Are there options to stop a Mesa AZ IRS levy without resulting in filing a bankruptcy? Of course there are!

Before meeting with a Mesa AZ IRS tax attorney suggesting bankruptcy as your best option consult with us, Tax Debt Advisors, Inc here in Mesa Arizona. We will meet with you and go over all the available options to you be stop a Mesa AZ IRS levy if not immediately, within 24-48 hours. Filing an IRS tax bankruptcy can have a lasting affect on your life, business, credit, and family. Before hiring a Mesa AZ IRS tax attorney be sure it is in your best interest to do so and you have exhausted any and all tax settlement solutions. Please browse my site for more information on the IRS and stopping a Mesa AZ IRS levy. Below I have written some thoughts and quotes that may help you feel confident you can get past this tough moment in your life. Thank you for reading.

Do you need a Mesa AZ IRS Tax Attorney ?

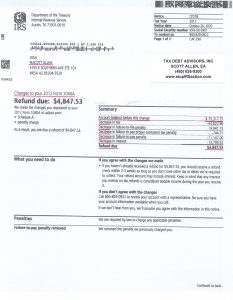

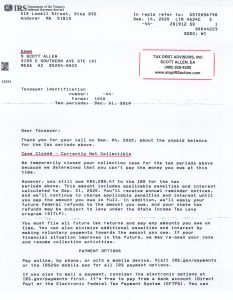

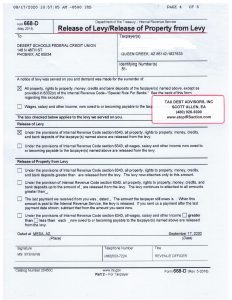

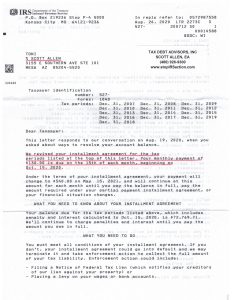

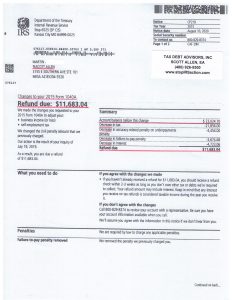

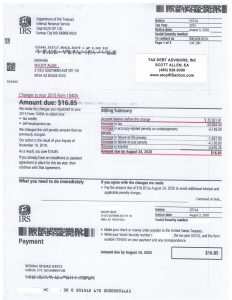

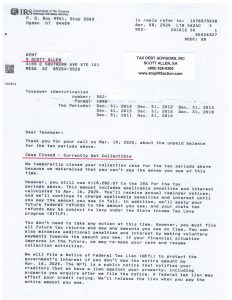

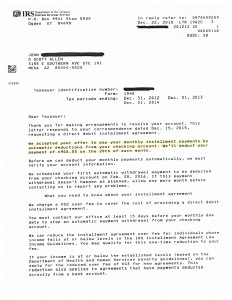

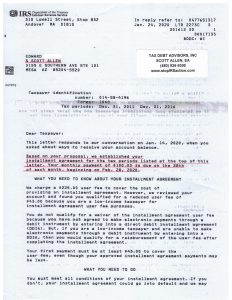

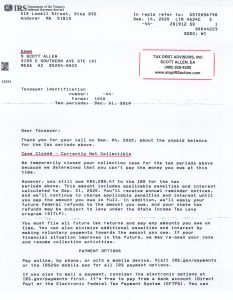

See how Scott Allen EA successfully stopped the IRS from a levy or garnishment without using a Mesa AZ IRS tax attorney. Click on the image below and you can see for yourself that Dawn’s entire IRS debt of over $80,000 was put into a currently non collectible status protecting her small income and her home.

Mesa AZ IRS Tax Attorney

Reviewing the following quotes on success will help you in the process of getting your IRS problem and Mesa AZ IRS levy resolved. As you read them consider the ones you may need to incorporate in your life that can make the difference between success and failure.

Quotes on Success

Learn the art of patience. Apply discipline to your thoughts when they become anxious over the outcome of a goal. Impatience breeds anxiety, fear, discouragement and failure. Patience creates confidence, decisiveness, and rational outlook, which eventually leads to success.—Brian Adams

Whenever I hear, “It can’t be done,” I know I’m close to success.—Michael Flatley

Each success only buys an admission ticket to a more difficult problem.—Henry Kissinger

Success is a lousy teacher. It seduces smart people into thinking they can’t lose.—Bill Gates

If one advances confidently in the direction of his dreams, and endeavors to live the life which he has imagined, he will meet with a success unexpected in common hours.—Henry David Thoreau

I will not allow yesterday’s success to lull me into today’s complacency, for this is the great foundation of failure.—Og Mandino

A successful marriage is an edifice that must be rebuilt every day.—Andre Maurois

Success is liking yourself, liking what you do, and liking how you do it.—Maya Angelou

He has achieved success who had lived well, laughed often, and loved much.—Bessie A. Stanley

The only place where success comes before work is a dictionary.—Vidal Sassoon

There are no secrets to success. It is the result of preparation, hard work, and learning from failure.—Colin Powell

Success is a journey, not a destination. The doing is often more important than the outcome.—Arthur Ashe

If you are struggling with an IRS levy in Mesa AZ, need to file back tax returns, being audited, or want the know the quickest and best way to settled you debt with the IRS call Scott Allen E.A. at 480-926-9300 for a free initial consultation.