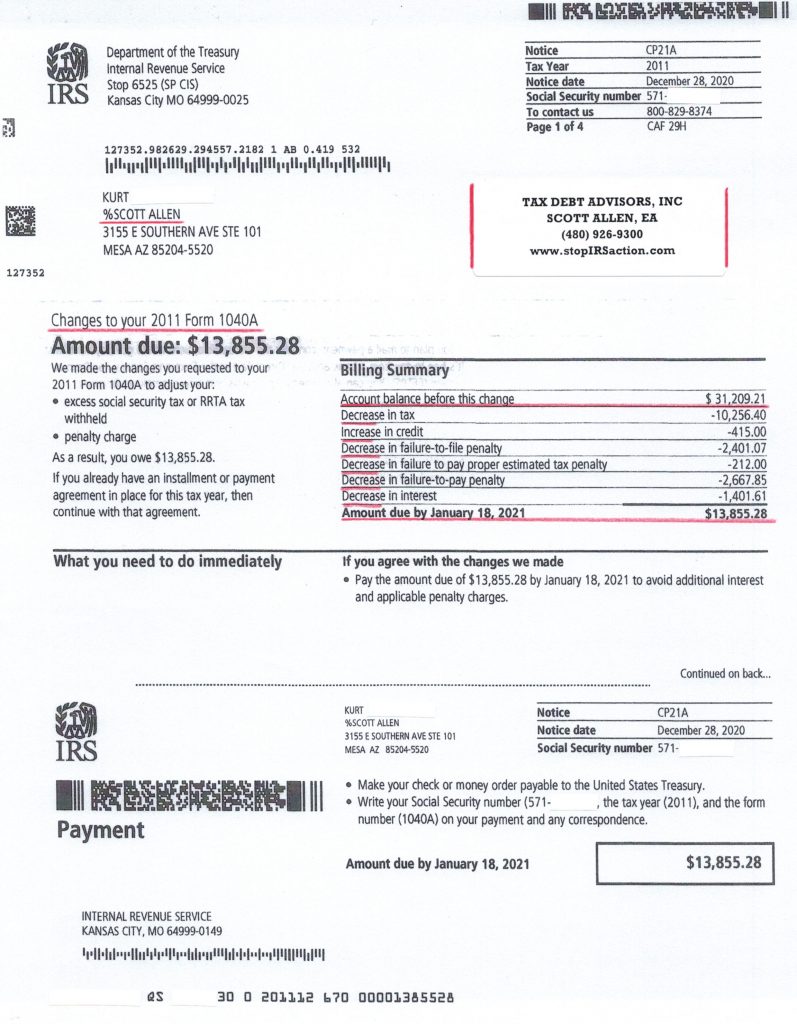

- Determine if any of your interest or penalties can be abated.

- Determine if you should amend a previously filed tax return.

- Determine if you should request an audit reconsideration on a return that was audited—especially if you did not attend the audit and were denied all of your legitimate deductions.

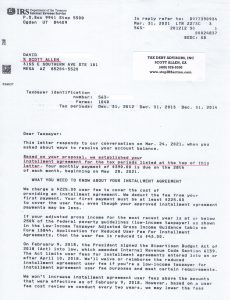

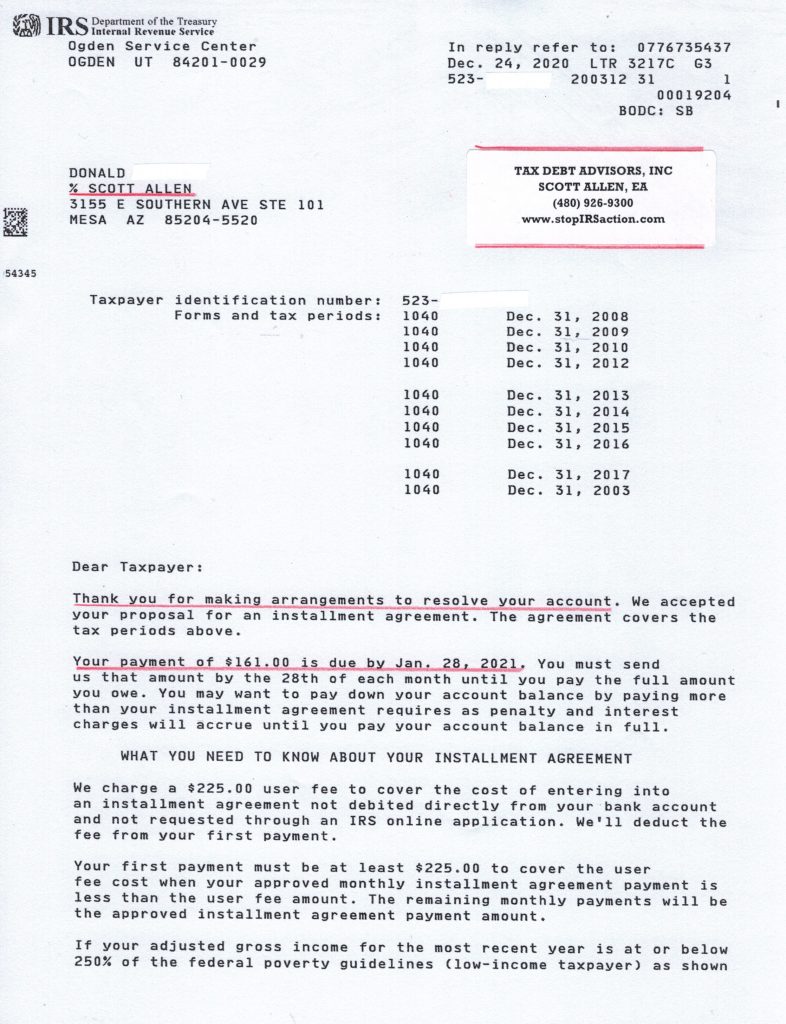

- Determine if you qualify for a reduction in your monthly IRS Installment Arrangement.

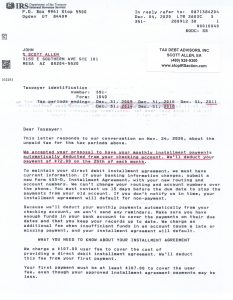

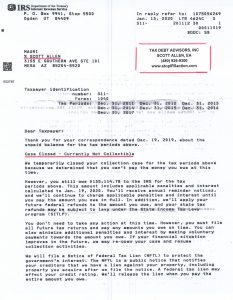

All of these options should be considered if you cannot pay the IRS what you owe. Scott Allen E.A. of Arizona is well versed in all of these IRS procedures and is available for a free consultation. He can be reached at 480-926-9300.

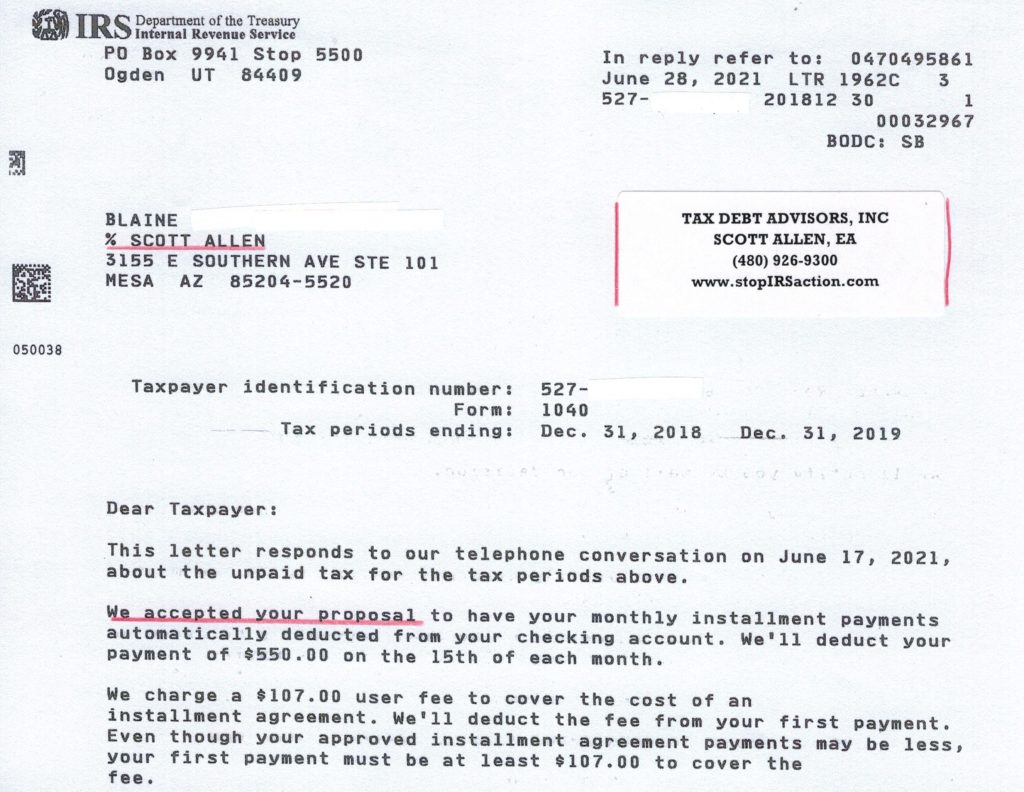

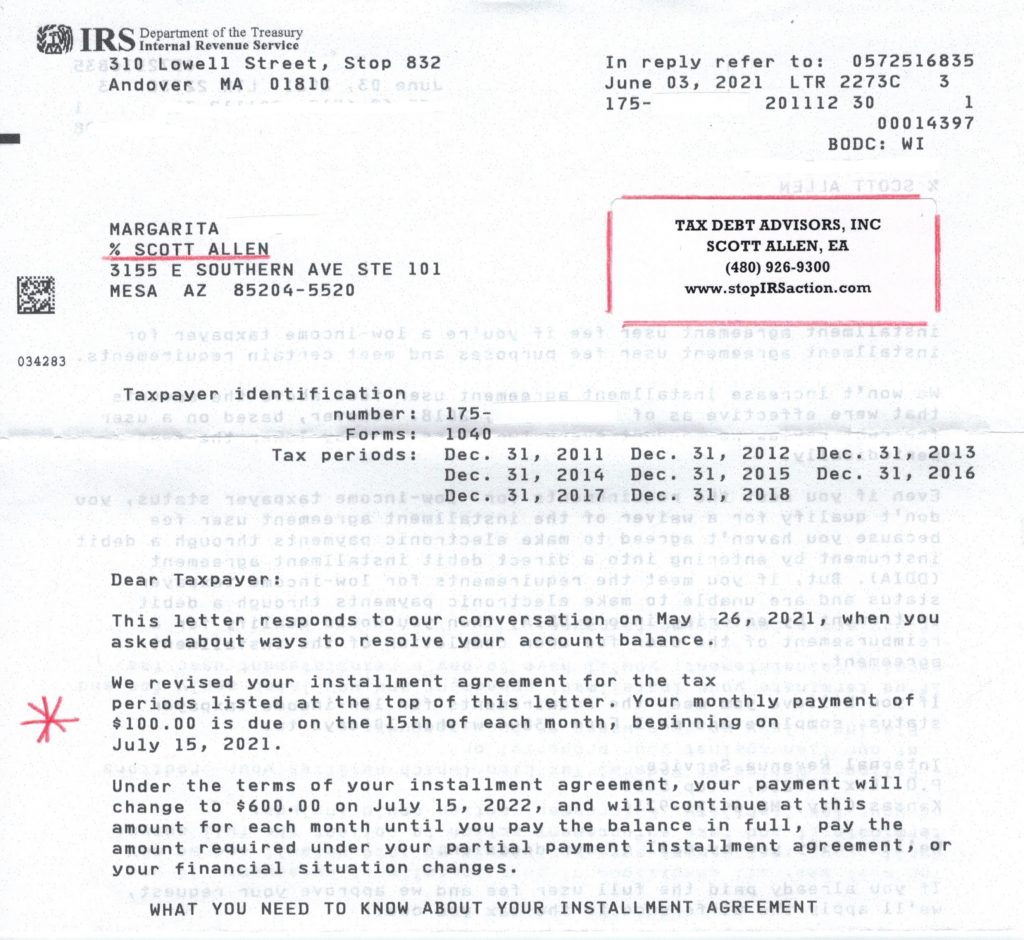

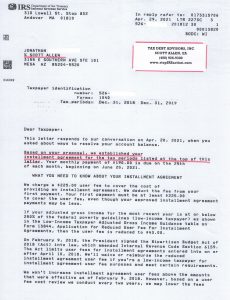

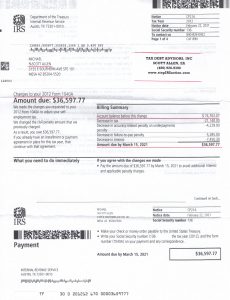

See how Scott Allen E.A. settled Blaine’s IRS debt by viewing the negotiated agreement below. It was just approved by the IRS. Not everyone has the same outcome but Scott Allen E.A. will promise to get you the best possible settlement the law will allow.