Stop IRS levy in Scottsdale AZ without a tax attorney: It is possible!

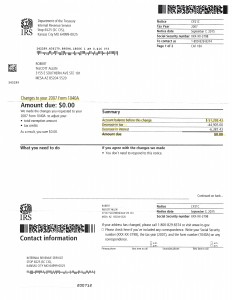

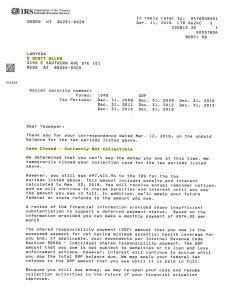

When a taxpayer gets a notice of an IRS levy they assume the only way to stop it is with a Scottsdale AZ IRS tax attorney. That is not the case. Below is a copy of a notice from the IRS for a clients tax return that he was getting levied on. He came to see Scott Allen EA to get a stop to the IRS levy in Scottsdale AZ. Scott is a licensed Enrolled Agent who specializes in stopping IRS levies.

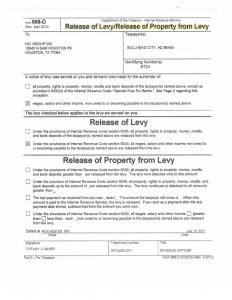

Robert and his wife came in getting levied on their 2007 tax return. It had been going on a while and they didn’t know how to get it stopped. After Scott Allen EA was able to review the situation and speak to the IRS on their behalf it was determined that the best way to stop the IRS levy in Scottsdale AZ was to correct the 2007 tax filing that needed to be protested which in result eliminated the tax owed. By doing so and faxing the return and information into the IRS directly Scott was able to get an immediate stop to the levy. Once the tax return was approved and posted, the money that was under the levy was able to be refunded to Robert and his wife. Talk about a big stress relief for them! Scott Allen EA deals with these issues on a daily basis and understands how to navigate the IRS personnel to get you the best possible result. Don’t be under the “choke hold” of a Scottsdale AZ IRS levy any longer. If you are considering hiring a Scottsdale IRS tax attorney may I suggest giving Scott Allen EA a call today for a honest no obligation appointment. Remember if the person you decide to use to represent you before the IRS does not lift you up in the process but relies on fear tactics does not have your best interest in hand. Call 480-926-9300 today and I promise Scott with make today a great day for YOU! He will get done was needs to be done to stop IRS levy.

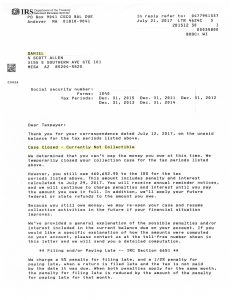

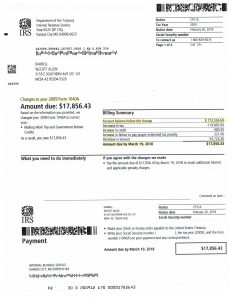

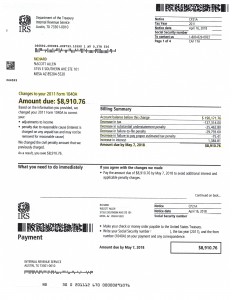

July 2018 update on another case:

Check out the IRS approval notice on another case Scott Allen EA resolved for someone in Scottsdale AZ. An IRS levy was avoided for this concerned taxpayer as he got back into compliance and let Scott Allen EA negotiate an agreement for him.