Now is the time to Stop IRS levy Phoenix AZ

Stop IRS Levy Phoenix AZ now!

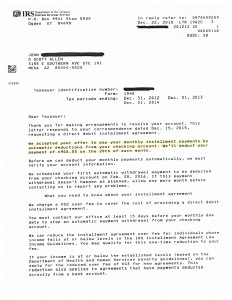

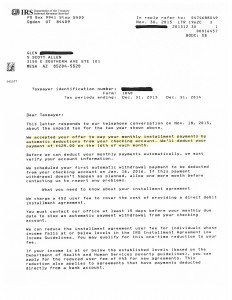

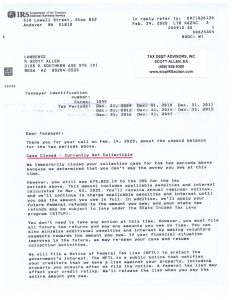

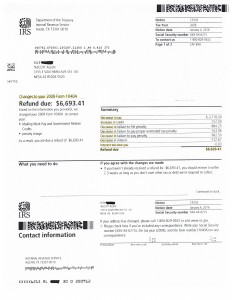

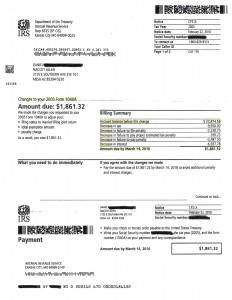

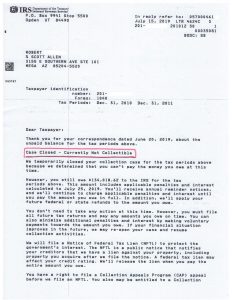

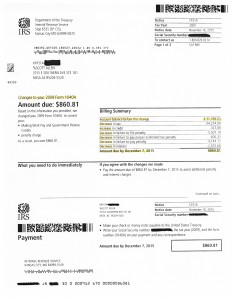

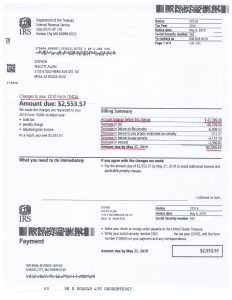

If you have to file back taxes to stop IRS levy Phoenix AZ now is the time to get started. Don’t procrastinate and allow the problem to get worse. John was able to use the services of Scott Allen EA and got rid of his IRS nightmare. To see his successful settlement view the IRS document below.

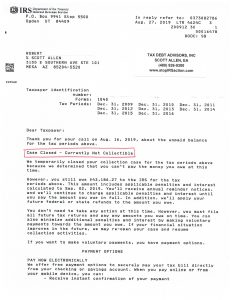

Can an IRS levy be stopped? The answer is yes. If you have received that notice to either levy your wages or the intent to levy your wages give Scott Allen EA a call. He will assist you in getting you in full compliance with the IRS and your taxes. As your IRS power of attorney he will be your individual representative before them. Any and all communication will go through Scott. With him you may never have to speak or contact the IRS yourself. It is important to hire the right local representation that knows the proper procedures to get you in compliance and either stop IRS levy Phoenix AZ or better yet prevent it from ever happening. Most IRS levy notices can be stopped within 24-48 hours. Don’t let your next paycheck go to the IRS.

What does compliance mean? Compliance means all your back tax returns have been filed and you are having the right amount of taxes withheld from your pay or making proper estimated tax payments if you are self employed.

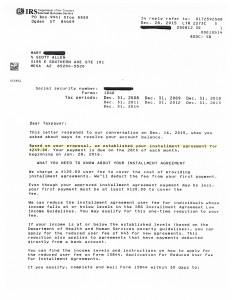

Scott Allen EA of Tax Debt Advisors will guide you through the entire process from stopping and preventing and levy notices, filing your back tax returns, and negotiation an aggressive settlement with the IRS. Call him today to schedule a free initial consultation. His office is located in Mesa Arizona and is a family owned and operated company since 1977.

Thank you.

Stop IRS Levy Phoenix AZ in 2020

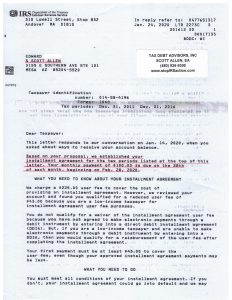

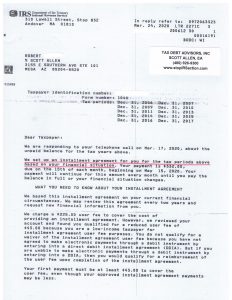

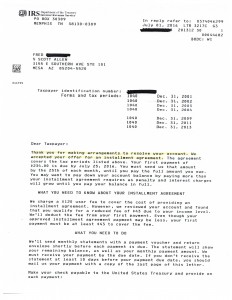

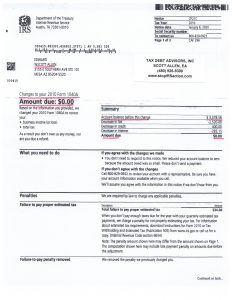

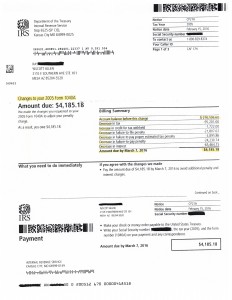

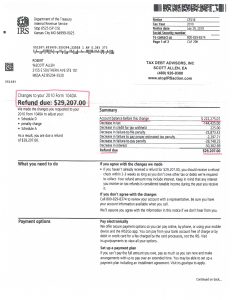

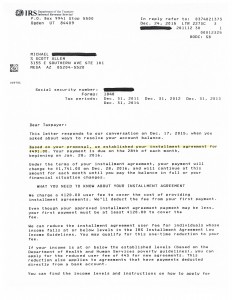

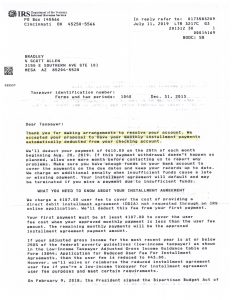

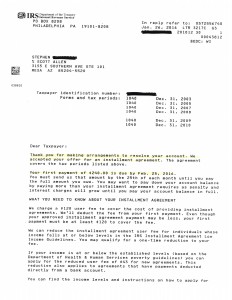

A clean cut way to stop IRS Levy Phoenix AZ is to negotiate a payment plan. Edward was behind on his tax preparations so once we completed those we set him up for an easy $100 per month payment plan. Check out the notice below.

Be careful of “out of state” companies selling you on false hope. Be told the truth by talking with Scott Allen EA today.