Gilbert IRS settlement 2016 & 2022

SwitchToScott.com Gilbert IRS Settlement

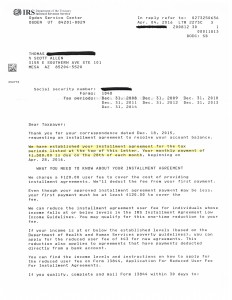

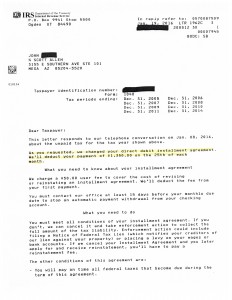

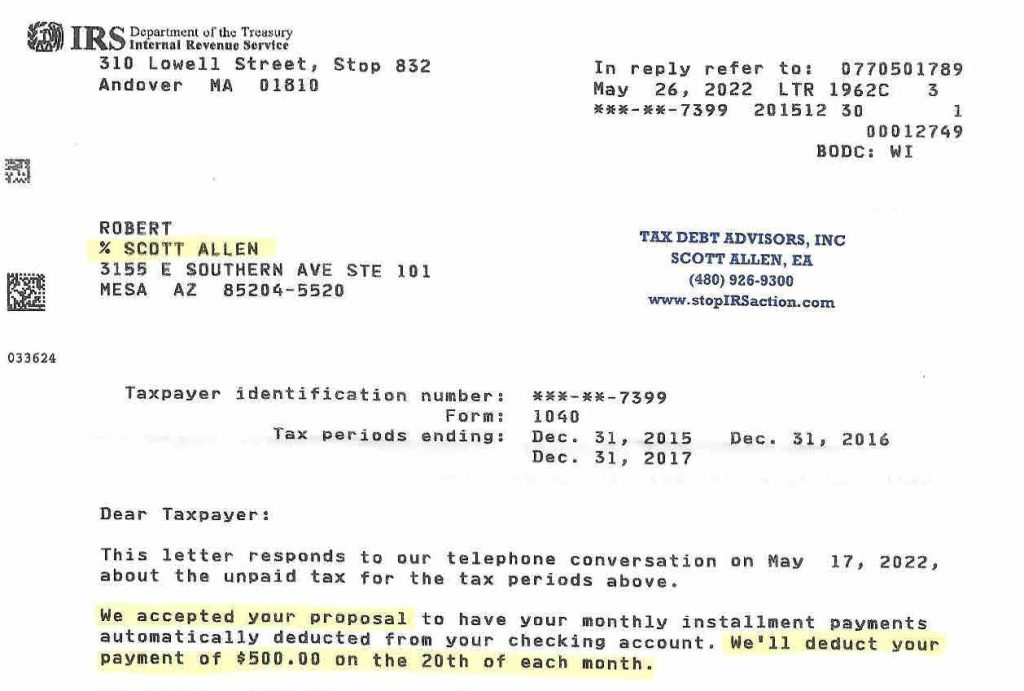

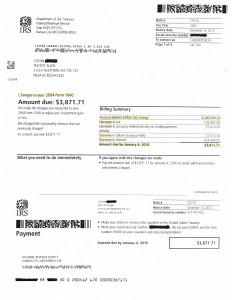

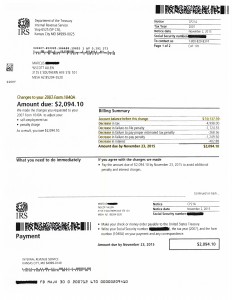

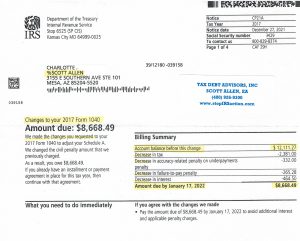

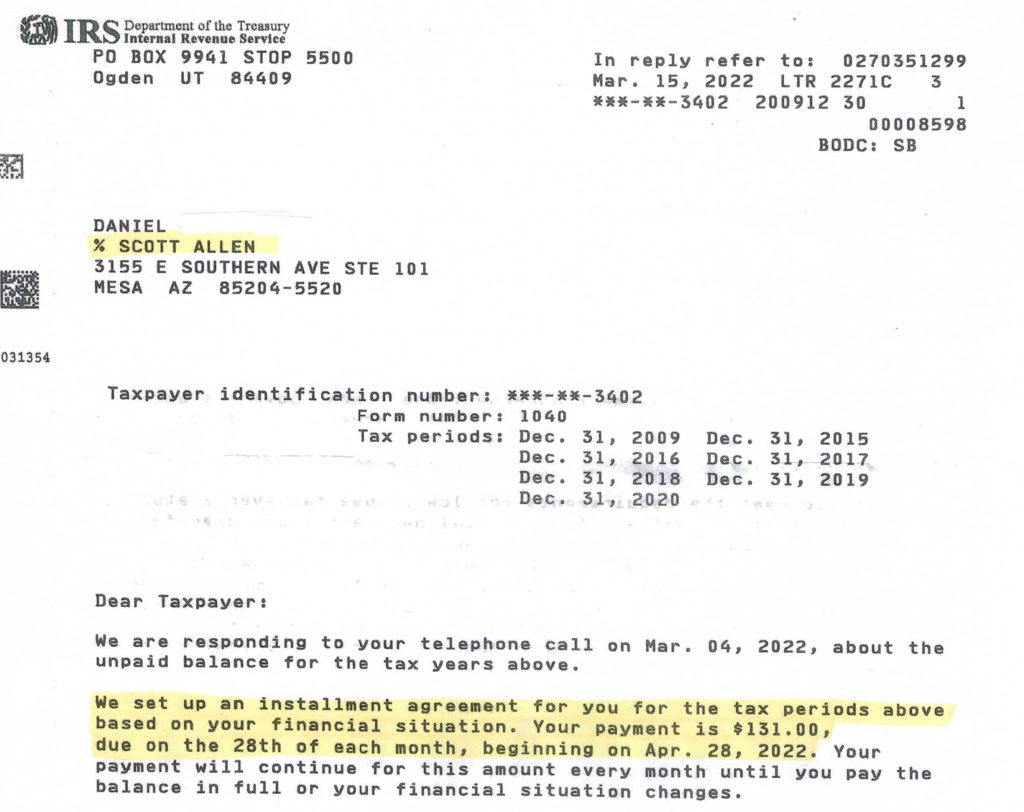

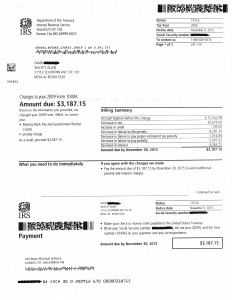

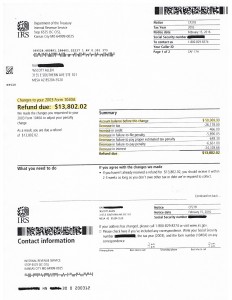

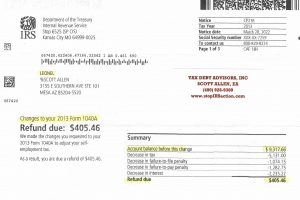

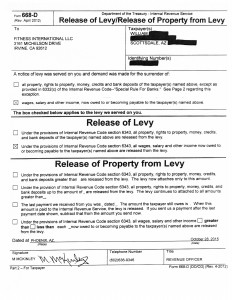

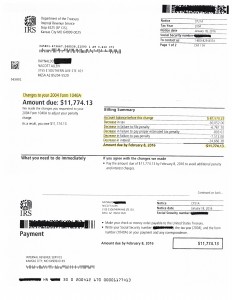

For your Gilbert IRS settlement now is the time to switch to Scott. Thomas hired Scott Allen EA to represent him before the Internal Revenue Service. Thomas had a handful of back tax returns to file along with negotiating his entire IRS debt into a payment plan. Its important that you too find an experienced professional who you can trust to get you the best possible outcome. Scott Allen EA would like to share one of his many recent successful accomplishments with you below. Click on the image below to view the actual letter of acceptance from the IRS.

Don’t walk down the dark hallway alone. Meet with Scott Allen EA to get the proper guidance to your IRS matter. He will meet with you face to face at no charge to you to let you discover if he the Enrolled Agent for you. Scott Allen EA is the owner of Tax Debt Advisors which is a family owned company. If you are in need of a Gilbert IRS settlement don’t delay your settlement any longer. He will walk you through each and every step so you know that you will get the best possible outcome that the law allows. There are several different options or ways to achieve a Gilbert IRS settlement and Scott Allen EA will make sure you know about them all before deciding on the best one for you.

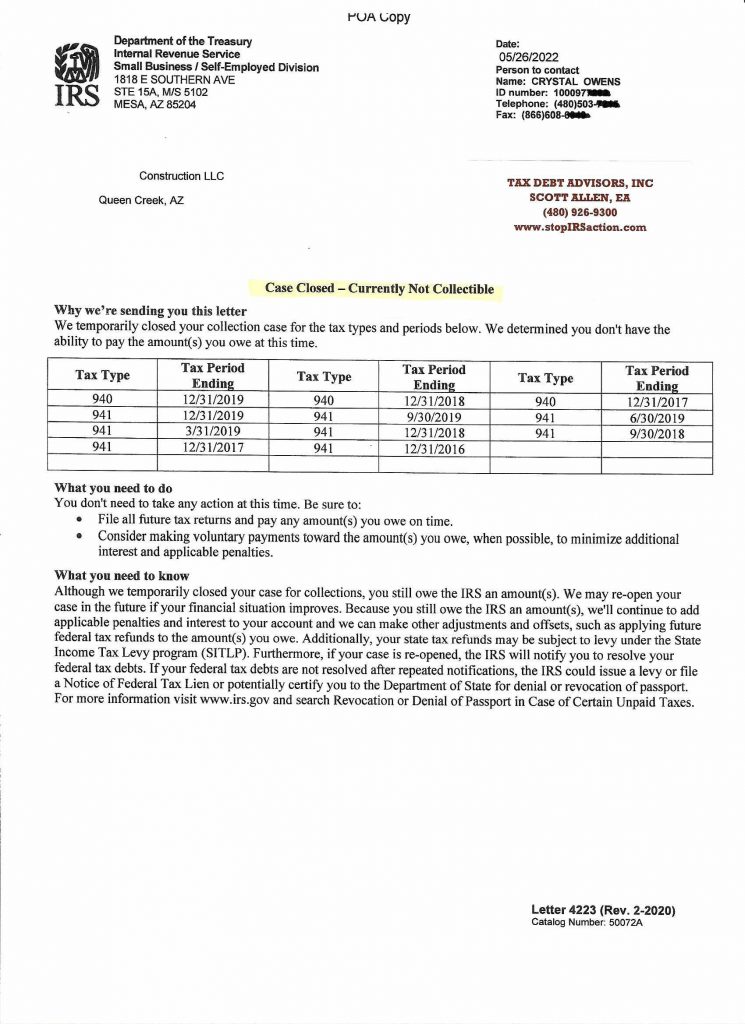

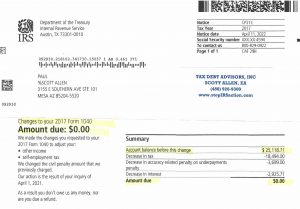

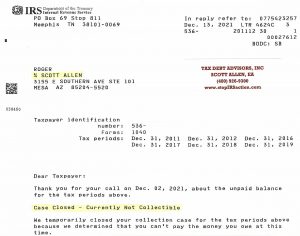

How about a Gilbert IRS Settlement in 2022 as well ?

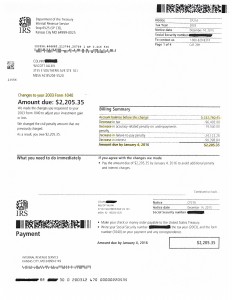

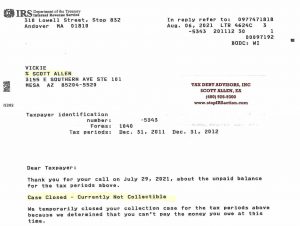

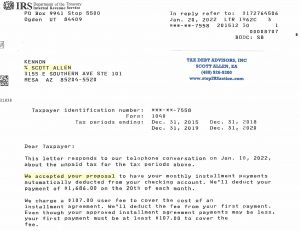

That is right Tax Debt Advisors Inc has been handling Gilbert IRS Settlements since 1977. Below is another example of a settlement negotiated by Scott Allen EA for his client Kevin. Hitting hard times post pandemic Kevin qualified to put all of his $106,000 IRS tax debt into a “Case Closed – Currently Not Collectible” status.