Scott Allen EA if you cannot afford your IRS Payment Plan GIlbert

Need to revise your IRS Payment Plan Gilbert?

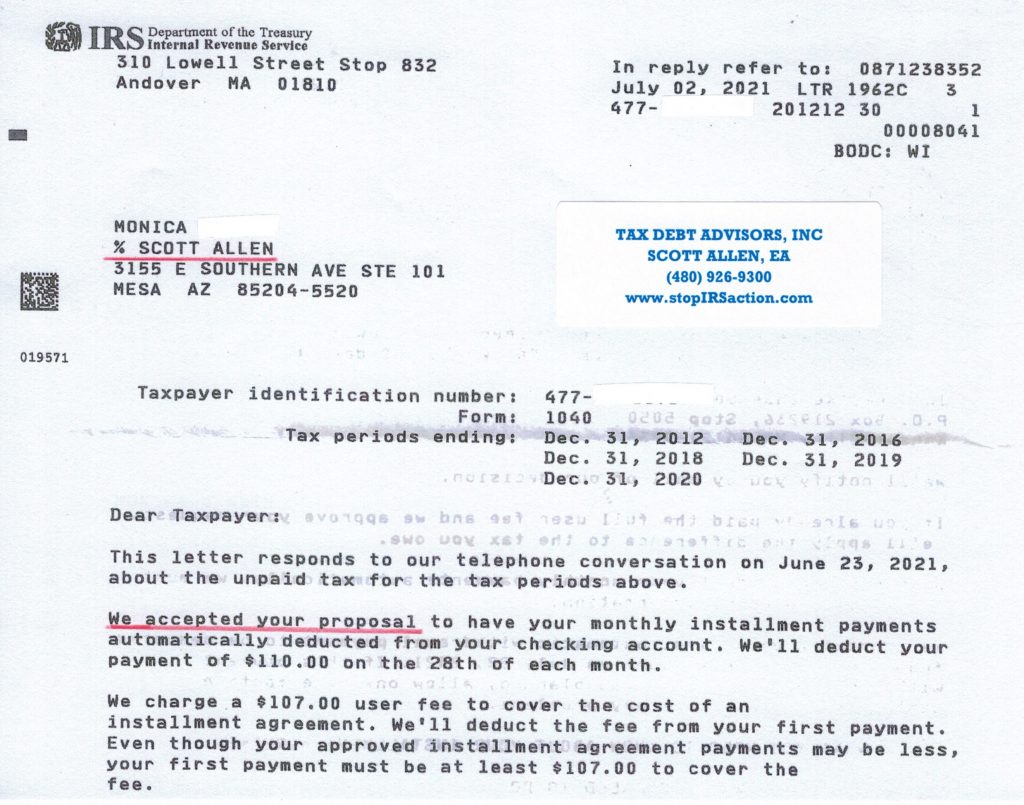

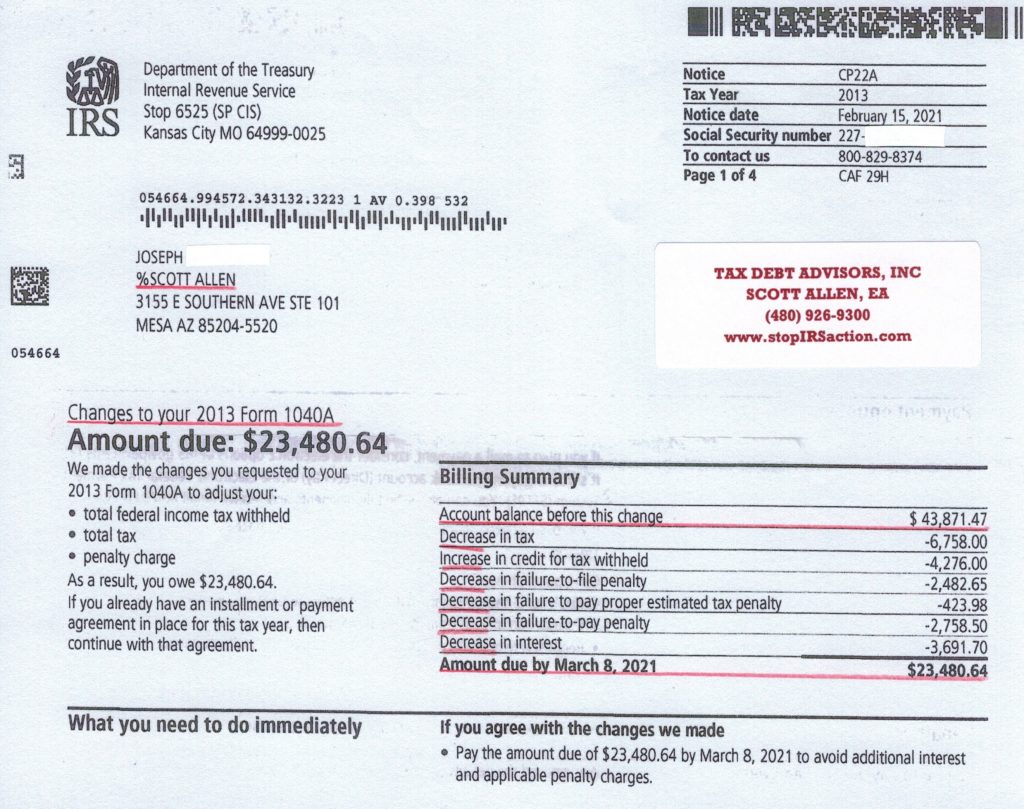

If you have a payment plan with the IRS that you no longer can afford, call Scott Allen EA of Gilbert AZ to see what your options are. If your financial condition has worsened since you entered into your IRS payment plan Gilbert, Scott can renegotiate a lower payment plan. In addition, Scott will verify if you now qualify for an Offer in Compromise or discharge your taxes in a tax motivated bankruptcy.

Scott Allen EA is the owner of a family tax resolution practice near Gilbert AZ that has been in business since 1977. Scott will not take your case unless it is in your best interest. His office is in Mesa, Arizona, not Colorado, California, Texas or any other state. Scott Allen E.A. will give you straight answers to your specific IRS settlement. Call Scott today at 480-926-9300 for a free consultation. He will make today a great day for you!

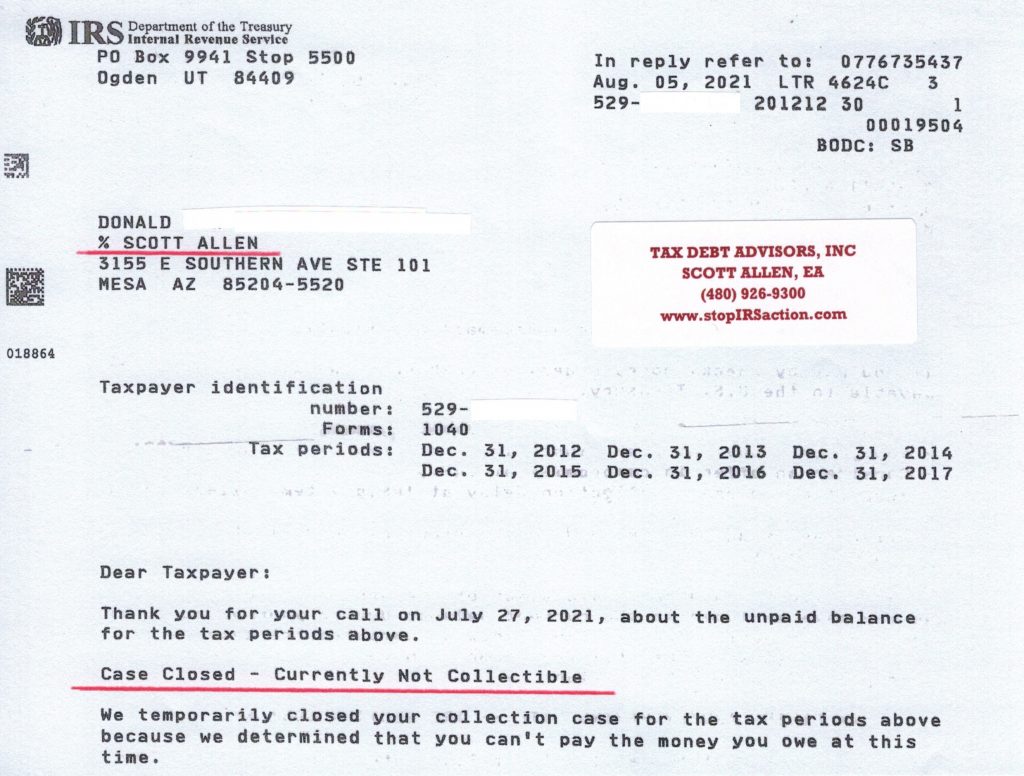

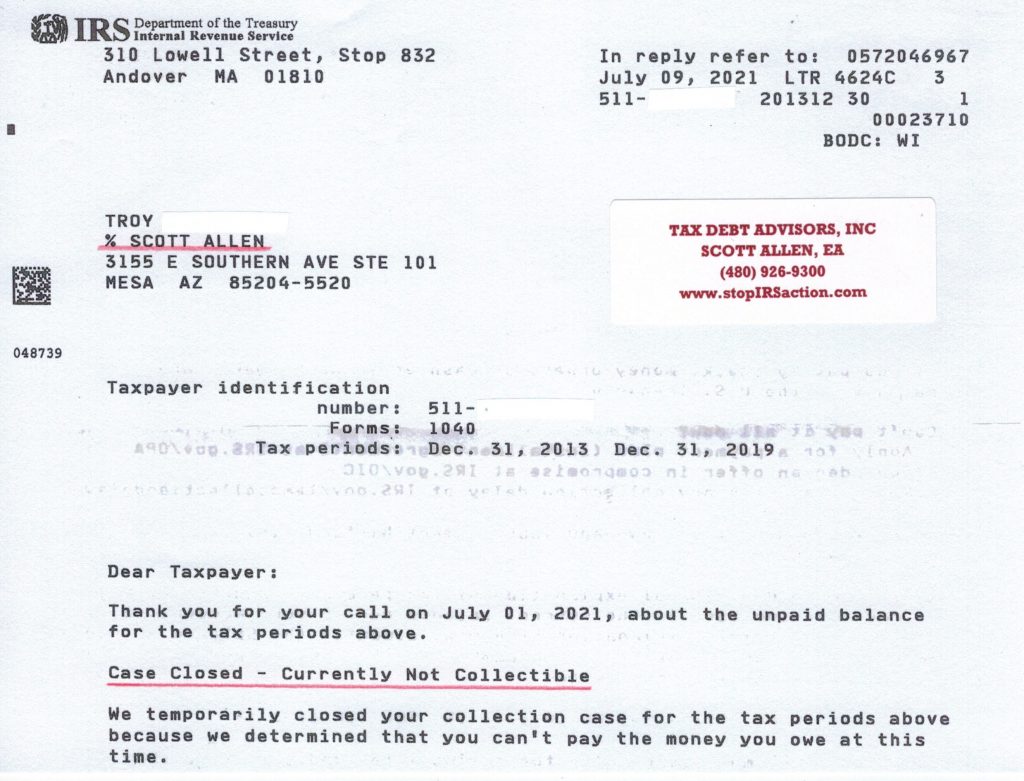

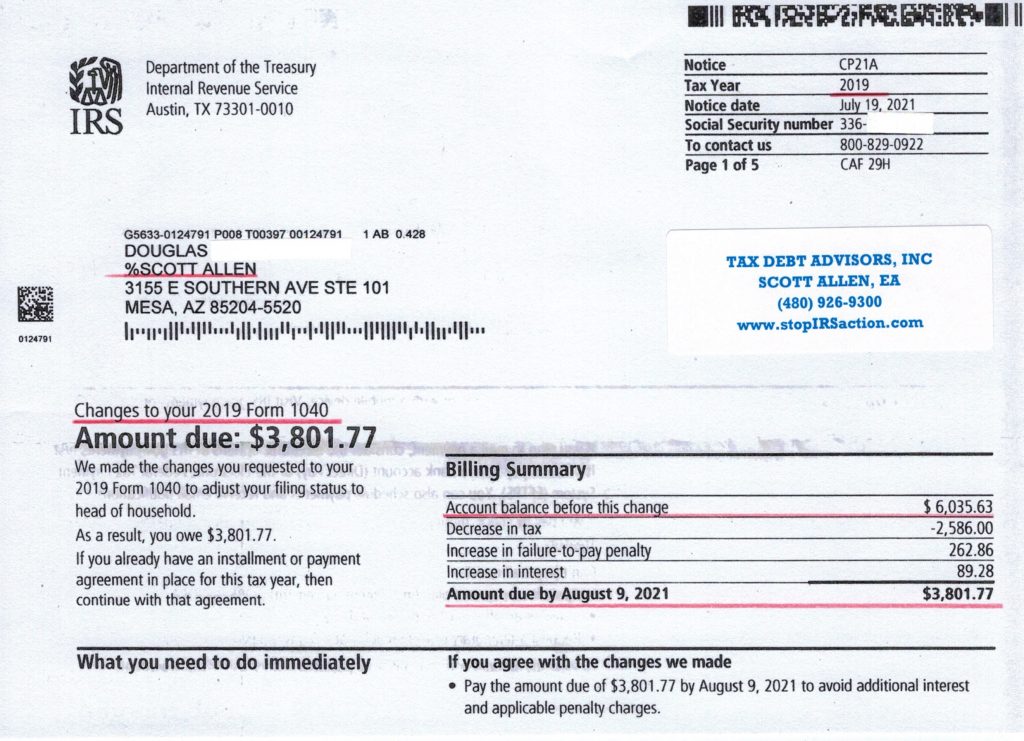

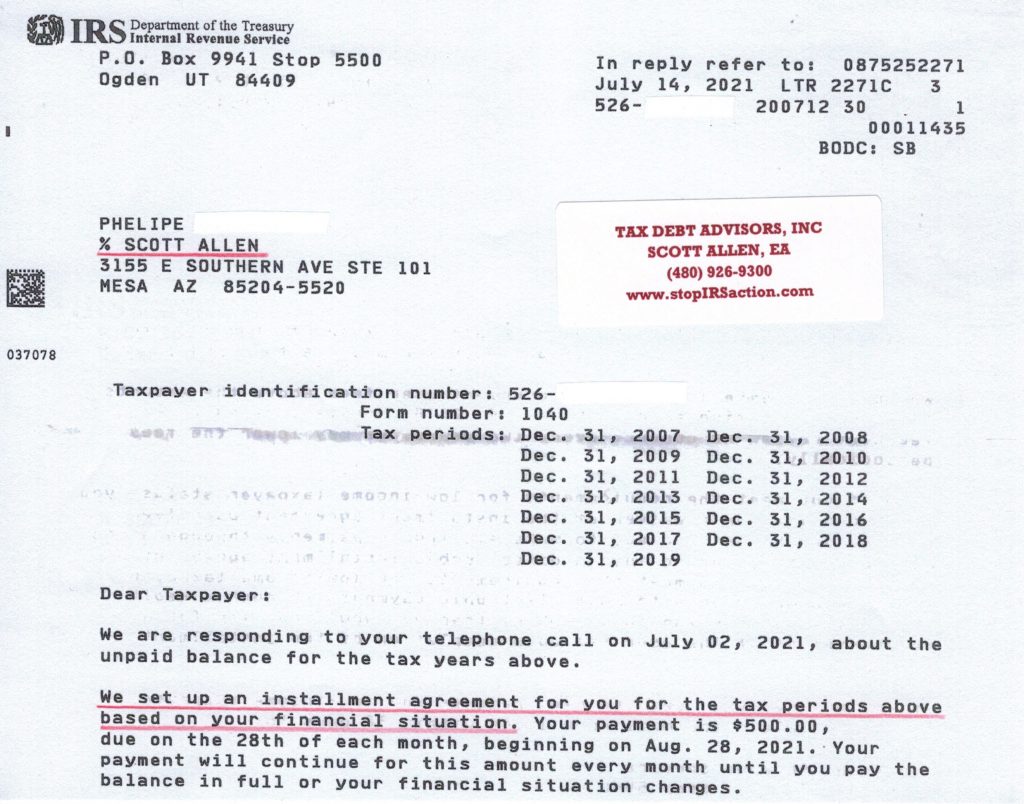

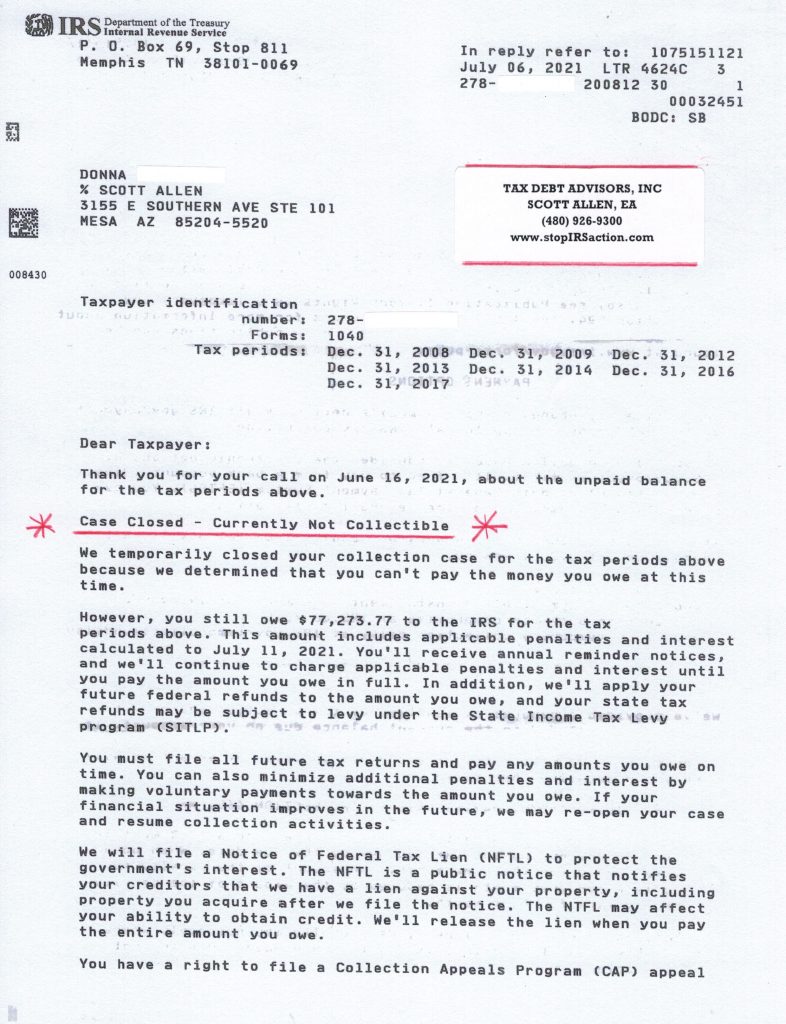

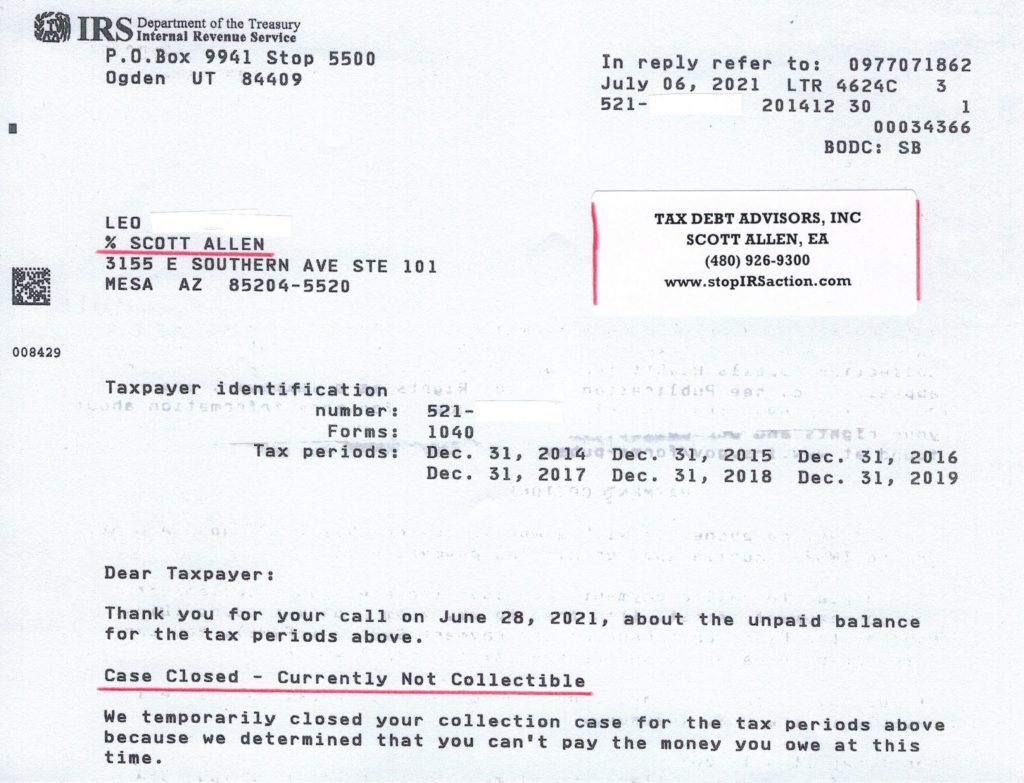

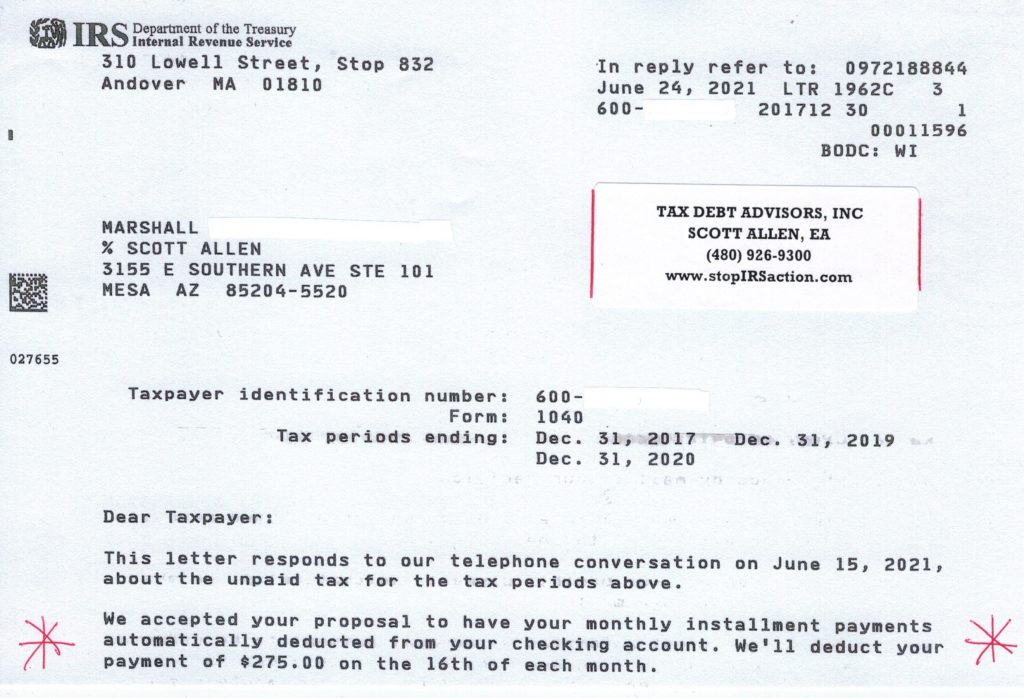

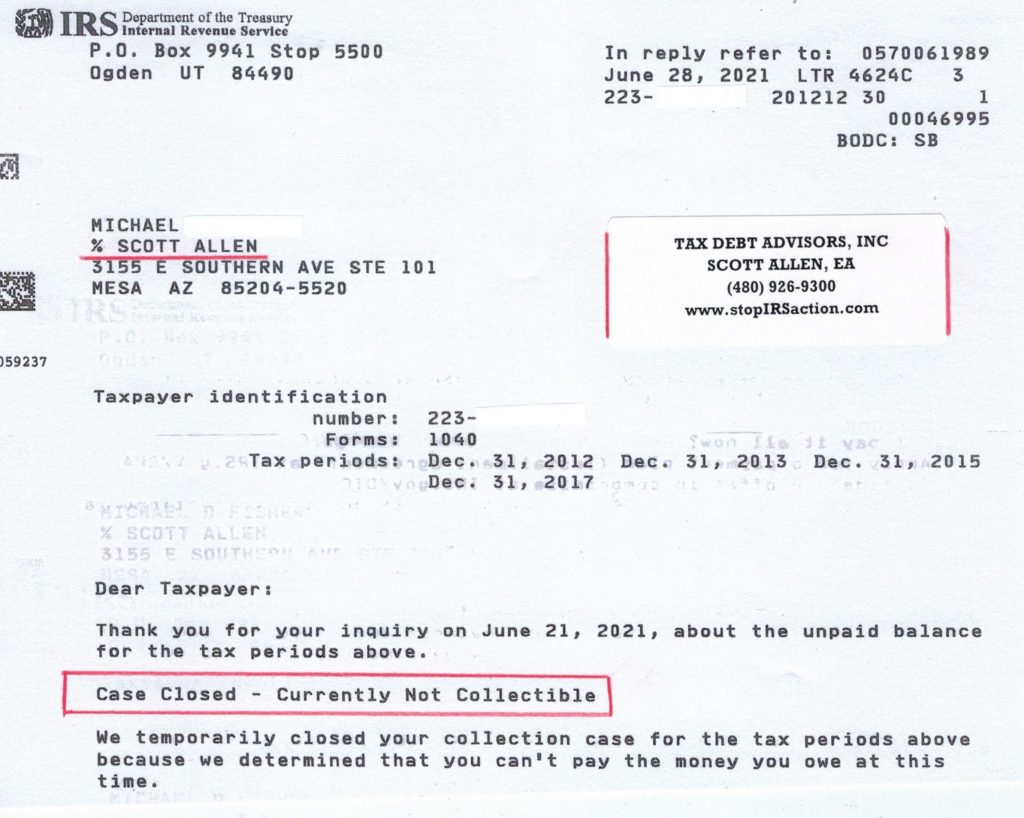

See a recent IRS payment plan Gilbert case below where the taxpayer could no longer afford the monthly payments. He met with Scott Allen EA and was able to revise the agreement. They gathered up new current financial information, evaluated it, and negotiated with the IRS in his behalf. Scott was able to negotiate a currently not collectible status. This is essentially a $0.00/month payment plan. Due to the taxpayer’s financial hardship situation he no longer has to make any payments to the IRS on the back taxes.