A Path to Tax Relief: Chandler AZ IRS Settlements

Taxpayers Struggling with Back Taxes: Chandler AZ IRS Settlements

Tax debt can be a daunting challenge, often leading to stress, anxiety, and financial hardship. For individuals facing significant back tax liabilities, the prospect of IRS collection actions can be overwhelming. However, there is hope. A strategic approach, coupled with expert representation, can help taxpayers navigate these complex situations and potentially achieve a favorable outcome.

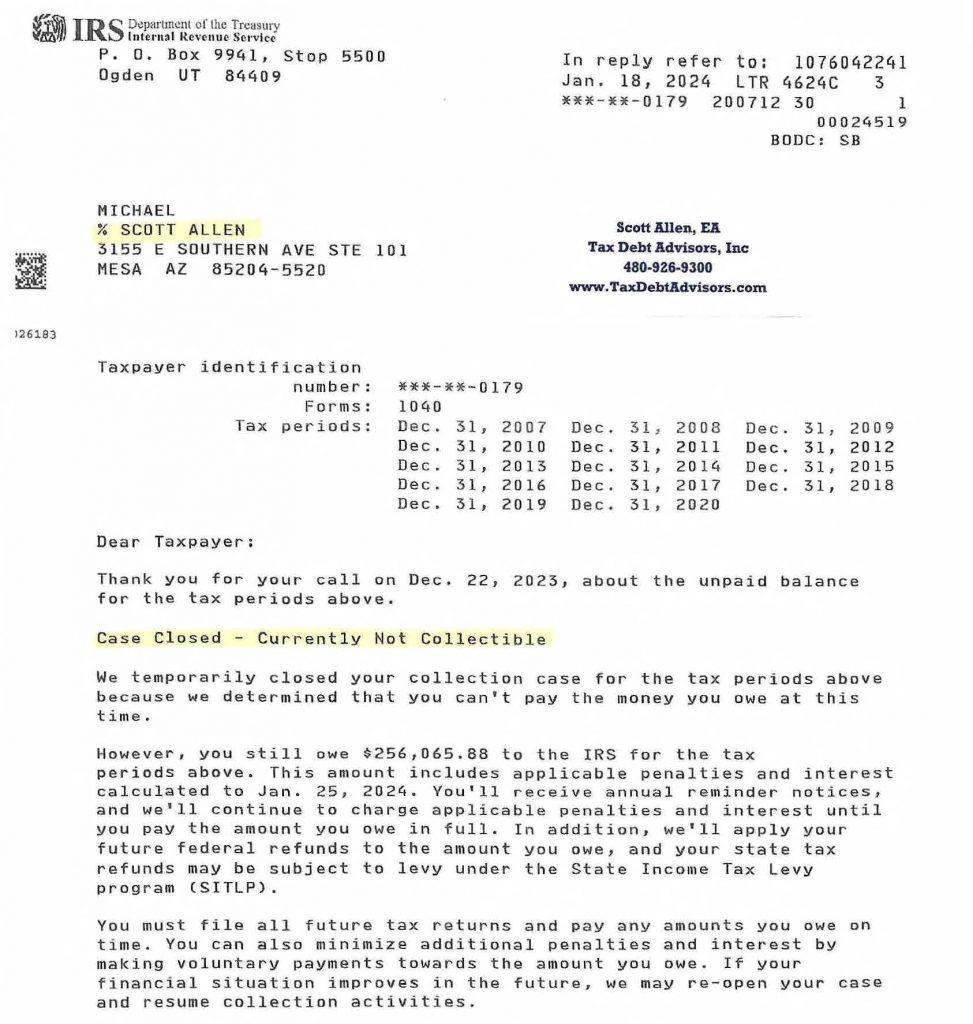

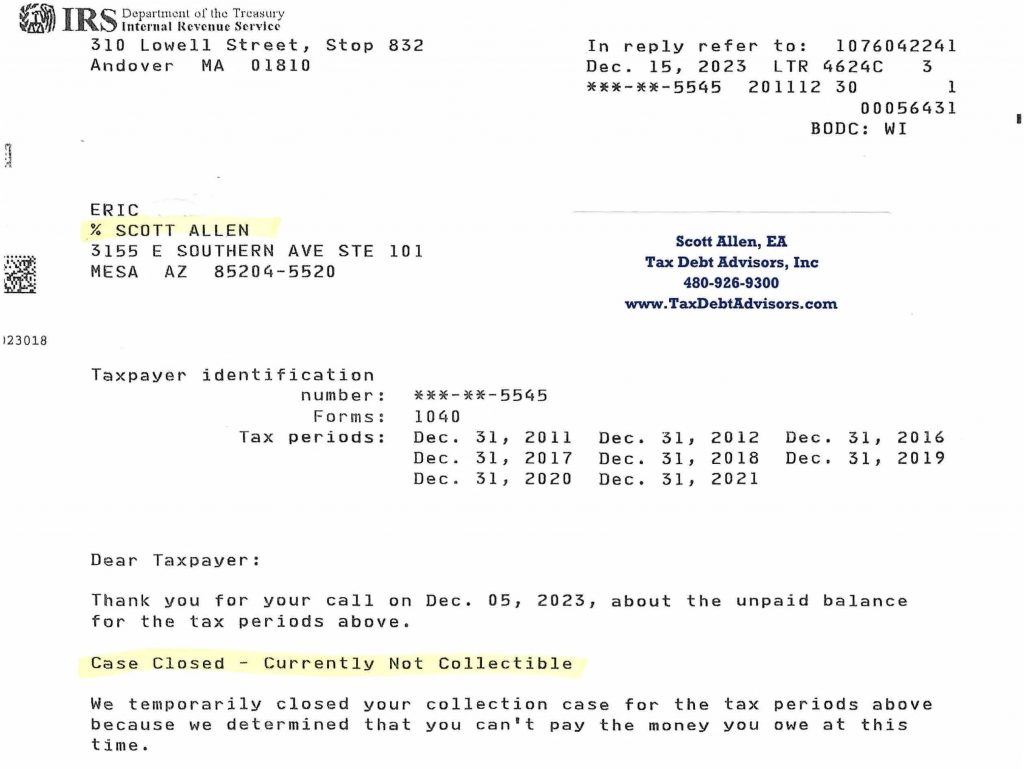

Understanding Currently Non-Collectible (CNC) Status

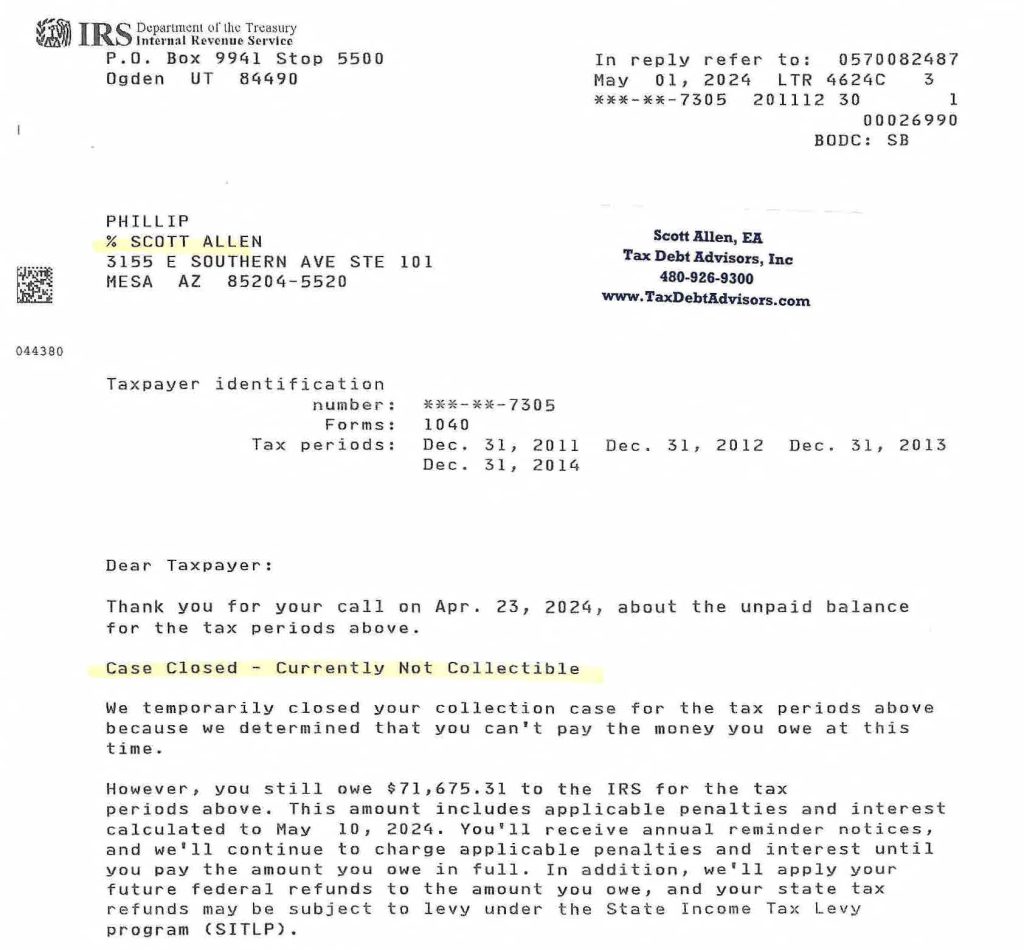

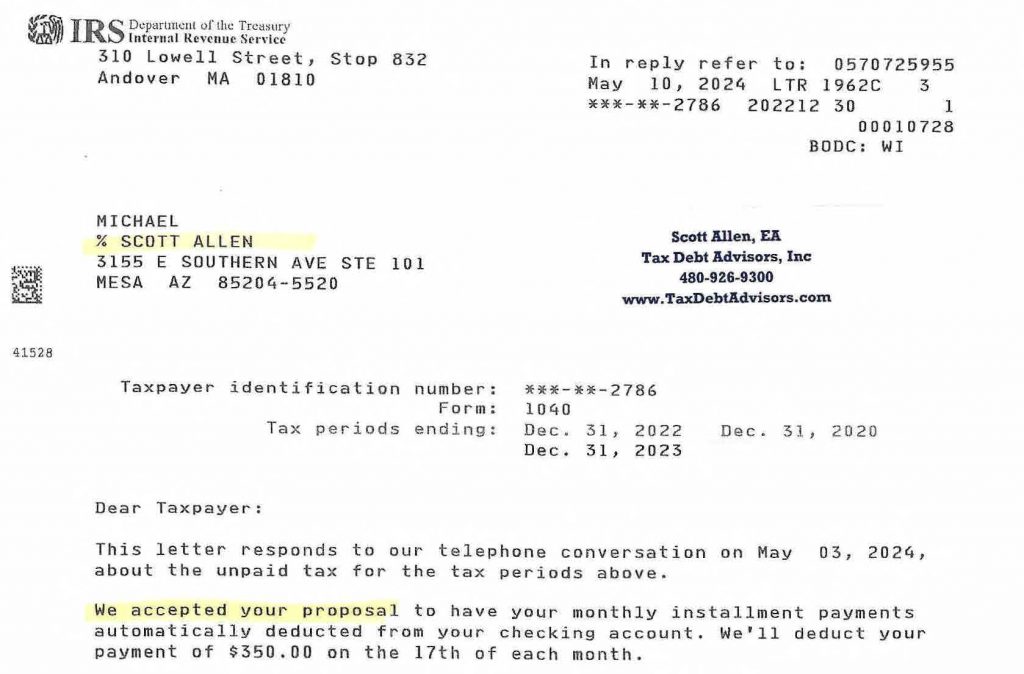

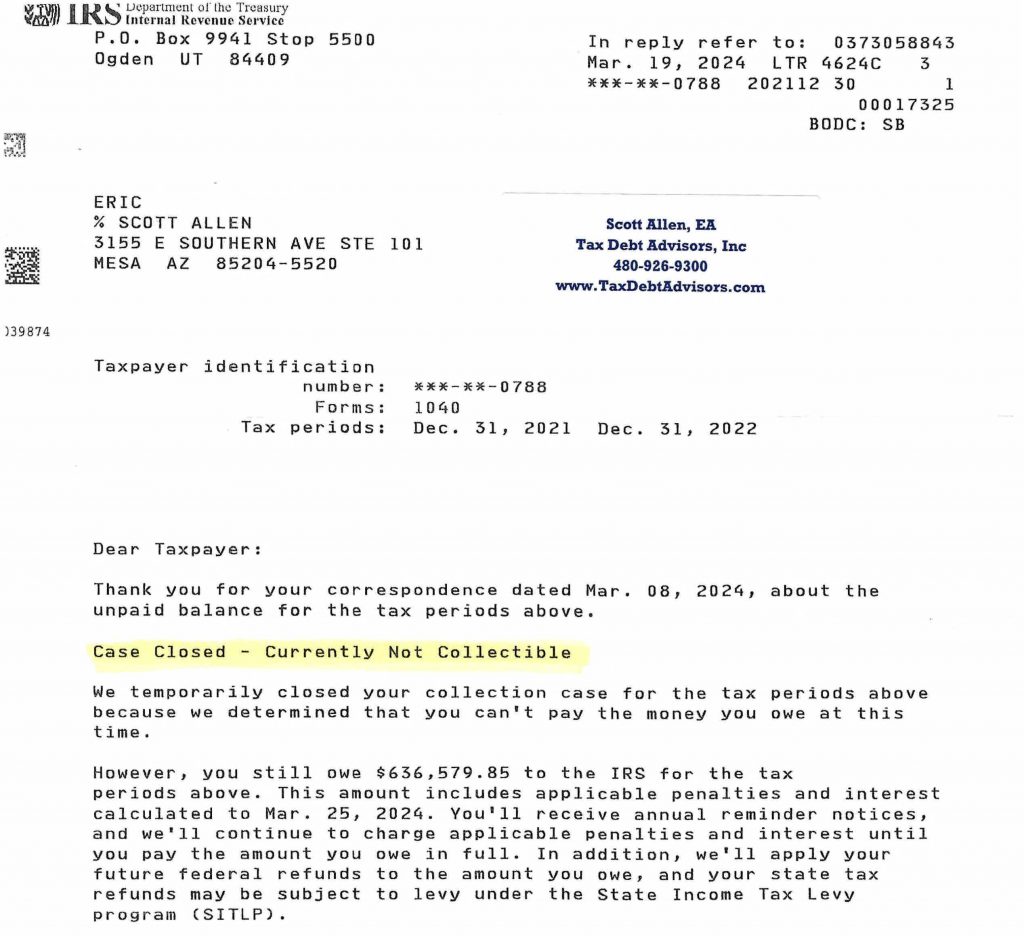

One such strategy is to pursue a Currently Non-Collectible (CNC) status with the IRS. This status essentially pauses IRS collection efforts temporarily, providing taxpayers with much-needed relief. To qualify for CNC status, taxpayers must demonstrate financial hardship, meaning they lack the ability to pay their tax debt while still meeting their basic living expenses. CNC status is just one of several ways to achieve a Chandler AZ IRS Settlement. Scott Allen EA will be sure to cover all available settlement options with you.

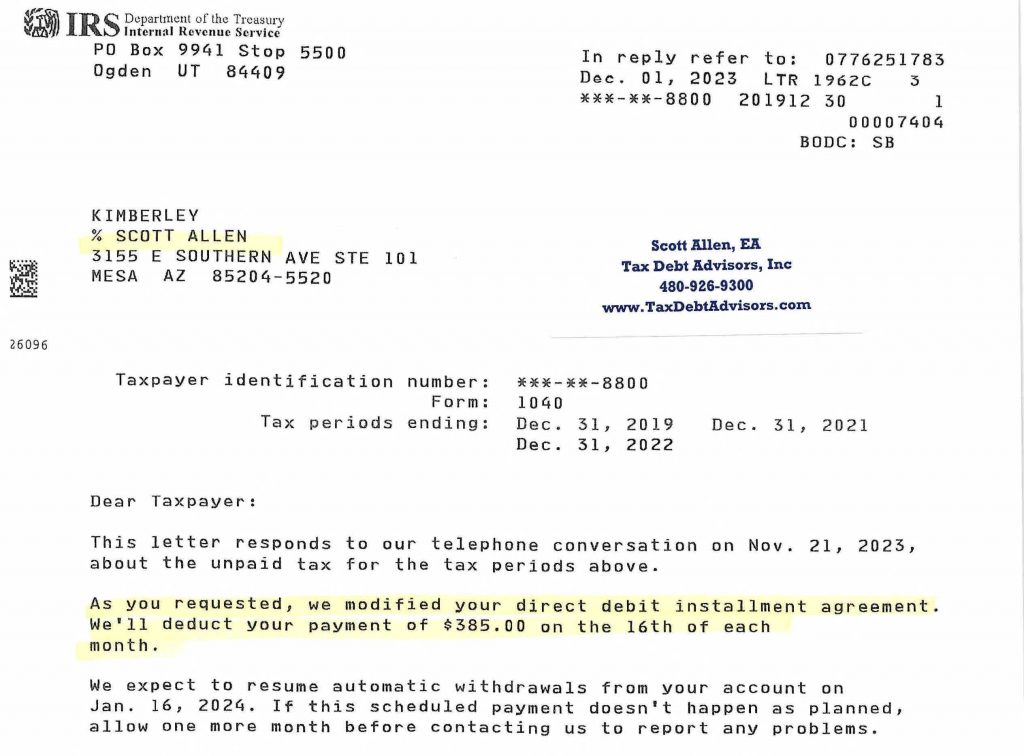

Scott Allen EA: A Trusted Advisor for Tax Debt Relief

Scott Allen EA, a seasoned tax professional at Tax Debt Advisors, Inc. in Mesa, Arizona, has extensive experience in helping taxpayers achieve CNC status and other forms of tax relief. His expertise in navigating the intricacies of IRS regulations and procedures has enabled him to successfully represent numerous clients facing significant IRS tax debt in Chandler and other surrounding cities in Arizona.

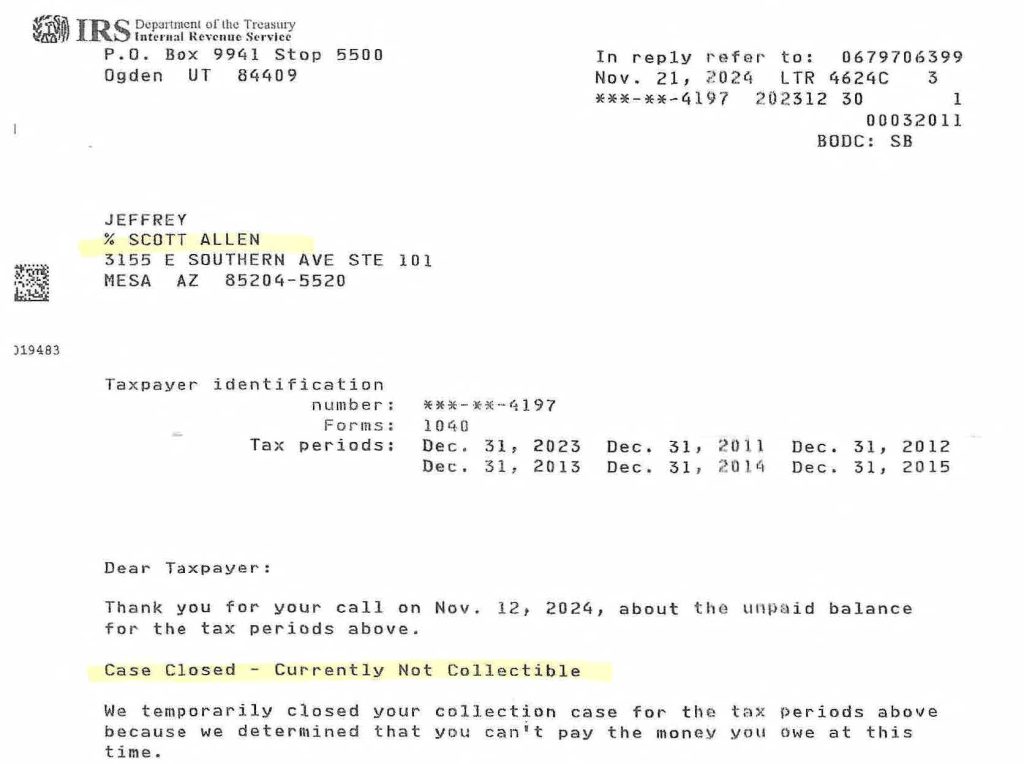

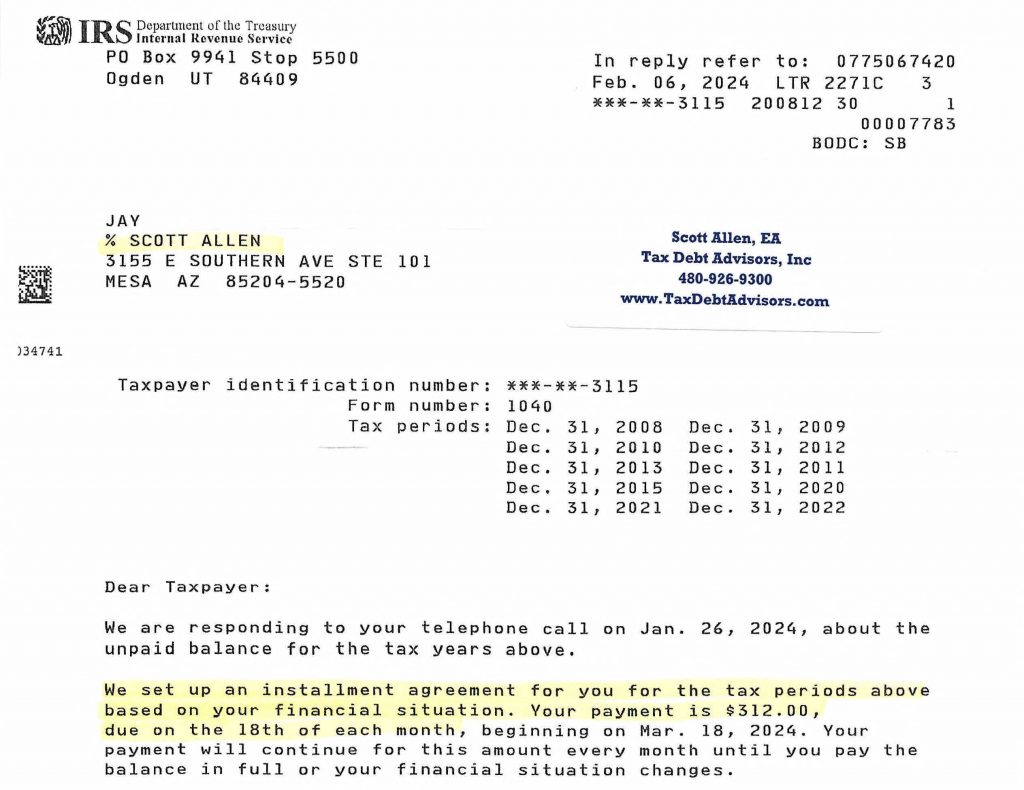

A Recent Success Story: Jeffrey’s Case

Recently, Scott Allen EA successfully helped a client named Jeffrey, who was burdened with back taxes from 2011, 2012, 2013, and 2014. Jeffrey hired Scott Allen EA as his IRS Power of Attorney to represent him in negotiations with the IRS. By meticulously analyzing Jeffrey’s financial situation and gathering the necessary documentation, Scott Allen EA was able to demonstrate that Jeffrey met the criteria for CNC status.

Through strategic negotiations and persuasive arguments, Scott Allen EA successfully convinced the IRS to grant Jeffrey CNC status. This significant achievement provides Jeffrey with much-needed relief, allowing him to focus on rebuilding his financial future without the constant threat of IRS collection actions.

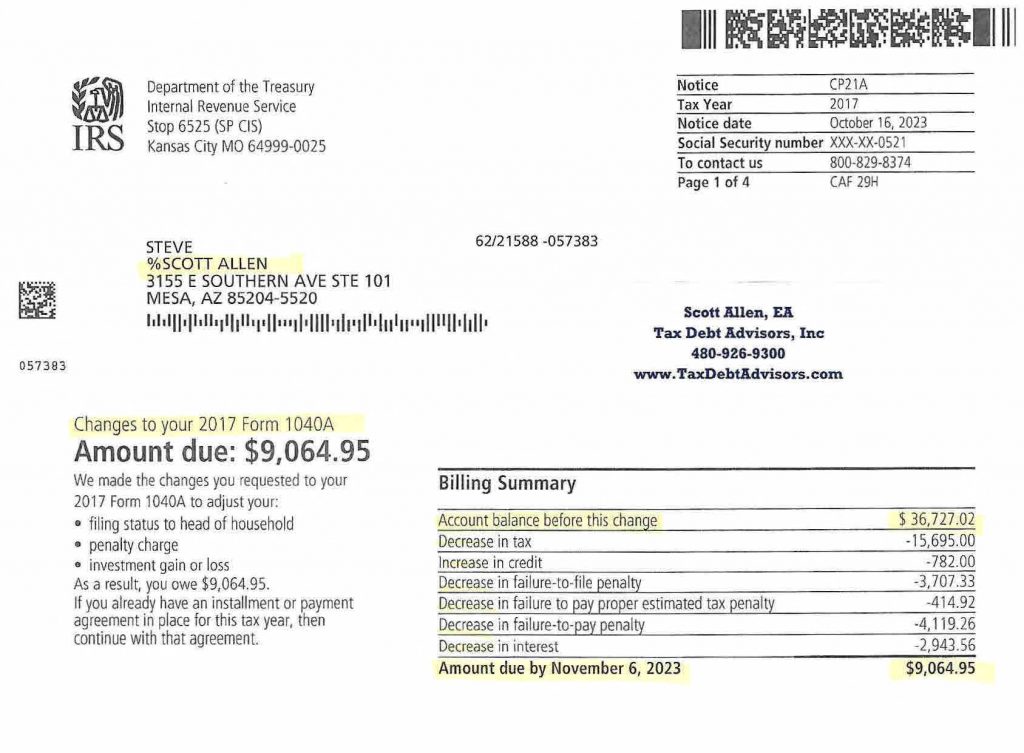

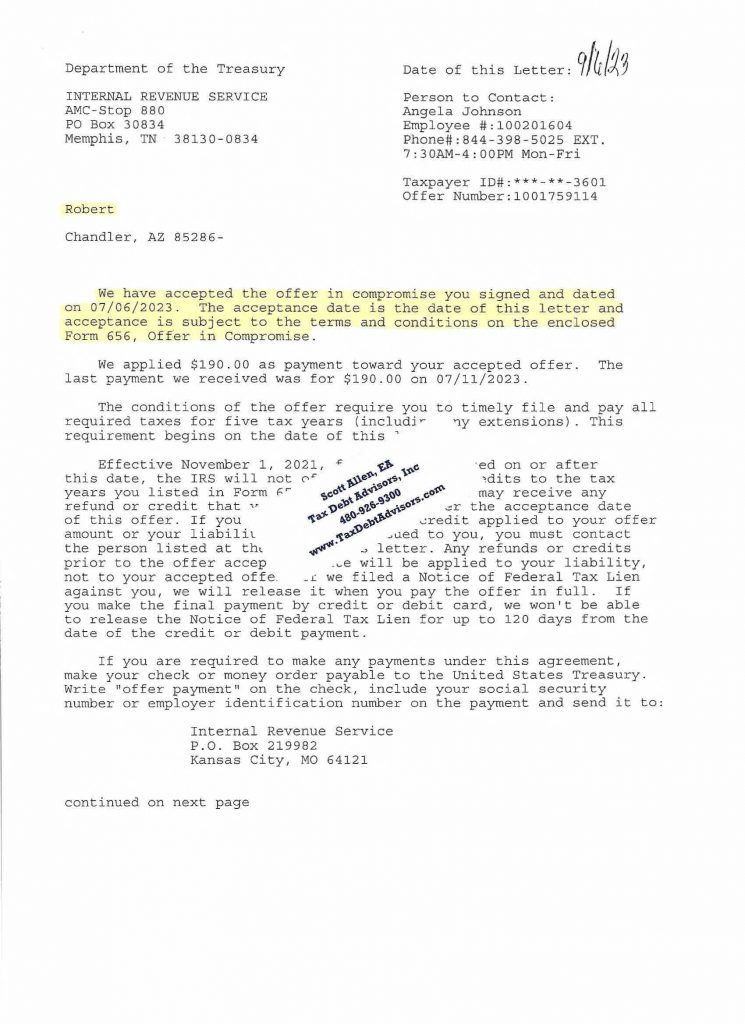

See the Chandler AZ IRS Settlement letter below. This is the IRS approving the Currently Not Collectible Status!

How Scott Allen EA Can Help You

If you are struggling with back taxes and are considering CNC status, Scott Allen EA can provide the guidance and support you need. Here’s how he can help:

- Comprehensive Financial Analysis: Scott Allen EA will conduct a thorough evaluation of your financial situation to determine your eligibility for CNC status.

- Strategic Negotiation: He will negotiate with the IRS on your behalf to present a compelling case for CNC status, emphasizing your financial hardship and inability to pay.

- Accurate Documentation: He will ensure that all necessary documentation is prepared and submitted to the IRS to support your claim.

- Effective Communication: Scott Allen EA will keep you informed throughout the process, answering your questions and addressing your concerns.

- Peace of Mind: By entrusting your case to Scott Allen EA, you can have peace of mind knowing that your tax debt is being handled by a qualified professional.

If you are facing significant IRS tax debt in or near Chandler AZ, don’t hesitate to seek professional help. Scott Allen EA at Tax Debt Advisors, Inc. is committed to providing effective and compassionate tax debt relief solutions. By understanding your unique circumstances and employing strategic approaches, he can help you achieve financial freedom and a brighter future.