Filing Late Returns—Why Mesa Arizona residents need to file on time.

Filing Late Returns Mesa AZ

- Avoid potential for prosecution. Willful failure to file is a misdemeanor and can result in being sentenced to one year in prison for each year not filed. This is a rare occurrence but why put your self through the possibility.

- You will lose your Earned Income Credit if you try to claim it on a return that is older than three years.

- If you are self employed, you will received a reduced benefit when you retire based on income earned that was not reported.

- You will lose refunds on years filed after three years from the due date of the return.

- Increased debt to the IRS from interest and penalties which can double the amount owed in a few years.

- Higher likelihood that your returns will be audited or reviewed.

- IRS will calculate a substituted tax return (SFR) based on income reported without any deductions. These liabilities are not dischargeable in bankruptcy.

Call me today for filing late returns Mesa AZ and schedule a free initial confidential consultation to see how easy it is to get yourself back in the saddle.

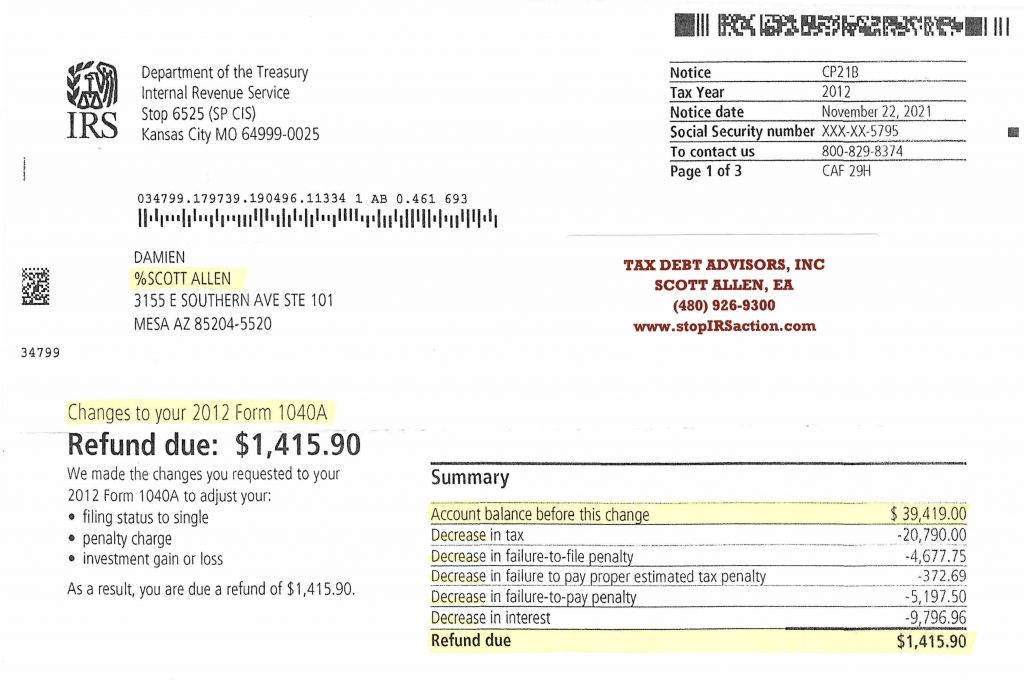

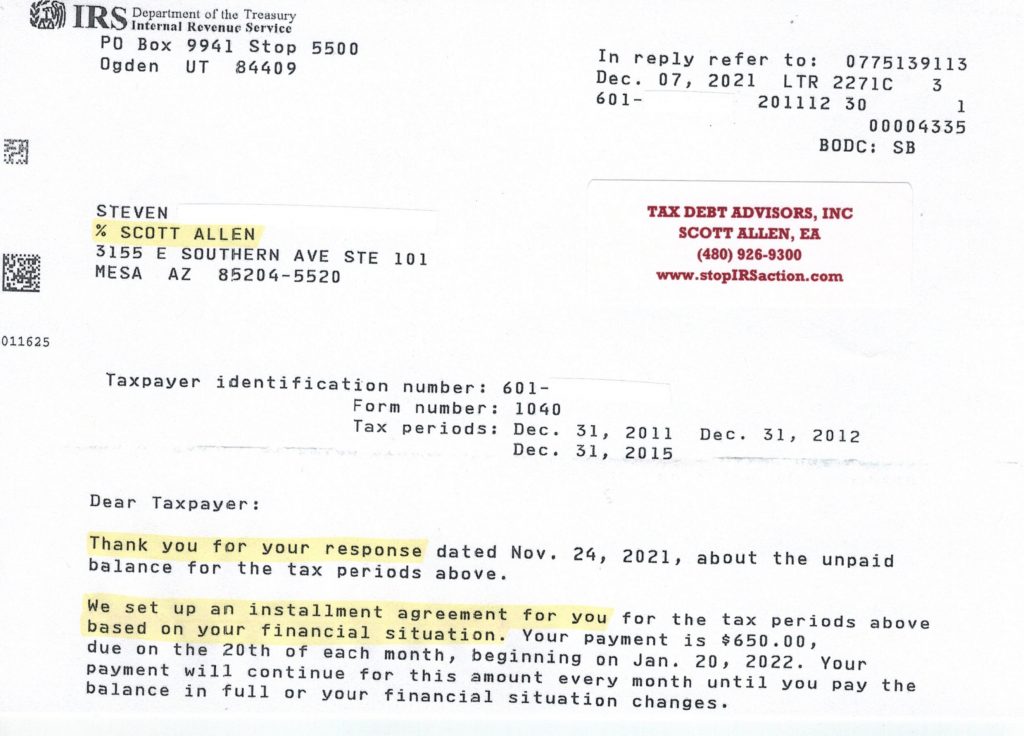

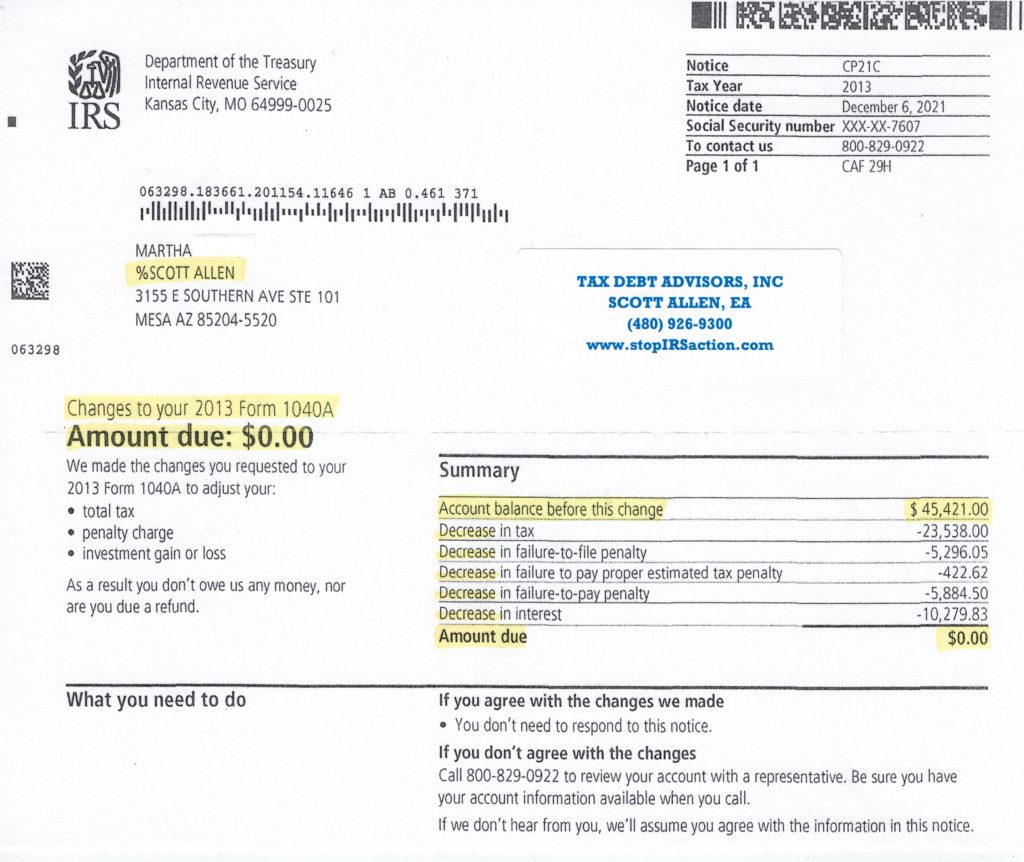

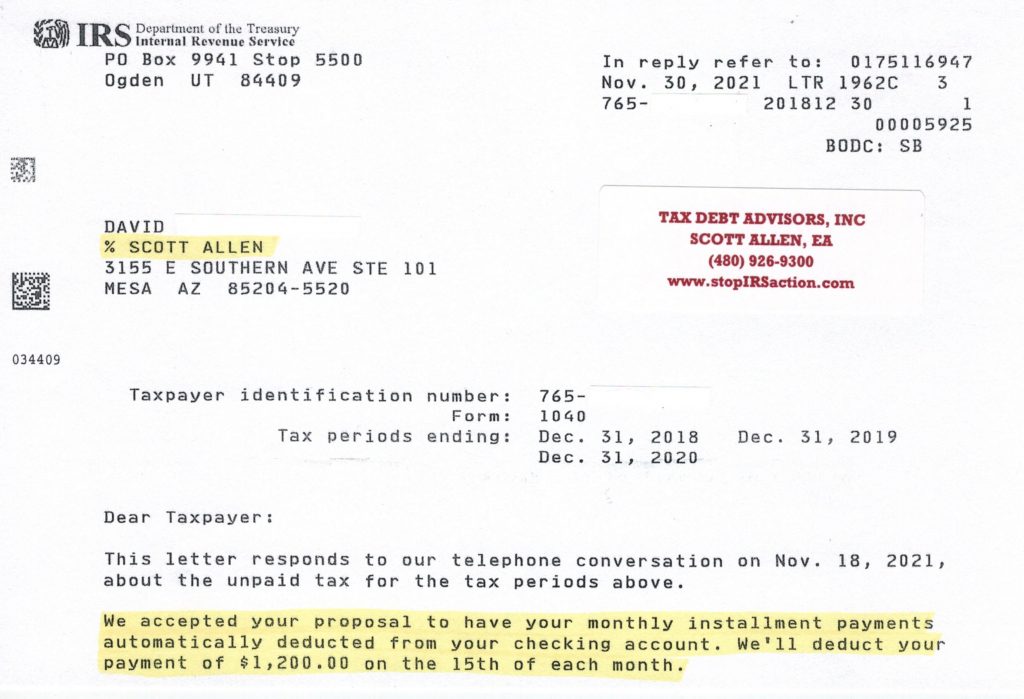

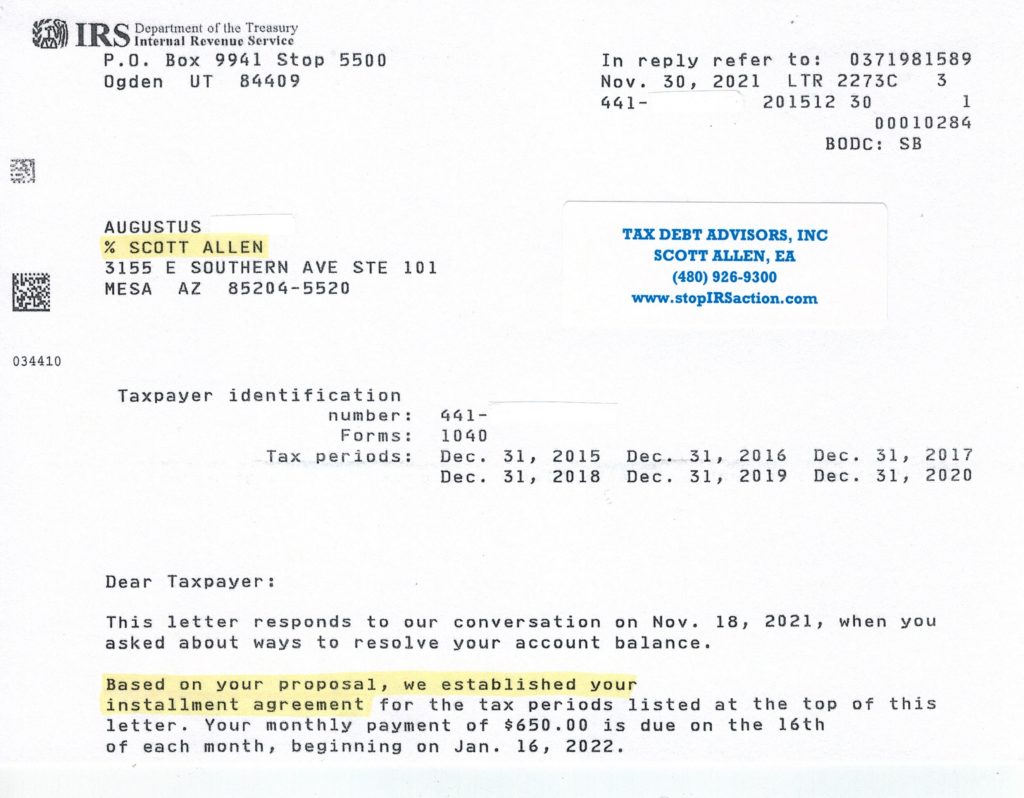

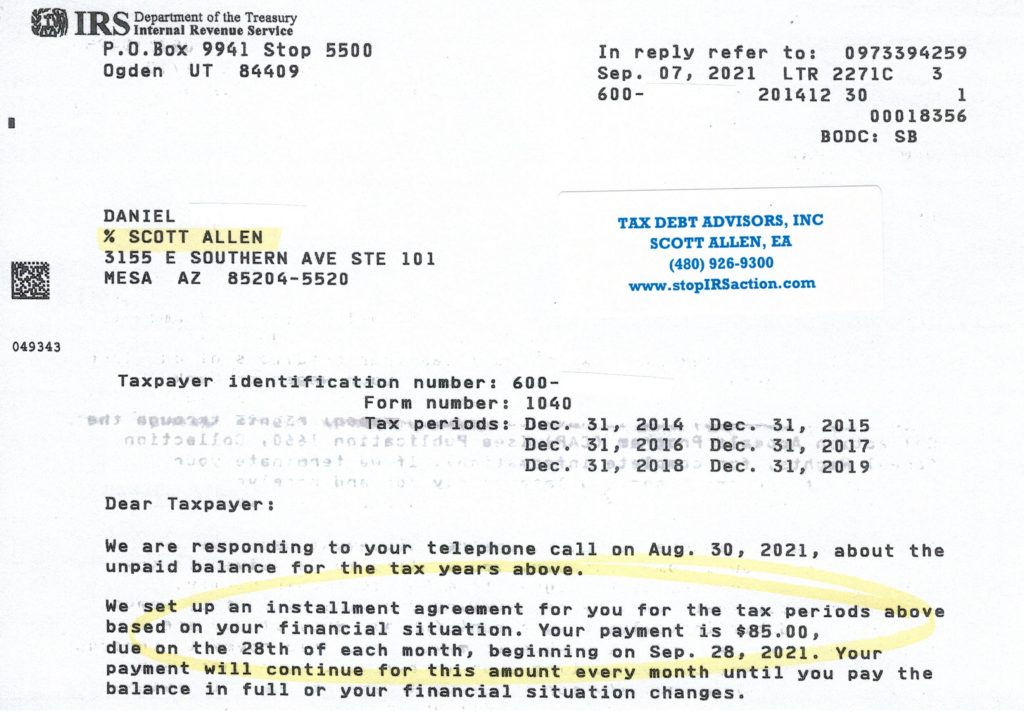

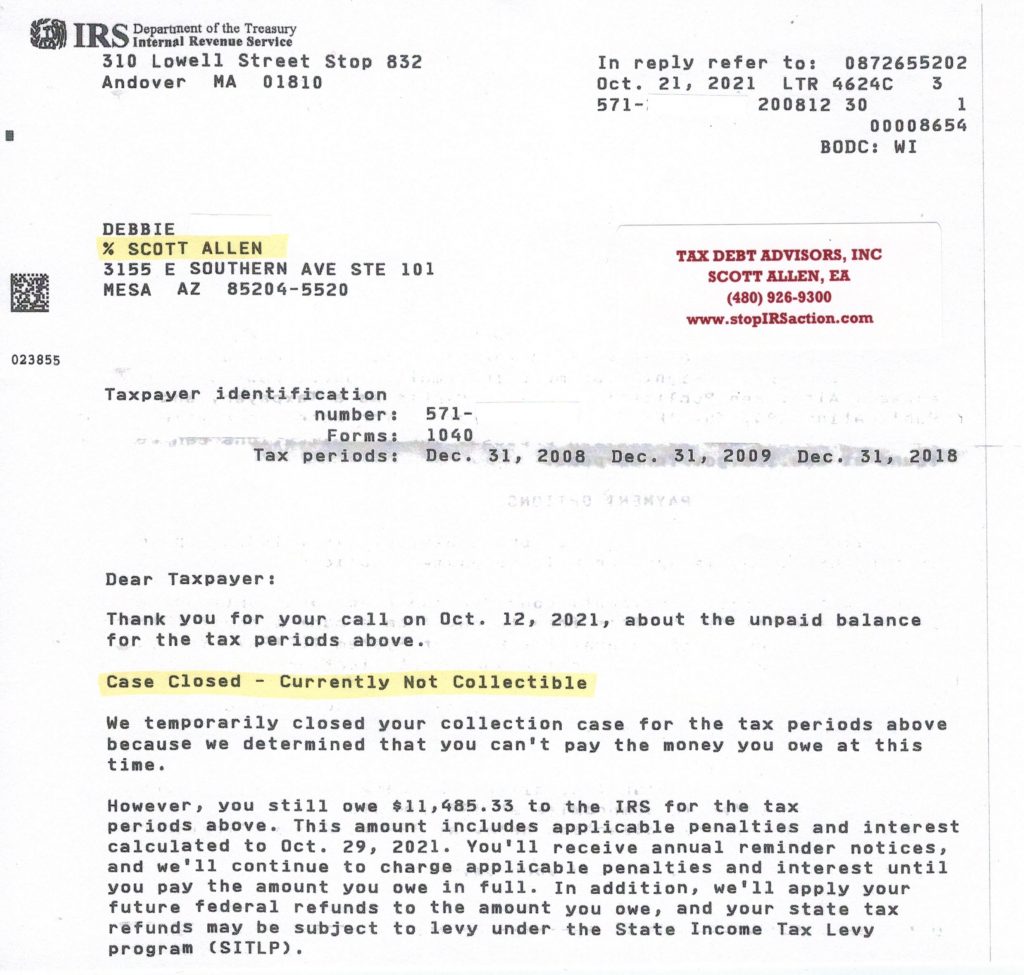

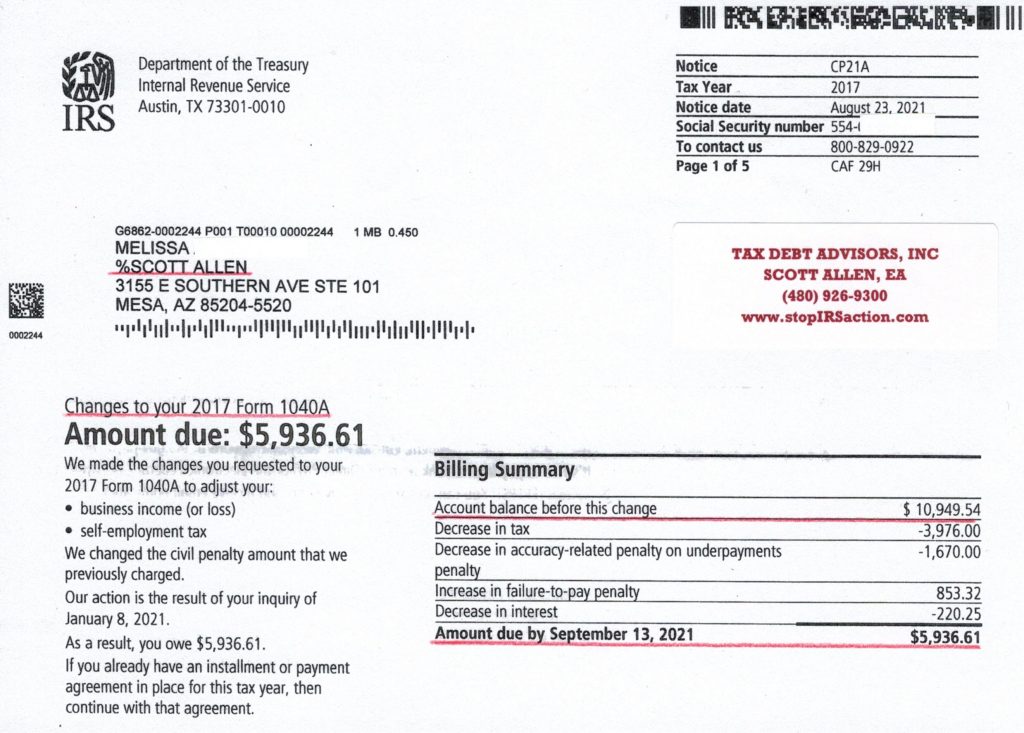

Damien was nearly ten years behind on his back taxes. He thought the IRS had forgotten about him. Low and behold it was the exact opposite. Because he did not file his taxes timely, the IRS filed an SFR tax return giving him a large tax bill of over $39,000. On top the that they were garnishing his income to collect on that tax bill. This got his attention and he hired Scott Allen EA to be his power of attorney. If you check out the IRS notice below you will see that he was able to file a protest tax return and wipe out the entire bill. Yes, you are reading that correctly. Not only that, but the IRS now owed him money and they returned the money they levied from him. Talk about a complete turn around of events. In addition to correcting Damien’s 2012 tax return Scott also helped him with filing late returns Mesa AZ up through the year 2020. He is now 100% filing compliant.

For more information on filing late returns click here.

Scott Allen E. A.—Tax Debt Advisors, Inc.