IRS Tax Lien in Phoenix, Arizona: Get a Resolution

Navigating an IRS Tax Lien in Phoenix, Arizona: A Path to Resolution with Tax Debt Advisors, Inc.

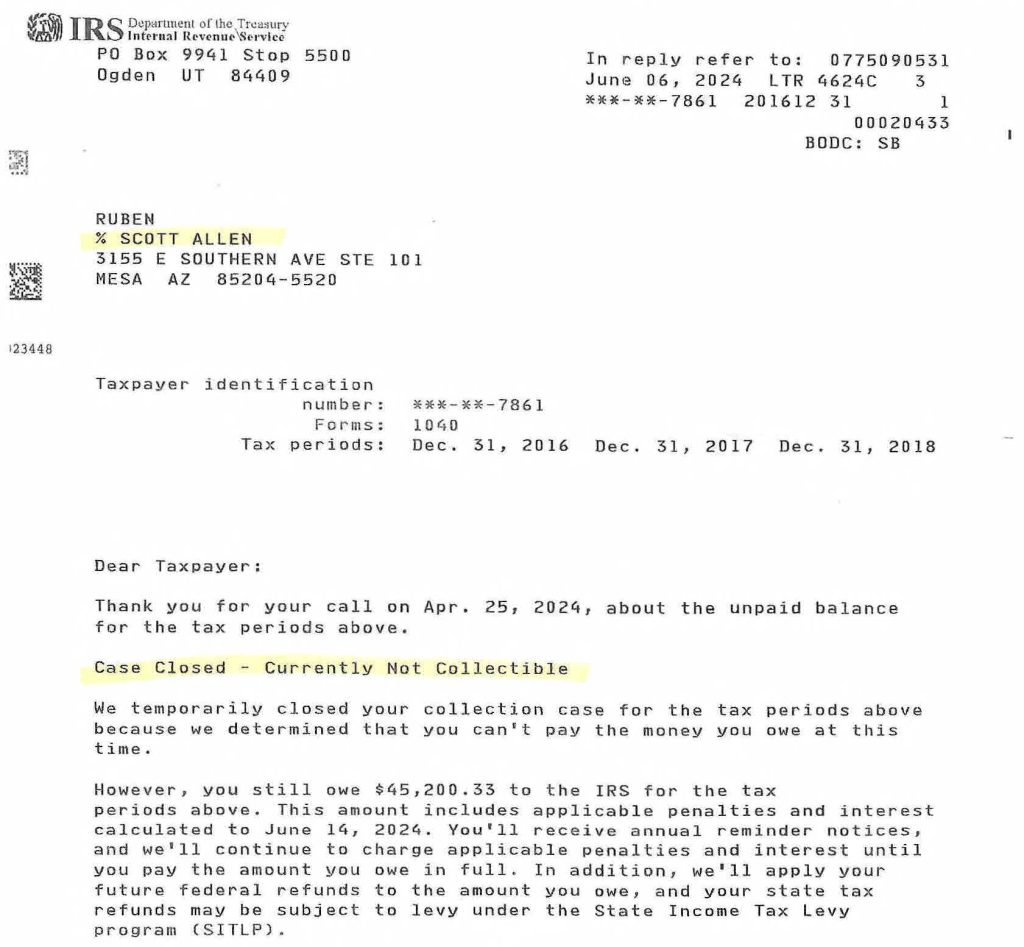

If you’re a taxpayer in Phoenix, Arizona facing a daunting IRS tax lien for unpaid taxes from back taxes owed you’re not alone. Tax problems can be overwhelming, but there is help available. This blog post explores the situation of a Phoenix resident, Ruben, who successfully navigated an IRS tax lien with the assistance of Tax Debt Advisors, Inc., a local, family-owned business established in 1977.

Understanding the IRS Tax Lien in Phoenix

An IRS tax lien is a serious matter. It signifies the government’s legal claim to your property to satisfy unpaid taxes, penalties, and interest. A lien filed against you can severely impact your financial situation by hindering your ability to obtain loans, sell assets, or even renew your passport.

In Ruben’s case, the IRS filed a tax lien for unpaid taxes from multiple years (2016, 2017, & 2018). This likely resulted from a combination of factors, such as missed tax filings, underpayment of taxes owed, or unexpected income changes.

Seeking Help from a Phoenix Tax Resolution Specialist

Faced with the burden of an IRS tax lien in Phoenix Arizona, Ruben knew he needed professional guidance. A quick Google search for “phoenix arizona irs tax lien help” led him to Tax Debt Advisors, Inc. (https://taxdebtadvisors.com/). He scheduled a free consultation with Scott Allen, EA (Enrolled Agent), a tax resolution specialist at the firm.

The Power of Attorney and Negotiation Process

During the consultation, Scott explained to Ruben the various options available to resolve the IRS tax lien. One crucial step involved Ruben granting Scott a Power of Attorney (https://www.irs.gov/forms-pubs/about-form-2848). This authorization empowers the tax professional to represent Ruben before the IRS, handle all communication, and negotiate a favorable outcome on his behalf.

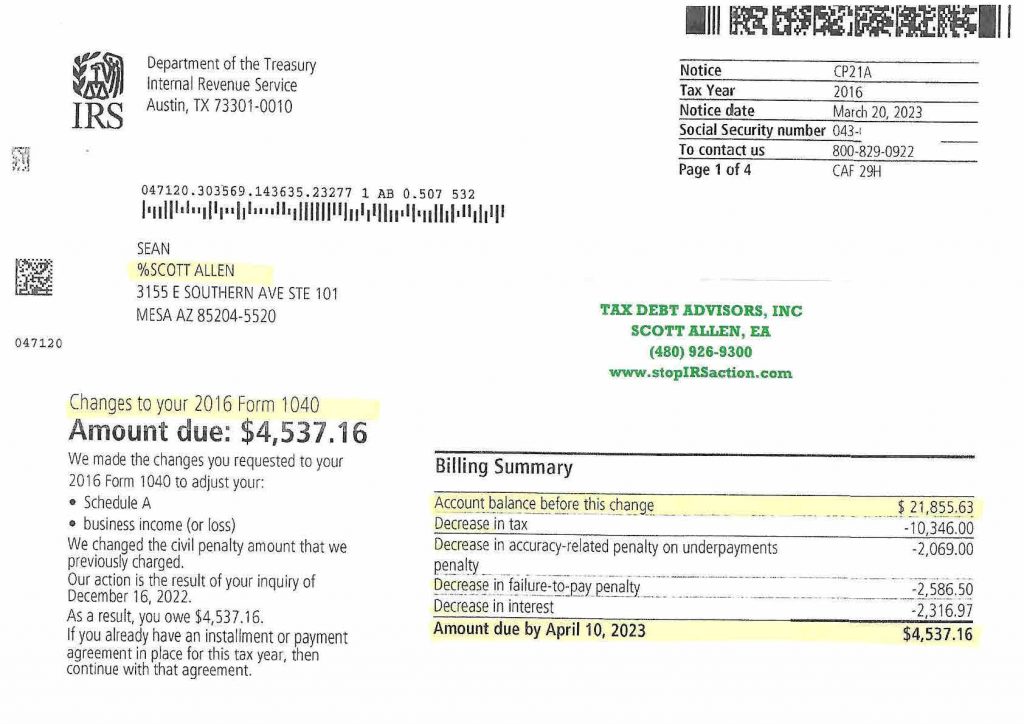

Scott, leveraging his expertise and experience, was able to achieve the following for Ruben:

- Halt IRS Collection Activity: Scott stopped the IRS from further collection efforts on the tax lien. This provided Ruben with much-needed breathing room to focus on resolving the underlying tax debt.

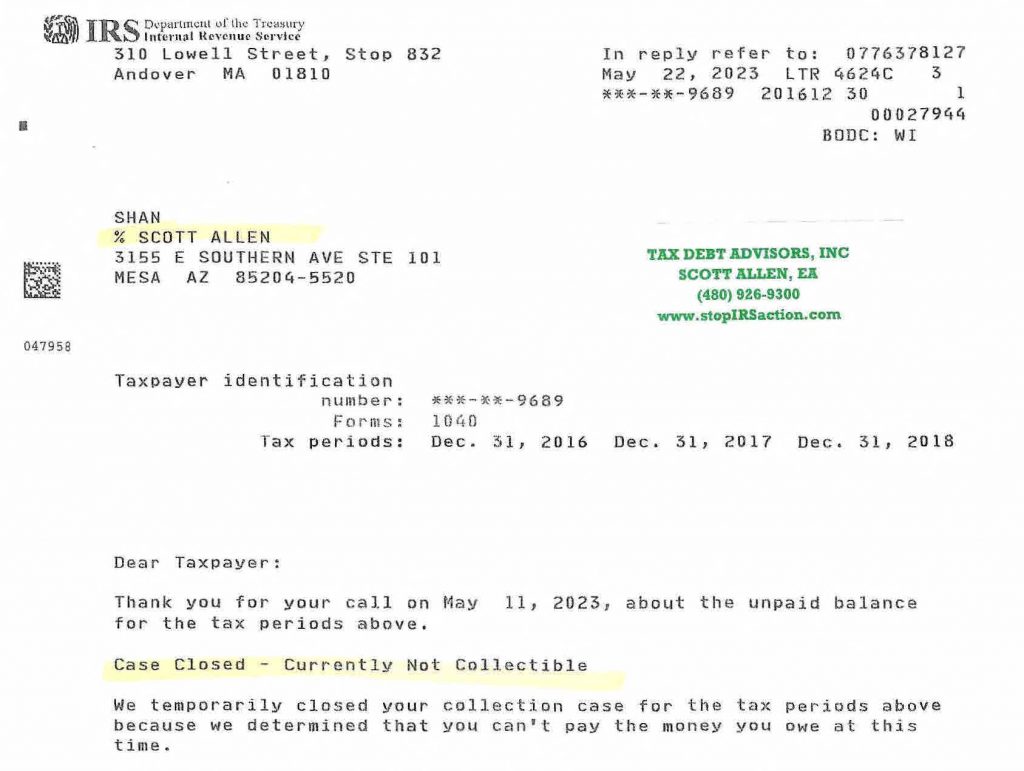

- Negotiate Currently Non-Collectible (CNC) Status: Through effective negotiation with the IRS, Scott was able to secure a “currently non-collectible” (CNC) status for Ruben’s tax debt. This means that, based on Ruben’s current financial situation, the IRS cannot actively collect the tax debt. It’s important to note that a CNC status is not debt forgiveness; the tax obligation remains, but collection efforts are temporarily suspended. A copy of Ruben’s IRS settlement is below. This is evidence that Scott Allen EA provides honest follow thru service, not just faulty promises.

A Path Forward for Phoenix Taxpayers

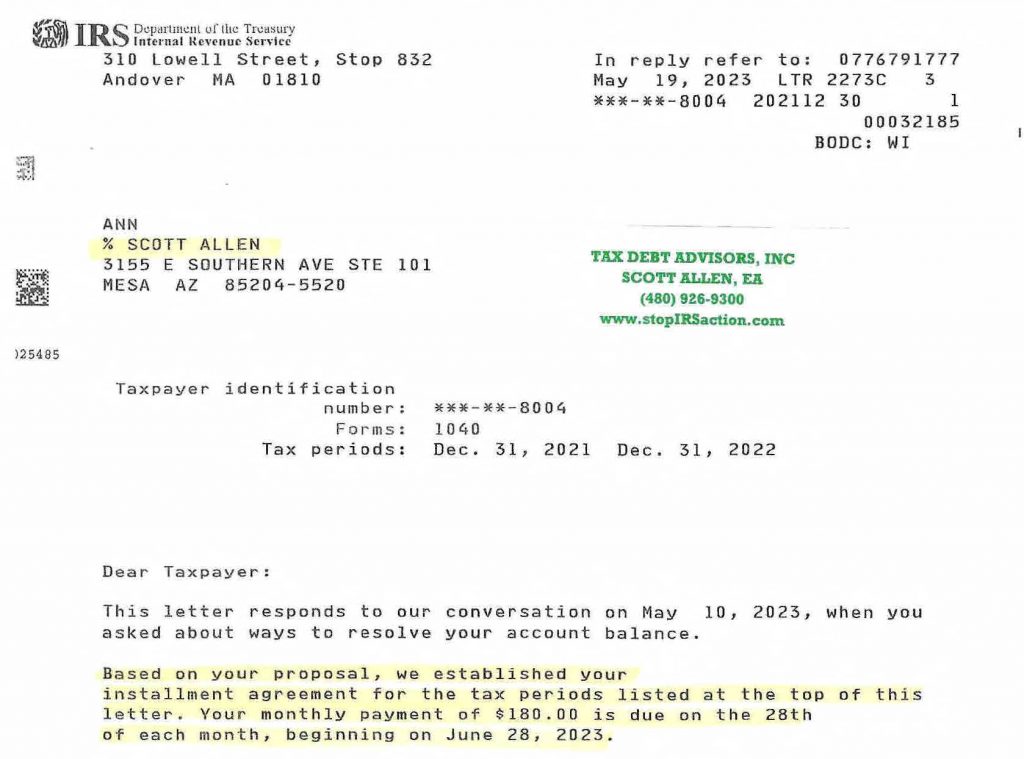

Ruben’s case highlights the importance of seeking professional help from a qualified tax resolution specialist when facing an IRS tax lien in Phoenix, Arizona. Tax Debt Advisors, Inc., with its team of experienced EAs like Scott Allen, can guide you through the complex process of navigating IRS regulations and finding the best solution for your specific situation.

Here’s what Tax Debt Advisors, Inc. can offer you:

- Free Consultation: Discuss your tax problems with a qualified EA during a free, no-obligation consultation.

- Personalized Strategy: Develop a tailored plan to resolve your IRS tax lien based on your unique circumstances.

- Experienced Representation: Benefit from the expertise of EAs who handle IRS matters daily.

- Communication and Transparency: Stay informed throughout the process with clear and consistent communication.

If you’re a taxpayer in Phoenix or surrounding cities struggling with an IRS tax lien, don’t hesitate to contact Tax Debt Advisors, Inc. Schedule your free consultation today and take the first step towards resolving your tax burden. Scott Allen EA can represent you from start to finish.

Additional Resources:

- IRS (.gov): https://www.irs.gov/

- Tax Debt Advisors, Inc.: https://taxdebtadvisors.com/

Disclaimer: This blog post is for informational purposes only and should not be construed as tax advice. Please consult with a qualified tax professional to discuss your specific tax situation.