File Back Taxes Gilbert just like David had

File Back Taxes Gilbert

Are you an Arizona resident embarrassed that you need to file back taxes Gilbert? Don’t be! Probably 1/3 of everyone out there has some sort of IRS tax problem or just got over one. One thing we have learned in our over 40 years of experience is that every IRS problem is solvable.

David is a small business owner working 60 hours a week and fell behind on his taxes. As a homeowner with equity he was worried and stressed the IRS would want to take his house away. He needed to get this business (C-Corp) and personal taxes all caught up for five years.

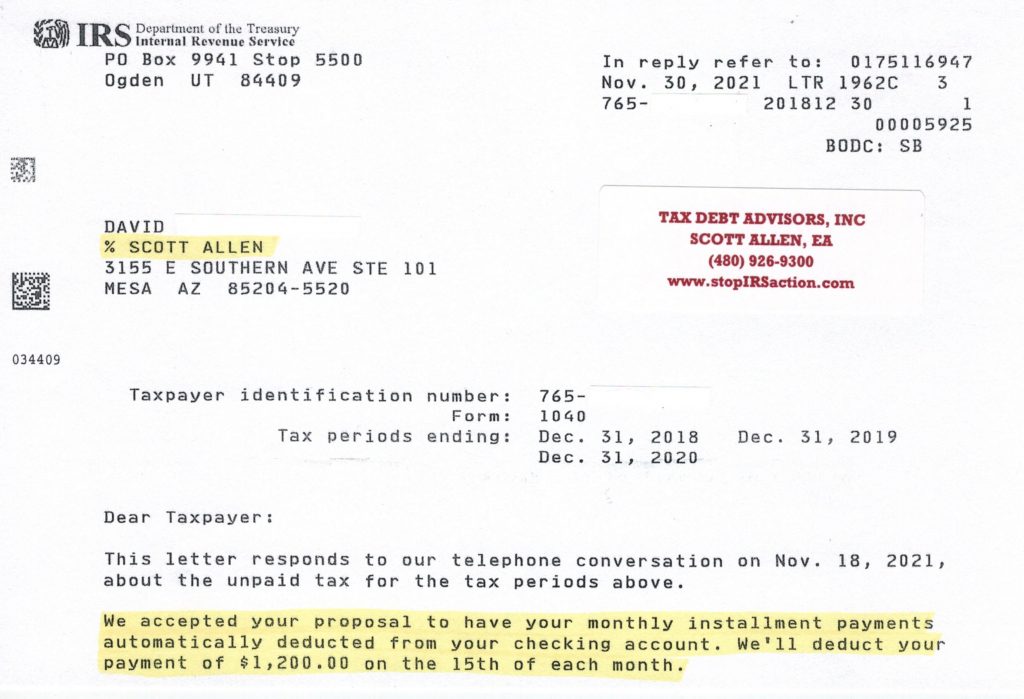

Scott Allen EA was able to help him communicate with the IRS on his behalf, organize his records, and prepare his personal and business taxes one year at a time until he was all caught up. It took two months but it was accomplished without any problems or issues from the IRS.

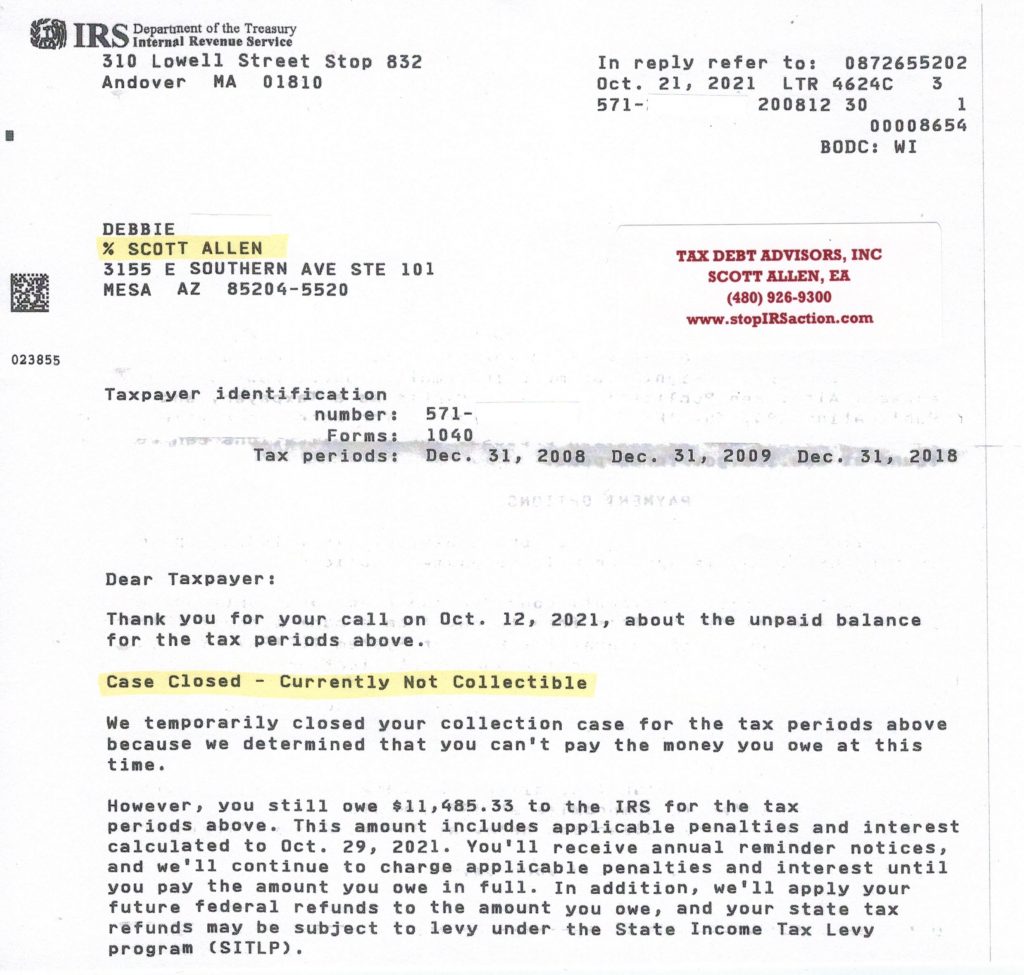

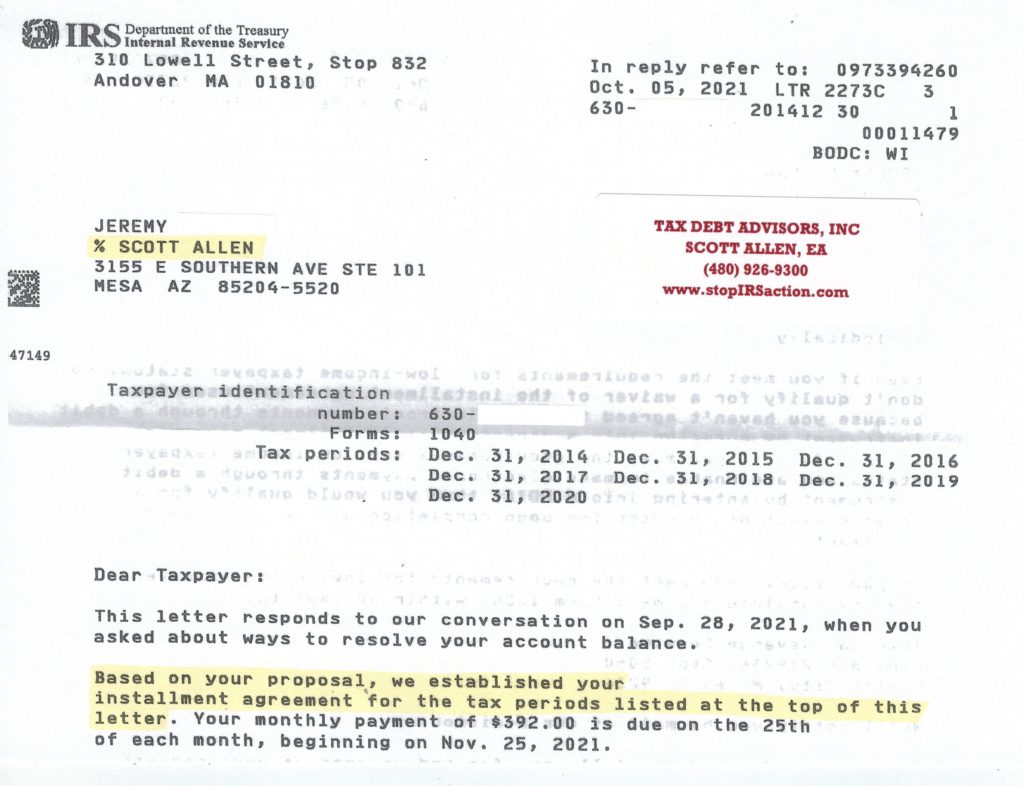

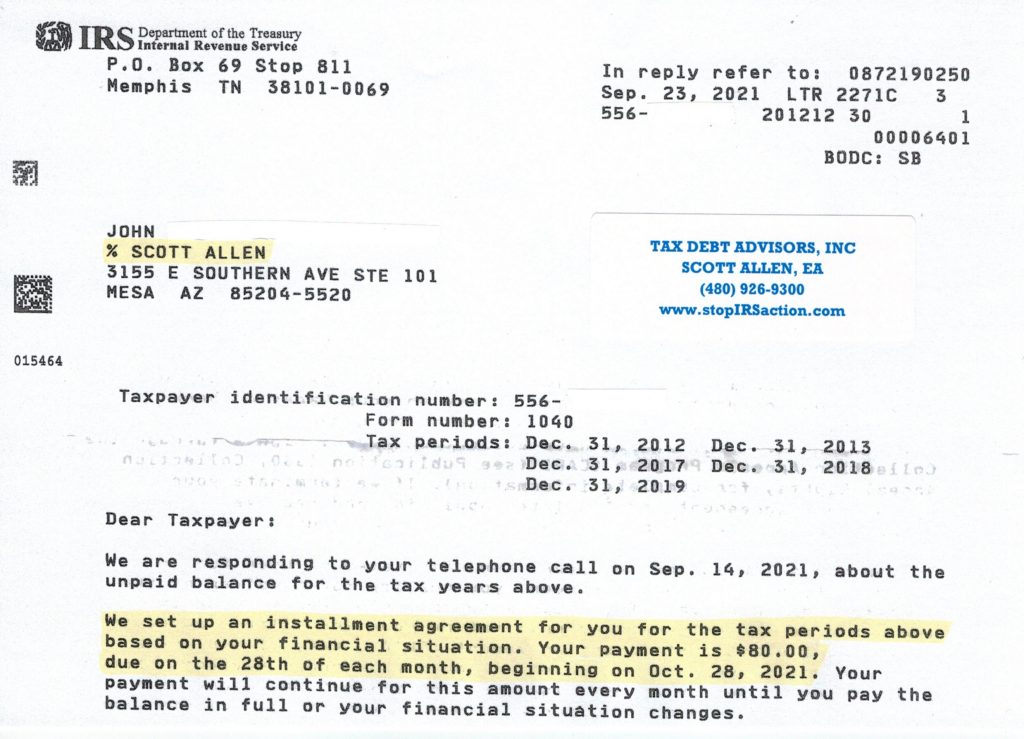

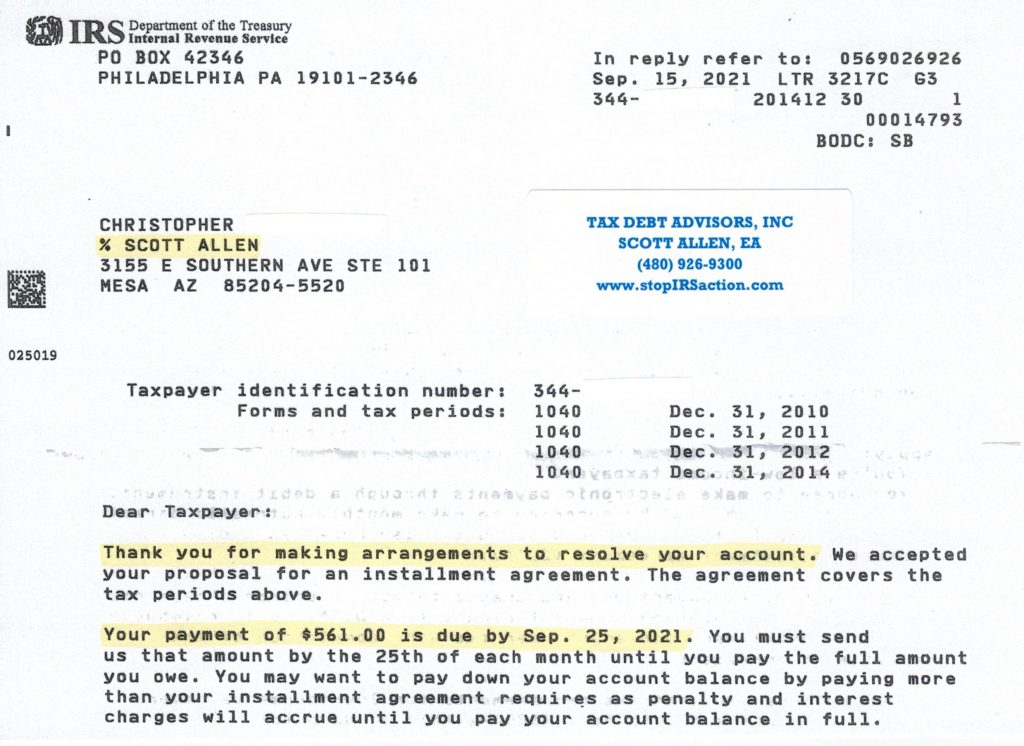

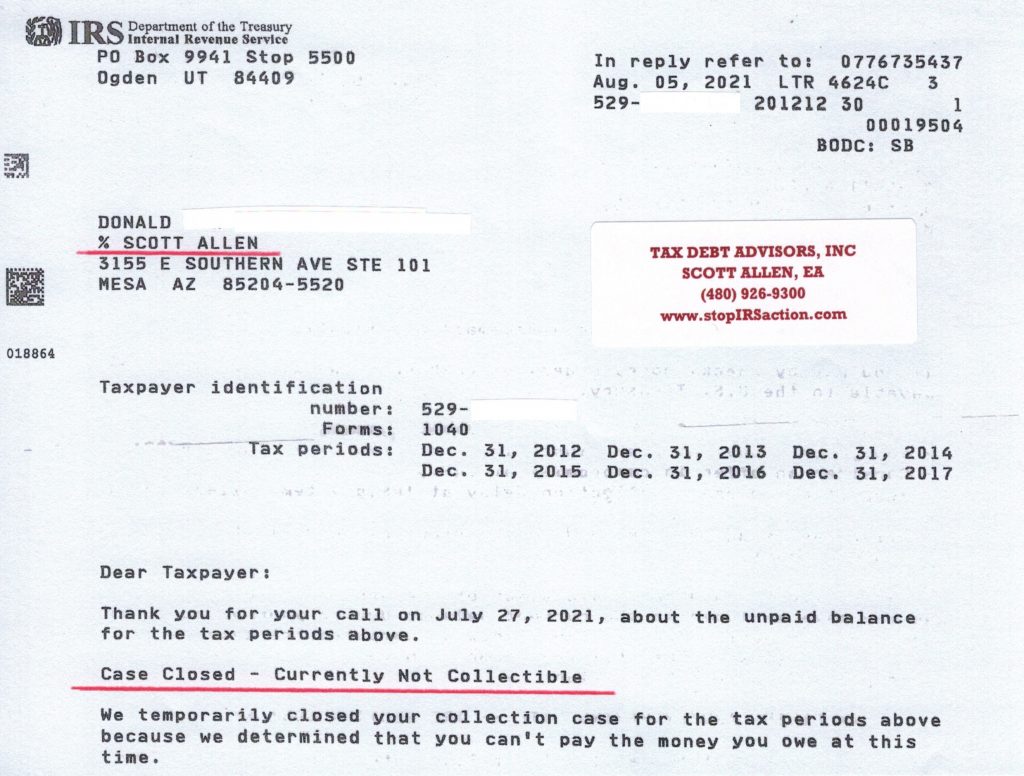

Once all the back taxes were filed Scott Allen EA collected David’s financial information (i.e. income, expenses, debts, & assets) and evaluated his ability to pay back his taxes to the IRS.

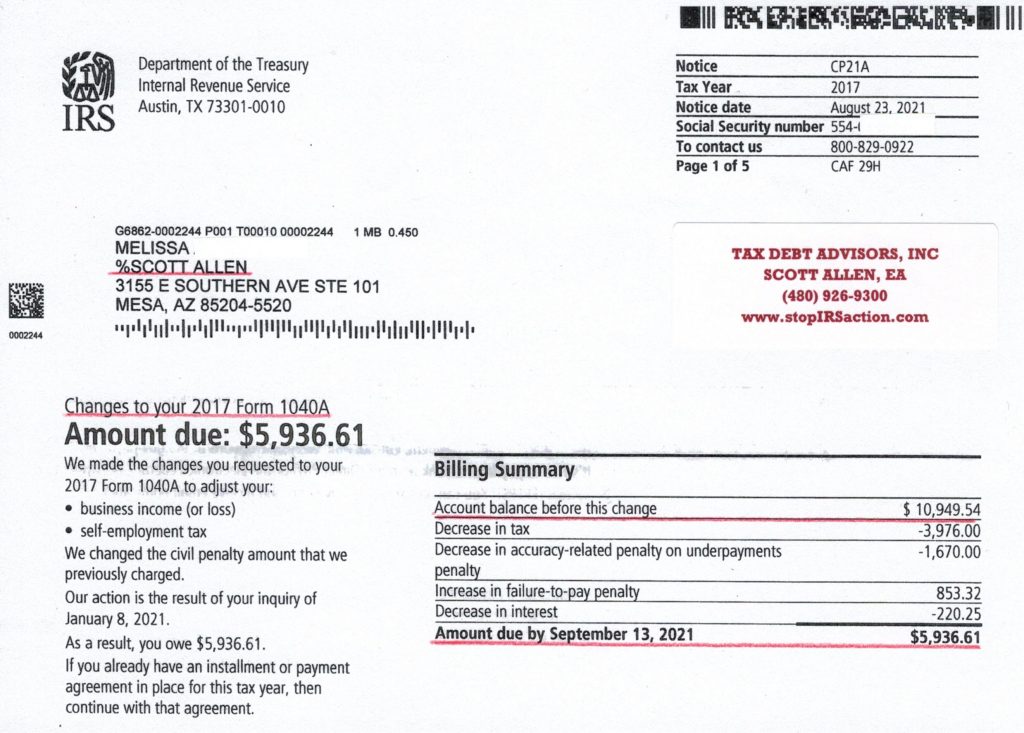

See the approval letter from the IRS on our negotiation work. Mission complete! If you need to file back taxes Gilbert, whether it is for one year or seven years call and speak with Scott today.