Mesa AZ IRS Problems no more

If you have serious Mesa Arizona IRS problems, unfiled tax returns or owe the IRS more than you can pay back, who should you use? Think for a moment before continuing to read further. Who should you use?

The answer to this question might surprise you, but it is the first question you need answered before seeking help in dealing with the IRS.

If you have cancer you should see an Oncologist that specializes in your type of cancer. But you certainly would not call an Oncologist unless you have cancer. This analogy applies to Mesa AZ IRS matters. The only time you need the services of a tax attorney for a tax problem is when you need attorney client privileges. This is only needed when you have committed a criminal act.

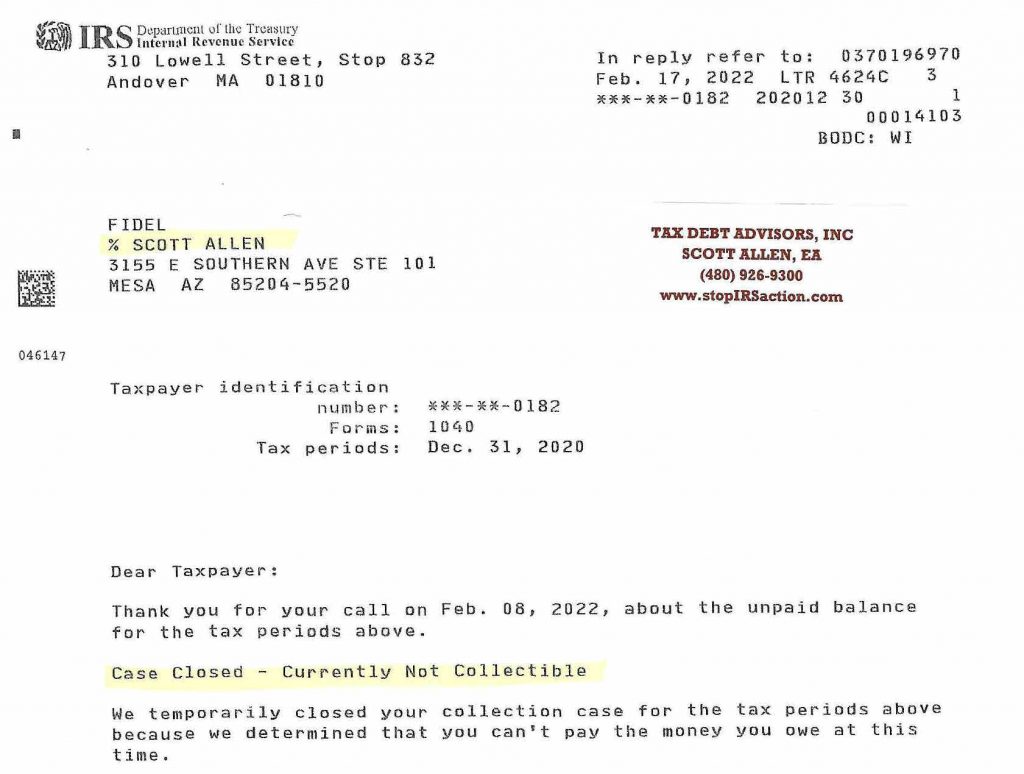

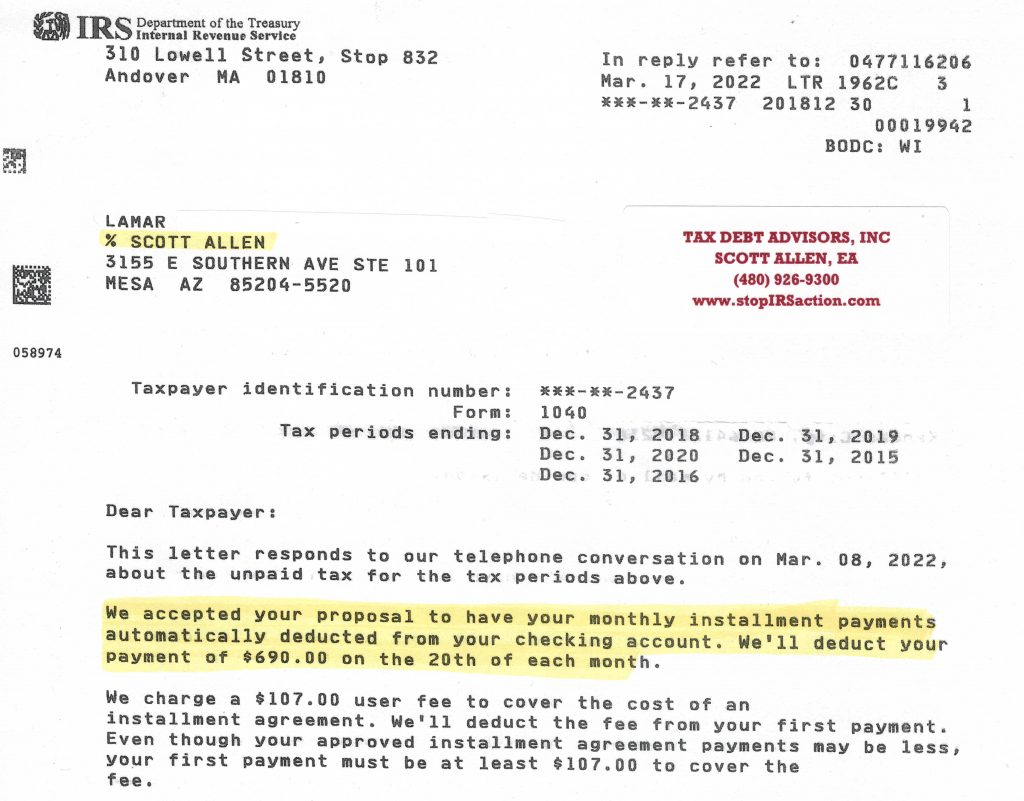

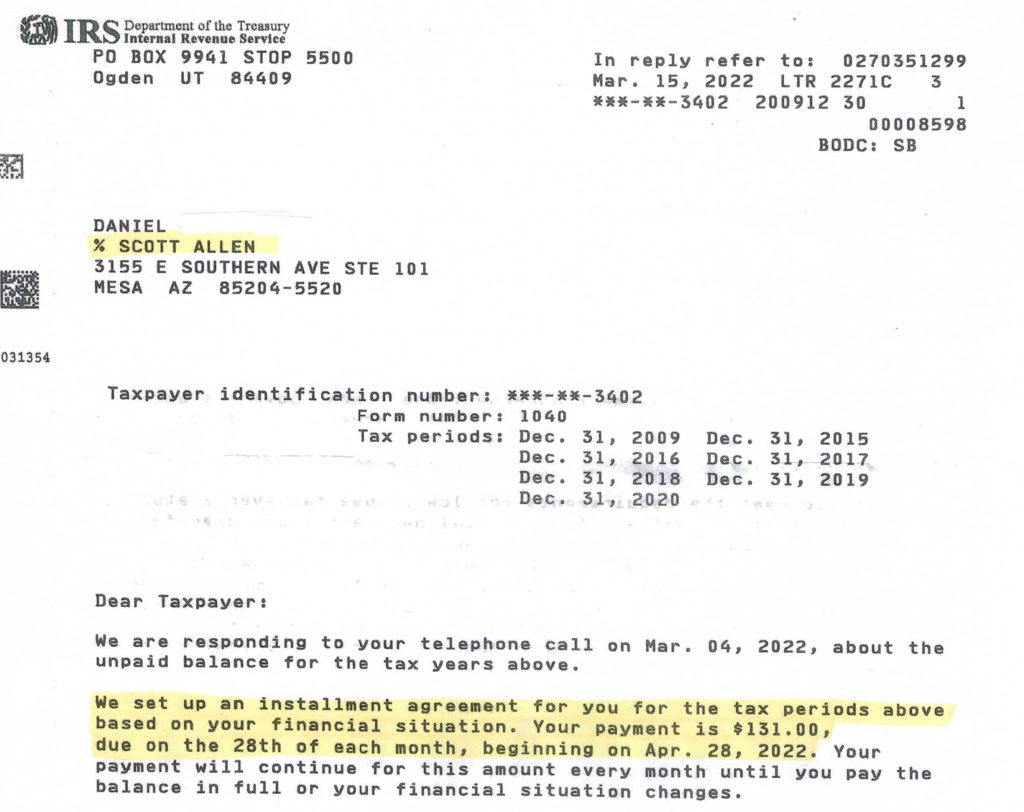

Listen to this…In 45 years, Tax Debt Advisors, Inc. has resolved over 113,000 IRS tax debts, using the Offer in Compromise program, payment plans, tax motivated bankruptcy, non-collectible status, or expiring the tax debt using the statute of limitations. Not one of these cases required the need for a Mesa Arizona Tax Attorney. None of these clients committed a criminal or fraudulent act. Not filing or paying your taxes is not criminal. Not one of our clients have had their home seized or faced jail time. It just doesn’t happen in real life situation. The IRS would rather just work out the matter and move on…AND SO WOULD I.

These tax settlement options are NOT CANCER. They are options that require the services of the best person in your local area that has performed these services consistently for several years. Tax Attorneys have a way of using fear and intimidation to scare potential clients into over paying for Mesa AZ IRS resolution services that can best be done by an

Enrolled Agent. In the 45 years we have been in business we have referred only 4 clients who had tax CANCER (committed a criminal act). You would be upset if a cancer doctor told you that you had cancer, when all you had was a severe sore throat…but got billed for curing cancer.

In the vast majority of cases, you have a serious “sore throat,” you are not in “stage 4 cancer”. So rather than over pay, consider having a free initial consultation with Scott Allen E.A. first. If you need the services of a Mesa Arizona tax attorney, Scott will be the first one to refer you to one who specializes with your particular need.

If you have unfiled tax returns, Scott Allen E.A. can prepare the returns within 24-48 hours of having all of the information needed file the back tax returns in Mesa AZ. Call Scott Allen E.A. today and save yourself the expense of using a “cancer doctor” when all you have is a sore throat. Schedule your appointment today to meet with Scott by calling 480-926-9300. Let him be your Mesa Arizona IRS Power of Attorney!

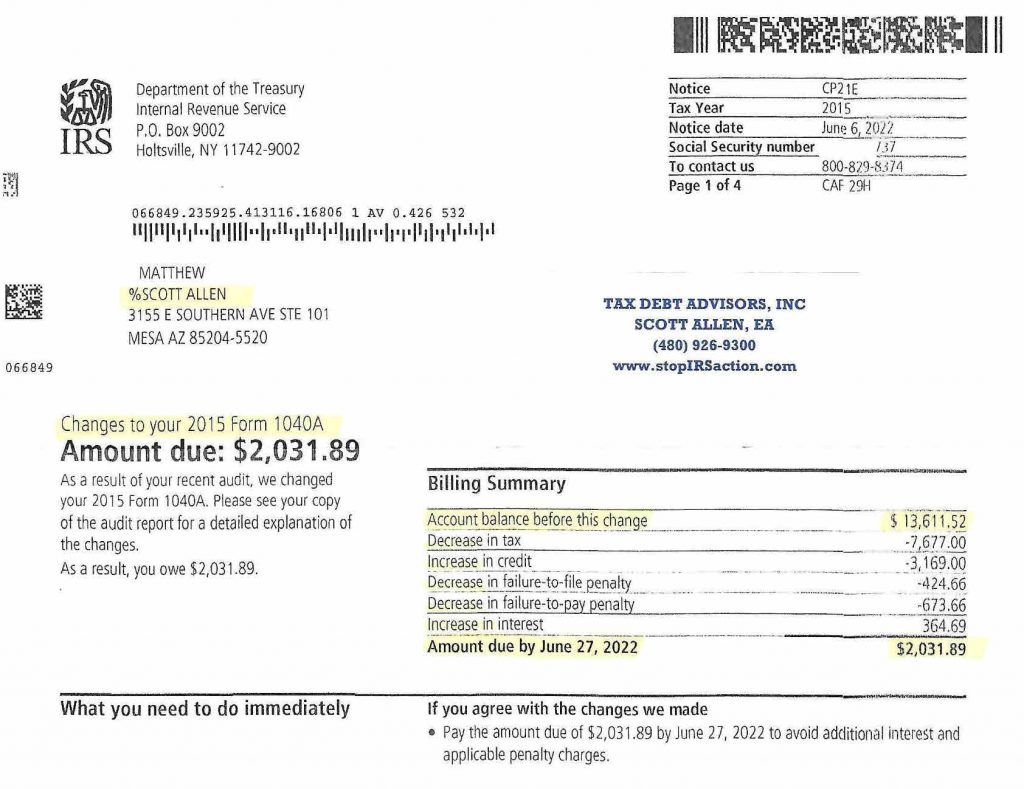

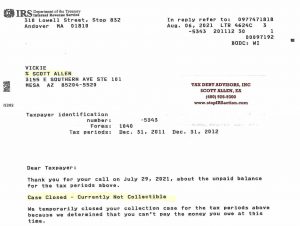

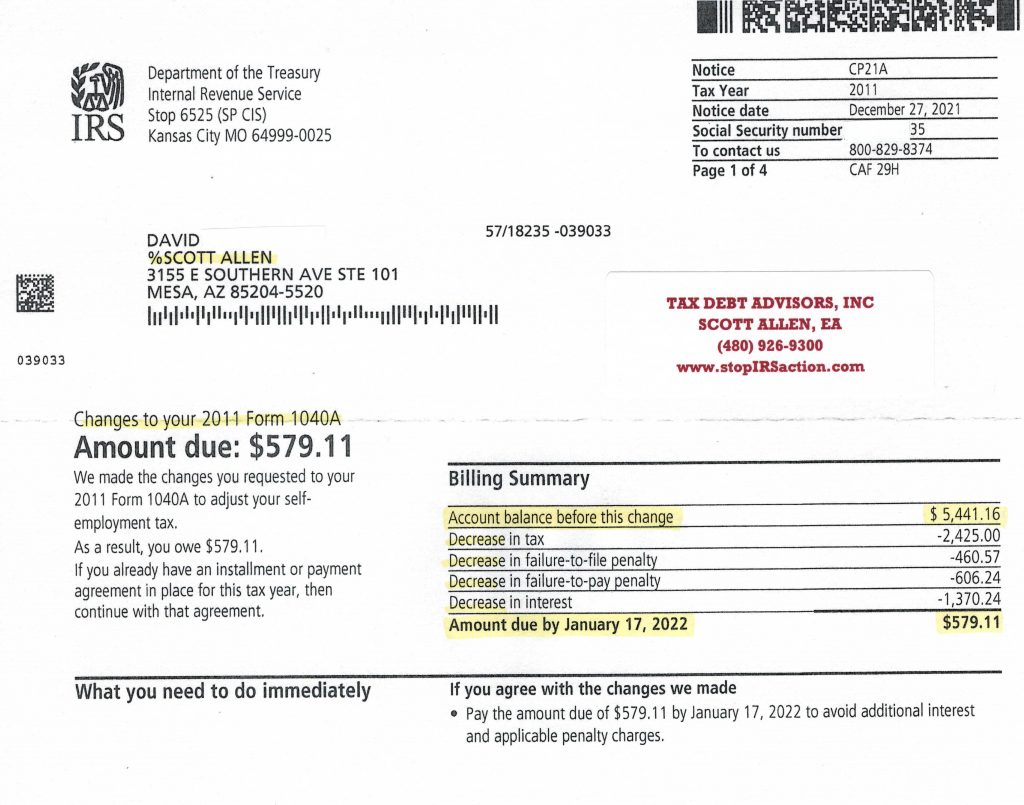

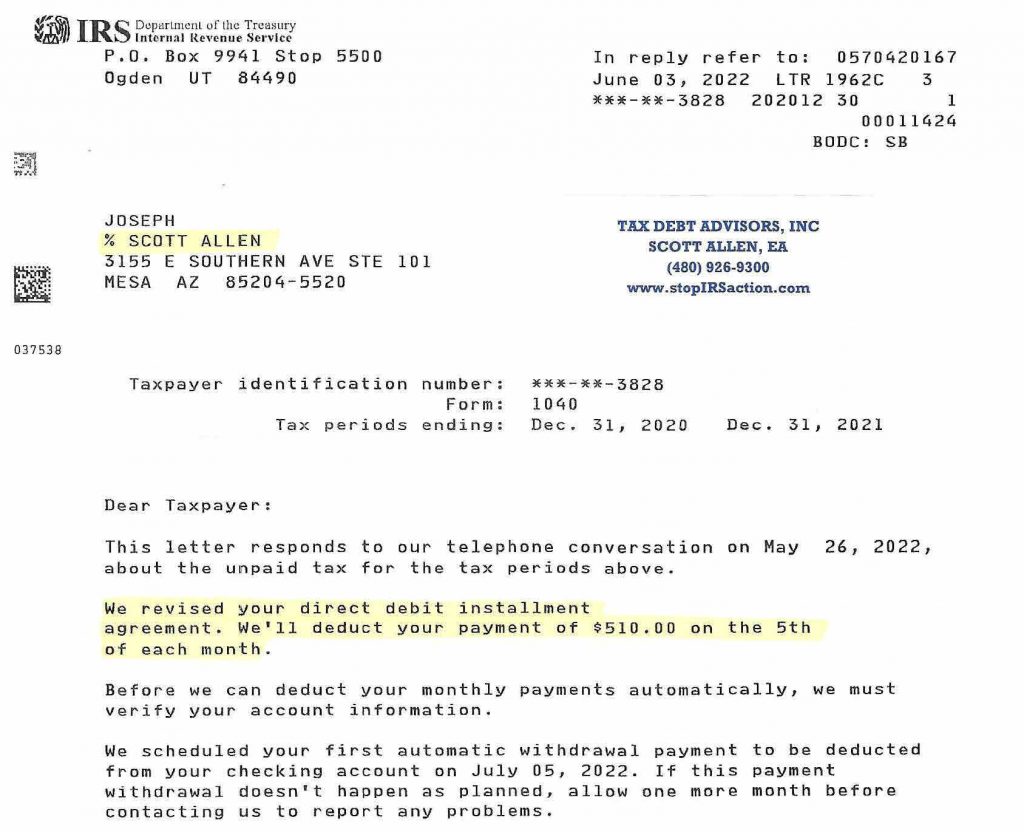

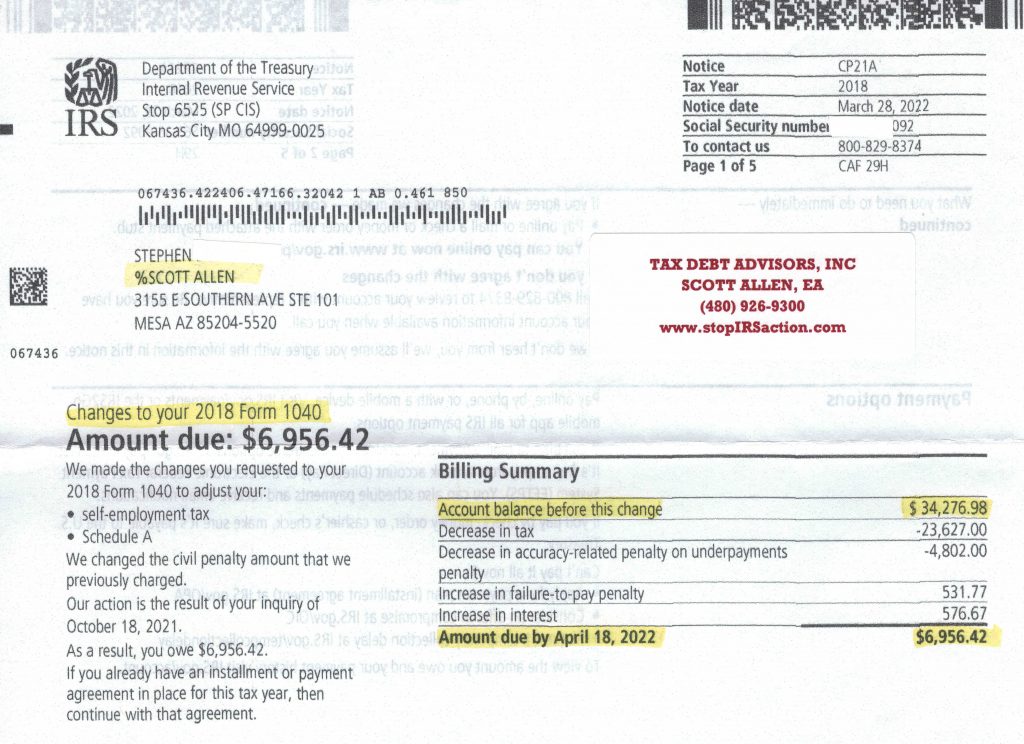

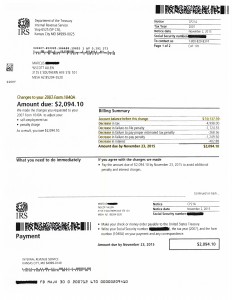

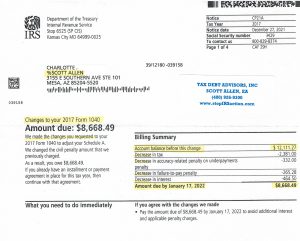

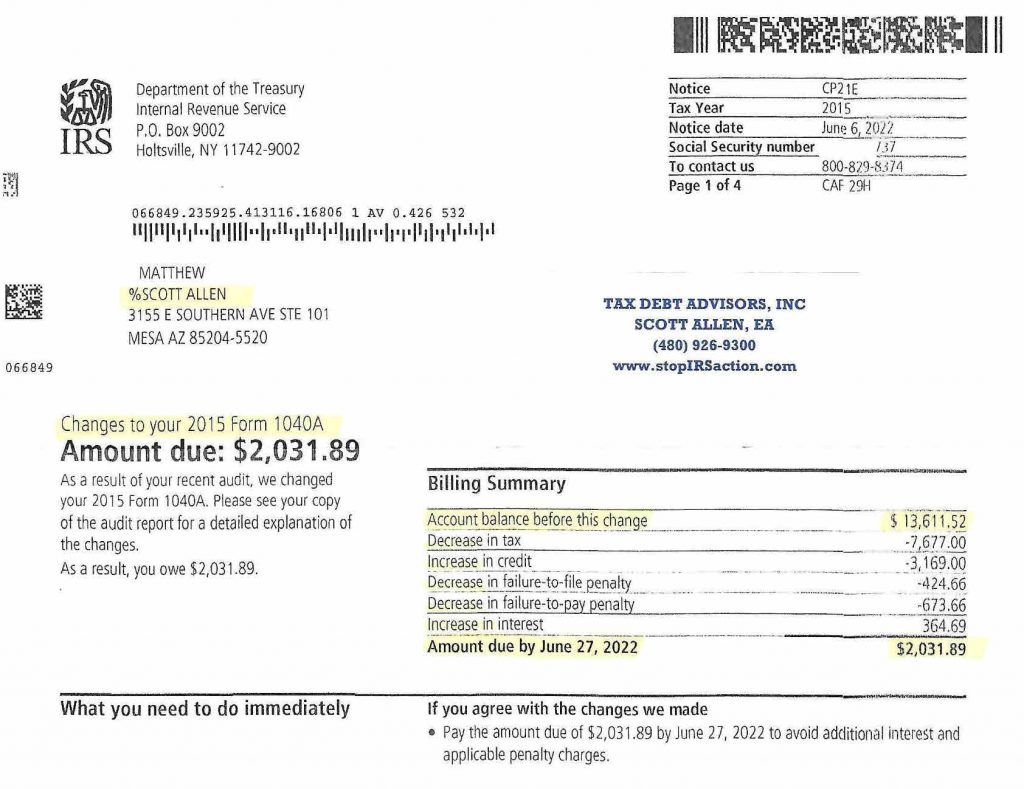

See a recent accomplishment by Scott Allen EA for his client Matthew. Scott helped him settle his “sore throat” caused by an IRS audit that he didn’t initially respond to. As you can see, over $11,000 in taxes, interest, and penalties were reduced thru the

audit reconsideration process. It took a bit of time from beginning to end but victory was accomplished. This is just one of thousands of successes by Scott Allen EA.

Mesa AZ IRS problem solved