Casandra received help with her back tax returns in Mesa AZ

Need help with Back Tax Returns in Mesa AZ ?

Are you drowning in a sea of tax debt? Feeling overwhelmed by IRS notices and collection actions? You’re not alone. Thousands of Americans face similar financial challenges every year. But there’s hope. Tax Debt Advisors, Inc., a family-owned business since 1977, is dedicated to helping individuals and businesses navigate complex tax issues and find solutions to their tax problems right here in Mesa Arizona.

Understanding the IRS and Tax Debt

The IRS is a powerful government agency with the authority to collect taxes owed to the U.S. government. When Mesa AZ individuals or businesses fail to file tax returns or pay taxes on time, the IRS can take aggressive collection actions, including:

- Wage garnishment: The IRS can garnish your wages to collect unpaid taxes.

- Bank levies: The IRS can seize funds from your bank accounts.

- Property liens: The IRS can place liens on your property, including your home and vehicles.

The Role of a Tax Professional

Navigating the complex world of tax law can be daunting. That’s where a qualified tax professional can make a significant difference. A tax professional, such as an Enrolled Agent (EA), can:

- Represent you before the IRS: An EA has the authority to represent taxpayers before the IRS, just like an attorney.

- Negotiate with the IRS: EAs can negotiate with the IRS to reduce penalties and interest, and to establish affordable payment plans.

- File back taxes: EAs can prepare and file back tax returns, bringing you into compliance with the IRS.

- Protect your rights: EAs can protect your rights and ensure that you’re treated fairly by the IRS.

Tax Debt Advisors, Inc.: Your Trusted Partner

Tax Debt Advisors, Inc., has been helping individuals and businesses resolve their tax problems for over 40 years. Our team of experienced tax professionals is dedicated to providing personalized solutions tailored to your specific needs.

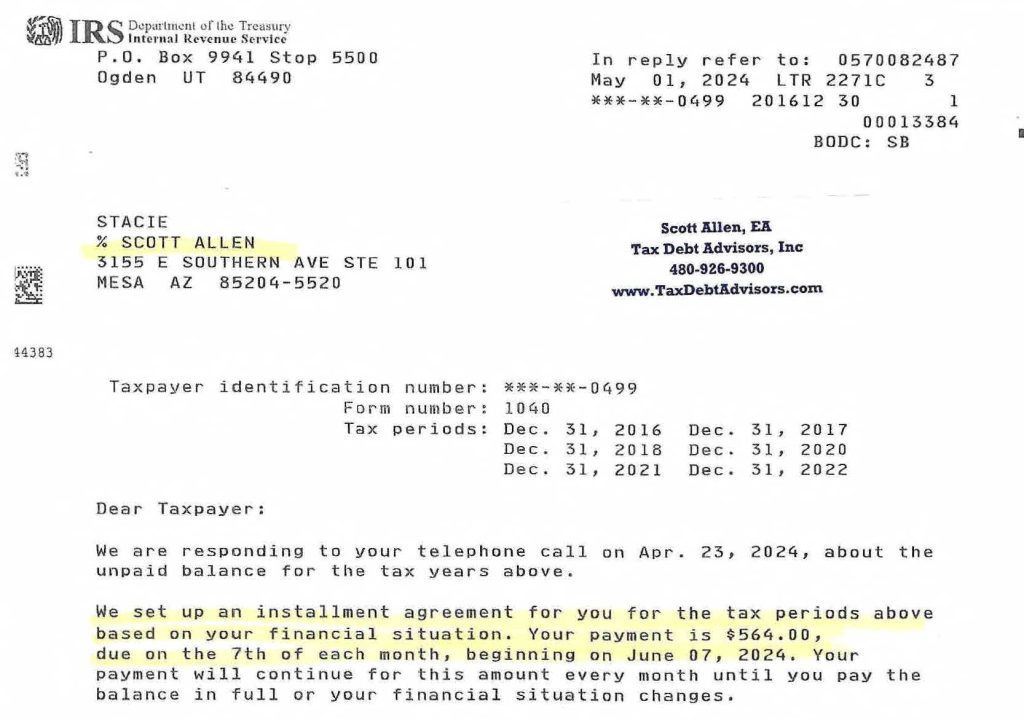

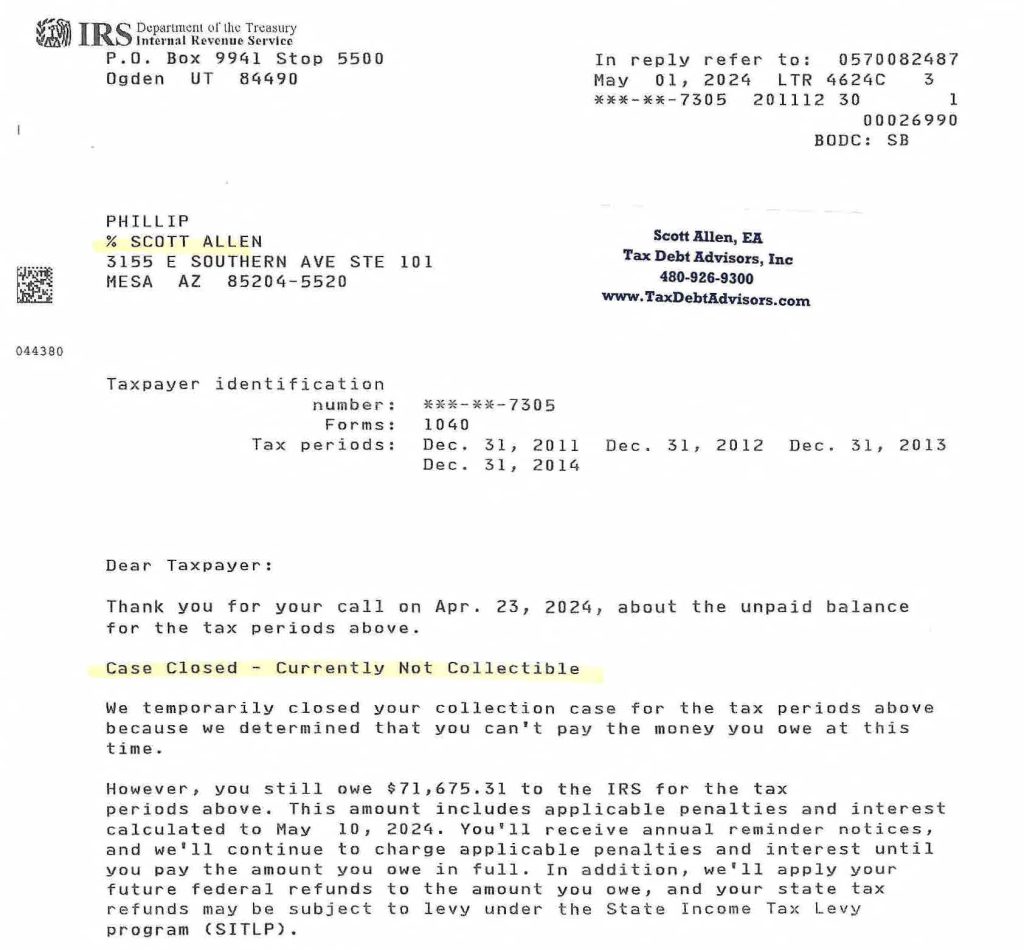

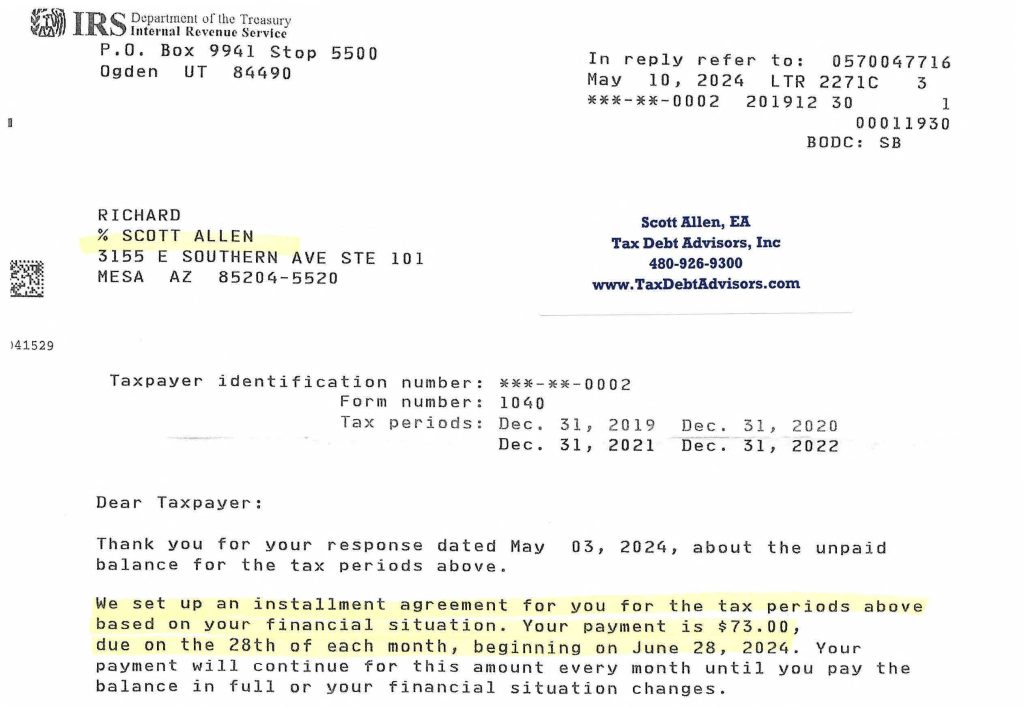

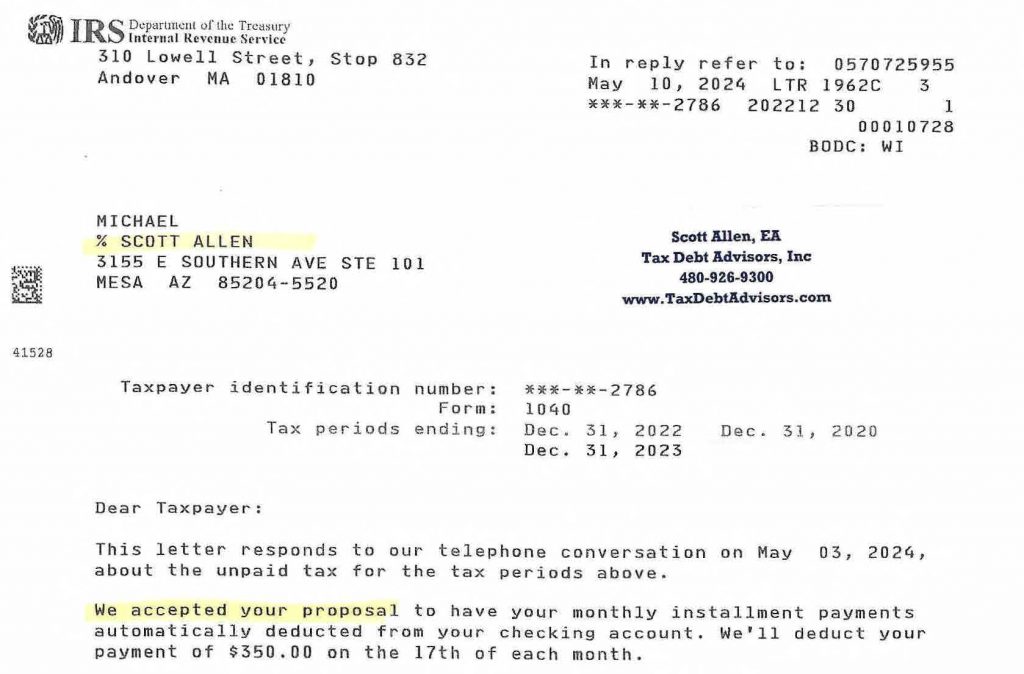

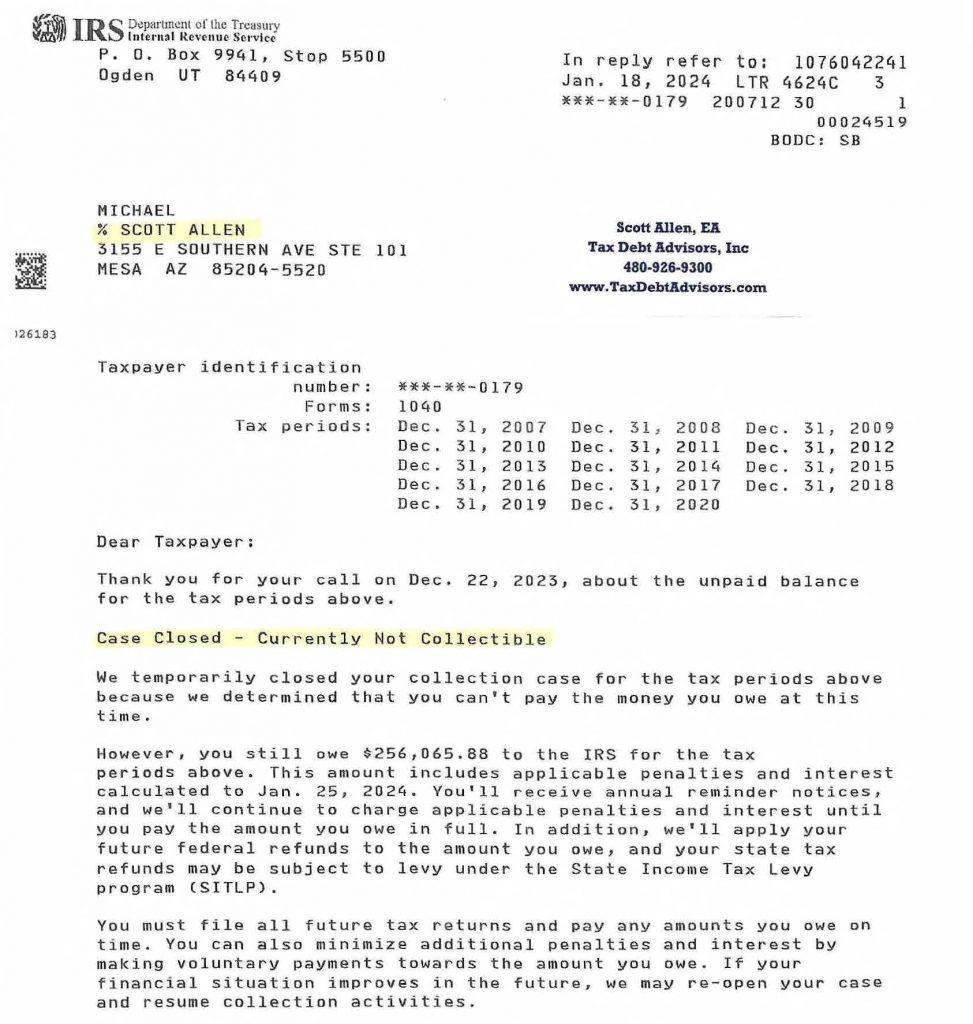

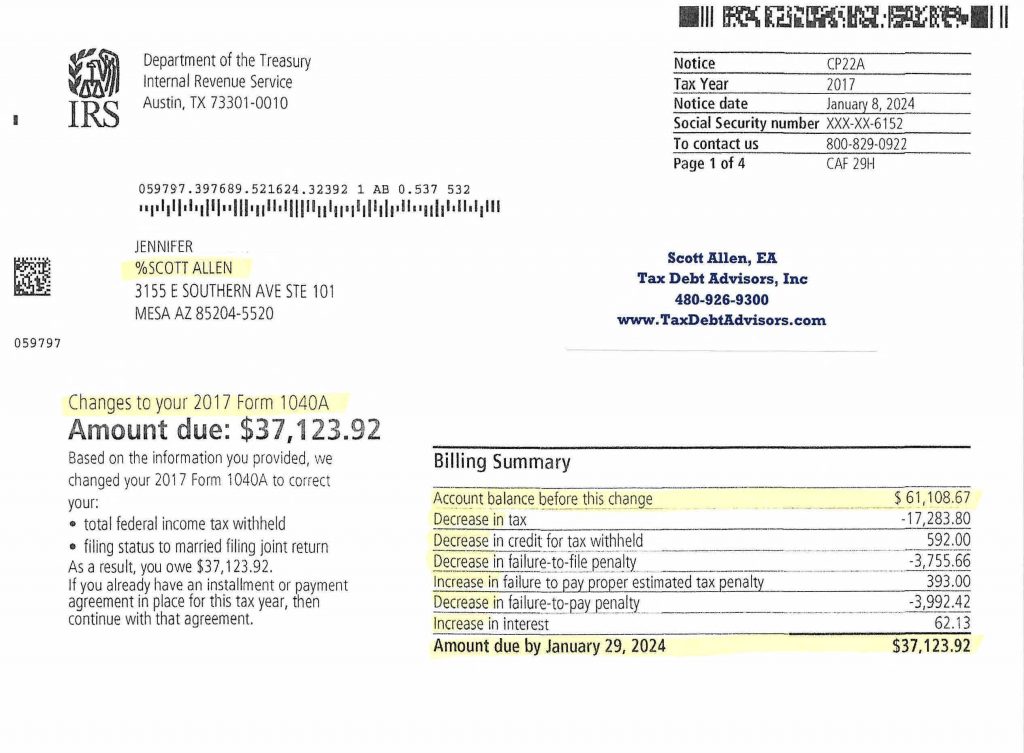

Recent Success Story: A Mesa Resident’s Tax Debt Relief

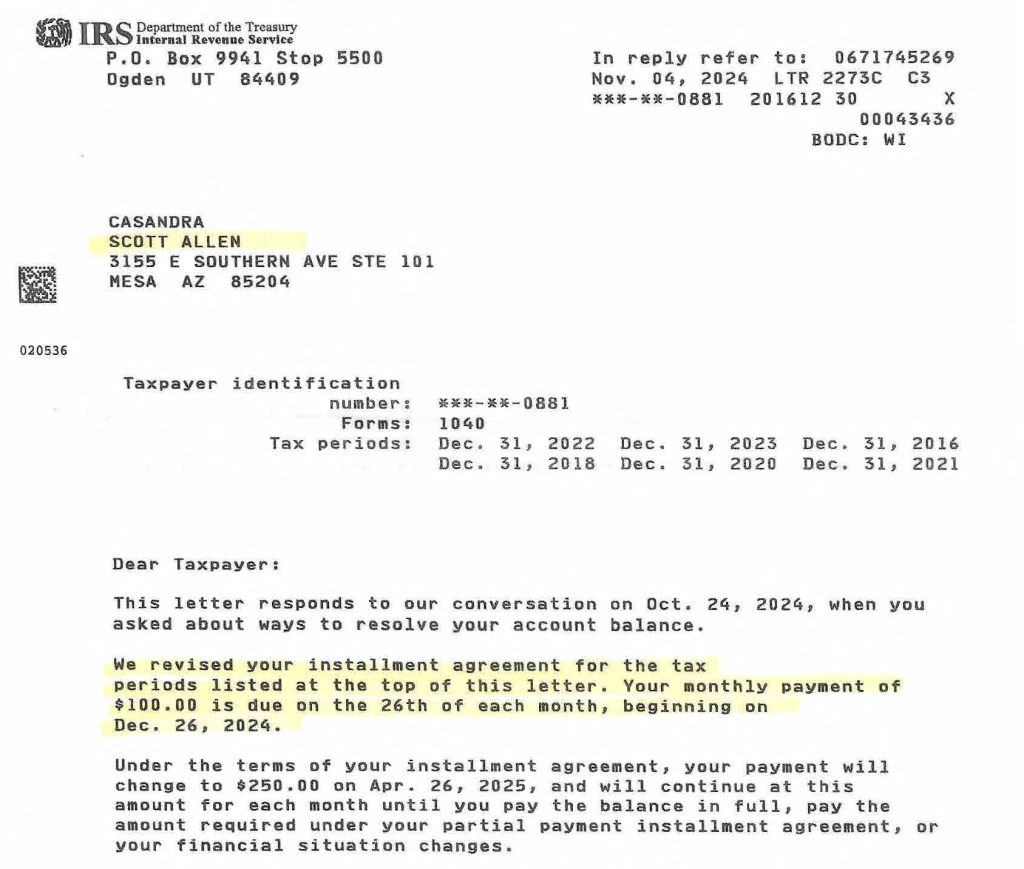

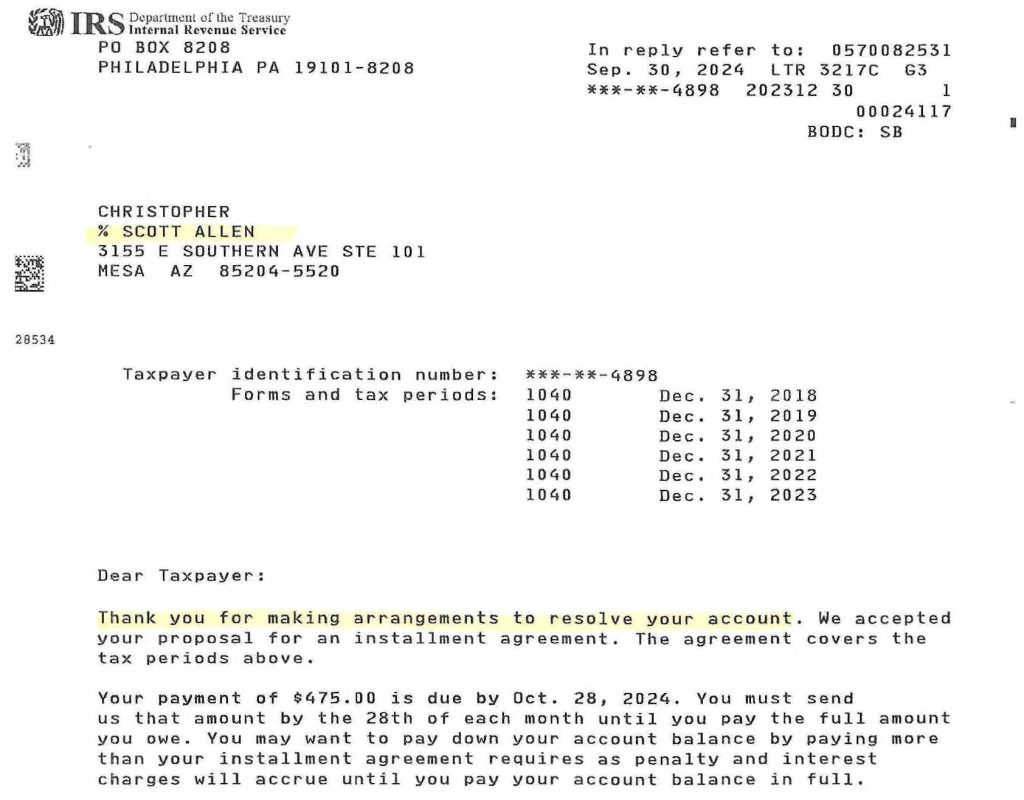

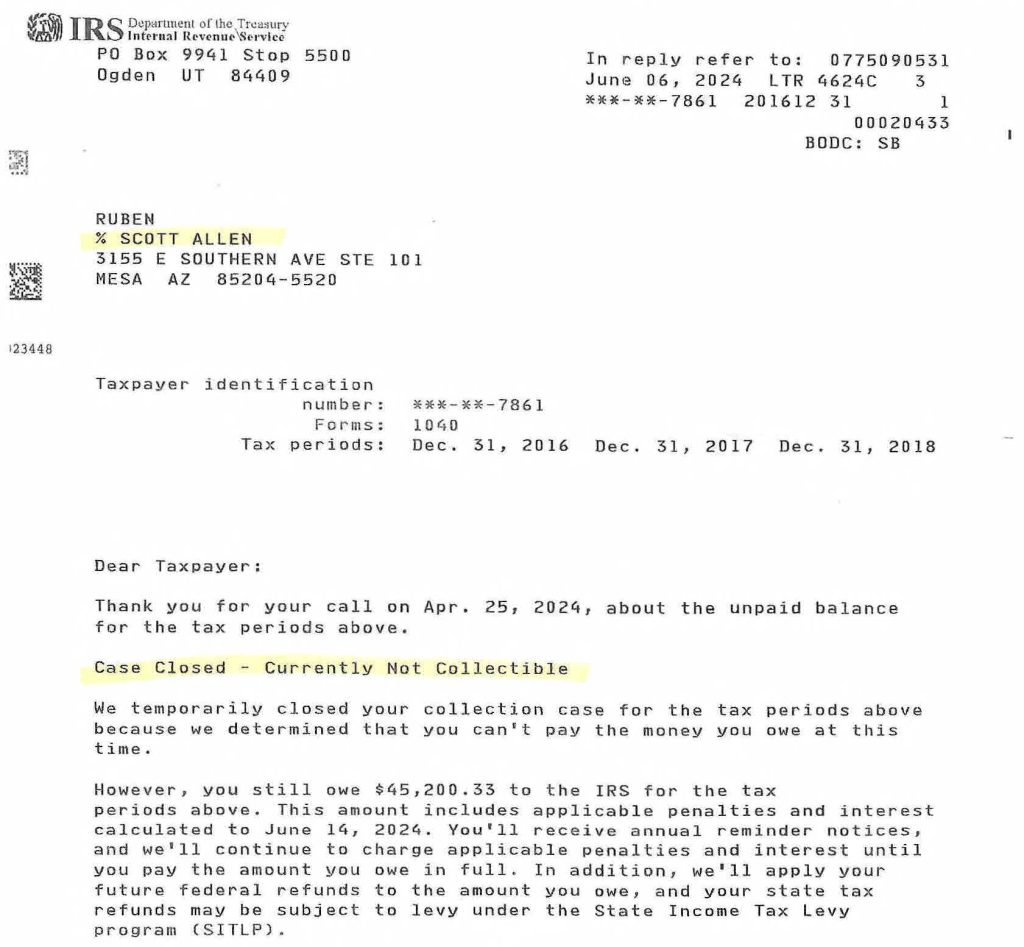

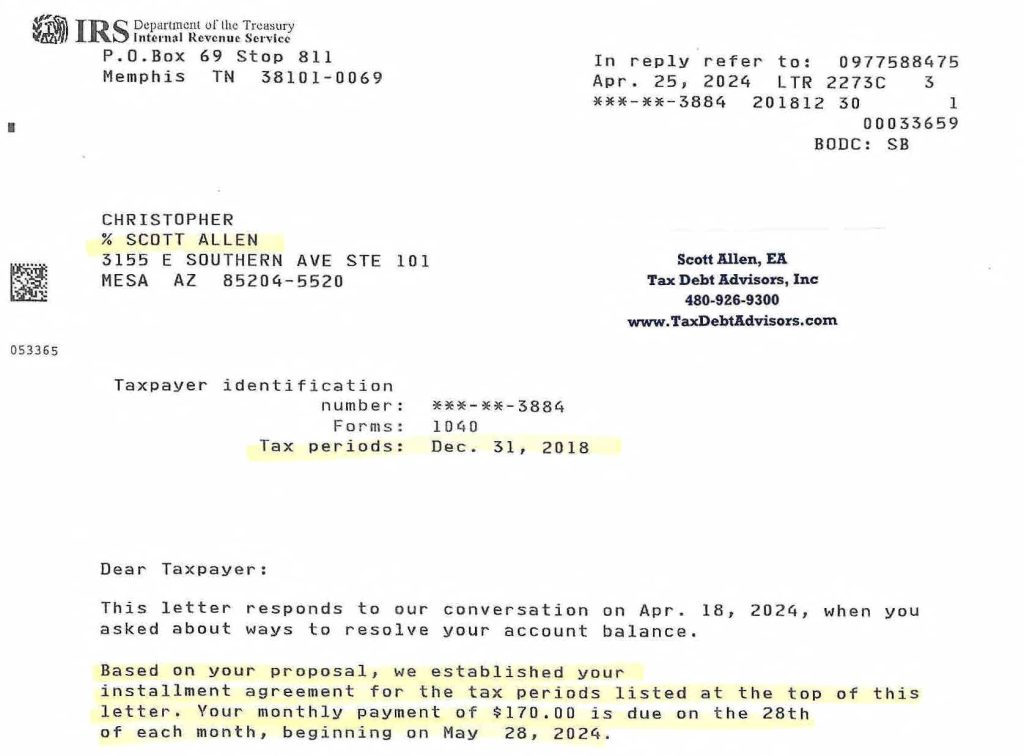

Recently, a Mesa, Arizona resident turned to Tax Debt Advisors, Inc. for help with six years of unfiled tax returns and significant tax debt. Our team worked diligently to:

- Prepare and file the back tax returns: We meticulously prepared and filed six years of Mesa AZ back tax returns, ensuring accuracy and compliance with IRS regulations.

- Negotiate with the IRS: Our experienced negotiators worked with the IRS to negotiate a favorable settlement.

- Establish a low monthly payment plan: We secured a low monthly payment plan of $100 per month, making it easier for the client to manage their tax debt. See the IRS letter below on what Scott Allen EA was able to negotiate for his client Casandra.

Why Choose Tax Debt Advisors, Inc.?

- Experience and Expertise: Our team of Enrolled Agents has decades of experience in resolving complex tax issues.

- Personalized Service: We take the time to understand your unique situation and provide tailored solutions.

- Confidentiality: We maintain the strictest confidentiality to protect your sensitive financial information.

- Compassionate Approach: We understand the stress and anxiety associated with tax debt and offer compassionate support throughout the process.

- Affordable Fees: We offer competitive fees and flexible payment plans to make our services accessible to all.

Take Control of Your Tax Future

Don’t let tax debt weigh you down. Take the first step toward financial freedom by contacting Tax Debt Advisors, Inc. today. Schedule a free consultation with Scott Allen, EA, to discuss your specific tax situation and explore your options.

Remember, you’re not alone. We’re here to help!

Additional Tips for Managing Tax Debt

While seeking professional help is crucial, here are some additional tips to manage your tax debt:

- Don’t ignore the IRS: Ignoring the IRS will only worsen the situation.

- Communicate with the IRS: Contact the IRS to discuss your situation and explore payment options.

- File all back tax returns: Filing back tax returns is essential to resolve your tax debt.

- Create a budget: Develop a realistic budget to allocate funds for tax payments.

By taking proactive steps and seeking professional advice, you can overcome tax debt and achieve financial stability.