Steven Filed Back Taxes Chandler with Tax Debt Advisors

File Back Taxes Chandler

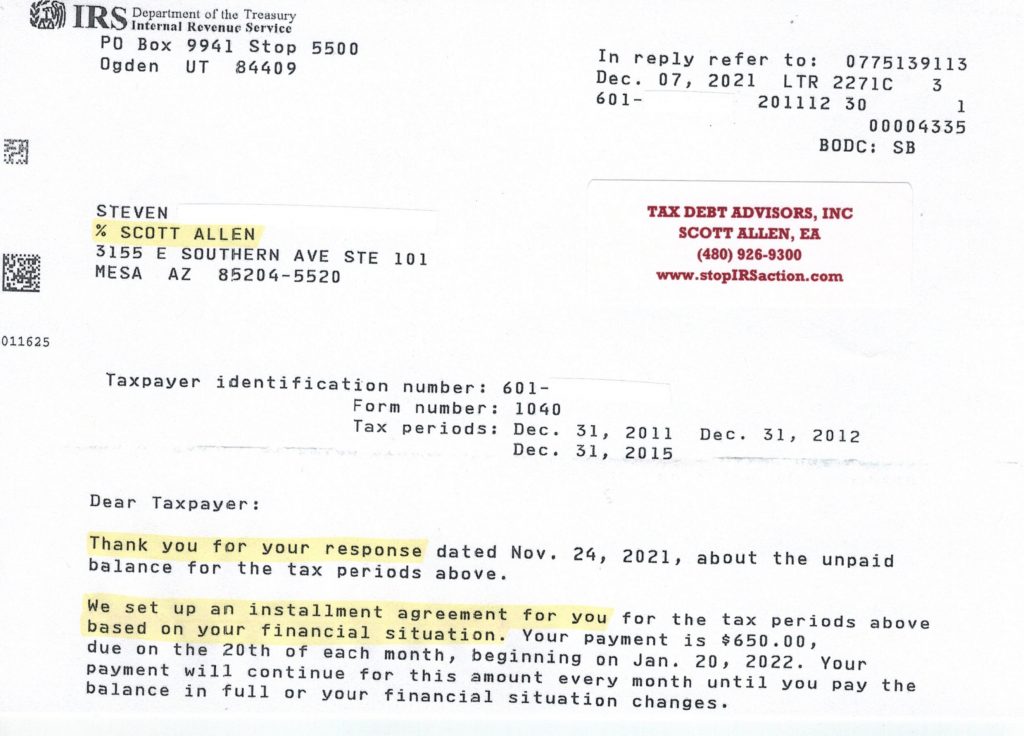

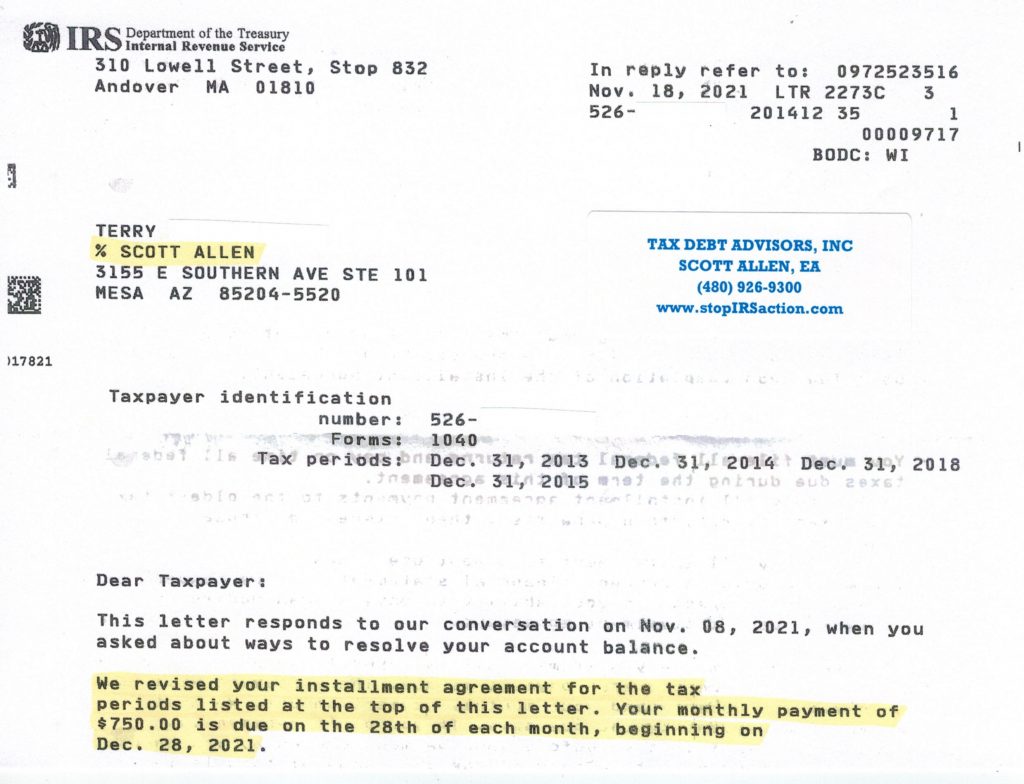

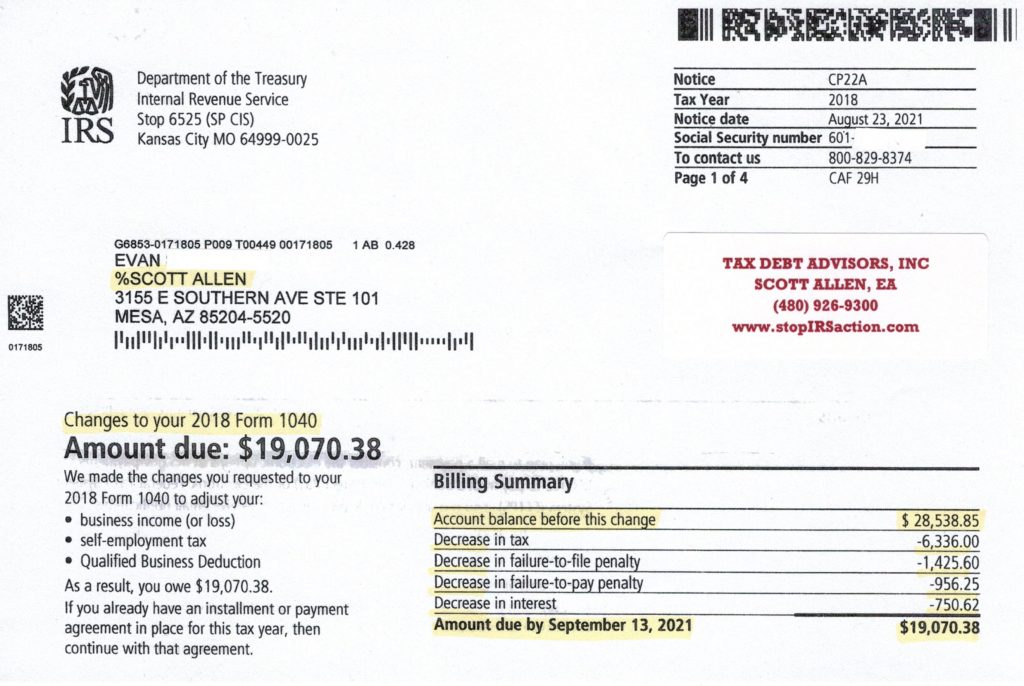

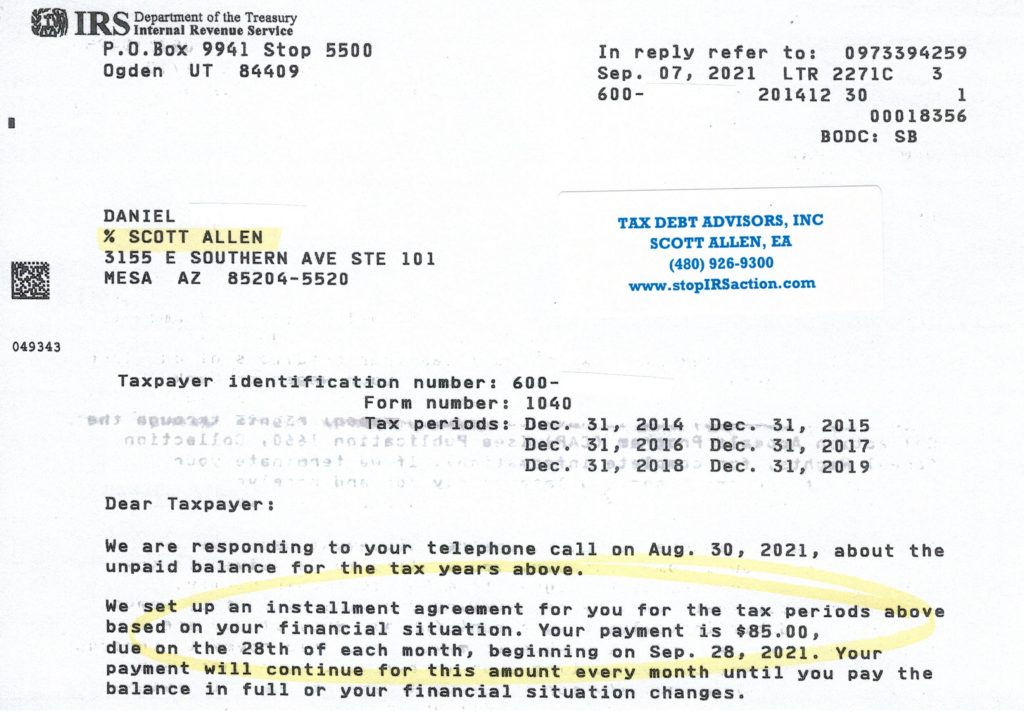

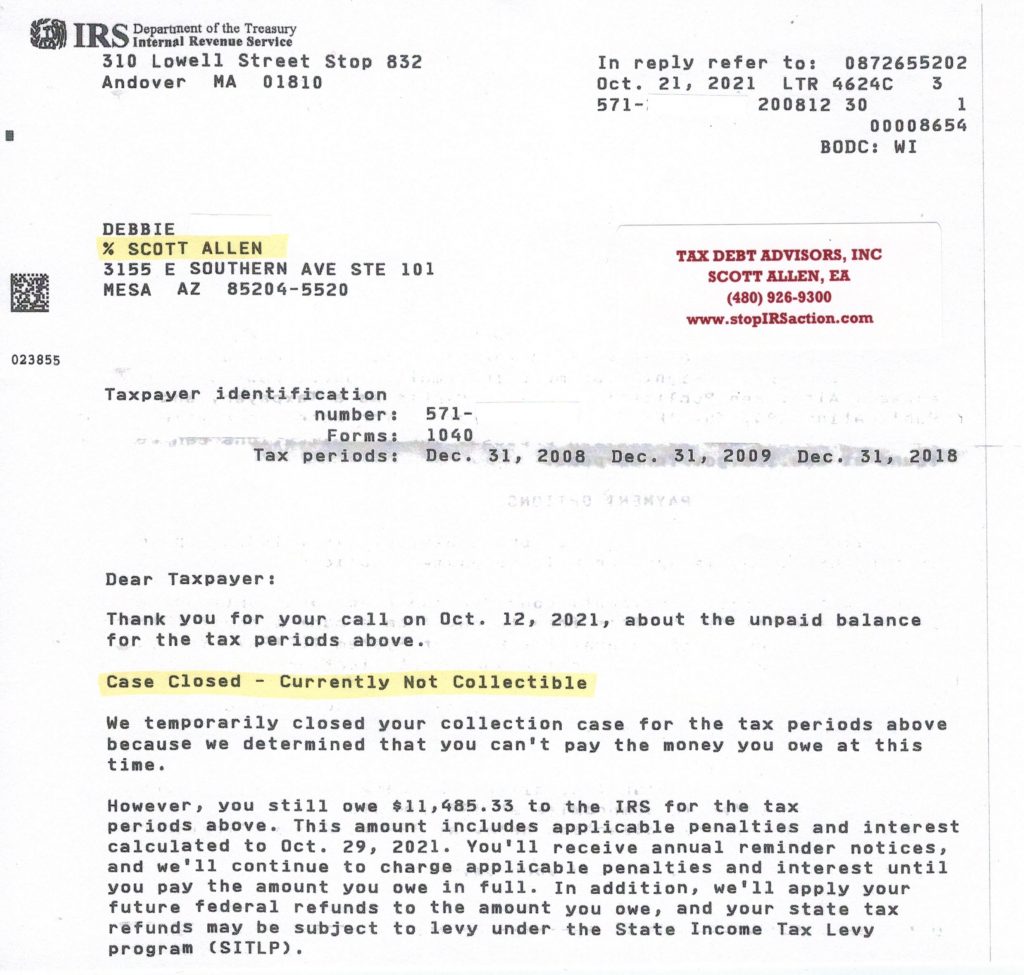

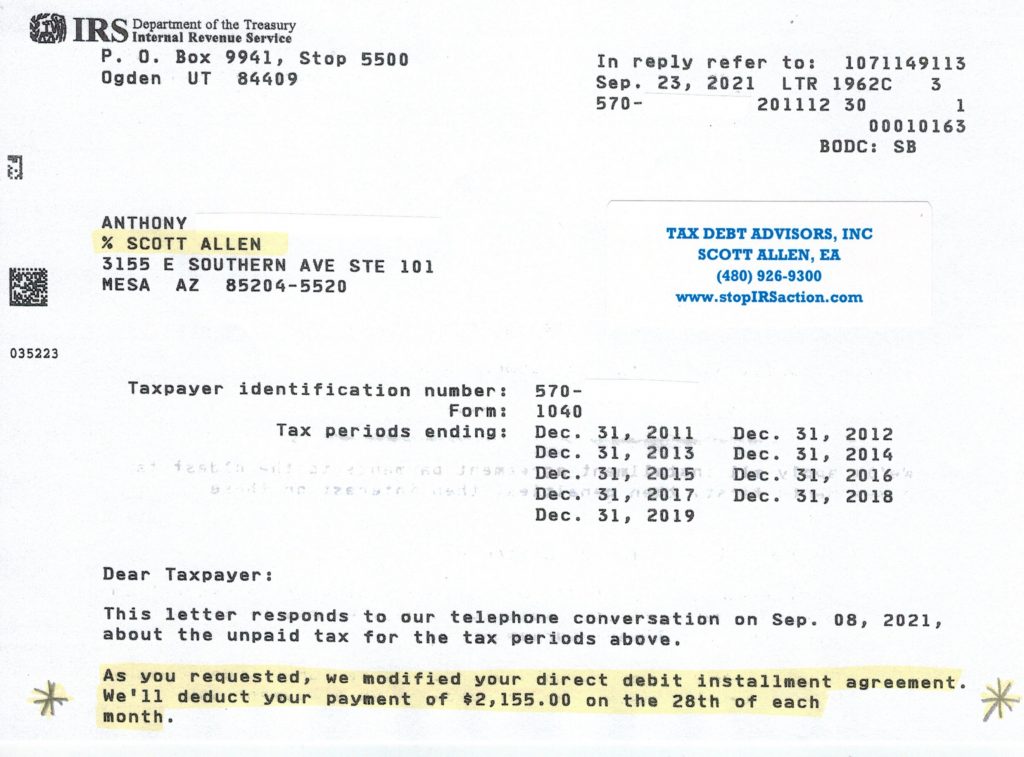

Tax Debt Advisors is the right choice if you need to file back taxes Chandler. Tax Debt Adviors has been solving IRS problems for over 44 years. That is two generations of committed success of filing back taxes and settling IRS debts. The average clients that comes in hasn’t filed in about seven years and/or owes the IRS more then $50,000 in back taxes. Steven was above the average and owes the IRS more than $93,000 on his back taxes. Two of the years that he owes for are 2011 and 2012 so those debts expire in less than two years from now. That means that when they expire the IRS cannot collect on the back taxes any longer. So in essence he is settling his back taxes on a $650/month payment plan (or $13,000 by the time it expires). Not a back deal if you ask us. Check out the IRS acceptance letter below.

If you have a tax problem that needs some solving (whether large or small) give Tax Debt Advisors a call today. They can help guide you on the right path to victory over the IRS. Even if you don’t need to file back taxes Chandler they can still be of help settling your IRS debt, responding to an IRS notice, or represent you in an audit.

Thank you.