Why Use Scott Allen EA instead of a Mesa AZ IRS Tax Attorney?

Make sure you feel comfortable with your IRS representation

• Intimidation Factor—Most clients feel intimidated when using a Mesa AZ IRS Tax Attorney. You don’t need to add to the intimidation factor a Mesa AZ IRS Tax Attorney on top of the intimidation factor of the IRS.

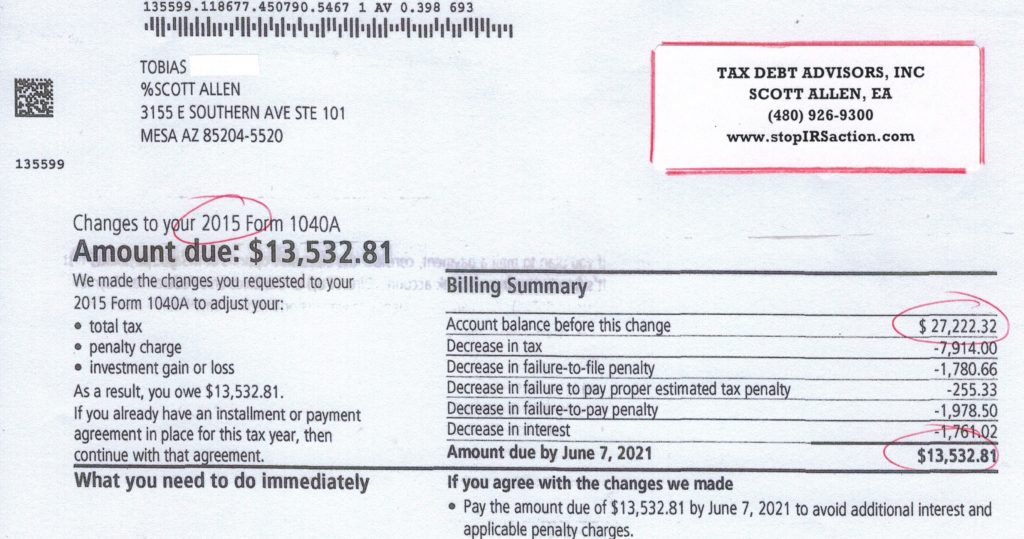

• IRS Settlement Experience—The most important factor is the number of successful cases your representation has done. Our firm has successfully resolved over 113,000 IRS tax debts over the last 40+ years.

• Rapport with IRS Agents—The second most important factor is the relationship your IRS representative has with local IRS agents and IRS officers. Our firm has work with almost all of the local IRS agents or officers that could be assigned to your case. Because of our track record of success with IRS problems, IRS agents and IRS officers prefer working with someone who has expertise in settling IRS problems and provides the information in a timely manner.

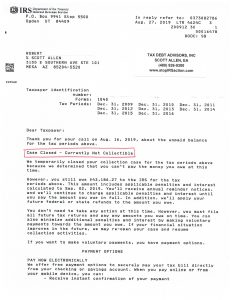

Call Scott Allen E.A. for a free consultation at 480-926-9300 and put your mind at ease. A problem with the IRS is stressful enough. Selecting the right person to represent you is critical. Scott Allen E.A. will provide the service you need to be successful in settling your matter with the IRS and won’t intimidate you in that process. The company he works for is Tax Debt Advisors, Inc. He prepares taxes (current and delinquent) and settles or negotiates IRS debts. This is his niche and this is all that he does on a day in and day out basis. Just last night he was here until 7:00pm because someone called in at 5:30pm and just found out his bank account had been levied by the IRS. Rather than putting it off for another day, Scott met with the client and got started on the resolution to his case immediately. Scott is not a bankruptcy Tax IRS Attorney dabbling in IRS problem work. He is an Enrolled Agent licensed to prepare tax returns and represent taxpayers before the IRS.

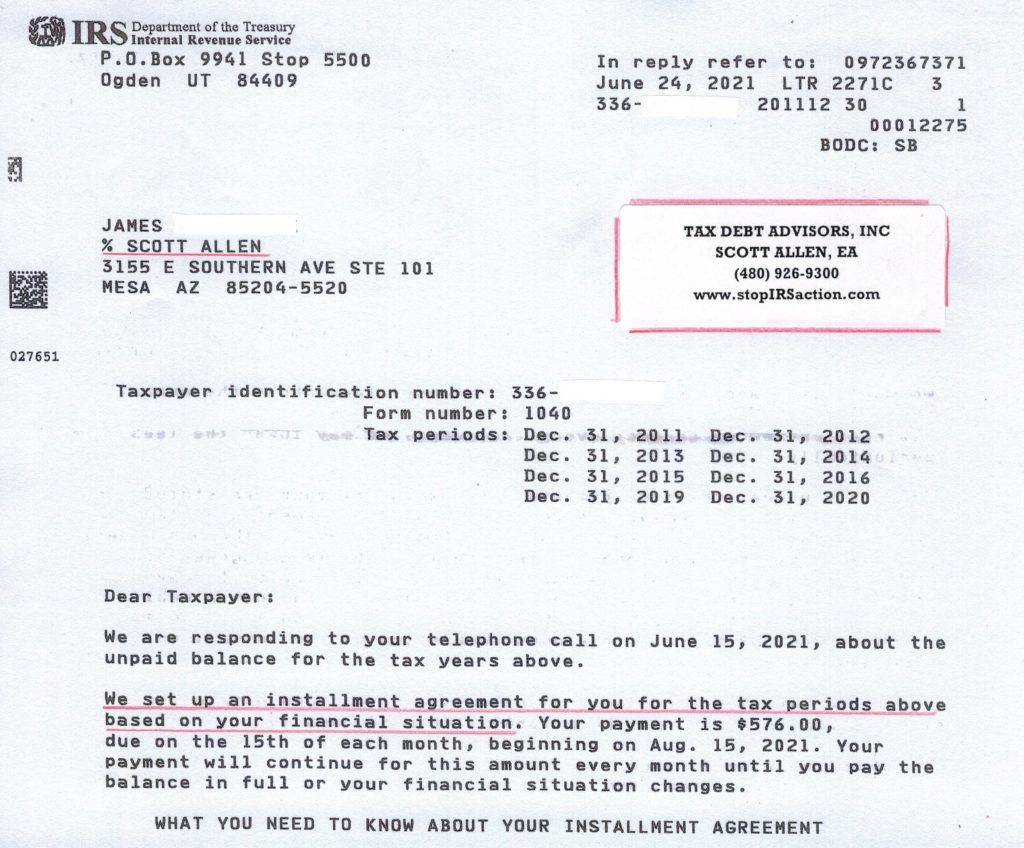

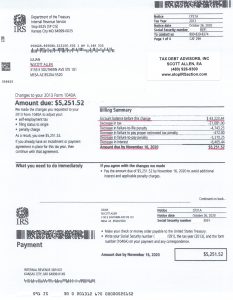

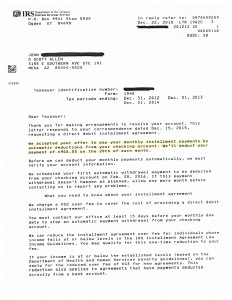

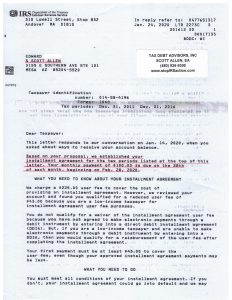

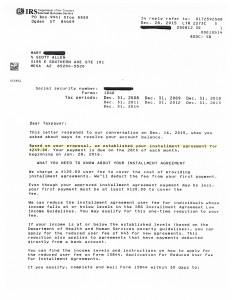

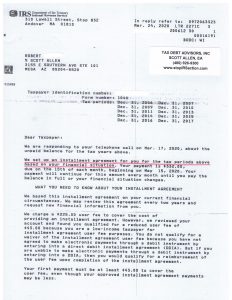

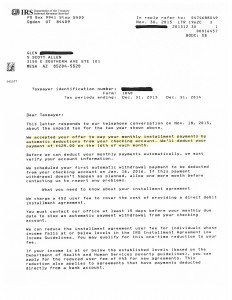

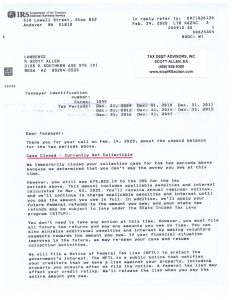

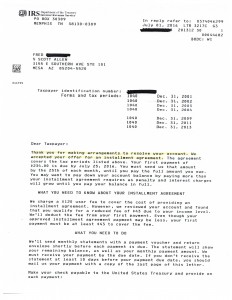

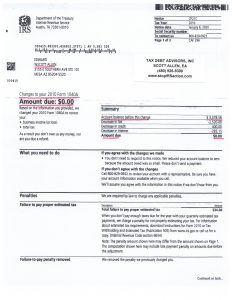

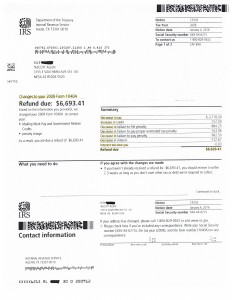

Check out this recent success Scott Allen EA has with a recent client facing a tax lien and IRS levy. Rather then hiding from the IRS, he faced it and negotiated into a low $576 a month payment plan. Speak with him today to see how he can best represent you.