Can I file Chandler AZ back tax returns without records?

Scott Allen EA gets asked this questions quite often. Many Chandler AZ residents who have to file back tax returns have lost of misplaced their tax records. They are usually misplaced for reason such as moving, a flood, divorce, or theft. You don’t have to panic any longer if this is your situation. Scott Allen EA has the experience and expertise of filing back tax returns for Chandler AZ taxpayers. His company, Tax Debt Advisors is within a 10 minute drive of where you are at. He will sit down with you for a face-to-face free initial consultation to address your situation, go over the process of how to file back tax returns, and if necessary work out a settlement option with the IRS if you owe Chandler AZ back taxes. With Scott Allen EA as your power of attorney he can contact the IRS for you, get a hold on any and all collection activity and gather up the necessary information from the IRS that you may have misplaced or lost. A lot of tax records can be pulled from the IRS’s database. Otherwise, many deduction and expenses can be properly estimated thru the natural way of doing business – i.e. a realtor has to use a car to sell homes.

If you are in or near Chandler AZ and need to file back tax returns please give Scott Allen EA a call today. He is usually available to meet with you within 1-2 business days if time is of the essence. He offers professional guaranteed tax services. Click here to contact Scott Allen EA or to have him contact you.

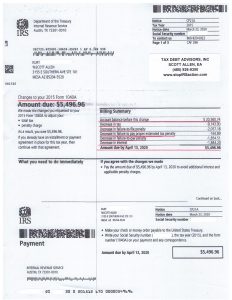

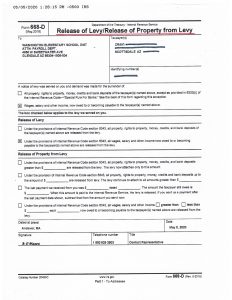

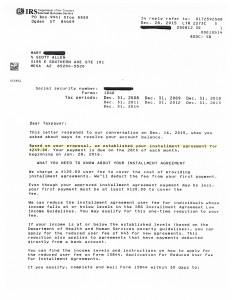

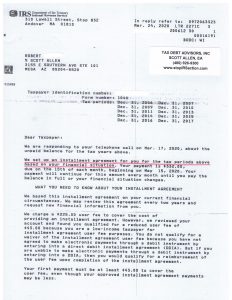

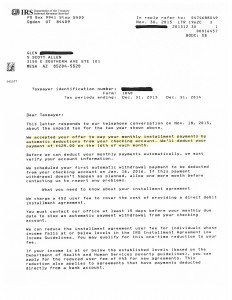

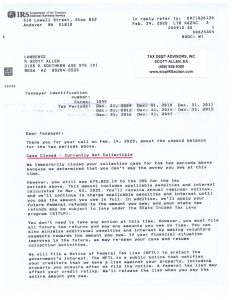

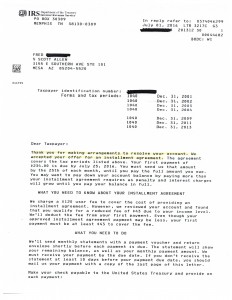

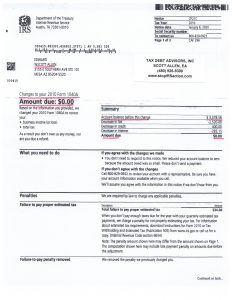

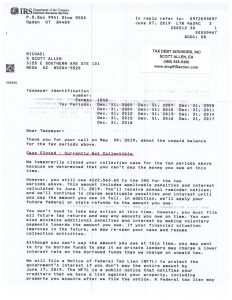

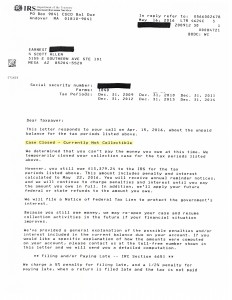

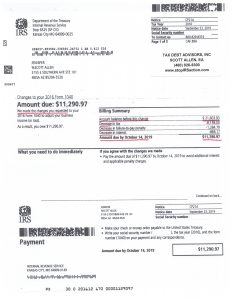

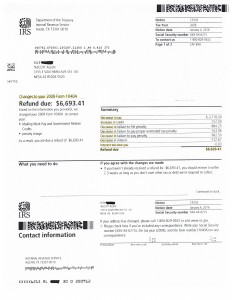

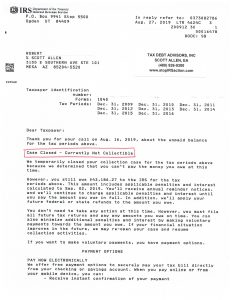

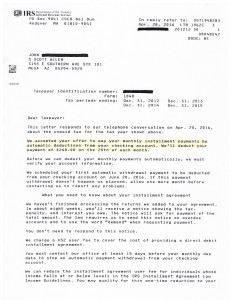

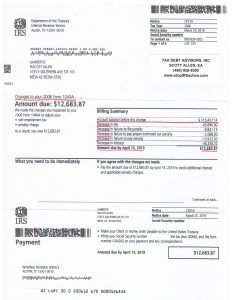

View a recent settlement below negotiated for a client’s Chandler AZ back tax returns. Gary was many years behind on his taxes with the IRS and met with Scott Allen EA to get the problems resolved.

This is an actual settlement approval letter from the IRS and a common outcome for many taxpayers. Because of all the advertising on the TV and radio many people believe the IRS will settle everyone’s tax debt for a lesser amount. While this is a true program it isn’t a reality for everyone. There are many qualifications to be a candidate for that program and Scott Allen EA will go over those with you. With that being said, if you are not a viable candidate for a debt reduction with the IRS he will get you in the next best possible settlement.