(480)926-9300 will get your Chandler AZ IRS bank levy released.

Get your Chandler AZ IRS bank levy stopped!

The most important action you can take is to quickly locate the right IRS professional near Chandler AZ that can settle your IRS problem. If you just recently started getting IRS notices, now is the time to act—BEFORE—you receive a Chandler AZ IRS bank levy and/or your wages garnished. Scott Allen E.A. of Tax Debt Advisors has helped employees at dozens of companies including the following to name just a few:

Don’t subject yourself to unnecessary aggressive IRS action. Call Tax Debt Advisors near Chandler AZ at 480-926-9300 for a free review of your IRS problem.

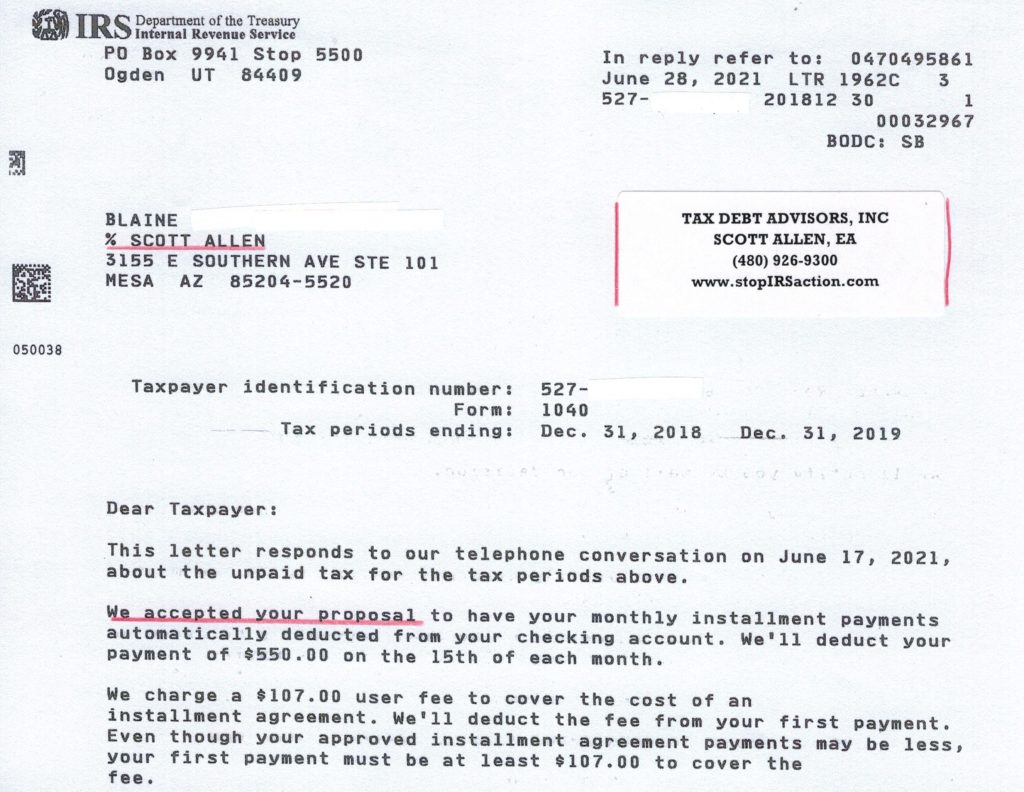

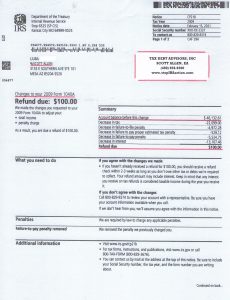

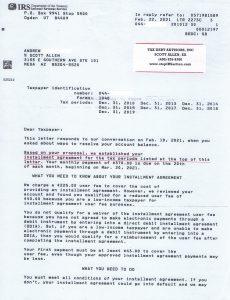

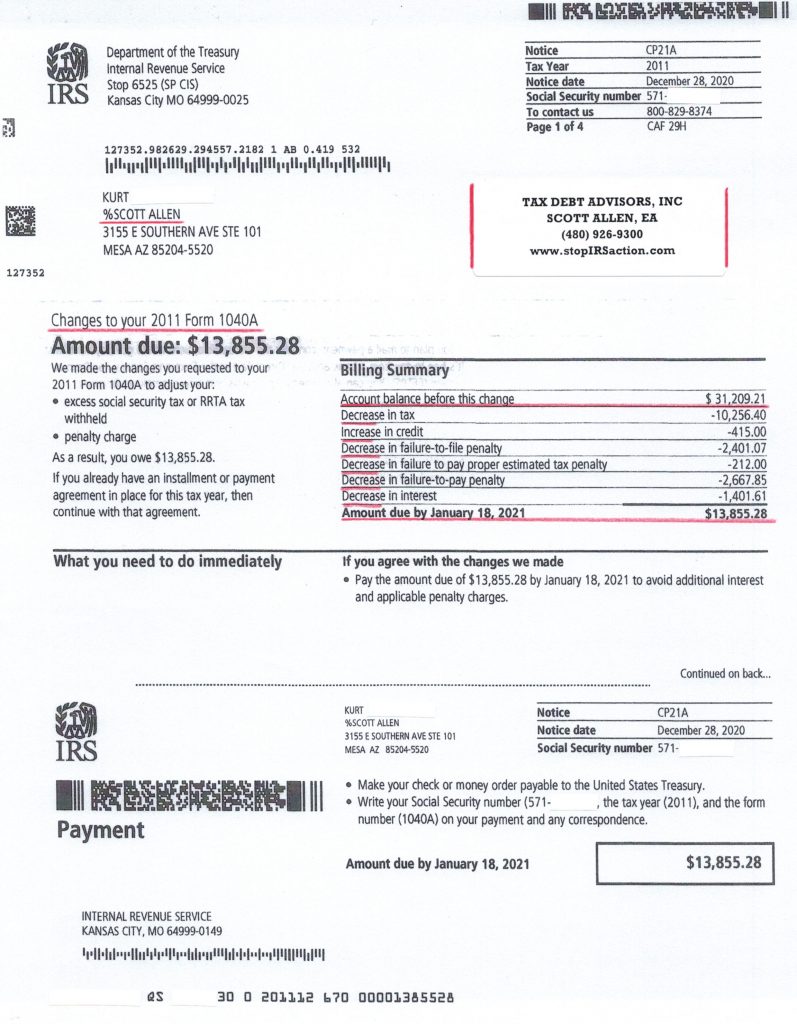

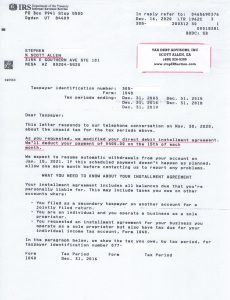

2021 IRS payment plan stopped Chandler AZ IRS bank levy

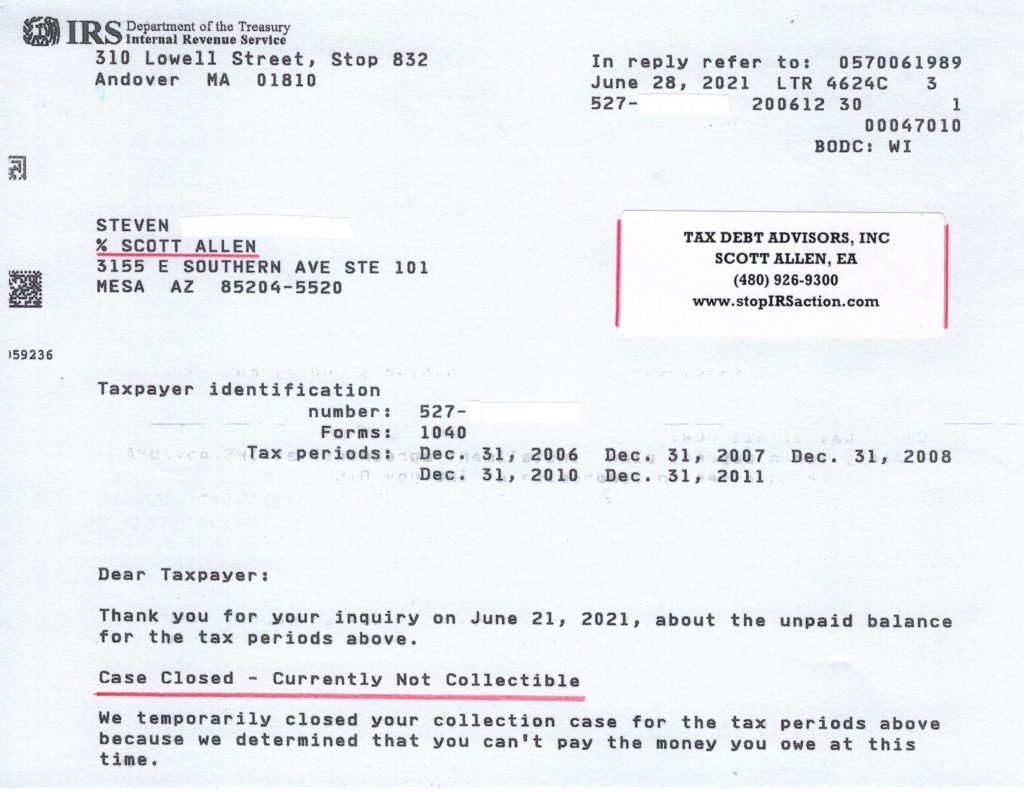

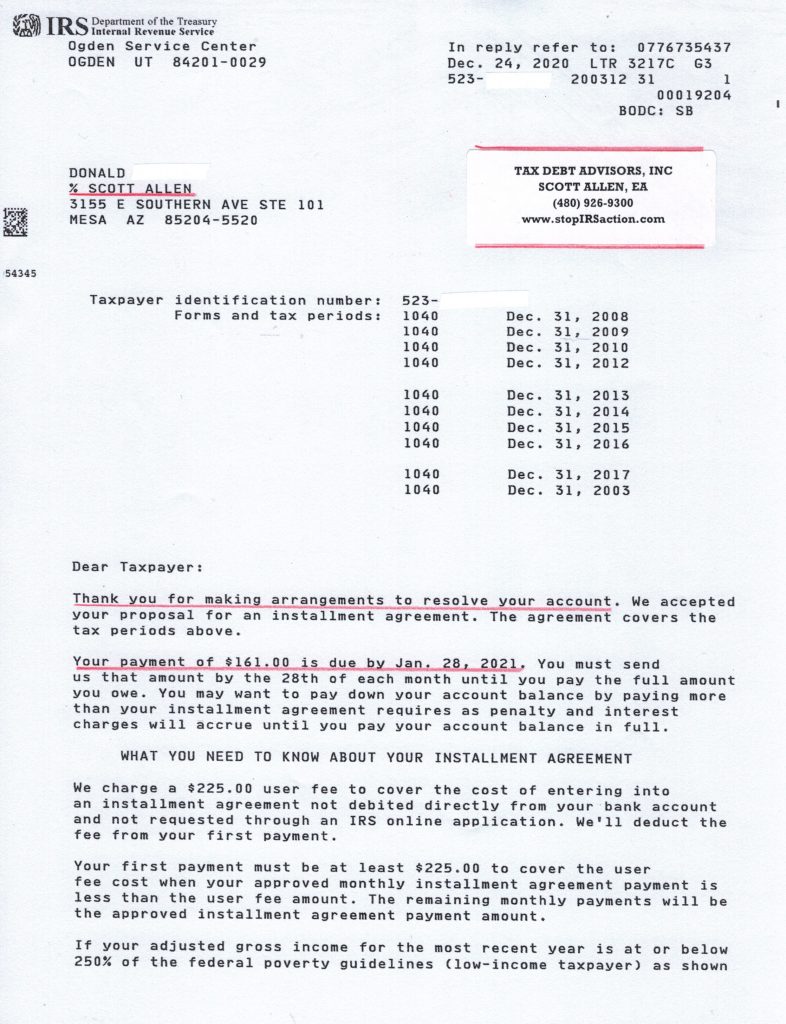

See what Scott Allen EA was able to do for Steven by viewing the IRS letter below. Steven was able to negotiate a currently non collectible status. Don’t wait for the IRS to levy your bank account. Settle you IRS debt with them today.