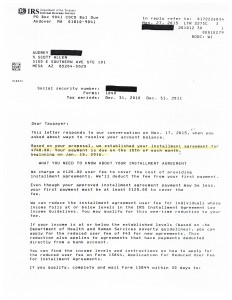

Do you often feel like you need the representation of a Mesa Arizona tax attorney for your IRS payroll tax debt? Before signing power of attorney over to a Mesa AZ tax attorney, first consult with a tax professional. Scott Allen is an Enrolled Agent licensed to prepare tax returns in all 50 states and to represent taxpayers before the IRS in matters of collection and audits. Scott Allen’s expertise includes preparing tax returns, handling State or IRS collection matters, federal and state income tax audits, sales tax audits, IRS tax debt, reduction, Offers in Compromise, installment agreements, tax penalty abatement, tax-motivated bankruptcy, business tax issues and bankruptcy filing if needed.

Most cases are not legal matters that require the cost of client attorney privilege. Owing back 941 payroll taxes in Mesa AZ does not make you a criminal; it makes you delinquent. All that IRS wants if to see you get back in compliance and to not get into this situation a 2nd or 3rd time.

Many Mesa businesses have difficulty staying current with IRS 941 payroll taxes. They may even be tempted to borrow from their 941 payroll account to pay other bills. You want to stay away from this tactic. It may be a short term relief but in the long term it will have its costing affect to your business.

But, if you find yourself behind on your IRS 941 (or 940) payroll taxes in Mesa Arizona you need to consult with Scott Allen EA. He will be able to get you from point A to point B in the best and quickest manner possible. Most payroll taxes are cannot be discharged in bankruptcy through a Mesa AZ tax attorney. You will need to look at other alternatives. Scott will go over all the other alternatives with you.

Call Scott Allen EA today at 480-926-9300 to schedule a free initial consultation.