Receive a Mesa AZ CP2000 IRS Audit Notice?

CP2000 Notice: Don’t Face the IRS Alone

Receiving a CP2000 IRS audit letter in Mesa AZ from the IRS can be a daunting experience. Whether it’s an CP2000 audit notification, a demand for payment, or a notice about delinquent tax returns, the stress and uncertainty can be overwhelming. This is where Tax Debt Advisors, Inc., a Mesa, Arizona-based firm, can provide invaluable assistance.

With years of experience navigating the complex world of taxes, Tax Debt Advisors, Inc. specializes in resolving IRS problems for individuals and businesses. Their local family owned business, led by Enrolled Agent Scott Allen, is committed to helping clients achieve peace of mind and financial stability.

Understanding the IRS Process

The IRS is a formidable agency with a vast array of tools at its disposal to collect unpaid taxes. From audits and levies to wage garnishments and liens, taxpayers can find themselves in a precarious financial situation. The complexities of tax law, coupled with the intimidating nature of the IRS, can make it difficult for individuals to navigate the process on their own.

This is where an experienced tax professional can make a significant difference. Enrolled Agents, like Scott Allen, possess specialized training and qualifications to represent taxpayers before the IRS. They have a deep understanding of tax laws and regulations, enabling them to effectively communicate with the IRS and advocate for their clients’ best interests.

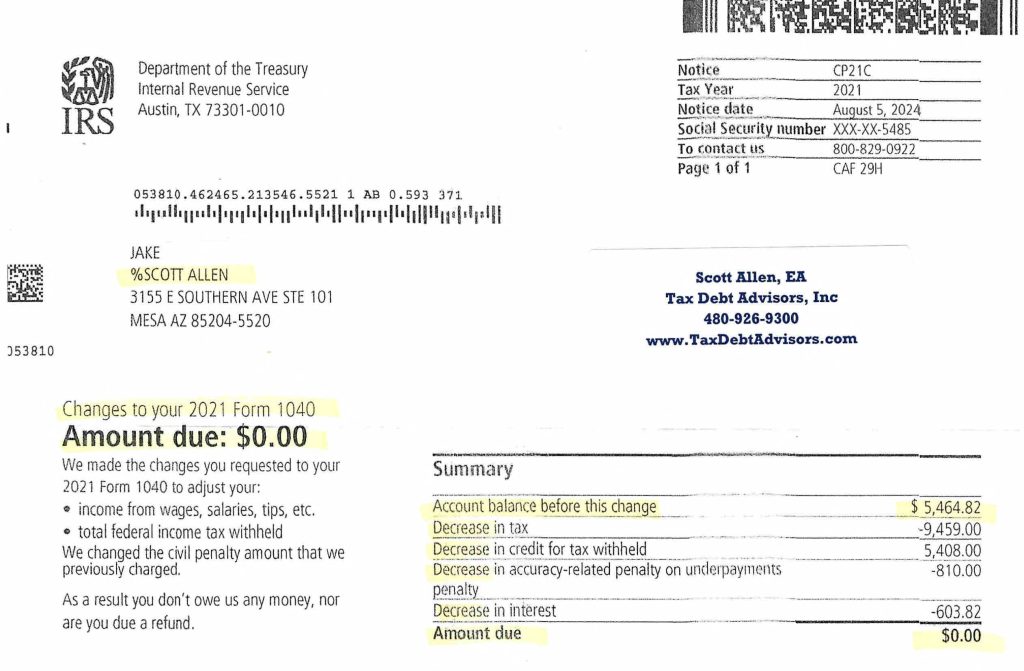

A Success Story: Jake’s Experience

One such success story involves a Tax Debt Advisors, Inc. client named Jake. Jake received a CP2000 audit letter in Mesa AZ from the IRS regarding his 2021 tax return, informing him of a $5,464 tax debt. Faced with the prospect of an IRS audit, Jake was understandably concerned about the potential consequences.

Instead of attempting to handle the situation alone, Jake turned to Scott Allen and Tax Debt Advisors, Inc. for help. Scott immediately initiated a thorough review of Jake’s case, carefully examining the IRS’s claims and gathering the necessary documentation to support his client’s position.

Through skillful negotiation and a deep understanding of tax law, Scott was able to successfully protest the IRS’s findings. Ultimately, he achieved a complete resolution of the audit, resulting in the elimination of Jake’s entire $5,464 tax debt. See the IRS approval letter below.

How Tax Debt Advisors, Inc. Can Help You

Tax Debt Advisors, Inc. offers a comprehensive range of services to help Mesa taxpayers resolve their IRS issues. These services include:

- IRS Audit Representation: If you receive an audit notification, Scott Allen and his team can represent you throughout the process, protecting your rights and minimizing your tax liability.

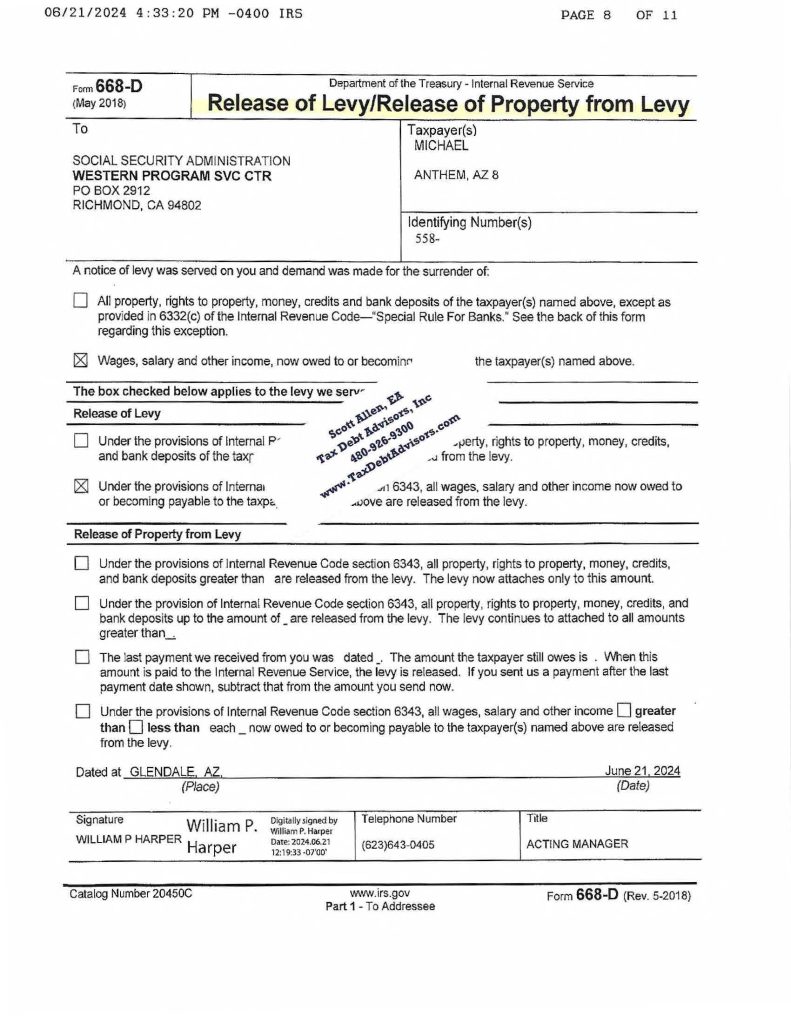

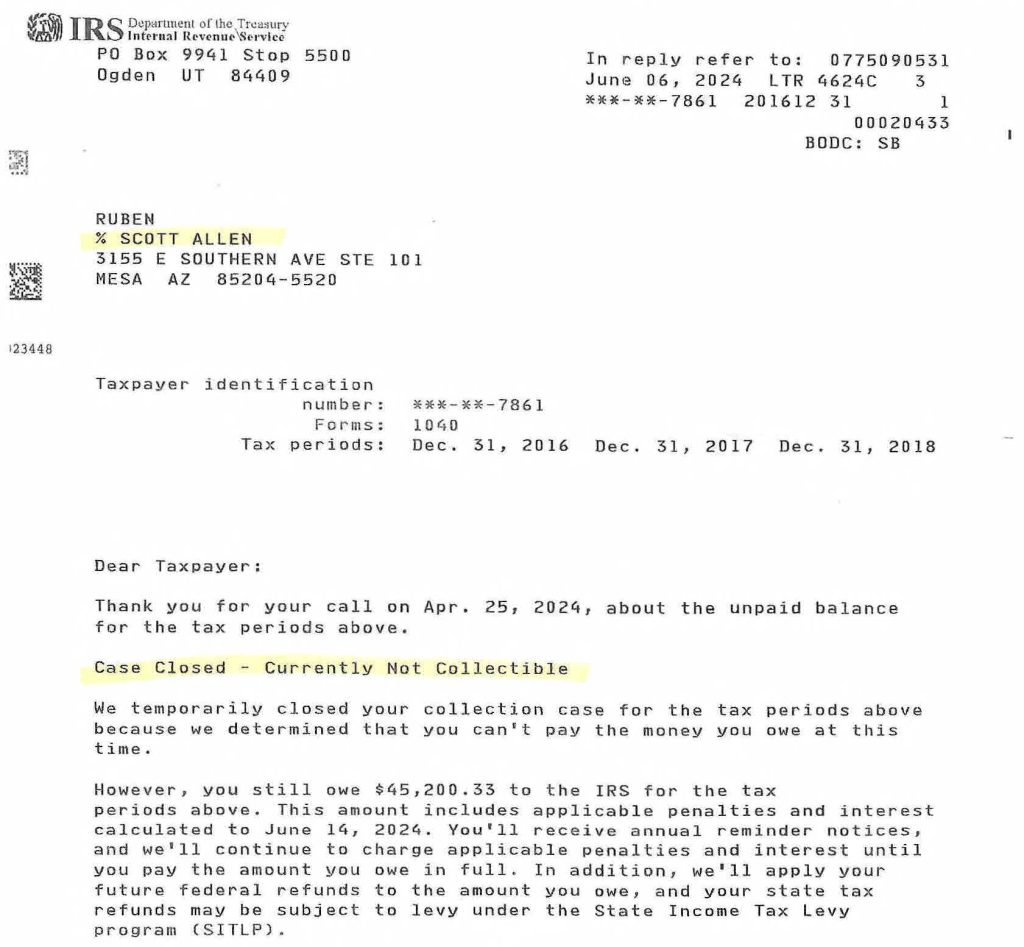

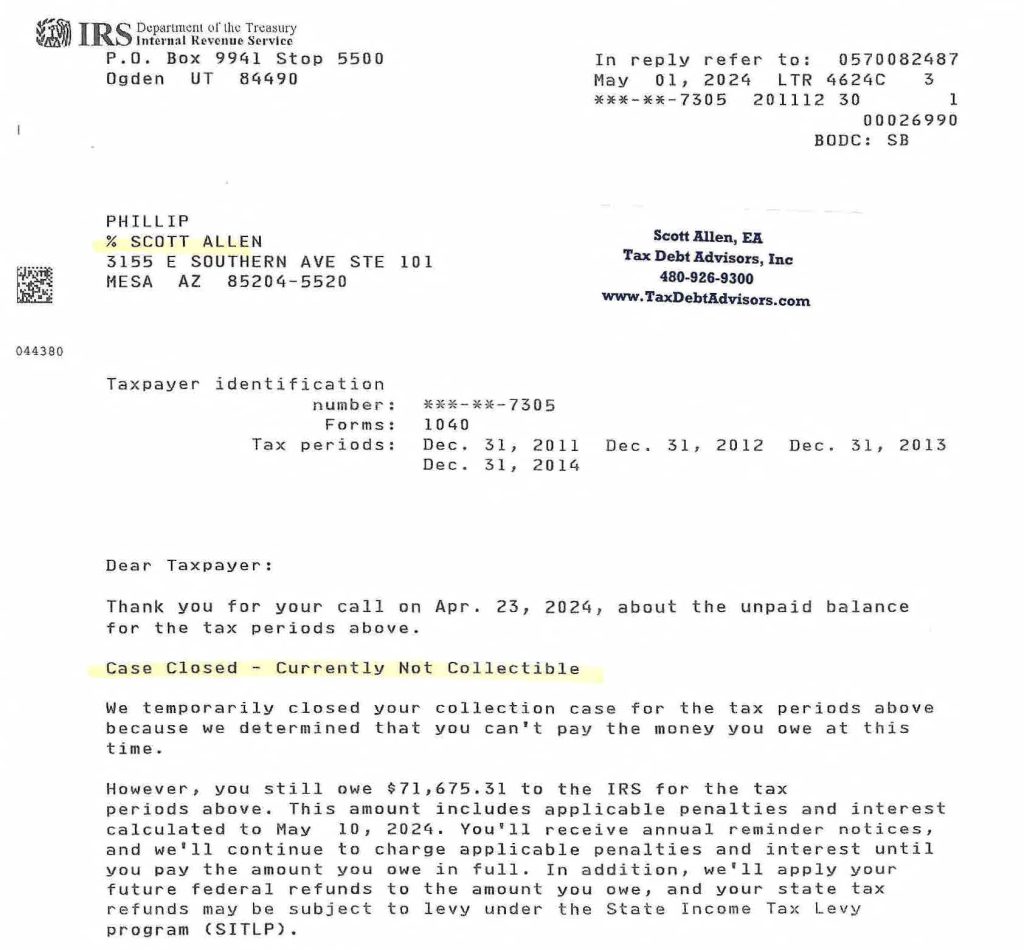

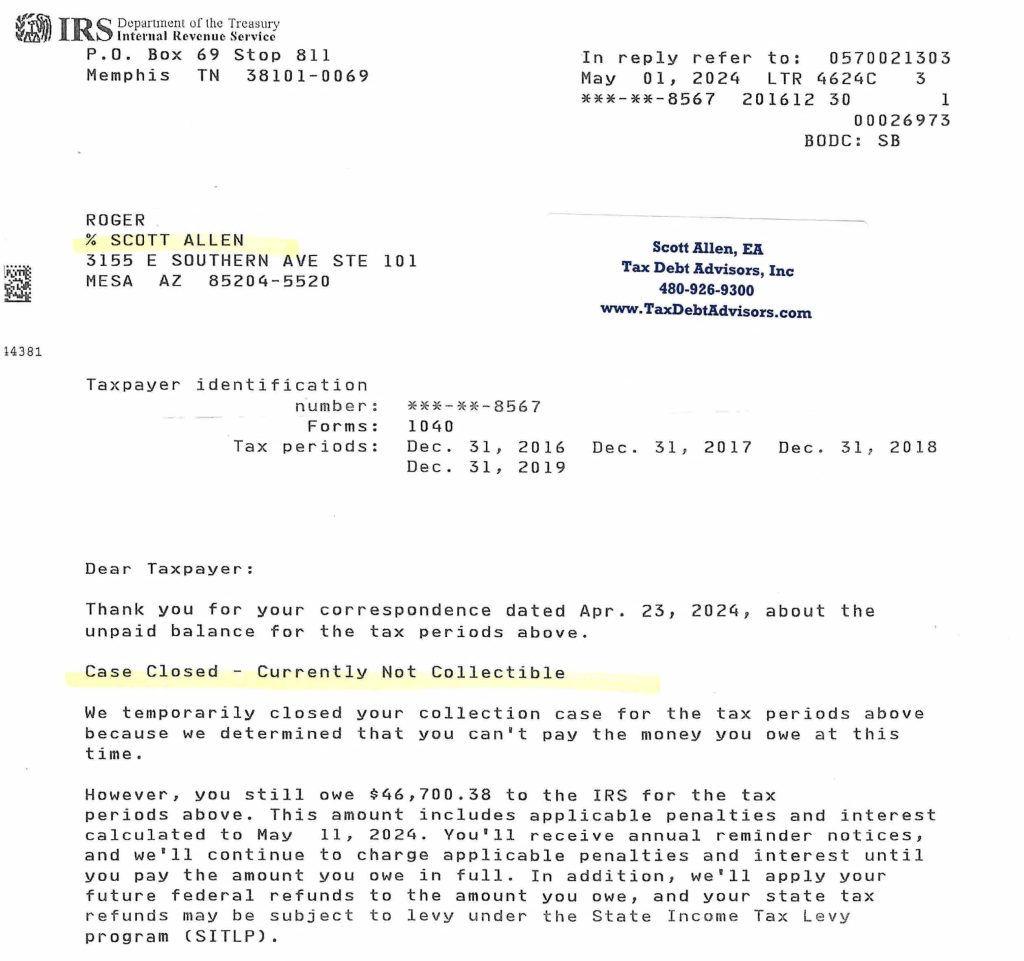

- IRS Collections Resolution: If you are facing IRS collections activity, such as levies, wage garnishments, or liens, Tax Debt Advisors, Inc. can help you develop a strategic plan to resolve your tax debt and stop collection actions.

- Delinquent Tax Return Preparation: If you have unfiled tax returns, Scott Allen can assist you in preparing and filing those returns to bring your tax account up to date and avoid penalties.

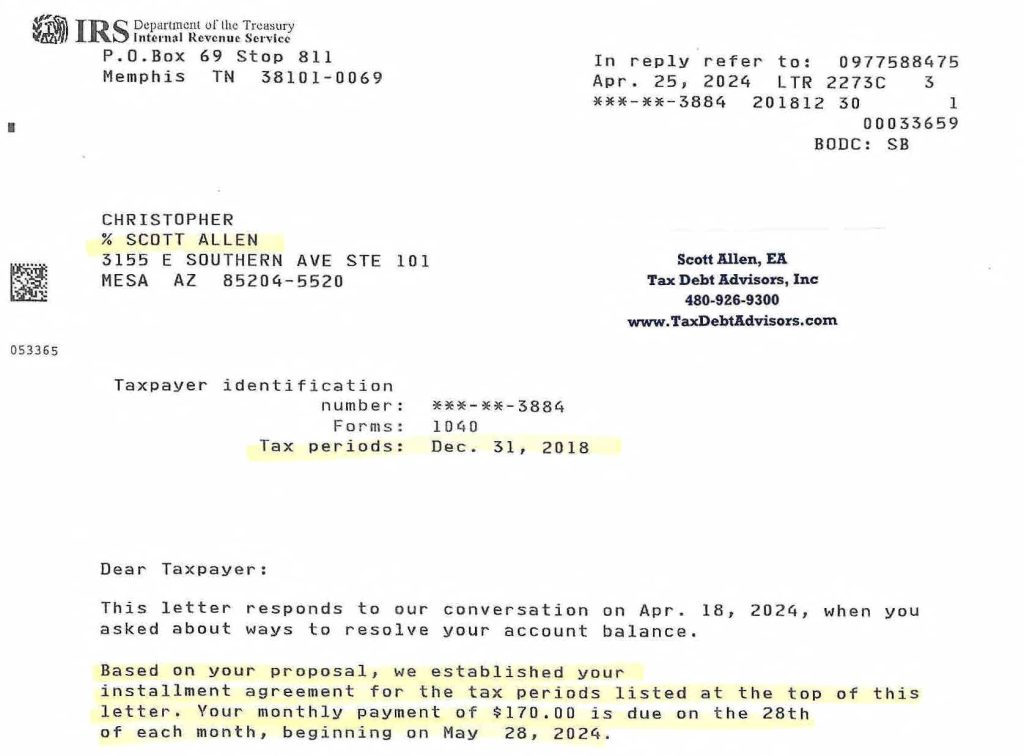

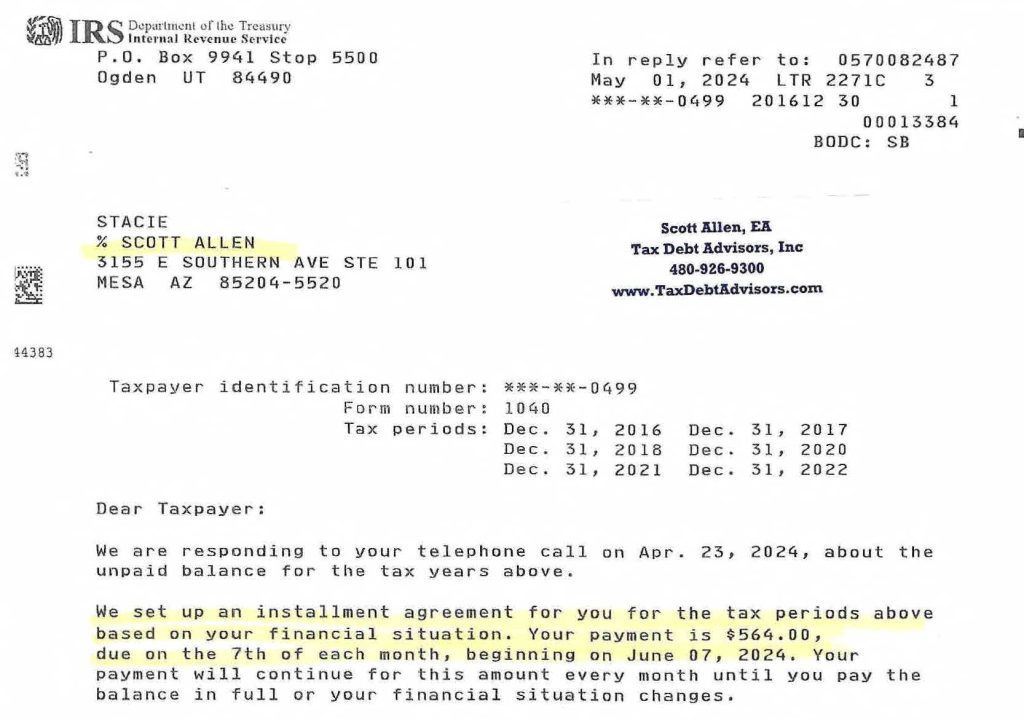

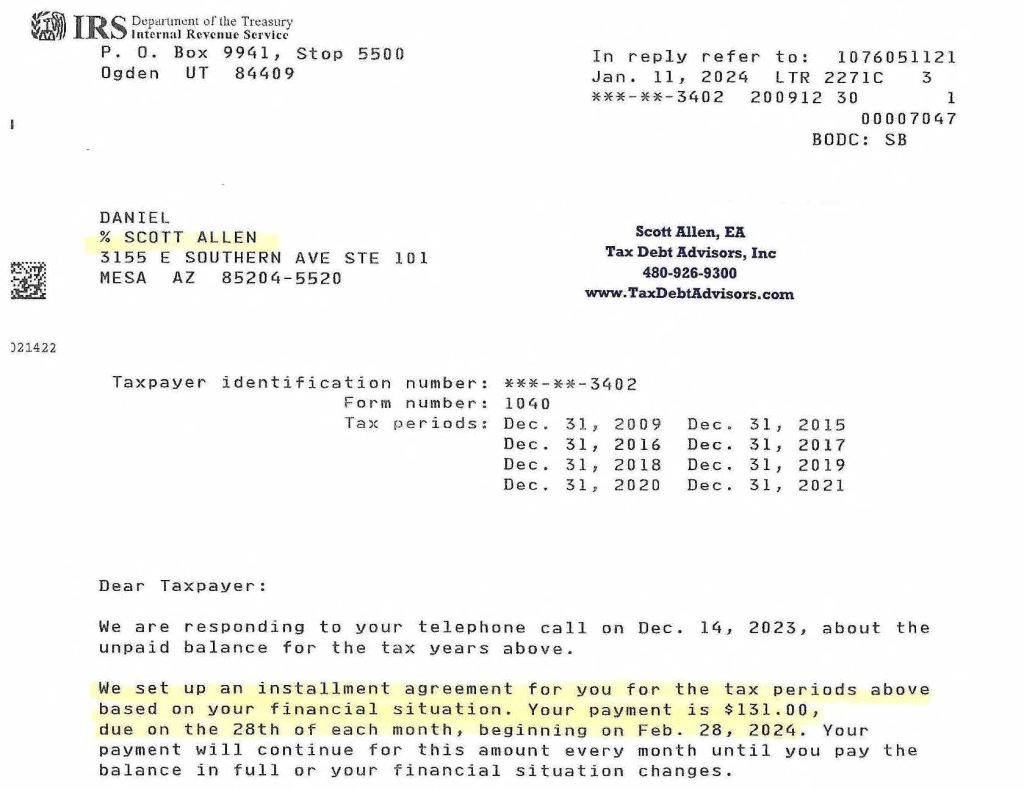

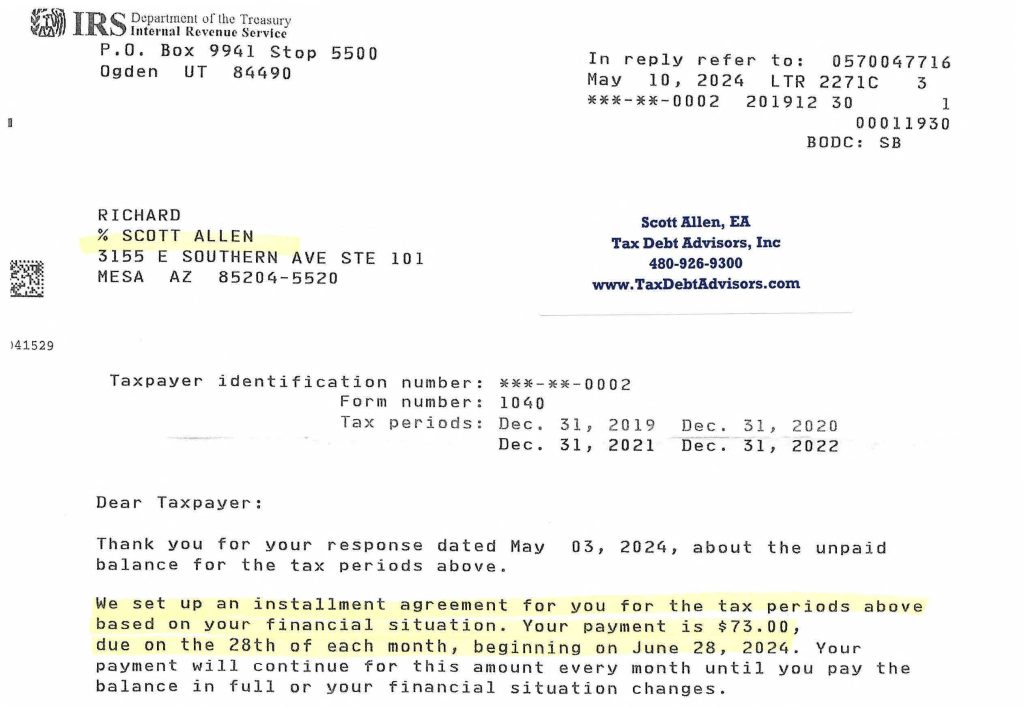

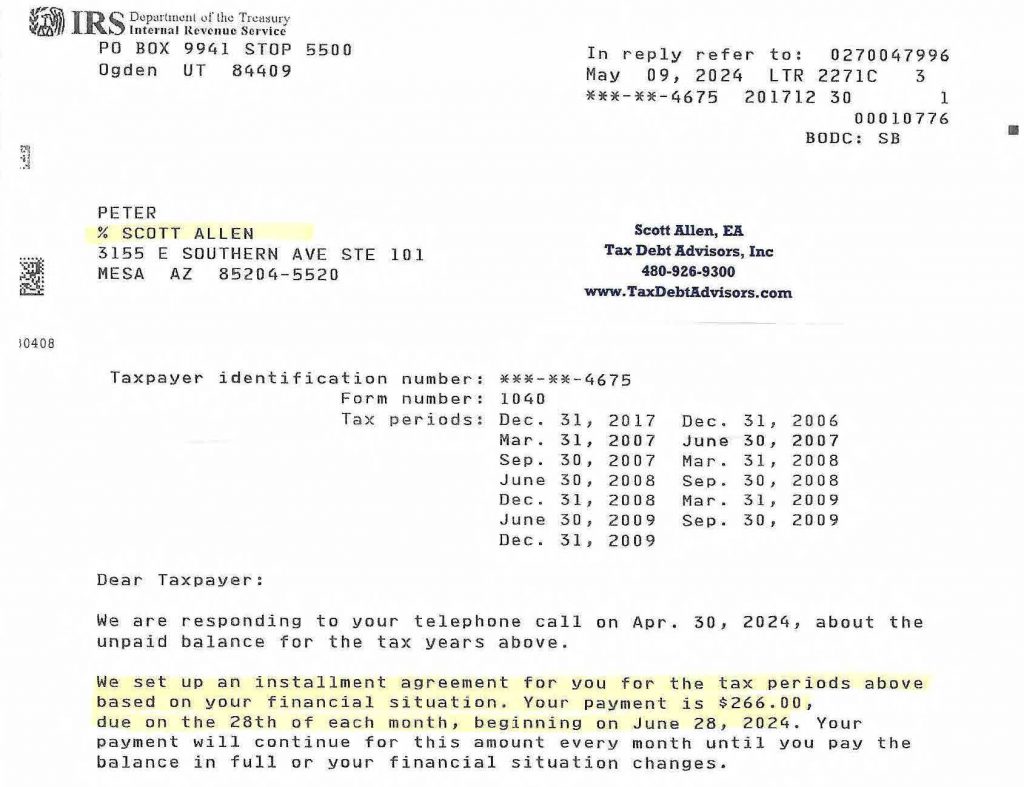

- Installment Agreements: If you are unable to pay your taxes in full, Tax Debt Advisors, Inc. can help you set up an installment agreement with the IRS to make manageable monthly payments.

- Offer in Compromise: In some cases, taxpayers may be eligible for an Offer in Compromise, which allows them to settle their tax debt for less than the full amount owed. Tax Debt Advisors, Inc. can help you determine if you qualify for this program and guide you through the application process.

Taking Control of Your Tax Situation

Facing IRS problems can be a stressful and overwhelming experience. However, it’s important to remember that you don’t have to go through it alone. Tax Debt Advisors, Inc. is here to provide the support and expertise you need to resolve your tax issues and regain peace of mind.

By choosing Tax Debt Advisors, Inc., you are investing in a family business that is dedicated to your success. Scott Allen and his team will work diligently to understand your unique situation and develop a customized plan to address your tax challenges right here in Mesa Arizona.

Don’t wait until it’s too late. Contact Tax Debt Advisors, Inc. today for a free consultation. Let them help you navigate the complexities of an IRS CP2000 audit and achieve a positive outcome.

Call us today for a free consultation @ 480-926-9300