Mesa AZ IRS payment plan accomplished

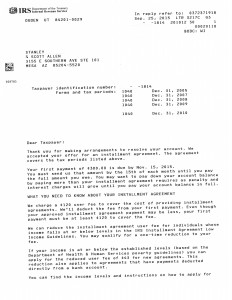

Tax Debt Advisors just accomplished a Mesa AZ IRS payment plan for their client, Stanley. They were able to push the payment plan out to not start for about 60 days from the acceptance to allow the taxpayer ample time to prepare for the agreement.

Tax Debt Advisors is a tax debt resolution company that handles all sorts of IRS problems. Many of those problems results in negotiating a Mesa AZ IRS payment plan. You may be wondering why didn’t the client do an Offer in Compromise. Statistics show that only about 3% of taxpayers with an IRS debt qualify for an Offer in Compromise. Scott Allen EA of Tax Debt Advisors had evaluated the clients financial and determined ahead of time that that client would not qualify for an IRS offer. They taxpayer’s income was too high and could afford to pay off his IRS debt within a reasonable period of time. Because of that an IRS offer would never get accepted. There is no reason to go down that route and expense of attempting an offer if it can be discovered at the beginning that you are not a viable candidate.

Whatever the size of your IRS debt or if you have unfiled tax returns Scott Allen EA will be able to assist you from beginning to end. Tax Debt Advisors has settled over 108,000 IRS debts since in 1977 many of those by the use to setting up a Mesa AZ IRS payment plan. Don’t procrastinate getting the IRS off your back just like what Scott Allen EA did for Stanley. He can do the same for you. Set up that initial consultation with him today by calling 480-926-9300.

To learn more about the process to “settle up” with the IRS go to Scott Allen EA’s website about the IRS Settlement Process.