Top IRS Problem Solvers

Many IRS Problems can be confusing because you don’t always get the most accurate information from the IRS. Furthermore, most people who pay taxes don’t feel comfortable calling the IRS directly for answers. View the IRS problems we specialize in solving below.

Payroll Tax Problems

The IRS can be aggressive with their attempts to collect your past due payroll taxes. You should try to avoid meeting with IRS representatives until you have met with a experienced tax professional first.

Learn More

IRS Liens

Tax liens are records that document your owing of the IRS> These can prevent you from obtaining financing for homes and automobiles. One a IRS lien has been filed, you cannot transfer or sell the property without obtaining a clear title.

Learn More

IRS Levy

The IRS has the power to issue bank levy’s to take money from your checking and savings accounts. Faced with a IRS levy? You must comply or face further IRS problems. Avoid levies and let a professional talk to the IRS for you!

Wage IRS levies can take money from your paycheck that makes it tough to live on. Stop IRS levy now!

Learn More

IRS Audits

You can get audited by the IRS via office, home or in the mail. Usually audits happen because the IRS is missing documents. For example if you claim your children on your tax return as a dependent, the IRS could randomly audit you to verify the children live with you in the home.

IRS audits are serious and should be taken as such as they can often lead to auditing other tax years that weren’t originally listed in the tax letter from the IRS.

Learn More

IRS Seizures

The IRS can seize your assets. They can seize business or personal assets to pay off your tax liabilities. This can occur when certain taxpayers avoid the IRS. IRS seizure is the last attempt to collect past due tax liabilities.

Learn More

Wage Garnishment

The IRS can slap a wage garnishment on your paycheck to collect unpaid taxes. One garnishment takes place, the IRS can keep taking money out of your check until they are paid in full.

Learn More

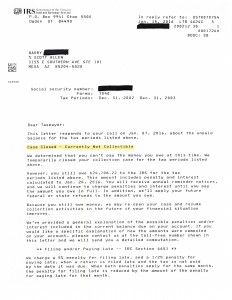

Unfiled Tax Returns

Haven’t paid your taxes in a couple of years? Do you know that is considered a criminal act by the IRS, that can be punishable for up to 1 year in jail for each year your didn’t file taxes.

You can still file those tax returns, no matter how many years it has been. Call a professional like Scott A Allen to guide you through the process.

Learn More

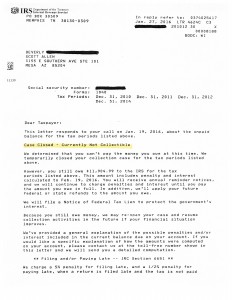

IRS Penalties

IRS penalties such as failure to pay or failure to file can increase the amount of money you own to the IRS quickly.

Before you pay the IRS one single dollar, you might want to think about requestion abatement of your penalties. Call Scott Allen for more information about IRS abatement.

Learn More