IRS Tax Attorney in Arizona: When should I NOT use an attorney?

If you are searching for “tax attorney“, “tax lawyer“, “IRS tax lawyer“, “IRS attorney“, “tax attorneys“, “IRS tax attorney“, “tax attorney near me” or “best tax attorney” in Phoenix, Mesa, Chandler, Gilbert, Tempe or Scottsdale, Arizona, Scott Allen E. A. from Tax Debt Advisors can help!

Even the best tax lawyers & attorneys can’t compare to what Scott Allen E. A. can offer to help settle your problems with the IRS. First of all, lets take a look at what a tax attorney does.

What Is A Tax Attorney?

A tax attorney is a layer who specializes in tax law. They can help solve legal, technical and complex problems with the IRS.

What Does A Tax Attorney Do?

A tax attorney solves legal, technical and complex problems with the IRS. Tax attorneys can also help with:

- Filing appeals of tax court decisions

- Communication with the IRS

- Help businesses save money

- Help people take advantage of tax credits

However, these are all things a tax debt advisor could do for less money! Read more about why you need a tax debt advisor instead of hiring a tax attorney.

Can A Tax Attorney Really Help?

Yes, a tax attorney can really help if you want to pay more money for the same services a tax debt advisor can do for cheaper.

Why You Should I Tax Debt Advisor Vs. Hiring a Tax Attorney?

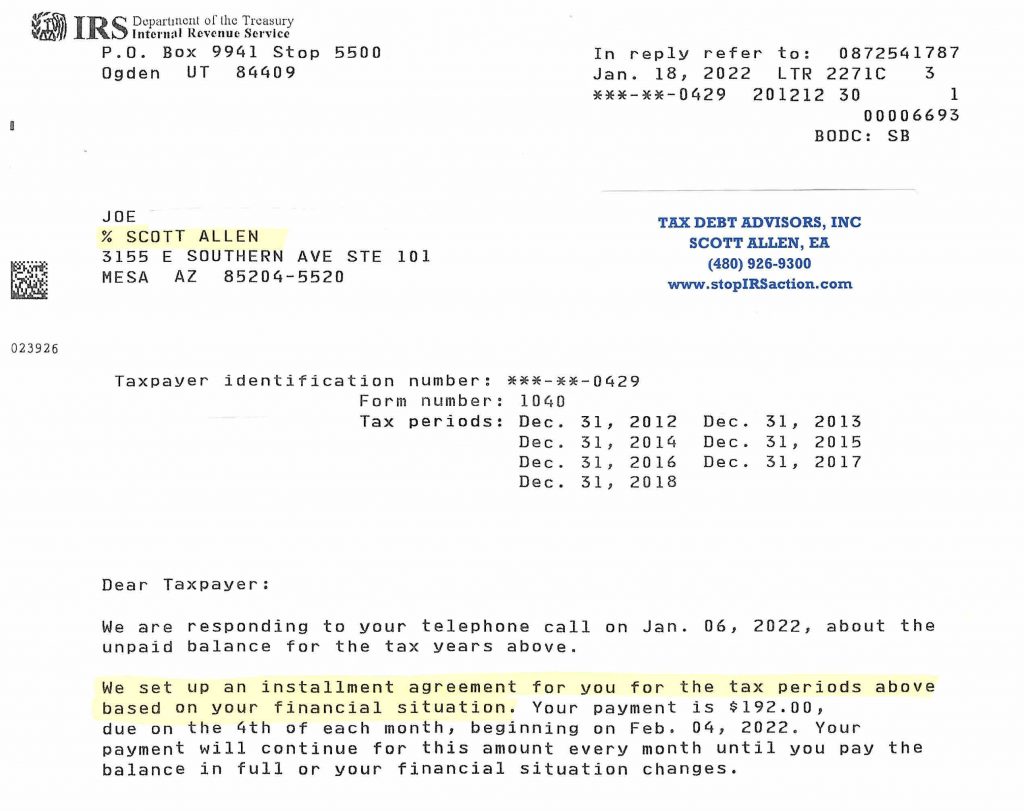

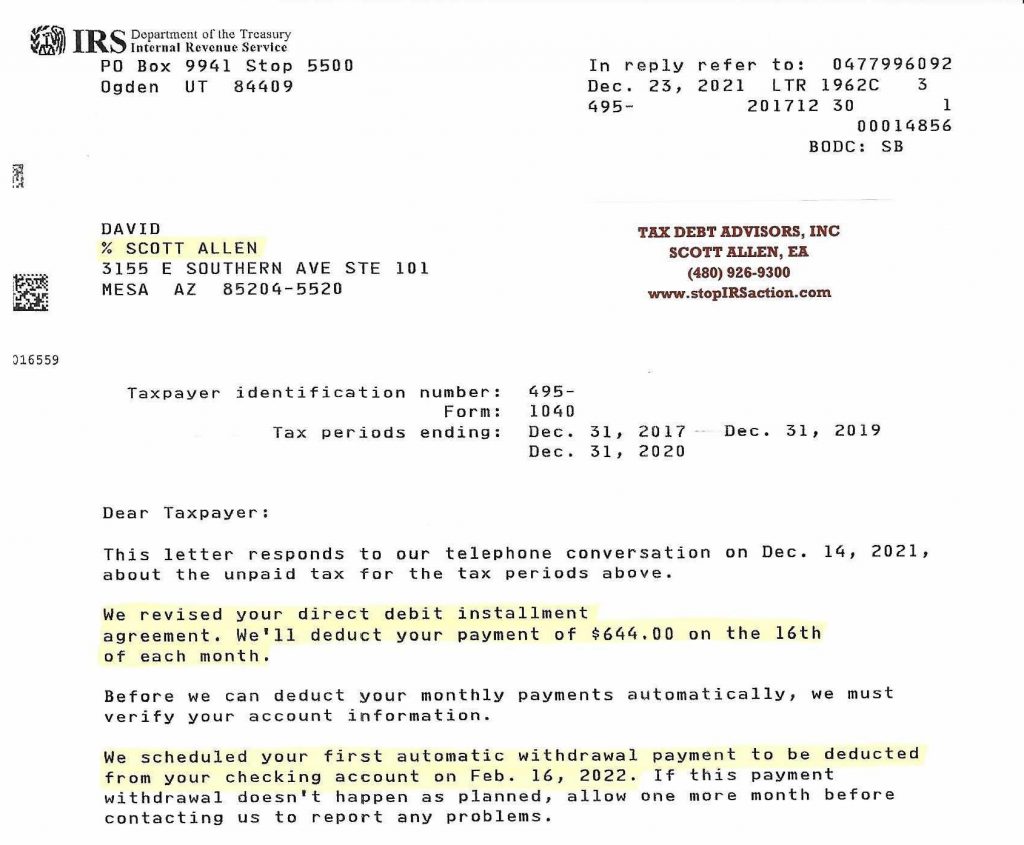

Tax Debt Advisors have great experience in settling debts with the IRS. Choosing a tax debt advisor instead of a tax attorney offers many benefits including:

- More affordable services

- Tax attorney typically charge 100-400% more for the same services a tax debt advisor could do

- Tax debt advisors don’t use fear tactics to make you think the situation is worse than it is

- Settle debt faster with simple tax debt solutions

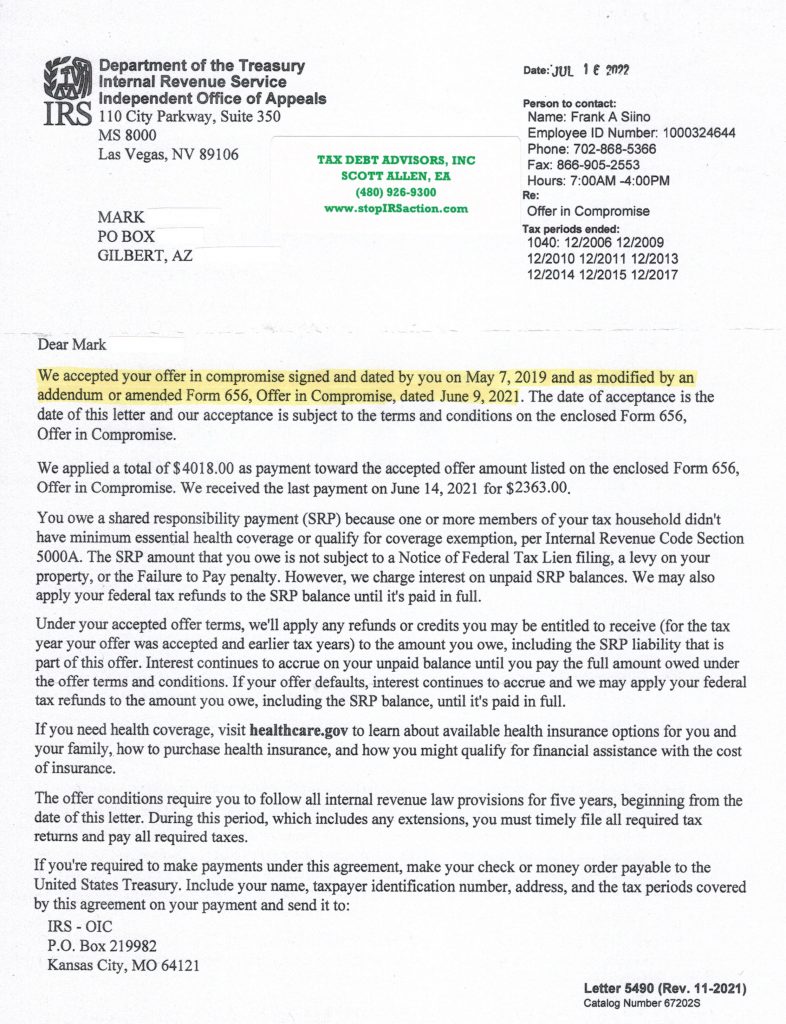

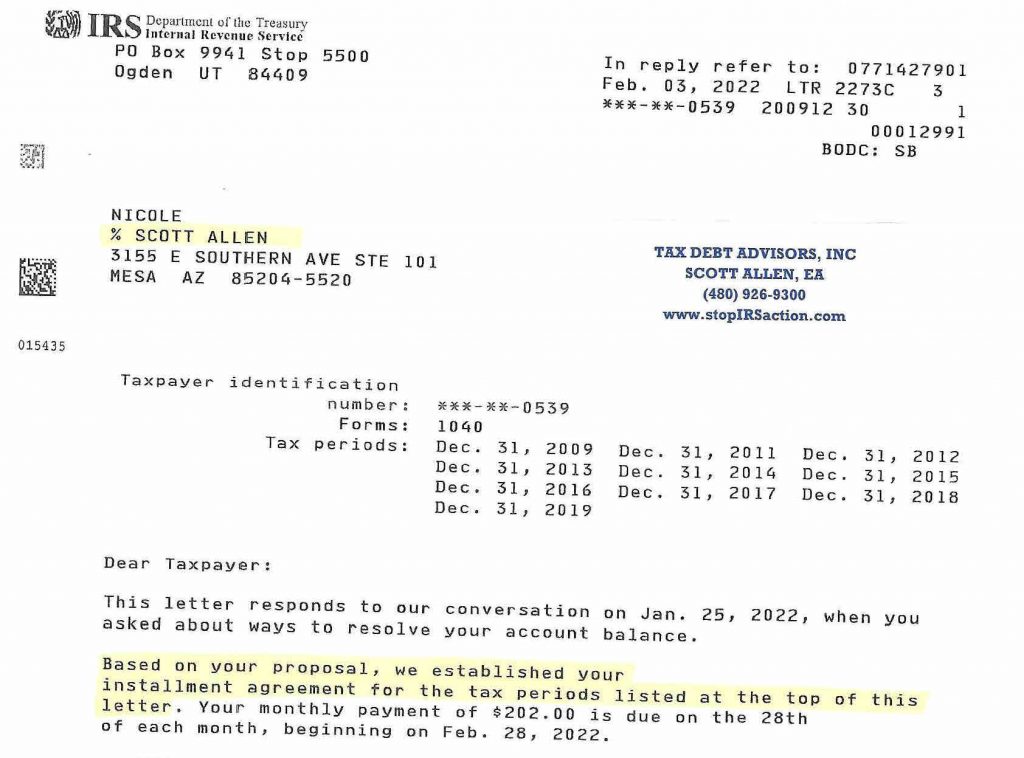

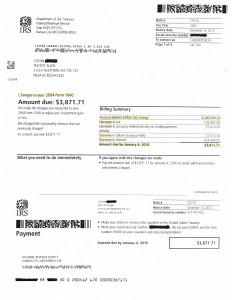

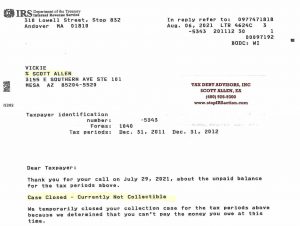

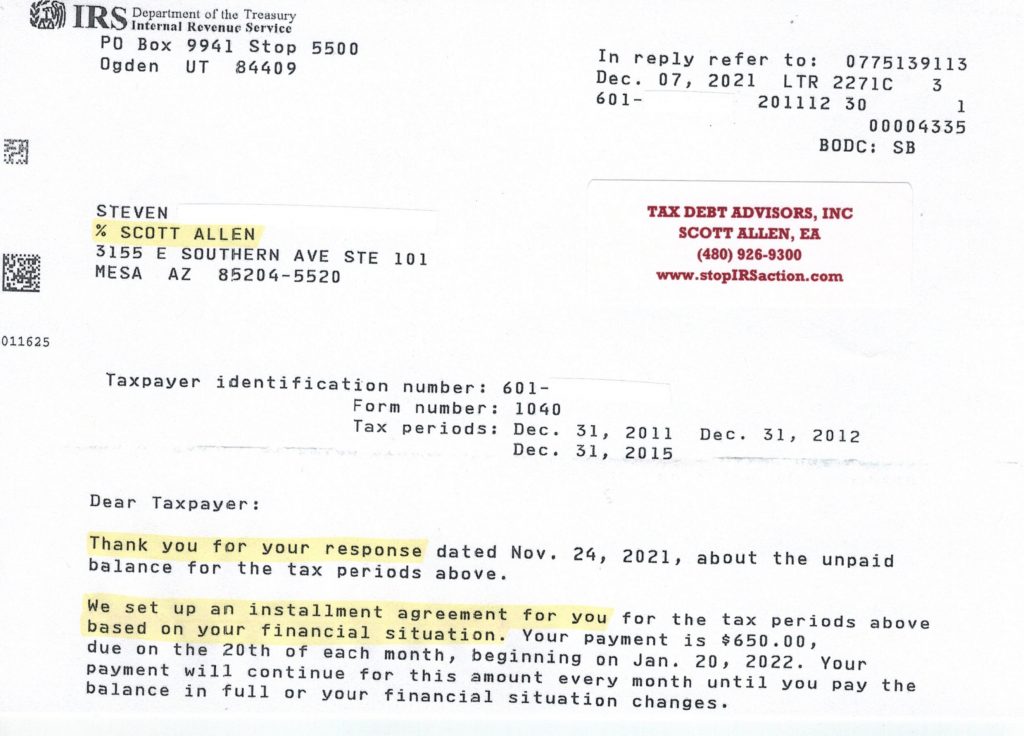

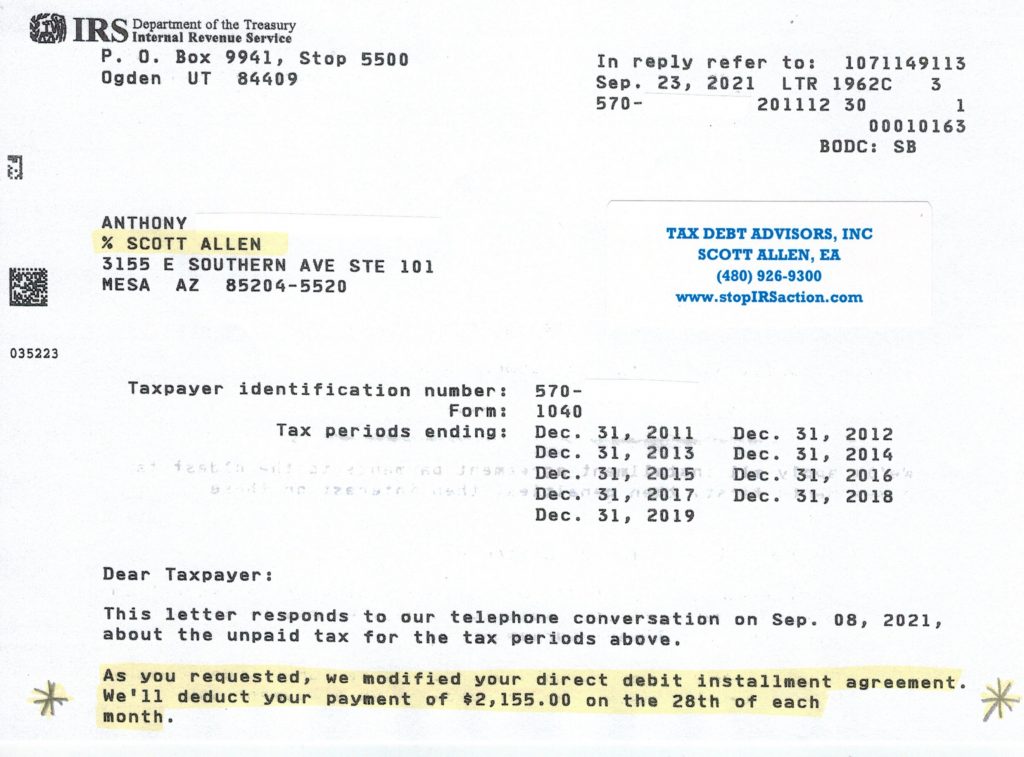

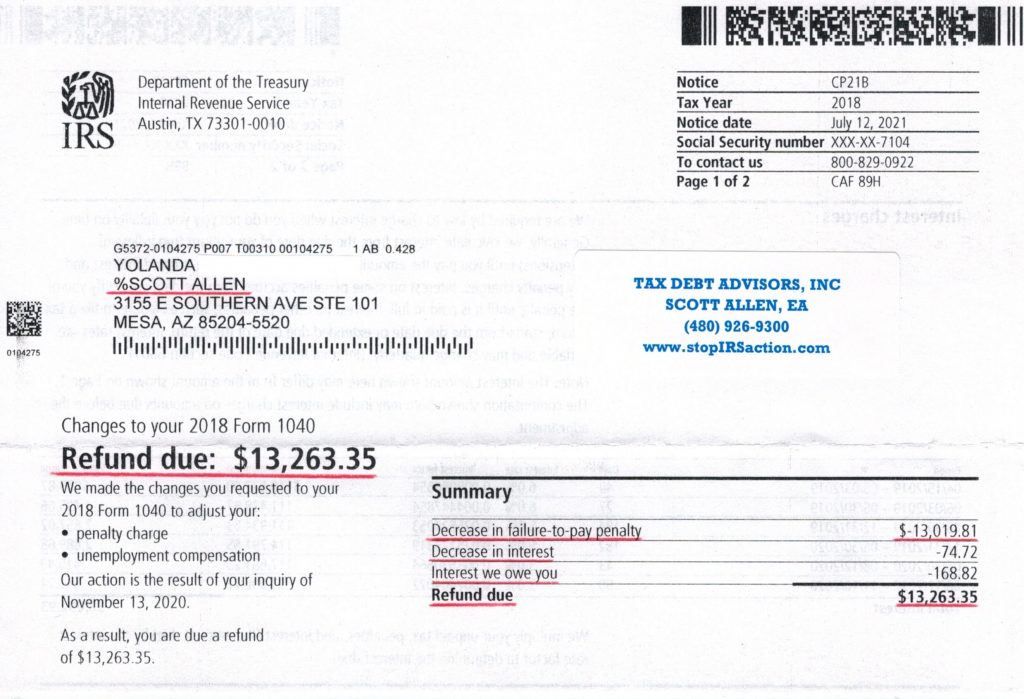

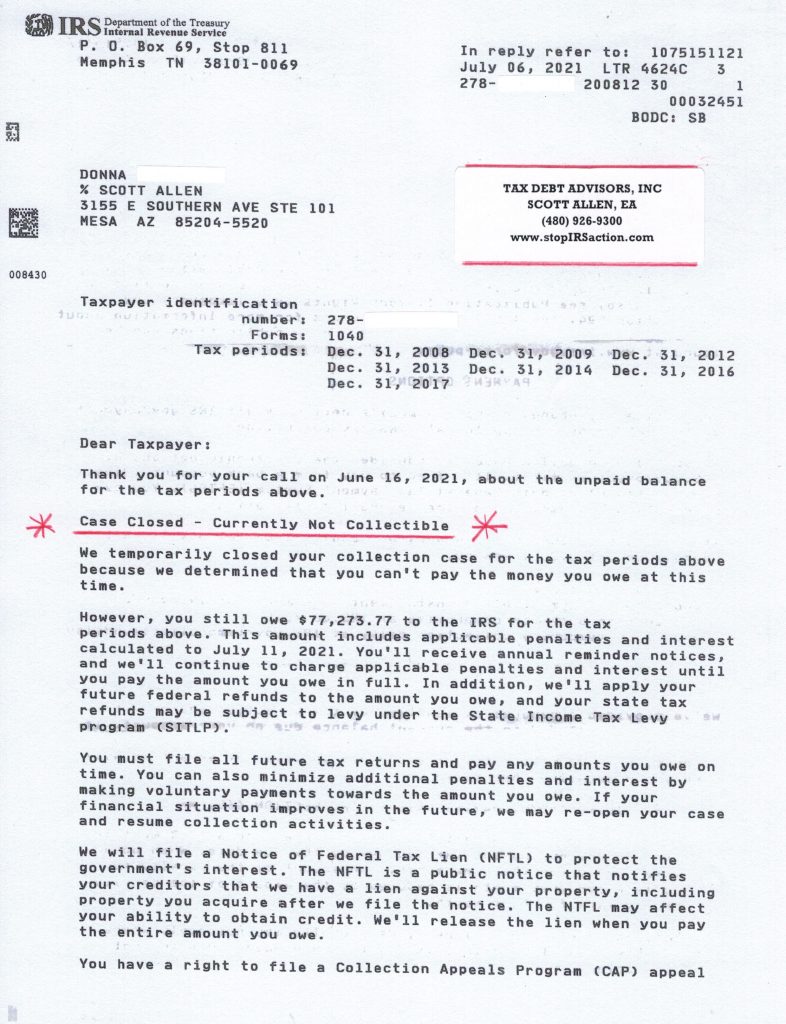

We are not a tax attorney firm, rather, a tax debt specialist with expert knowledge in tax law that can help you solve complicated IRS problems & tax debt issues that would normally require a tax lawyer. Contact Scott Allen with Tax Debt Advisors, Inc. 480-926-9300 to help you get right with the IRS today! Don’t hire a tax attorney! Instead, why not hire an affordable Tax Debt Advisor who has been helping customers dealing with tax issues since 1977, and has helped solve over 113,000 tax debts.

Why Hire A Tax Attorney In Arizona?

Believe it or not, you actually don’t have to hire a tax attorney in Arizona when dealing with the IRS. Instead why not hire a Tax Debt Advisor who can do the same thing as a tax lawyer and who has been helping customers dealing with tax issues since 1977. His father and Scott Allen E.A. from Tax Debt Advisors has helped over 113,000 people settle their problems with the IRS and can help guide you through any tax situation you may be dealing with, including:

Why You Don’t Need A Tax Attorney

Here are the reasons of why you don’t need a tax attorney:

- If you are making a decision full of fear and think you need a tax attorney for other than criminal or fraudulently filed returns, you will be seriously disappointed. Attorneys are able to generate income by perpetuating fear. Most of our clients who started with an attorney and switched to us mentioned always being intimidated with fear that something bad would happen if… and that if always is followed by another big retainer fee.

- IRS resolution work is not rocket science. It is common sense work that improves over time because of relationships established with the IRS and understanding their idiosyncrasies. Attorneys will often scare clients into thinking that their legal training is necessary for a successful resolution.

- Many clients think that they will get what they pay for and base the quality of the work on the amount they pay. In most cases, an attorney will charge anywhere from 25% to over 400% more for the same exact service. If you go for a consultation with an attorney consider getting a second opinion by calling me for a free initial consultation. I love these appointments.

When To Hire A Tax Attorney?

A Tax debt advisor can help with almost everything a tax attorney can except criminal charges. If the IRS is pursuing criminal charges against you, you will need to hire a tax attorney. Tax fraud and tax evasion are 2 of the most common reasons for an IRS investigation. IRS investigations are serious: 80% of defendants that go through a criminal investigation are sentenced to prison. This is one situation where a tax debt advisor cannot help you, you will have to hire a tax attorney.

Why You Should Hire An Enrolled Agent Vs. Hiring A Tax Attorney

View our recent blog post “When is an IRS tax attorney in Phoenix necessary and when isn’t it?“

1. Your tax problems might not be that bad – It doesn’t take a tax lawyer or rocket scientist to work with the IRS. Furthermore, legal training isn’t a necessity to handle most tax issues. Also, tax attorney’s will try to scare you into thinking that legal representation is necessary. That is not true! Let Tax Debt Advisors help solve your tax problems without instilling fear or requesting huge retainer fees for our services.

2. Get a 2nd Opinion – Some tax customers think that paying a higher fee will give them a higher quality services. That is false! Tax attorney commonly charge 400% more for the same services a tax debt expert can handle. There is literally no difference in the process besides you paying more money. We are not saying it is a bad idea to talk to a tax attorney but you should get a second opinion as well. At Tax Debt Advisors we offer free tax consultations.

3. Don’t Make A Decision Based On Fear – Do you think you need a tax attorney because you filed fraudulent tax returns, you might be disappointed. Tax lawyers generate income based off of fear. Most of our tax clients started with a tax attorney, only to find out that they try to intimidate you into thinking you have a bigger tax problem than you do. And, that’s almost always followed by a big retainer fee.

Feel Confident With Experienced Tax Representation

When I have looked back over the years, the one common factor in bad decision making on my part, is when I was overly influence due to fear. I love the quote from one of the Star Wars movies that explains how Anakin became the evil Darth Vader—the quote, “It was fear that pushed me to the dark side.” If you have already had a consultation with an attorney ask yourself one question, “Did he reduce my level of fear or just use it to get what he or she wanted?” A good representative will always leave you feeling better, not fearful. A great representative will focus on the 99% that can go right and the wrong ones will focus on the 1% that almost never happens. When you are trying to decide if you need representation from an attorney consider taking the time to get a second opinion from me. I know you will be glad you did!

Schedule A Free Tax Consultation In Arizona

Schedule your free tax consultation with Tax Debt Advisors today by giving us a call today at 480-926-9300.

5 Star Review: “Scott is professional and real. He looks out for me and is so thorough. He waived an IRS penalty for me that a different accountant said couldn’t be waived. And it was so simple. He is so kind and really works with you. I now have multiple family members who use him and each of us all love him!” Rebecca O.

5 Star Review: “Scott did an outstanding job helping my parents on their back due taxes. When I met him he was very professional and knowledgeable about how to approach the problem. Our issue took 9 months to resolve because of problems with how our taxes were filed (not his fault), but he stayed engaged and helpful the whole time even though we were very small clients for him. My parents don’t have to pay anything back to the IRS. It just amazing, it was a burden and now it’s such a relieve, such peace of mind. My dad comments that now he can sleep better without thinking about it. Thank you Scott!” Pilar L.

Our Service area includes: Mesa, Apache Junction, Avondale, Buckeye, Carefree, Cave Creek, Chandler, El Mirage, Fountain Hills, Gila Bend, Gilbert, Glendale, Goodyear, Komatke, Litchfield Park, Luke AFB, Paradise Valley, Peoria, Phoenix, Queen Creek, Scottsdale, Sun City, Sun Lakes, Surprise, Tempe, Tolleson, Waddell, Whitman, Wickenburg, Youngstown, Flagstaff, Tucson, Payson, Winslow, Sierra Vista, Page, Prescott, Globe, Yuma, Arizona.