Call Scott Allen E.A. if you default on your IRS Installment Arrangement in Goodyear Arizona

Goodyear AZ IRS Installment Arrangement Help

If you fail to make your monthly payment to the IRS, you will eventually receive an Installment Agreement Default Notice in Goodyear AZ. If this is your first default the IRS may allow you to be reinstated at your original payment amount provided you catch up on all missed payments. If this is your second default, or it has been a long time since you have made a payment, or you owe a significant amount to the IRS, it is likely they will want to renegotiate your payment plan all over again. This means providing new financial information.

If you are required to renegotiate with the IRS may I suggest you seriously consider having a free consultation with Scott Allen E.A. near Goodyear AZ This is a time to revisit whether your installment arrangement can be negotiated lower or if it is likely to increase to determine if another settlement option would be more favorable. Scott Allen E.A. can be reached at 480-926-9300 to schedule an appointment and he will make that day a great day for you!

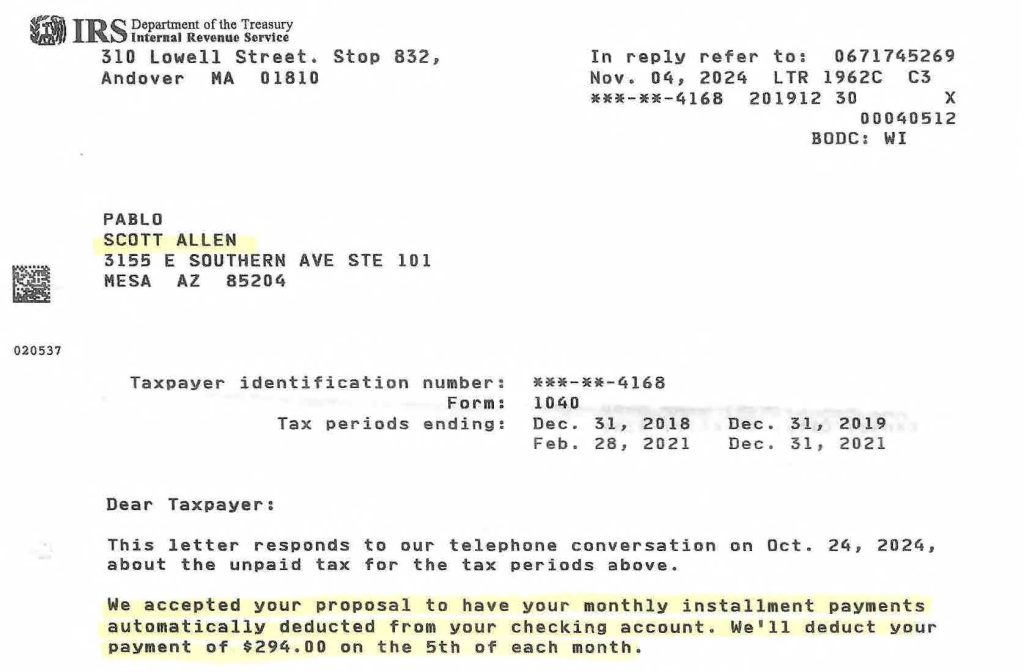

See what Scott Allen E.A. did for his client Pablo. Pablo needed to get his back tax returns settled into one nice low monthly payment plan and that is exactly was was negotiated for him. All four years of his back taxes owed were settled into a $294 per month installment arrangement. This is just one of thousands of examples of the follow thru service Scott Allen of Tax Debt Advisors, Inc can offer you.