Navigating Back Tax Returns in Queen Creek, AZ

Navigating Back Tax Returns in Queen Creek, AZ: How TaxDebtAdvisors.com Can Be Your Ally Before the IRS

In the picturesque town of Queen Creek, Arizona, nestled amid the stunning Sonoran Desert landscape, taxpayers have always taken pride in their strong sense of community. However, like any other place, Queen Creek residents may encounter financial challenges, leading some to fall behind on their tax obligations. Whether due to unforeseen circumstances or complex financial situations, filing back tax returns can be a daunting task for many individuals. Thankfully, the knowledgeable and dedicated team at TaxDebtAdvisors.com is ready to assist Queen Creek taxpayers in navigating this process and representing them before the Internal Revenue Service (IRS).

Understanding Back Tax Returns in Queen Creek, AZ:

Filing tax returns is an essential responsibility for every taxpayer in the United States. Unfortunately, life’s unpredictability sometimes leads individuals to overlook this obligation, inadvertently accumulating back taxes. As taxpayers in Queen Creek, AZ, grapple with this predicament, the consequences of unpaid taxes can loom heavily over their heads.

When taxpayers neglect to file their returns on time or accurately report their income, they might face penalties, interest charges, and even IRS audits. Moreover, unresolved tax debt can lead to wage garnishments, bank levies, and property liens, further compounding the financial strain on Queen Creek residents.

Enter TaxDebtAdvisors.com:

In times of distress, seeking expert advice and assistance becomes crucial, and this is where TaxDebtAdvisors.com shines as a reliable solution for Queen Creek taxpayers. As a local family owned and operated business since 1977, they are well-equipped to handle even the most complex tax situations.

- Expert Guidance:

The tax code is a labyrinth of rules and regulations, often confusing for the average taxpayer. TaxDebtAdvisors.com boasts a team of tax experts well-versed in the intricacies of tax law. They understand the nuances of the tax system and keep abreast of any changes in IRS policies. Armed with this knowledge, they can provide tailored guidance to Queen Creek taxpayers to help them navigate the process of filing back tax returns with ease.

- Thorough Assessment:

Every taxpayer’s situation is unique, and a one-size-fits-all approach simply won’t suffice. TaxDebtAdvisors.com conducts a thorough assessment of each client’s financial circumstances, including income, assets, and outstanding tax liabilities. This meticulous examination enables them to devise a personalized strategy to resolve back tax return issues effectively.

- Negotiating with the IRS:

Facing the intimidating IRS alone can be a daunting prospect. TaxDebtAdvisors.com acts as a buffer between Queen Creek taxpayers and the IRS, handling all communication and negotiations on their clients’ behalf. Their expertise in dealing with the IRS ensures that taxpayers’ rights are protected while exploring options for resolving back taxes in a manner that suits their financial situation.

- Minimizing Penalties and Interest:

Accrued penalties and interest on back taxes can quickly snowball into an overwhelming burden. TaxDebtAdvisors.com diligently works to minimize these additional costs, helping Queen Creek taxpayers find relief and a feasible path towards resolving their tax debt.

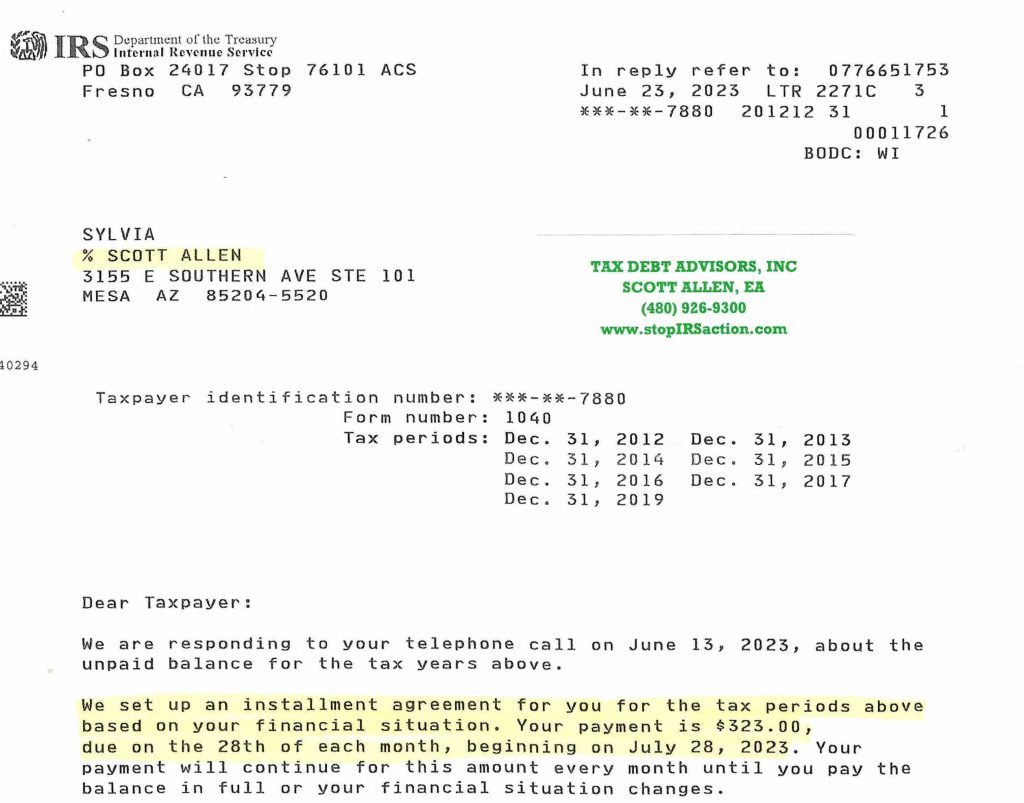

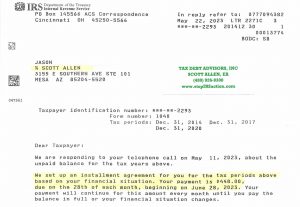

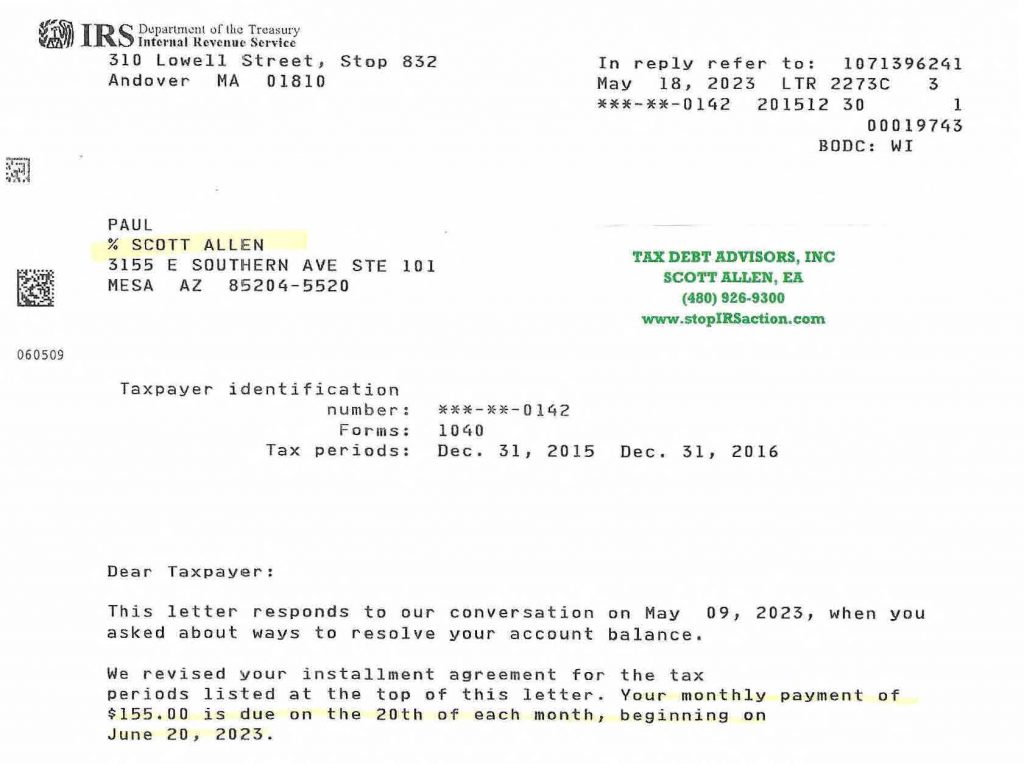

- Setting Up Payment Plans:

For taxpayers facing financial constraints, TaxDebtAdvisors.com assists in setting up manageable payment plans with the IRS. These plans allow individuals to pay off their back taxes in affordable installments, reducing the strain on their finances and paving the way to a debt-free future.

Taxpayers struggling with back tax returns in Queen Creek, AZ need not face the IRS alone. TaxDebtAdvisors.com offers a guiding light in these challenging times, providing expert assistance to navigate the complexities of tax debt resolution. By offering personalized solutions, minimizing penalties, and negotiating on behalf of their clients, TaxDebtAdvisors.com aims to help Queen Creek residents regain their financial footing and find peace of mind. So, if you find yourself facing back tax challenges, don’t hesitate to seek the support of TaxDebtAdvisors.com, your trusted ally near Queen Creek, AZ. If you need a tax organizer/checklist to help you organize you information feel free to go ahead and get started.

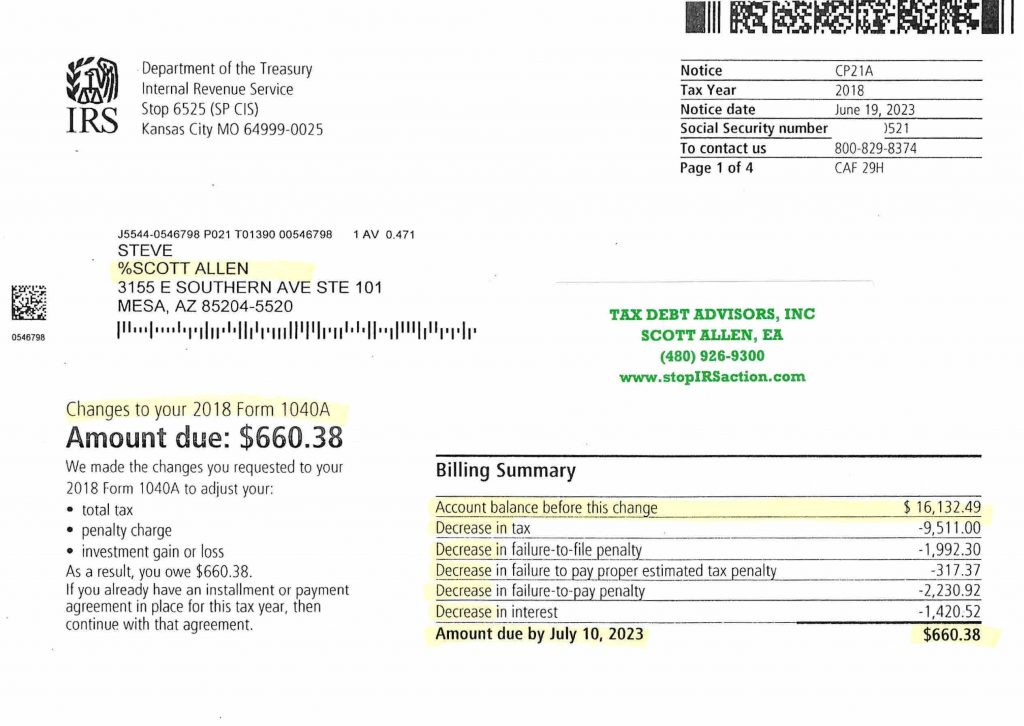

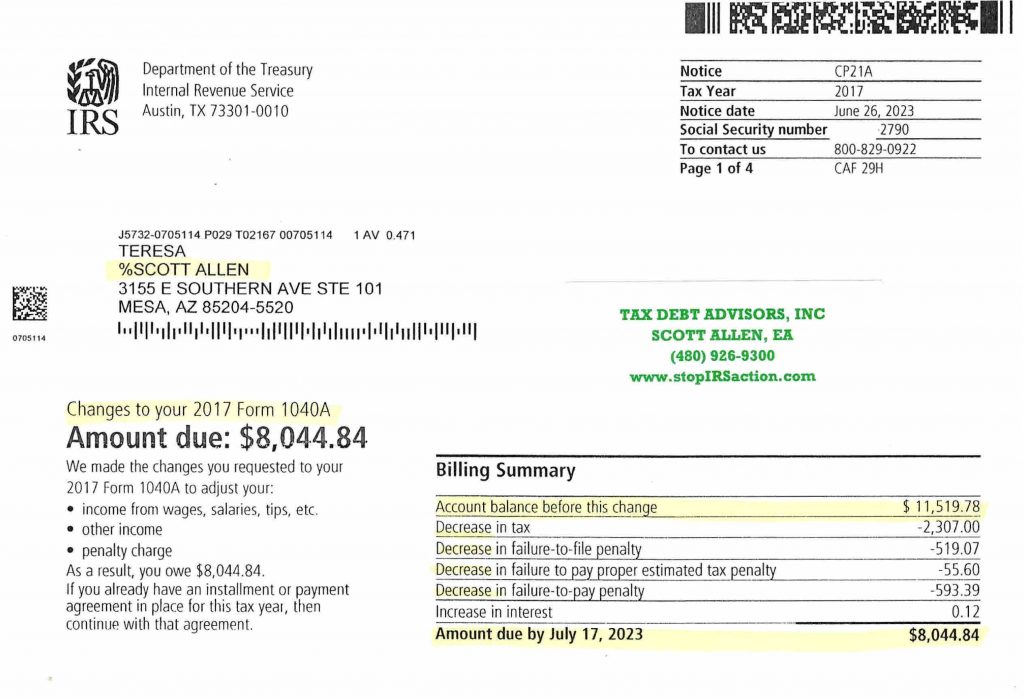

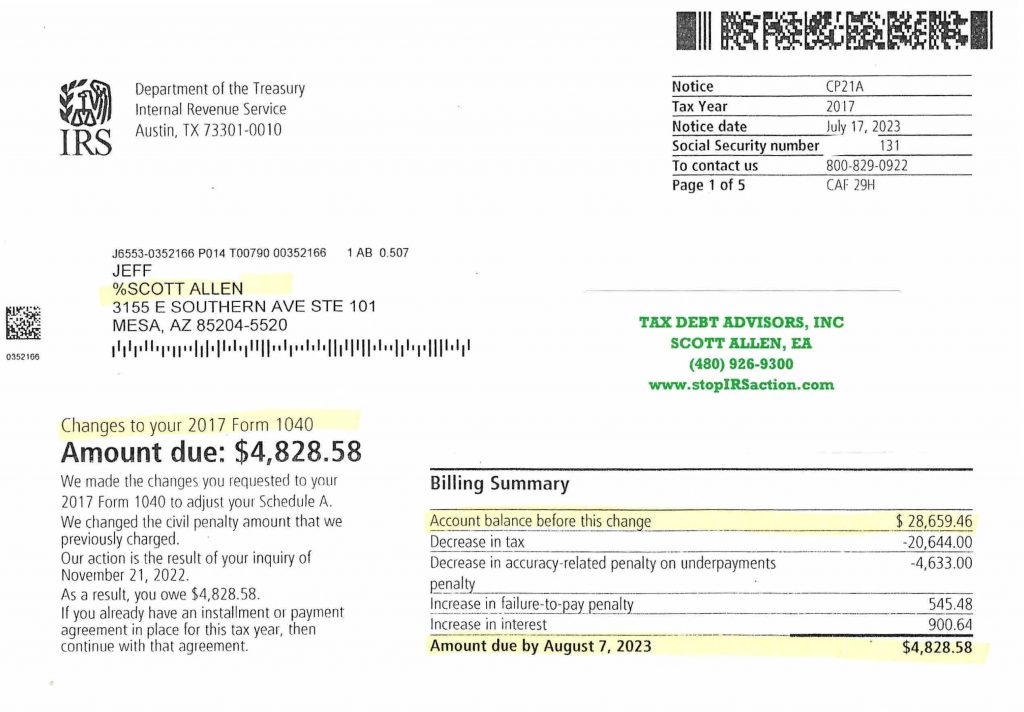

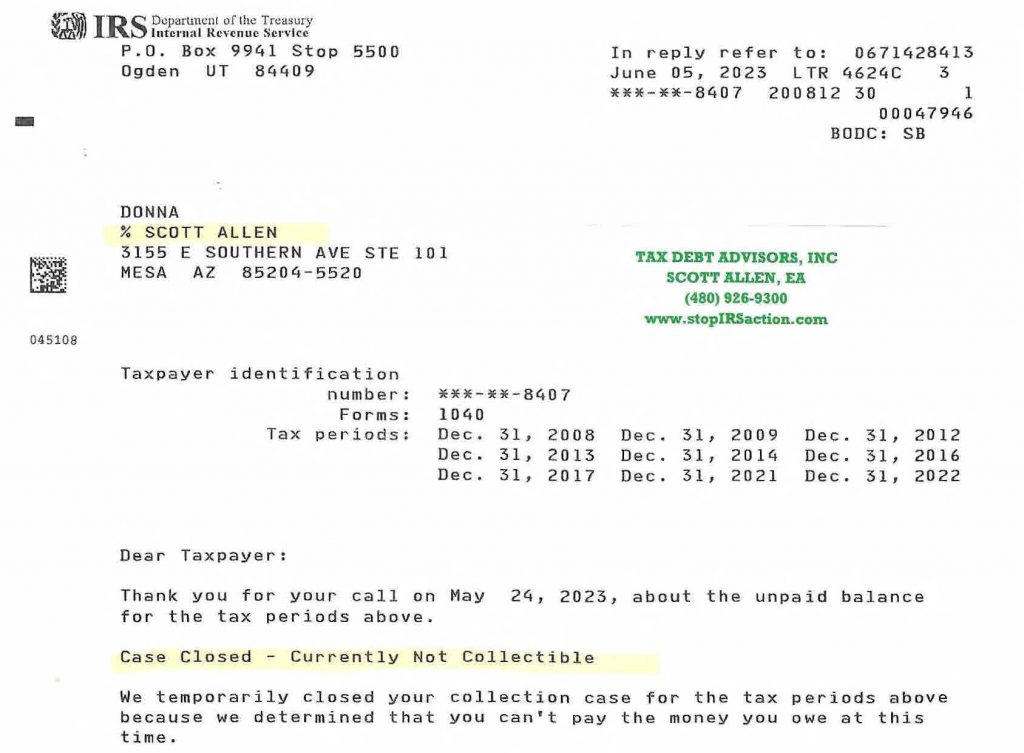

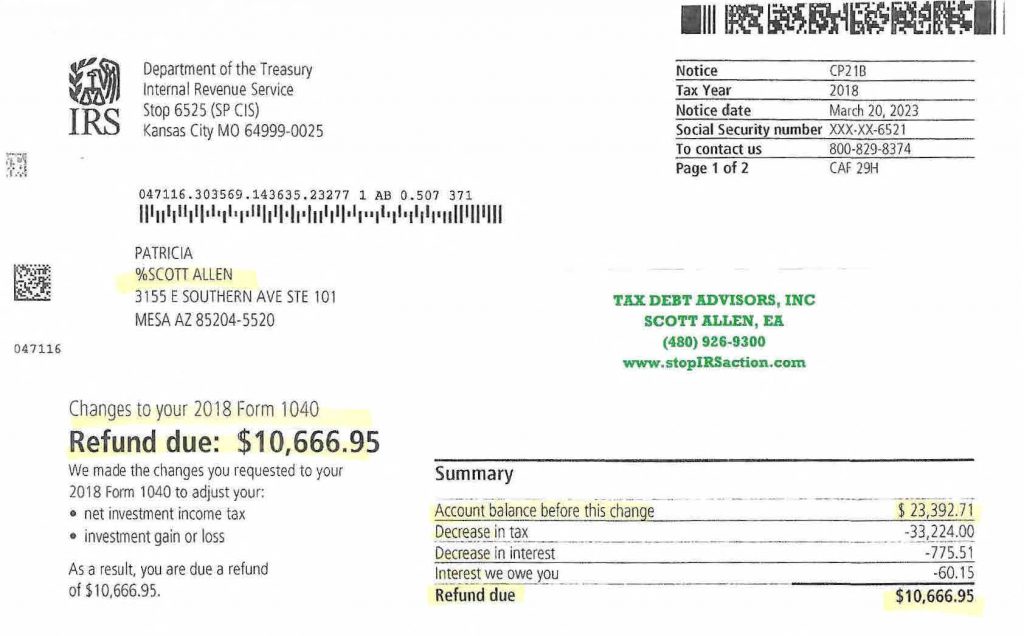

Check out the IRS letter below on how Scott Allen, EA with TaxDebtAdvisors.com helped Steve in Queen Creek, AZ with his back tax return filings. With Scott Allen, EA’s representation he reduced his tax bill by about $15,000. This is just one example of 1000’s of successful cases they have handeled.