Mesa IRS Debt Help

Look here for Mesa IRS debt help

It is always critical to get started correctly for Mesa IRS debt help. The only thing worse then your IRS matter is hiring the wrong IRS representation for your IRS matter. The best way to make the correct choice in this step is to meet with the person face-to-face who’s name is on the the IRS power of attorney form. Meet with Scott Allen EA and evaluate his expertise and discover if he is the right fit for you. He can help you with unfiled tax returns and settling IRS debts.

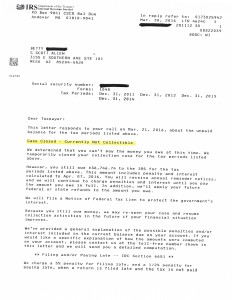

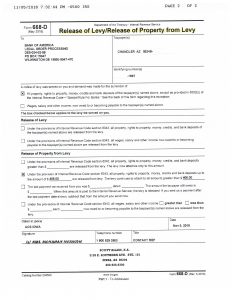

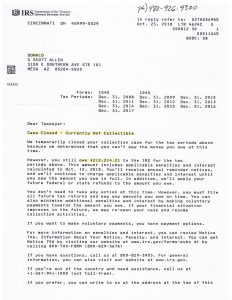

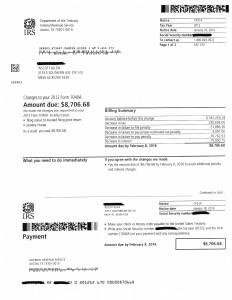

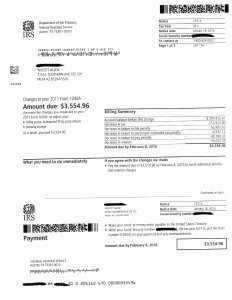

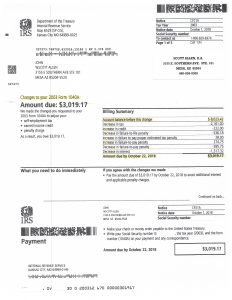

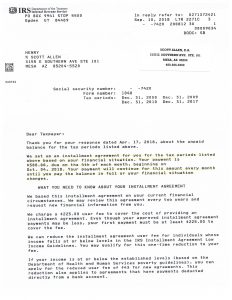

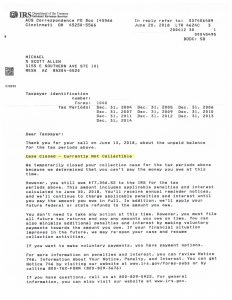

Mario took Scott Allen EA up on for a free consultation. All of his tax returns were filed prior to meeting with Scott but wanted to hire him to represent him in the negotiation process. As you can view below a $99/month payment plan was agreed up to settle his IRS debt. This is just one of 1000’s of settlements completed by Tax Debt Advisors

“I will make today a great day for you!”

Continue reading for a November 2018 Case Resolution

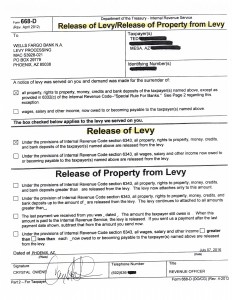

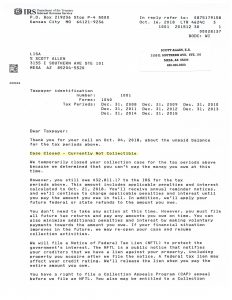

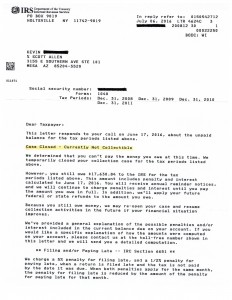

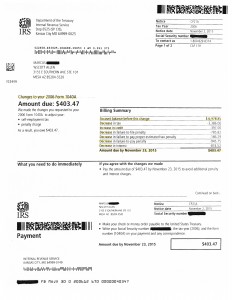

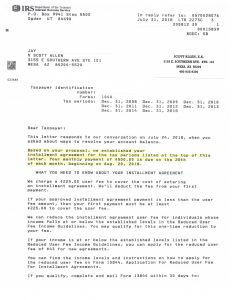

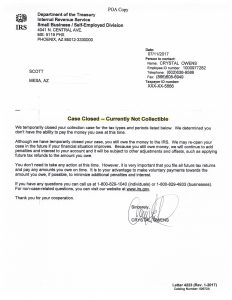

Scott Allen EA has been busy at work with more clients this year. Recently he has been working with David in correcting some old tax debts from 2005 and earlier. It is never too late to correct SFR returns that the IRS assesses against you. Below is a letter from the IRS approving one of their protest tax returns for 2005. In doing so Scott Allen EA was able to remove about $13,000 in debt from his account.

Scott Allen EA is an expert in back tax return filing. He has years of experience in representing taxpayers before the IRS and aggressively and properly preparing tax returns. If you find yourself delinquent with the IRS call Tax Debt Advisors Inc today.