The IRS Has Levied My Bank Account! I need a Scottsdale AZ Tax Attorney?

Is a Scottsdale AZ Tax Attorney needed?

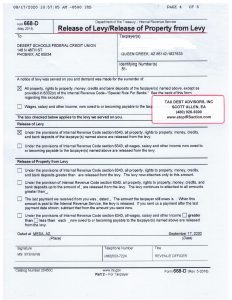

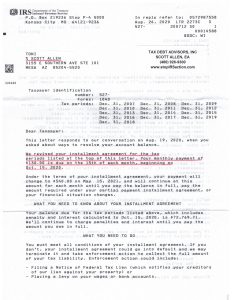

No, this is not a legal matter and usually does not need a Scottsdale IRS Tax Attorney. When the IRS has levied your bank account, it is because you have ignored collection letters. The first step to removing the IRS levy is to file any back tax returns. Then the IRS will consider you in compliance with your tax filings. The second step is to work out a settlement with the IRS. Once you have a settlement in place, the IRS will release the levy on the bank account. However, unless you can prove hardship, the IRS will keep the funds they have levied.

Scott Allen E.A. (an Enrolled Agent) is able to quickly prepare and file delinquent tax returns and explain the best way to settle your tax debt. There are several options available to settle past tax debt. Call Scott Allen E.A. to schedule a free consultation at 480-926-9300. His experience and expertise is with preparing honest aggressive tax returns and negotiating IRS settlements. Can your Scottsdale AZ Tax Attorney say that about his or her practice?

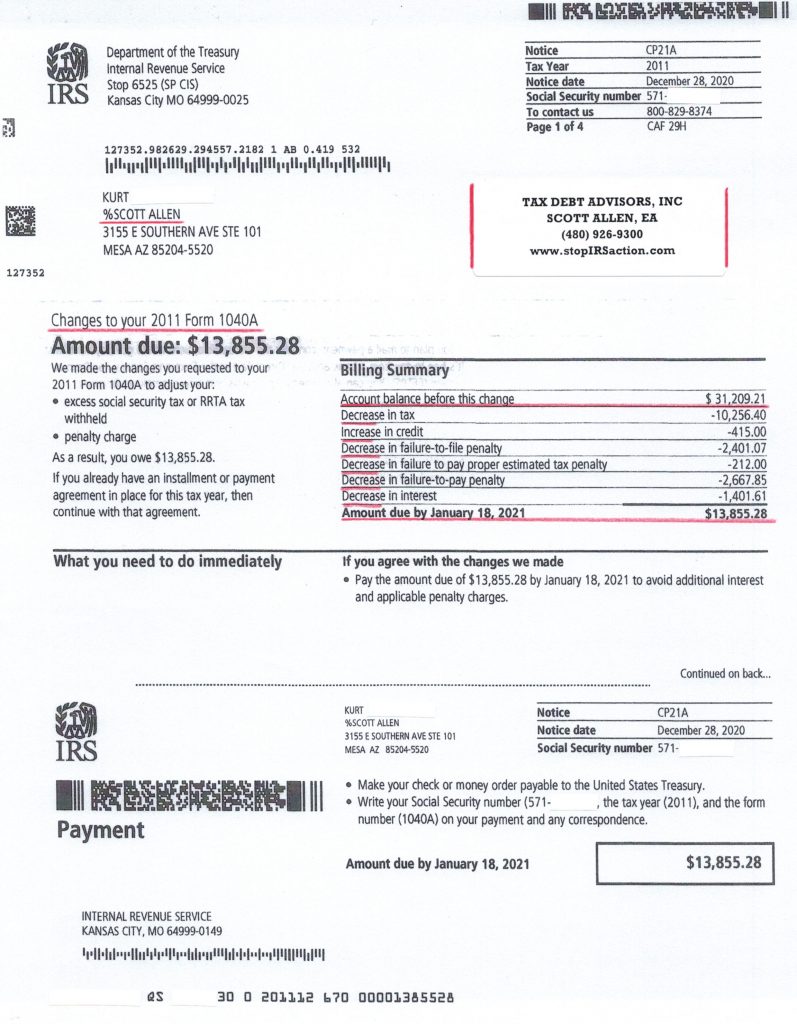

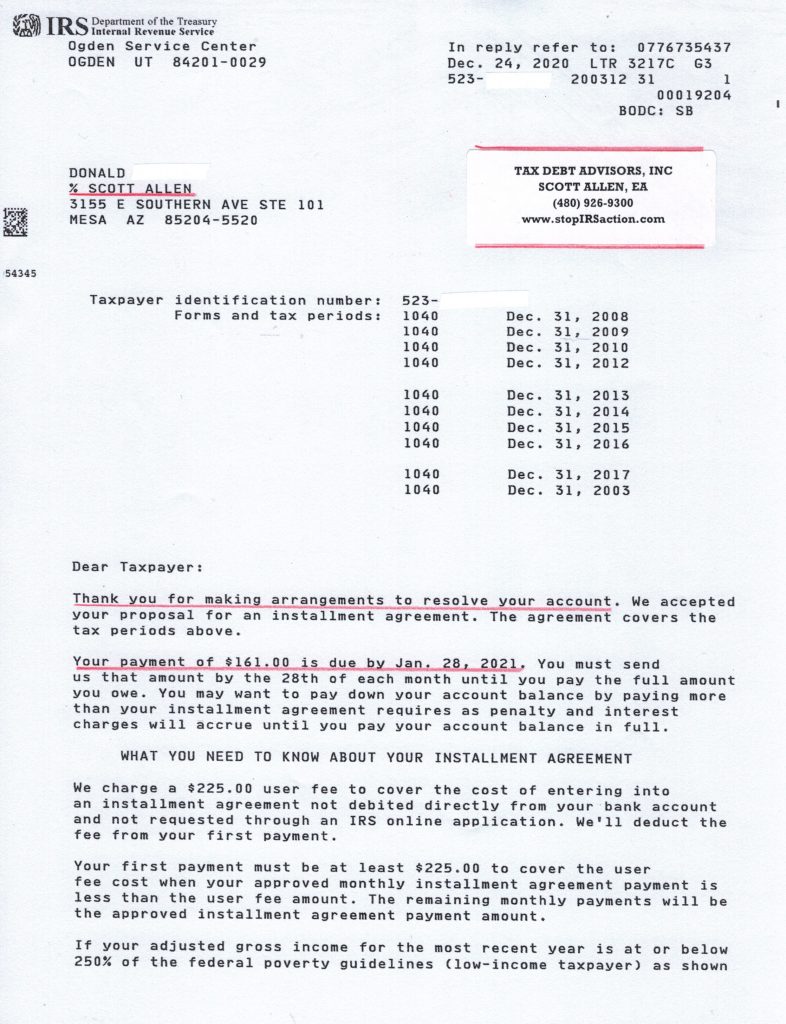

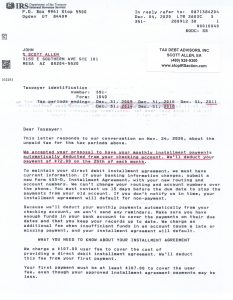

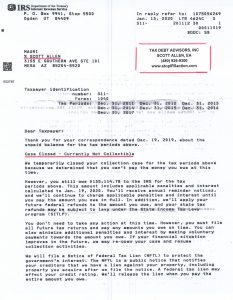

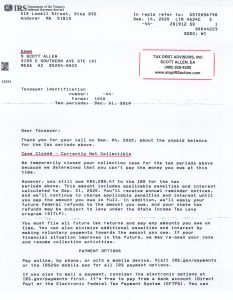

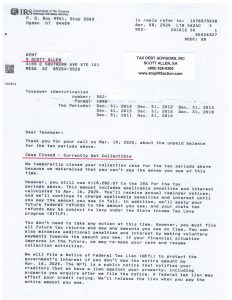

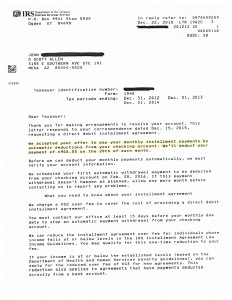

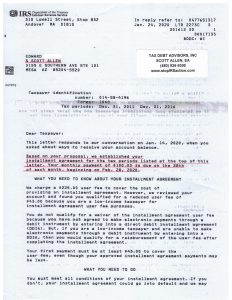

View a recent IRS settlement negotiated by Tax Debt Advisors, Inc

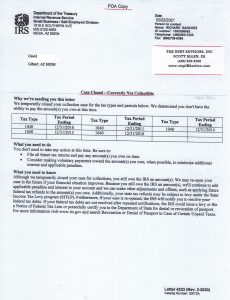

David had the IRS coming after him for back taxes owed but was currently in a financial hardship situation. He was recently put on social security disability and was on a limited fixed income. Scott Allen EA of Tax Debt Advisors, Inc was able to represent him, stop future collection activity, and negotiate a non collectible status on the back taxes owed. The IRS will now leave him alone and he is waiting for the IRS debts to expire.