Scott Allen EA for Back Tax Returns over a Mesa, AZ IRS Tax Attorney

Why Taxpayers Should Consider Hiring Scott Allen EA for Back Tax Returns and IRS Debt Settlement over a Mesa, AZ IRS Tax Attorney

When it comes to handling back tax returns and navigating the complexities of IRS debt settlement, taxpayers often find themselves facing a crucial decision: whether to hire a Mesa, AZ IRS tax attorney or enlist the services of a seasoned professional like Scott Allen EA. While both options offer potential solutions, this blog explores the reasons why taxpayers might opt for Scott Allen EA over a traditional tax attorney for effective resolution of their tax-related issues.

Scott Allen EA brings a wealth of specialized expertise to the table. As an Enrolled Agent (EA), he is a federally-authorized tax practitioner empowered by the U.S. Department of the Treasury. This specialized status allows him to represent taxpayers in dealings with the IRS, making him exceptionally qualified to address tax concerns. On the other hand, while IRS tax attorneys are equipped with legal knowledge, their expertise may be more generalized and not as focused on the intricacies of taxation.

Scott Allen’s role as an Enrolled Agent signifies his mastery of tax-related matters. He is well-versed in tax codes, regulations, and IRS procedures, giving him a unique edge in crafting effective strategies for back tax returns and debt settlement. While IRS tax attorneys possess legal acumen, they might not possess the same depth of knowledge when it comes to navigating the intricate world of tax codes and regulations.

One of the distinct advantages of hiring Scott Allen EA lies in his ability to provide tailored solutions to taxpayers’ specific circumstances. He takes the time to understand individual financial situations, allowing him to devise personalized approaches that address the root causes of back taxes and IRS debt. In contrast, some Mesa, AZ IRS tax attorneys might take a more general approach, lacking the in-depth understanding necessary to develop highly effective strategies.

Finances often play a pivotal role in decisions surrounding professional services. Enlisting the services of Scott Allen EA can often be more cost-effective compared to hiring a traditional Mesa, AZ IRS tax attorney. Tax attorneys, with their legal background, might charge higher fees for their services. Scott Allen EA, however, offers specialized assistance at a potentially more affordable rate, making quality tax expertise accessible to a wider range of taxpayers.

Scott Allen EA prioritizes direct client interaction, fostering a strong sense of trust and transparency. You will always meet with him from beginning to end. Clients appreciate his hands-on approach and the personalized attention he provides throughout the tax resolution process. In contrast, IRS tax attorneys might have a more formal approach, potentially creating a barrier between the client and the attorney. Scott Allen EA’s approachability and willingness to explain complex tax concepts can significantly alleviate the stress associated with back taxes and IRS debt.

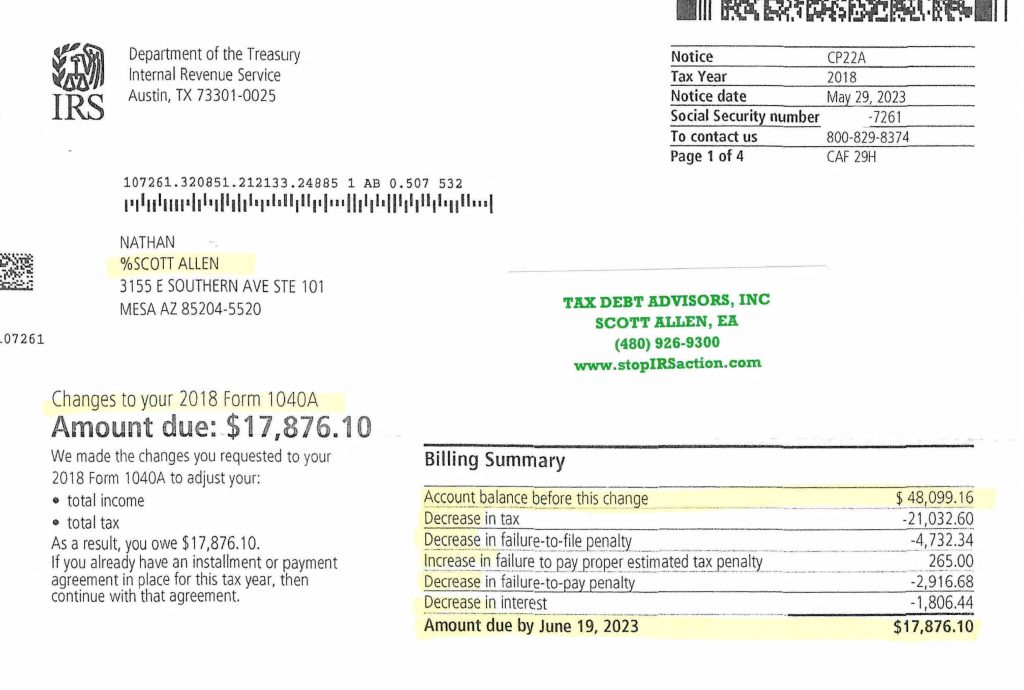

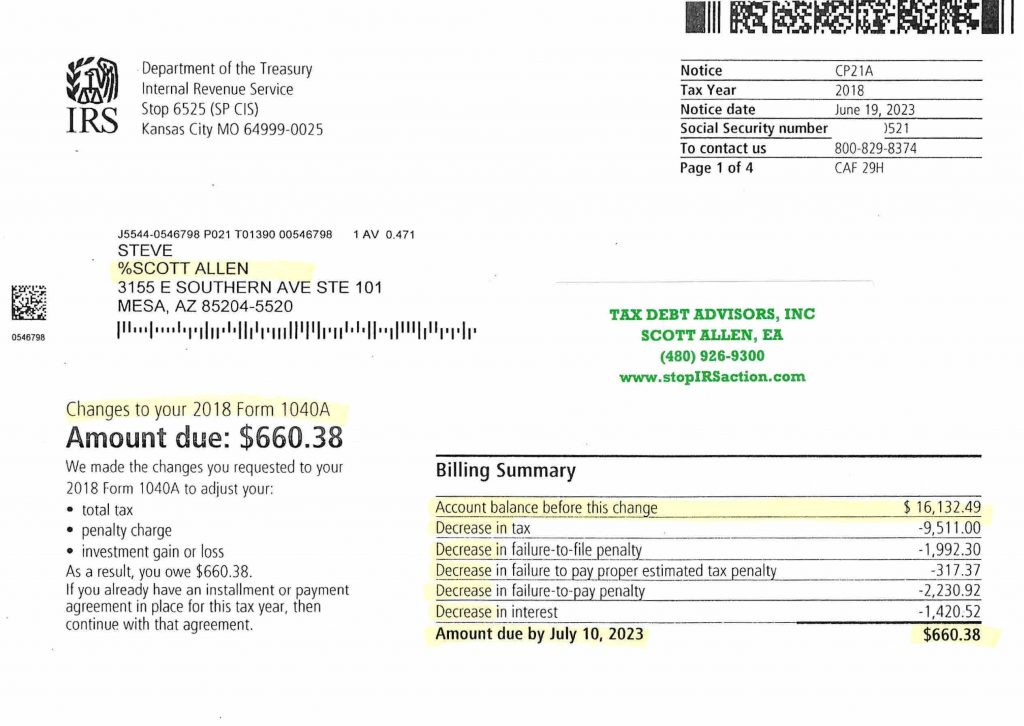

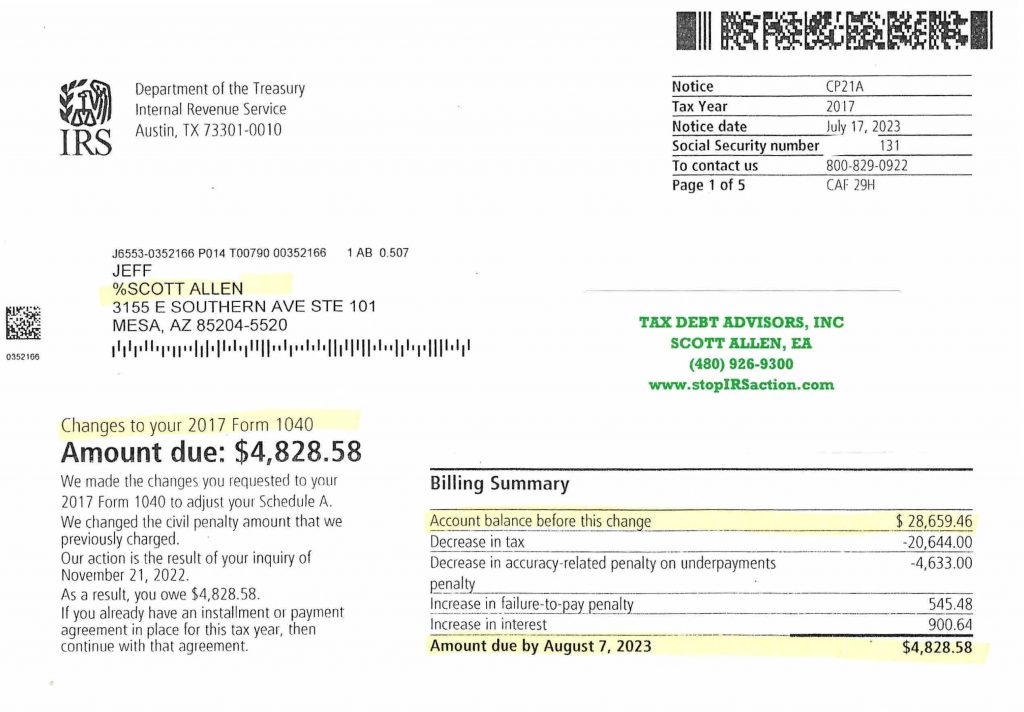

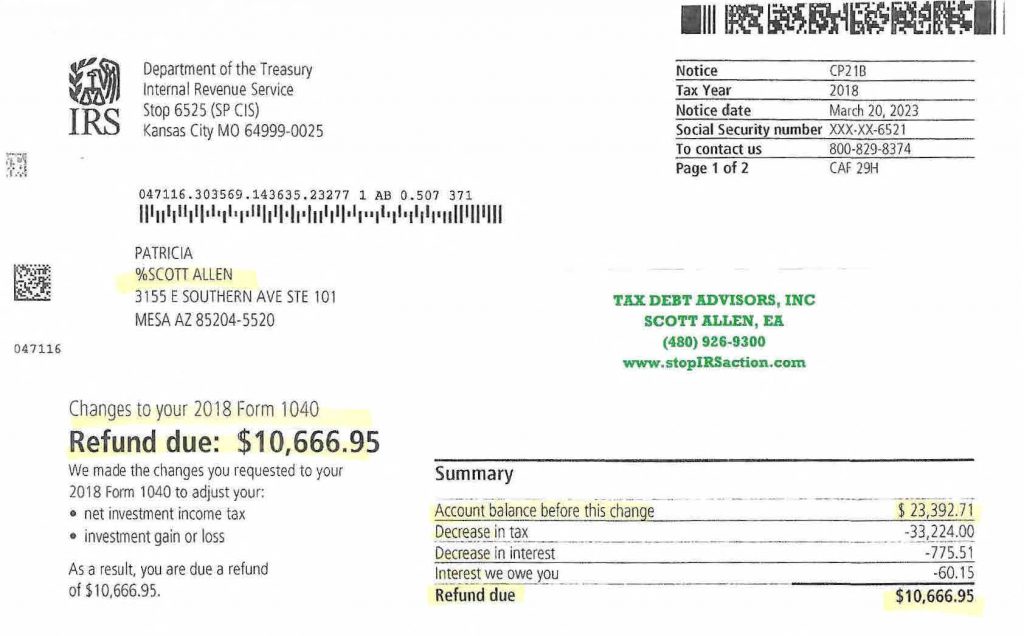

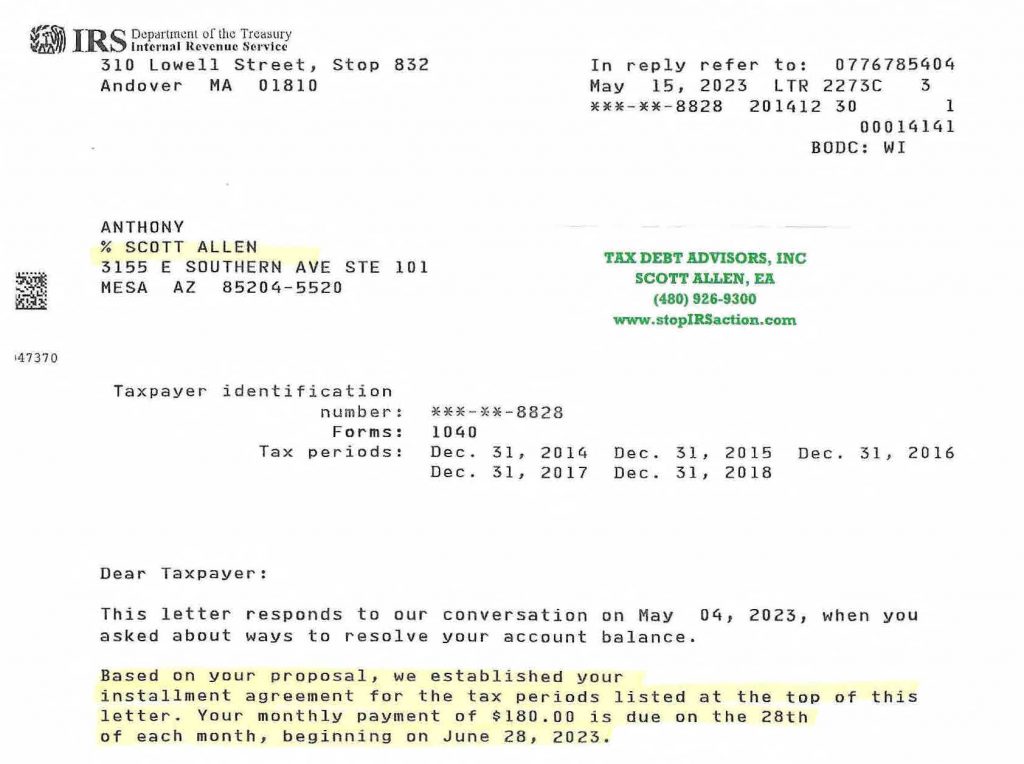

Scott Allen EA’s track record speaks volumes about his expertise and effectiveness in resolving tax-related issues. Numerous success stories from satisfied clients highlight his ability to secure favorable outcomes in challenging tax situations. This level of demonstrated expertise can provide taxpayers with the confidence they need to entrust their back tax returns and IRS debt settlement to his capable hands.

While the choice between hiring a Mesa, AZ IRS tax attorney and enlisting the services of Scott Allen EA may seem daunting, considering the specialized expertise, in-depth tax knowledge, tailored solutions, cost-effectiveness, direct client interaction, and proven track record that Scott Allen EA brings to the table can make the decision clearer. Taxpayers seeking a well-rounded professional with a deep understanding of tax matters and a dedication to achieving optimal results may find that Scott Allen EA is the ideal partner for handling their back tax returns and settling IRS debt.

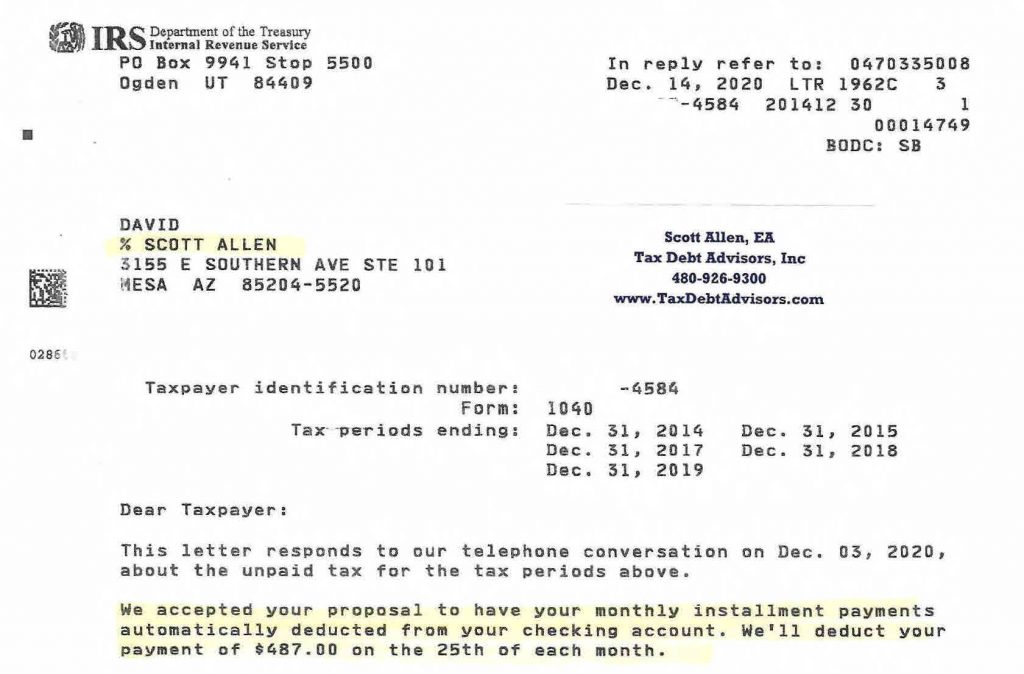

View the image below and you will see a recent example of how David was able to utilize Scott Allen EA of Tax Debt Advisors, Inc to prepare his back tax returns and settle his IRS debt into one manageable payment plan. If fear is leading you to believe that your case requires a Mesa, AZ IRS tax attorney may I suggest that you give Scott a call instead at 480-926-9300 and he will put your mind as ease.