Mesa AZ IRS tax attorney or not?

Do I need a Mesa AZ IRS tax attorney for my IRS problem?

Scott Allen EA gets asked this question quite often. My taxpayers feel their situation requires a Mesa AZ IRS tax attorney or that the only person that can assist them is an attorney. While an attorney can assist with a taxpayers problem its not the only course of action. It is important to remember, 98% of IRS problems are not of a criminal nature; they are a delinquent nature. Scott Allen EA is not an attorney but rather an Enrolled Agent (EA) who is licensed specifically to prepare tax returns and to represent taxpayers before the IRS in matters of collections and audits. He does not branch off into other aspects of taxation but focuses 100% of his practice on IRS problems. Scott Allen EA can do anything an attorney can do when it comes to those areas. Below we have provided to you a recent success of his work for a client before the IRS.

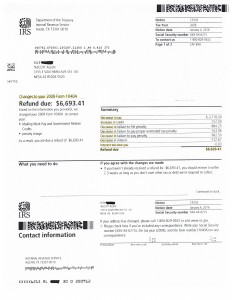

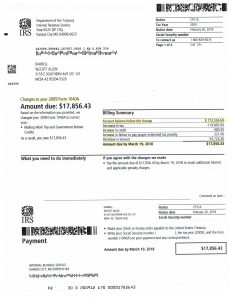

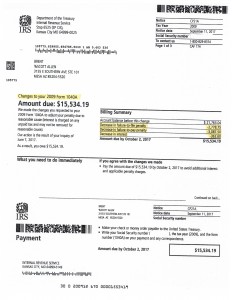

One of his clients came in with a couple unfiled tax returns and the IRS garnishing his retirement income (yes, the IRS can garnish your retirement or social security income). They were taking his money and applying it to a tax debt on his 2009 tax return that he had never filed. Actually, the IRS filed it for him giving him no room for expenses or deductions. As you can see they took over $6,000 of his income to a debt that should never have been there in the first place. What did Scott Allen EA do? To sum it up he was able to get an IRS power of attorney authorization to represent him, contact the IRS to “gather up the facts”, prepare and file his missing returns, and get a stop to the garnishment. Lastly, he was able to get the IRS to refund the money back to him within a reasonable period of time.

This may have been a case someone might think a Mesa AZ IRS tax attorney is required but as you can see it was not. Scott Allen EA was able to aggressively represent his client in the best possible manner. This client will be continuing to use his services on a yearly tax preparation basis. Let Scott Allen EA at Tax Debt Advisors be your “one stop shop” in getting you IRS nightmare behind you. He will meet with you for a free initial consultation.

Mesa AZ IRS Tax Attorney 2019

Scott Allen EA is not a Mesa AZ IRS tax attorney but is licensed to do anything an attorney can do pertaining to matters before the IRS. Tax Debt Advisors has been representing taxpayers since 1977. View a recent notice of success from the IRS below.

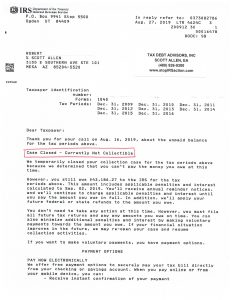

Robert was a struggling taxpayer just surviving to pay his household bills. This got him behind on his tax filings. He recently met with Scott Allen EA to hire him as his IRS power of attorney. Scott, as an Enrolled Agent, successfully released his wage garnishment, prepared his back tax returns and negotiated an aggressive settlement on that debt. Currently non collectible status is where Robert stands with the IRS. This means he does not have to make any payments to the IRS as long as he files and full pays his future tax obligations on time.

If you find yourself in a similar situation or just don’t know where to begin consider meeting with Scott Allen EA of Tax Debt Advisors to discuss your options. He will only take on your case if it is in your best interest.