Searching for “Tax Attorney Gilbert” while looking for an experts in tax law? If so, Tax Debt Advisors can help! We are not a tax attorney firm, rather, a tax debt specialist that helps with IRS problems. Solve the same tax problems for less money!

If you happen to be searching for tax attorneys, that must mean that you must be having tax trouble. Contact Scott Allen with Tax Debt Advisors, Inc. at (480) 926-9300 to help you to get the right type of help with the IRS today. Don’t just go out and hire a tax attorney, hire a tax debt advisor who has been helping people to deal with their tax issues since 1977 and has solved over 108,000 tax debts.

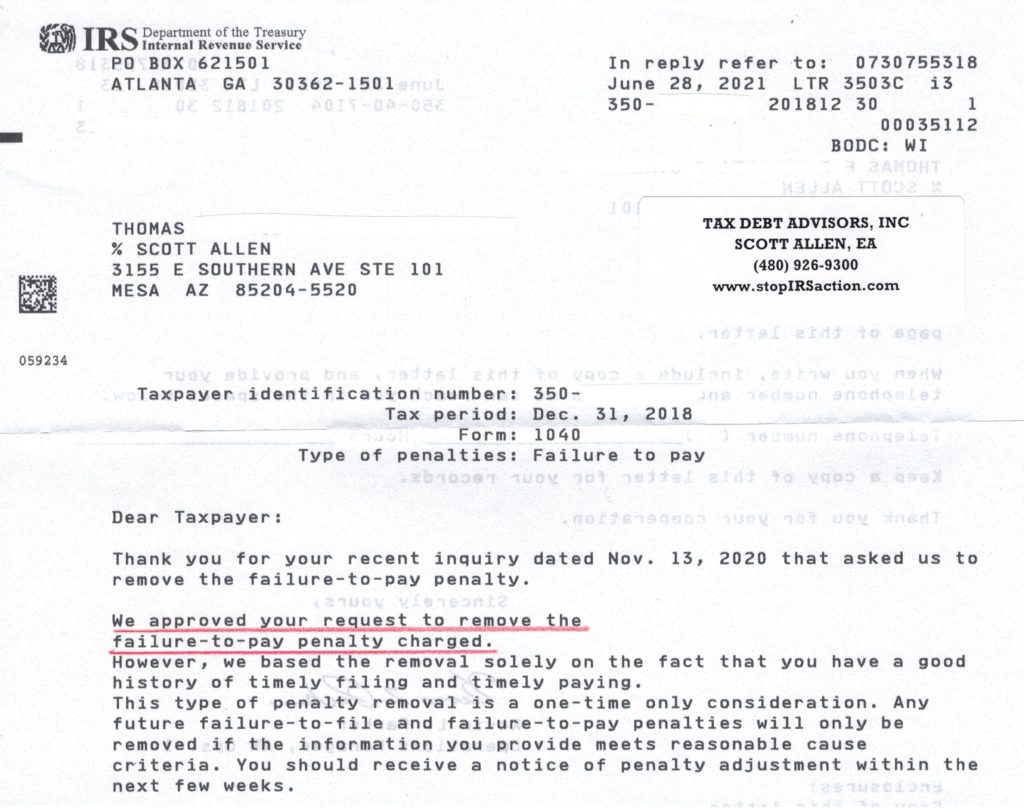

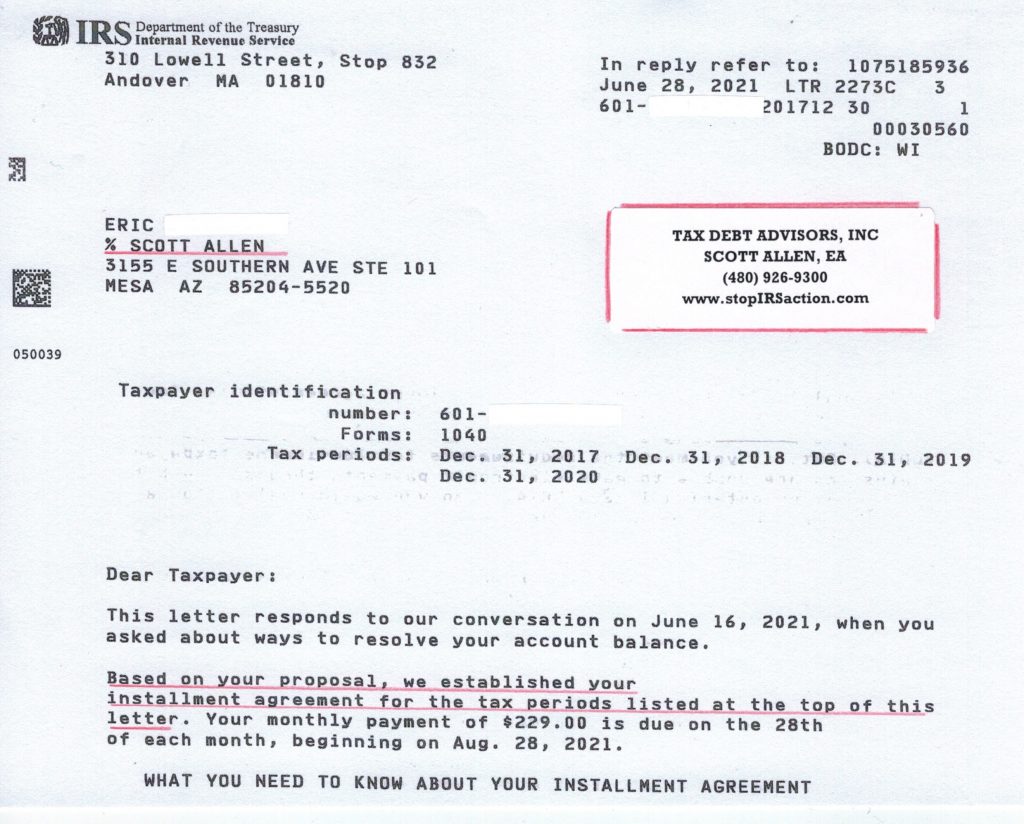

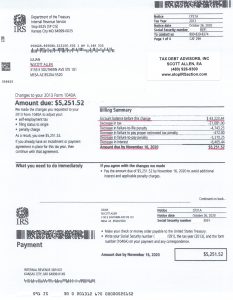

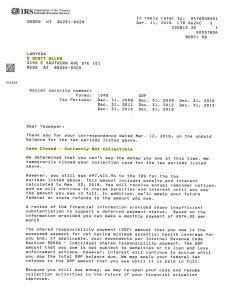

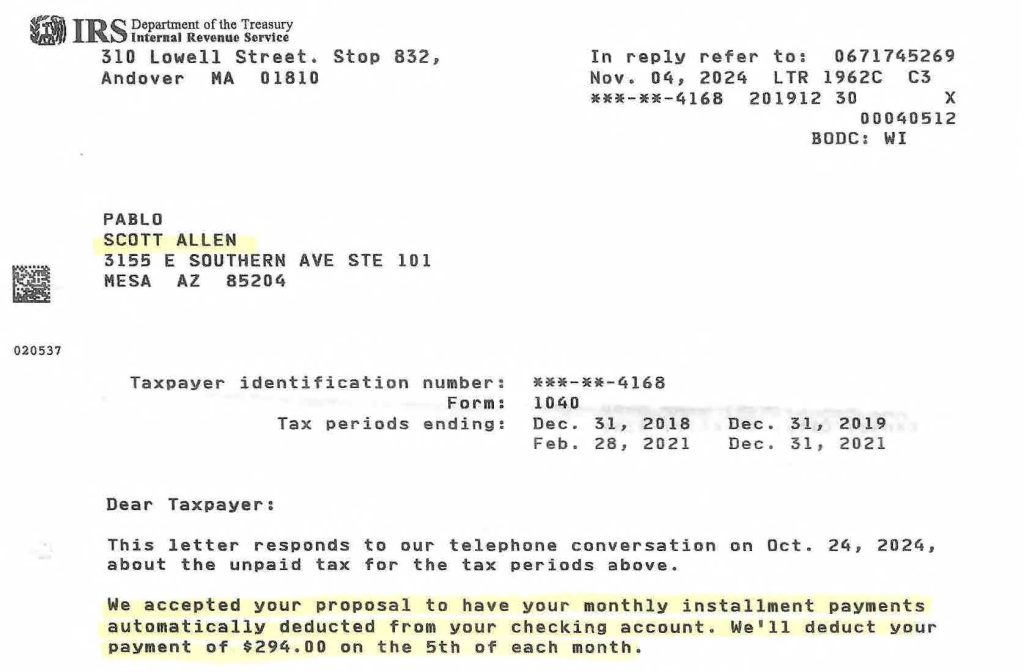

Help get things straight with the IRS by calling Scott Allen at Tax Debit Advisors, Inc. today at 480-926-9300 to help you get right with the IRS today! Check out one of our most recent successes where we helped Mary settle here tax debt in Gilbert without a tax attorney.

Common Reasons To Hire A Tax Attorney

Below are the most common reasons to hire a tax attorney. Although, these are also services provided by Tax Debt Advisors Inc. Tax Debt Advisors can help with:

It is true, you don’t really have to hire a tax attorney when it comes to dealing with the IRS. Instead you can hire a tax debt advisor who has been helping people since 1977. Scott Allen is able to guide you through basically any type of tax situation that you may need help in dealing with.

Why You Don’t Need A Tax Attorney

Below are some reason and warning signs that state that you don’t need a tax attorney:

- If you are making a choice out of fear and believe that you need a tax attorney for other than fraudulently filed or criminal returns, then you will be disappointed. Attorneys are able to generate their income by causing fear. Many of our clients who started with an attorney and switched to us had mentioned about being intimidated with fear that something bad will happen if . . . and those ifs are always filed by another large retainer fee.

- IRS resolution work isn’t exactly rocket science. It is just common sense work that actually improves over time because of the relationship that is established with the IRS and an understanding of their idiosyncrasies. Attorneys will scare their clients into believe that their legal training is needed to get a successful resolution.

- Most clients believe that they will only get what they pay for and will base the quality of work on how much they pay. In many cases, an attorney will charge between 25 to 400% more for the same type of service. If you go for a consultation with an attorney, you should get a second opinion from me with a free initial consultation. These are the appointments I love.

Why You Need To Hire An Enrolled Agent VS A Tax Attorney

View our recent blog post “When is a IRS tax attorney is necessary and when isn’t it?“

- Your tax issue may not be that bad: It doesn’t take a tax attorney or rocket scientist to work with the IRS. Legal training isn’t needed to handle most tax issues. Tax attorney’s will often try to scare you into thinking that you need legal representation. That just isn’t true. Let Tax Debt Advisors help to solve your tax problems without having to scare you or request a huge retainer fee for our services.

- Get a Second Opinion: There are some tax customers who believe that paying higher fees will give them better quality services. That isn’t true. Tax attorneys will charge 400% more for the same type of services that a tax debt expert is able to handle. There literally no difference in the whole process besides paying more money. We aren’t saying that it is a bad idea to speak to a tax attorney, but you should always get a second opinion. At Tax Debt Advisors we offer free tax consultations.

- Don’t make a decision based on fears: If you believe that you need a tax attorney just because you filed a fraudulent tax return, then you may disappointed. Tax lawyers will normally get their income based off of fear. Many of our tax clients started with a tax attorney, only to learn that they tried to intimidate them into believing that they had a bigger tax issue than in truth. And that is often followed by a huge retainer fee.

Feel Confident With Experienced Tax Representation

Whenever I have looked back over the years, the most common factor for bad decision making was when I was overly influenced because fear. I love the quote from Star Wars that explains how Anakin Skywalker became Darth Vader. “It was fear that pushed me to the dark side.” If you have already consulted with an attorney, ask yourself if they reduced the level of fear or just used it to get what they wanted. Good representation will make you feel better and not fearful. A great representative will focus on everything that can go right and the wrong ones will just focus on the thing that almost never happen. When you are trying to decide if you need to use an attorney, take some time to get a second opinion from me. You will be glad you did.

Free Tax Consultations | Do You Really Need A Tax Attorney?

“Tax Debt Advisors handled my tax issues, which included several years of tax returns with IRS issues. The back tax returns were processed quickly with no additional problems or delays. Scott managed every aspect of the IRS problem with ease. Thanks again Scott!” Stacy P Read More Reviews

If you are worried about IRS tax issues and think you need a certified tax attorney to represent you, give Tax Debt Advisors a call first. This is an important decision to make that requires the experience of a highly skilled Enrolled Agent. Scott Allen EA can be that choice for you. There is a great chance that you don’t need a tax attorney or legal representation for your tax problems. Our tax debt advisors can help you solve the same tax problems for less money. To schedule you free tax consultation in Gilbert to find out if you actually need a Phoenix tax attorney or not, give us a call today at 480-926-9300.