Phillip’s IRS Settlement in Chandler Arizona

From Burdensome Back Taxes to Relief: A Chandler Resident’s Success Story with Tax Debt Advisors, Inc.

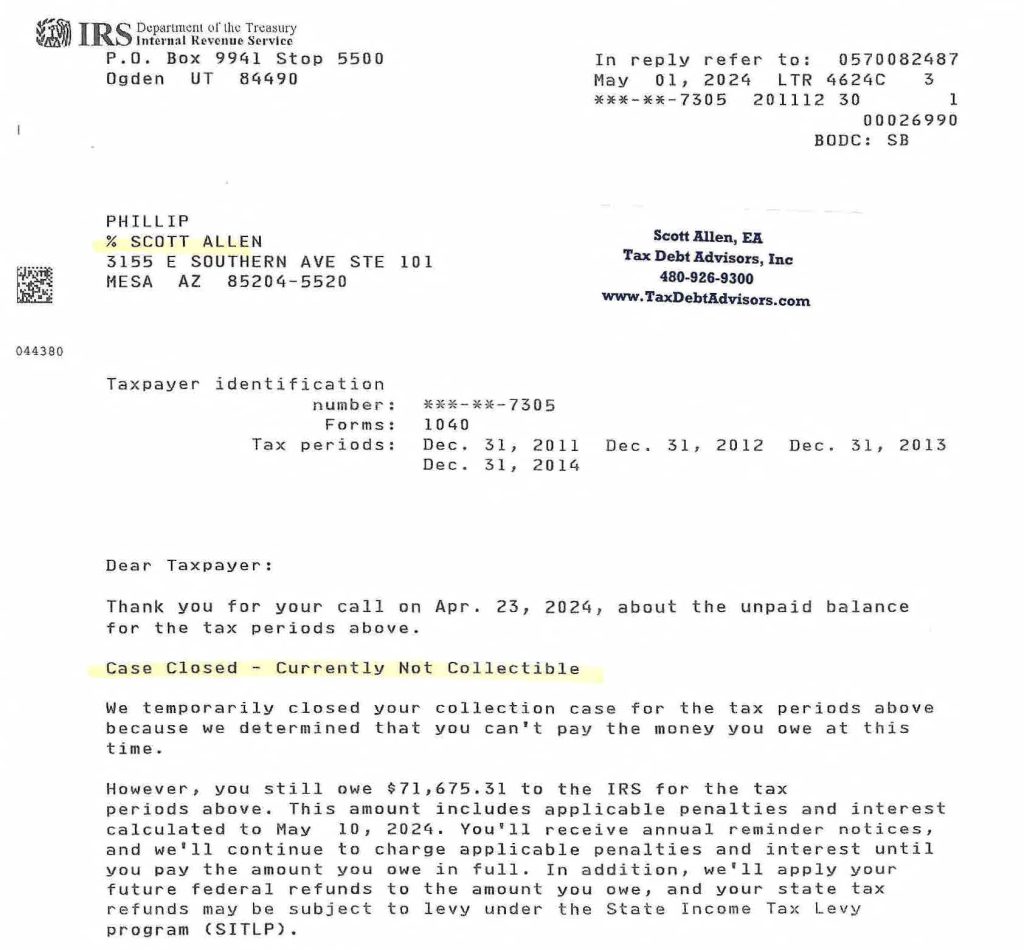

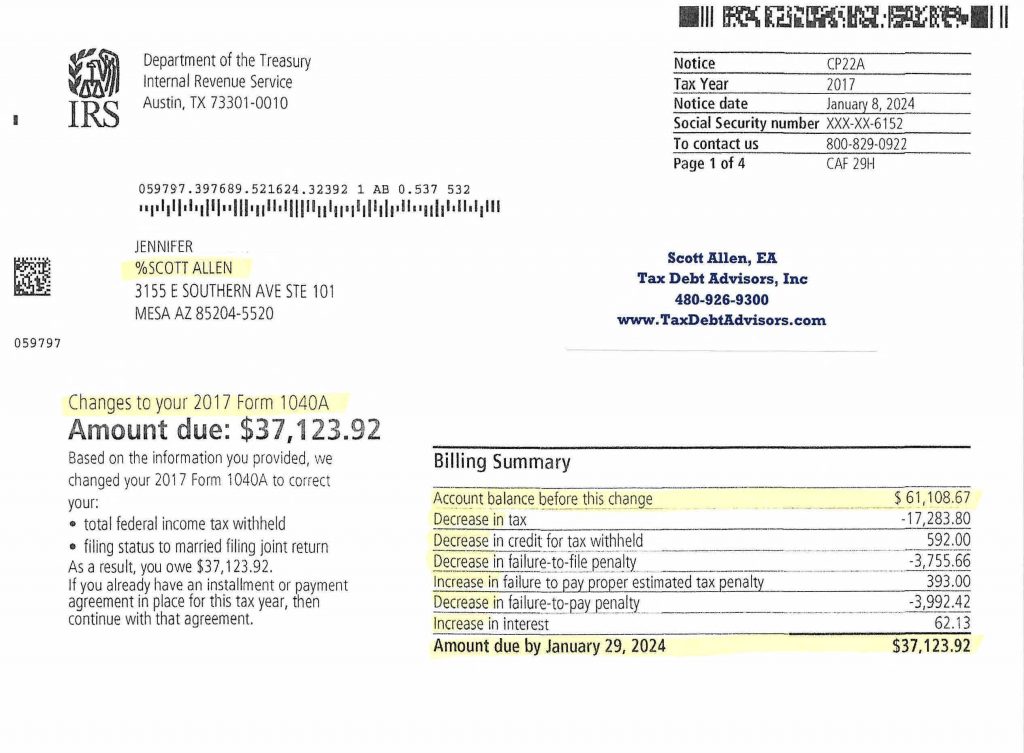

Tax time can be stressful for everyone, but for those facing significant back tax debt, the anxiety can be overwhelming. Philip, a resident of Chandler, Arizona, found himself in this very situation. With a daunting sum of $71,675 owed on four years of unfiled tax returns, he wasn’t sure where to turn. Thankfully, Philip discovered Tax Debt Advisors, Inc., a local firm specializing in helping individuals and businesses navigate the complexities of IRS issues needing an IRS settlement in Chandler Arizona.

Scott Allen, EA, the owner of Tax Debt Advisors, Inc., is a licensed Enrolled Agent with extensive experience representing taxpayers before the IRS. Enrolled agents are federally authorized tax professionals granted the same rights as attorneys and CPAs when it comes to representing taxpayers before the IRS https://www.irs.gov/tax-professionals/enrolled-agents. This expertise proved invaluable for Philip’s case.

Understanding the Problem: A Deep Dive into Philip’s Tax Situation

Scott’s first step involved a thorough analysis of Philip’s tax situation. This included reviewing any available financial records, understanding the reasons for the unfiled returns, and assessing Philip’s current financial hardship. Through open communication, Scott discovered that a combination of factors, including a job loss and unexpected medical expenses, had contributed to Philip’s inability to file his returns on time and pay the resulting tax liability.

Crafting a Strategy: Exploring Solutions for Philip

Armed with this information, Scott explored different avenues to resolve Philip’s IRS tax debt. Here’s where Scott’s local expertise in Chandler, Arizona, proved crucial. Understanding the specific needs and resources available in the area allowed him to tailor a strategy that would be most beneficial for Philip in getting a proper IRS settlement in Chandler Arizona.

Here are some of the potential solutions Scott might have considered:

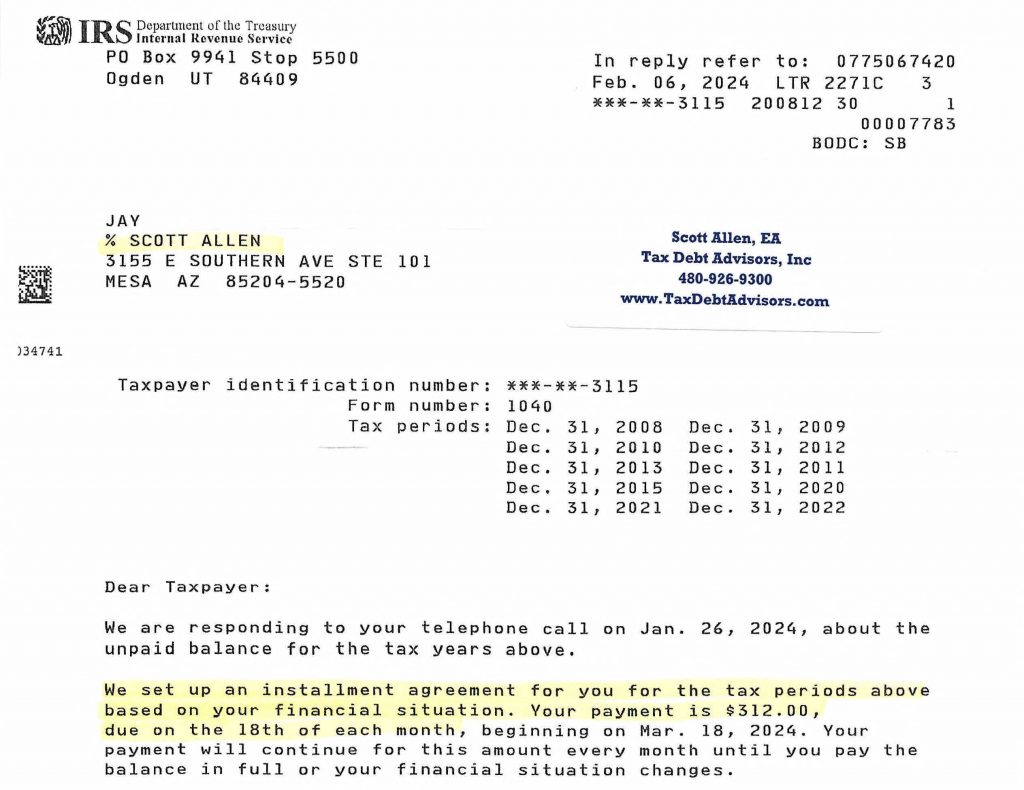

- IRS Payment Plans: For taxpayers who can afford manageable monthly payments, the IRS offers various installment agreement options https://www.irs.gov/payments/payment-plans-installment-agreements.

- Offer in Compromise (OIC): This program allows taxpayers to settle their tax debt for a lump sum payment that’s significantly less than the amount owed. However, qualification for an OIC requires meeting specific criteria set by the IRS https://www.irs.gov/payments/offer-in-compromise.

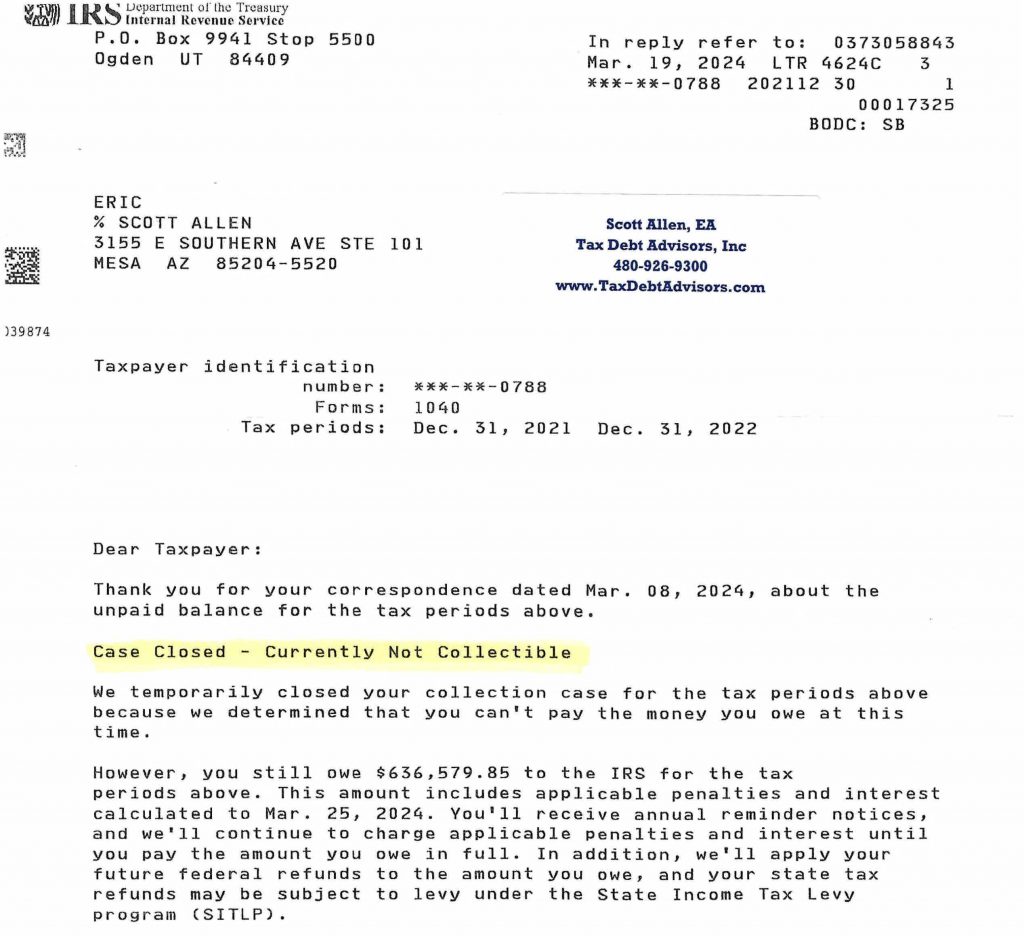

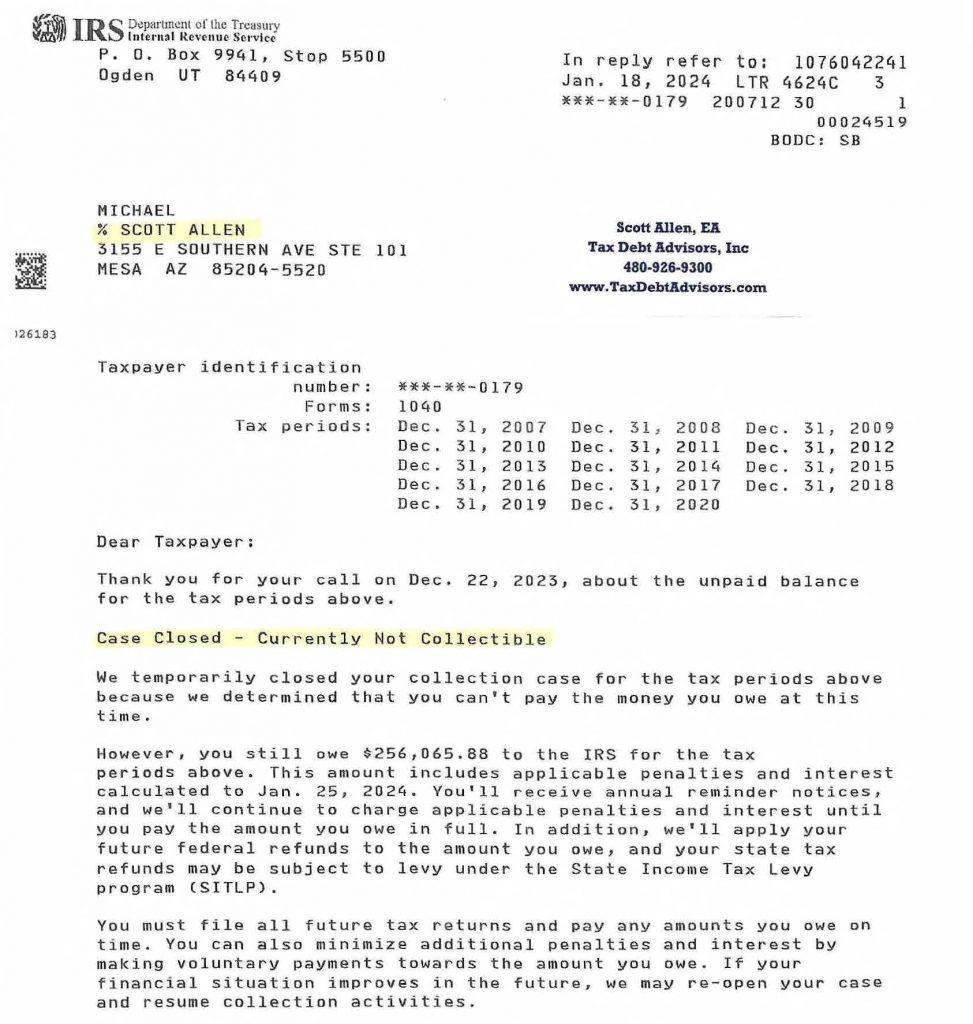

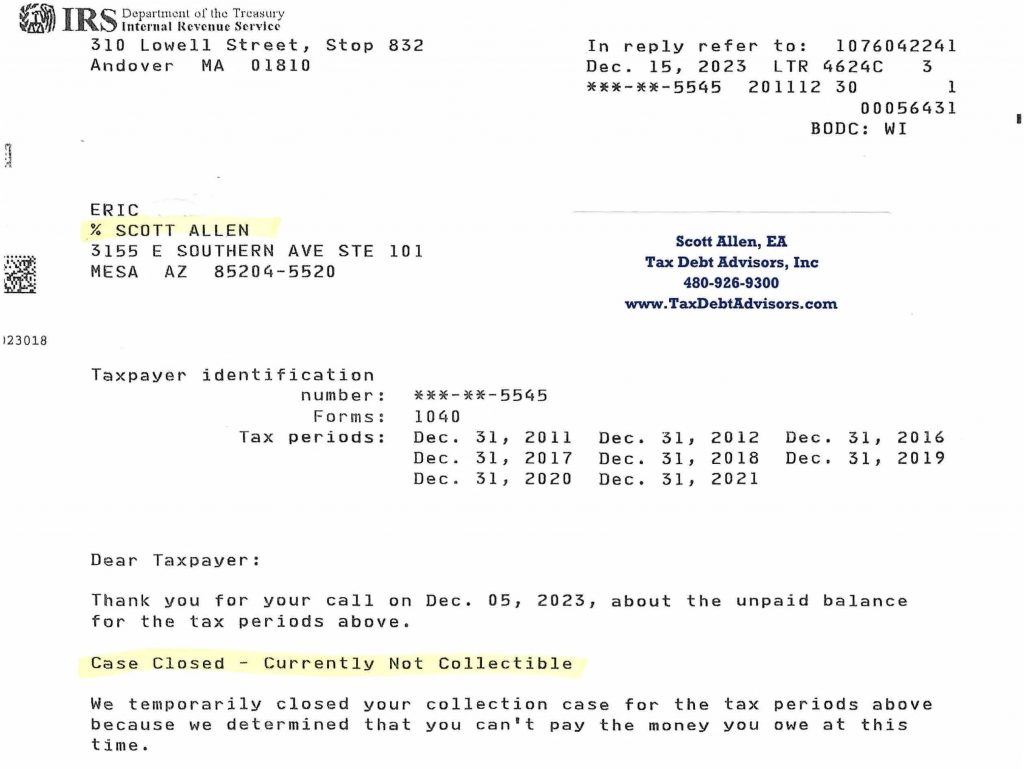

- Currently Not Collectible (CNC) Status: In situations where a taxpayer’s current financial hardship makes it impossible for them to make any payments, the IRS may consider a Currently Not Collectible (CNC) designation. This status does not erase the tax debt, but it temporarily suspends collection efforts.

The Path to Relief: Achieving Currently Not Collectible Status

After careful consideration of Philip’s specific circumstances, Scott determined that pursuing Currently Not Collectible (CNC) status would be the most favorable outcome. This strategy involved presenting a compelling case to the IRS that demonstrated Philip’s inability to pay due to his financial hardship. Scott meticulously prepared a comprehensive package documenting Philip’s financial situation, including income statements, expense reports, and hardship explanations.

The Benefits of Local Representation

Throughout the process, Scott Allen EA’s local presence near Chandler proved advantageous. He maintained clear communication with Philip, addressing his concerns and keeping him updated on the progress. This personal touch is often missing when dealing directly with the IRS, where navigating the complexities of the system can be daunting.

Furthermore, Scott’s understanding of the local economic landscape and the resources available near Chandler allowed him to strengthen Philip’s case. He could demonstrate, for instance, the average cost of living in Chandler and how it impacted Philip’s financial ability to repay the IRS debt.

A Successful Outcome: Relief from Back Taxes

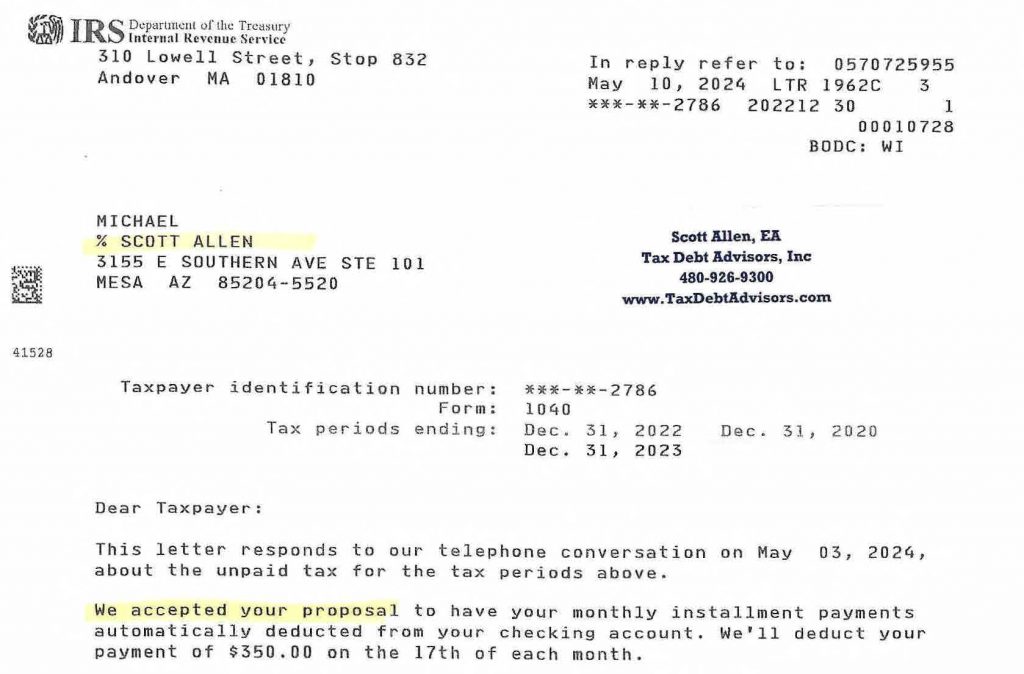

The culmination of Scott’s expertise and Philip’s cooperation resulted in a remarkable outcome. The IRS granted Philip Currently Not Collectible (CNC) status, effectively relieving him from the burden of immediate tax debt payments. While the debt remains on record, as long as Philip remains compliant with future tax filing and payment obligations, the IRS will not pursue collection efforts. Check out his approval letter below from the IRS confirming his IRS settlement in Chandler Arizona.

Moving Forward with Confidence

This successful resolution allowed Philip to breathe a sigh of relief. He can now focus on rebuilding his financial stability without the constant worry of looming IRS debt. Scott’s guidance also helped Philip develop a plan for future tax compliance to avoid similar situations in the future.

Why Choose a Local Enrolled Agent?

Philip’s story highlights the importance of seeking help from a qualified Enrolled Agent, especially one who is local to your area. Here’s why:

- Local Expertise: An enrolled agent familiar with your specific area understands the local economic landscape and cost-of-living factors that may impact your case.

- Personalized Service: Local representation allows for a more personal connection and better communication with your tax advocate.