How To Make Unfiled Tax Returns Okay with IRS

When you get backed up on filing taxes, it can be a scary journey of doubt and questions regarding how to make things right again with the IRS. Luckily there are some steps that you can take to make sure the IRS is satisfied and you get back in the system.

10 ways to correct unfiled returns and get back on track:

- In many cases, it is required by the IRS for the past six years of tax returns be filed to indicate that you are compliant and current. To reference, Internal Revenue Manual 4.12.1.3. and the IRS Policy Statement 5-133. Making sure the previous six years of tax returns are filed is the starting point.

- Collect your records. It is significant that you do your best to gather all of your records for the years that were not filed. The records may include W2’s or 1099s that was received for work, interest, mortgage interest paid, stock sales or dividends. If you are missing records, don’t stress over it, you are just starting.

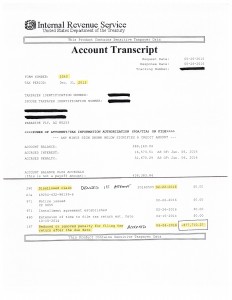

- You will supplement your records by securing internal IRS transcripts which indicate what was reported to the IRS. This is going to offer you a comprehensive list of all W2’s and 1099s that you received. This will be used for cross-checking with your records to discover anything that may be missing.

- IRS transcripts are simply the checking point. If there are amounts of income earned that does not appear on these transcripts, you should do your best to figure out the income and add it to the return.

- If you’re self-employed, business income as well as expenses should be figured out. There are several methods available for putting together the income, including total bank deposits or 1099s that report to the IRS (supplemented using income that was not reported). By going backwards, you can discover what was spent on living costs (housing, food, auto expense, utilities, etc.) and you can cross reference that with your income records using the presumption you earned at least the amount you spent and saved.

- Prior to preparing returns, you should conduct a financial review to discover how any taxes may or may not be repaid to the IRS. Dealing with unfiled tax returns is a twostep process. First, you must get everything prepared and filed. Second, you must negotiate solutions for balances due to the IRS collections. Doing this involves conducting a review of your current income, property, debts and living expenses. Once doing this, it is commonly found the amount owed for unfiled returns simply cannot be repaid, which may result in being qualified for a compromise offer, or you could be considered to be in financial hardship. In these cases, the debt amount owed to the IRS collection is put on forbearance (also called uncollectible). Bankruptcy may eventually wipe out tax debt as well.If you are unable to pay either way, taking the time to collect every possible business expense for your returns could be a useful effort if you are going to owe more than you can pay with or without receipts. If this is the case, you may be best off to file “gross” return, where you list the income amount and leave out the expenses, simply focus on solutions for collections.

- In the event that you are married, and only one spouse brought in an income, you should strongly consider having the spouse that developed the liability to file separately. By filing separately, it can put limitations on who the IRS is able to collect from, which can protect the innocent spouse.

- If you had been employed and received wages that had taxes withheld, you may find that you do not owe anything to the IRS. The amount withheld from your wages, along with other types of deductions (such as mortgage interest) will factor into this.Only balances due will incur penalties and interest charges by the IRS. Therefore, if you do not owe them, there are no penalties. Also, if you were due a refund, you may even receive those for the past three years of tax returns. However, if you have any balances rom other years, the refund will first be applied to those balances.

- There are times that the IRS will actually file a return for you in the event you do not file. In IRS terms, this is referred to as a Substitute for Return or an SFR. However, it is common for the IRS SFR’s to get things wrong, which can end up charging you for reported income on 1099s and W2s, but not providing any exemptions or deductions. You might have even received a bill due to the IRS substitute for Return. If this is the case, the estimated returns can also be corrected to lower the taxes, you just have to file an original tax return.

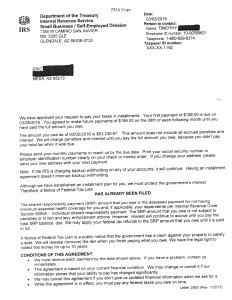

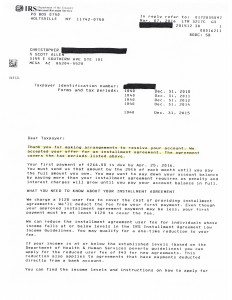

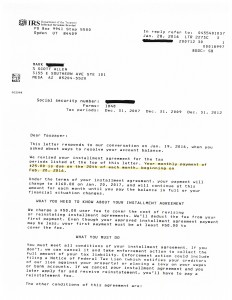

- If you have the option, you should hand file the unfiled returns using an IRS walk-in center. You will need to have an extra copy for the IRS to stamp as proof that you filed. If you’re working through an IRS Revenue Officer, you need to file directly through that person. The process can take several months once filed with the IRS, you should keep an eye out for billing notices in the mail which show the returns were processed by the IRS and that you’re now in the system again. If any balance is owed, the following step will be finding solutions to the balance due, which often consists of an installment agreement, compromise, uncollectible or bankruptcy.

You are able to become current on unfiled tax returns and get yourself back into the system using these steps. You should have the same goal the IRS has, getting your returns filed and providing financial disclosures so you reach a solution for any owed balances.

Tax Return Problems Solved

Tax Debt Advisors is here to help with any tax return problem you may be experiencing with the IRS. We have helped settle over 108,000 tax debt to date. Call us today at 480-926-9300 to get professional help in dealing with tax return issues and the IRS.