Need IRS Payment Plan Gilbert Arizona

Help with IRS Payment Plan Gilbert Arizona

If you are struggling with unpaid taxes, you are not alone. Millions of Americans owe money to the IRS each year. The good news is that there are options available to help you get back on track. One option is to hire a tax debt relief company for help with negotiating an IRS payment plan Gilbert Arizona.

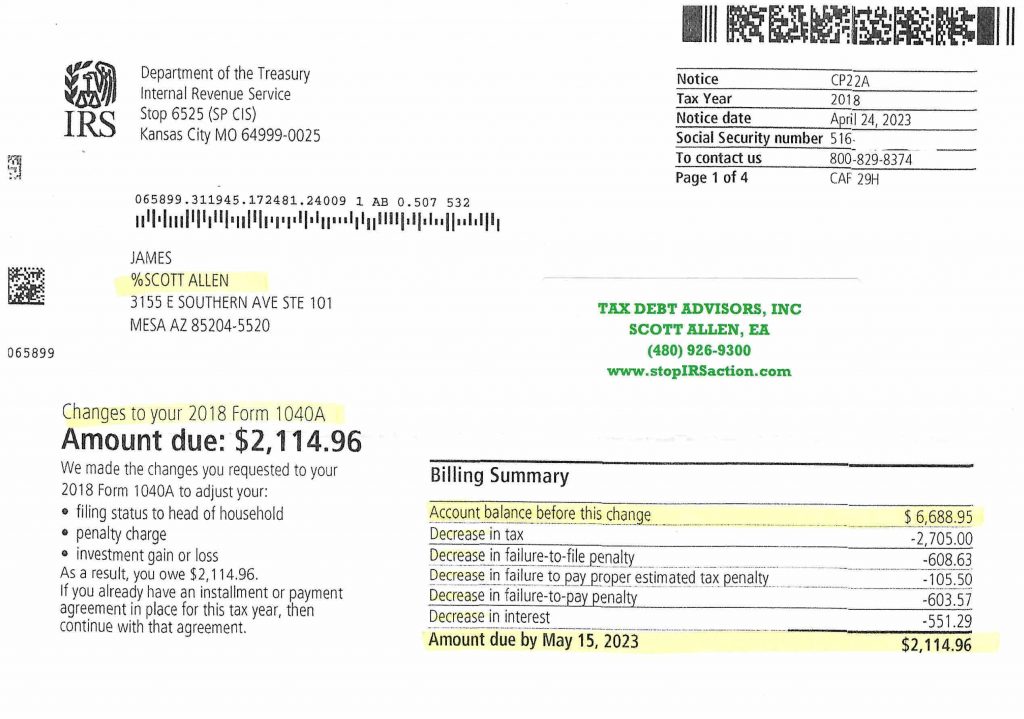

Tax Debt Advisors, Inc. is a leading tax debt relief company in Gilbert Arizona. They have helped thousands of clients get out of debt and get their lives back on track. They offer a variety of services, including IRS payment plans, tax settlement, and tax lien removal.

What is an IRS payment plan?

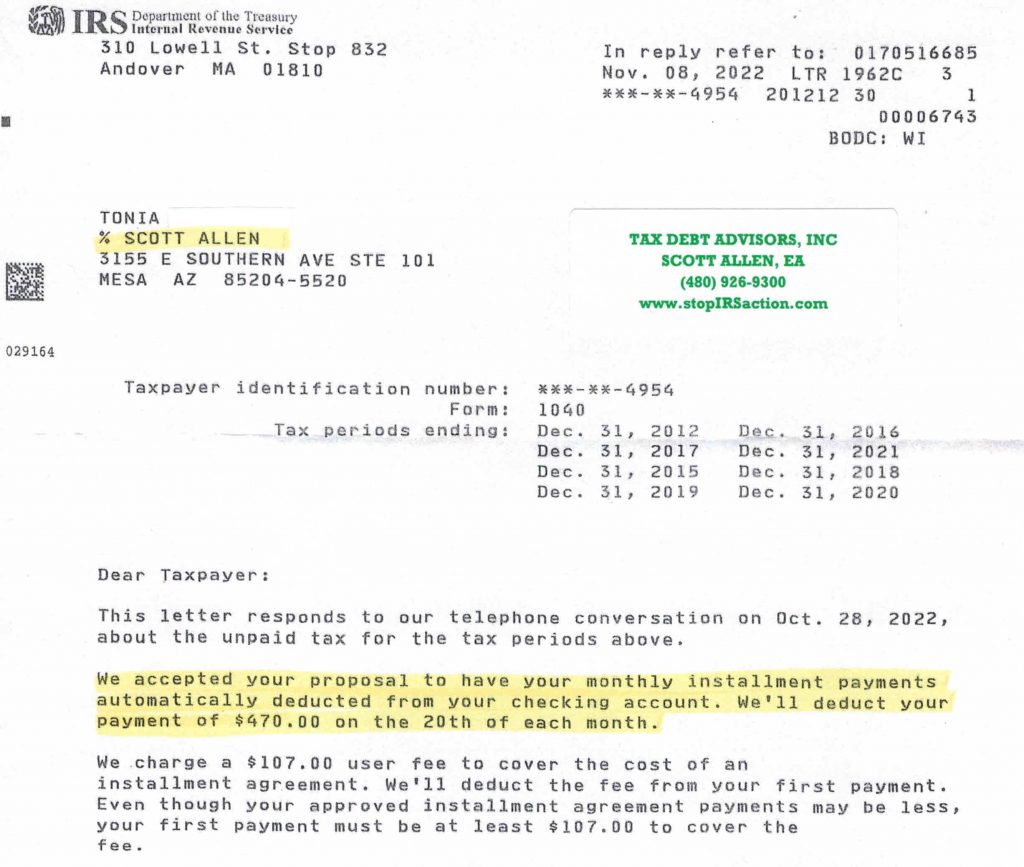

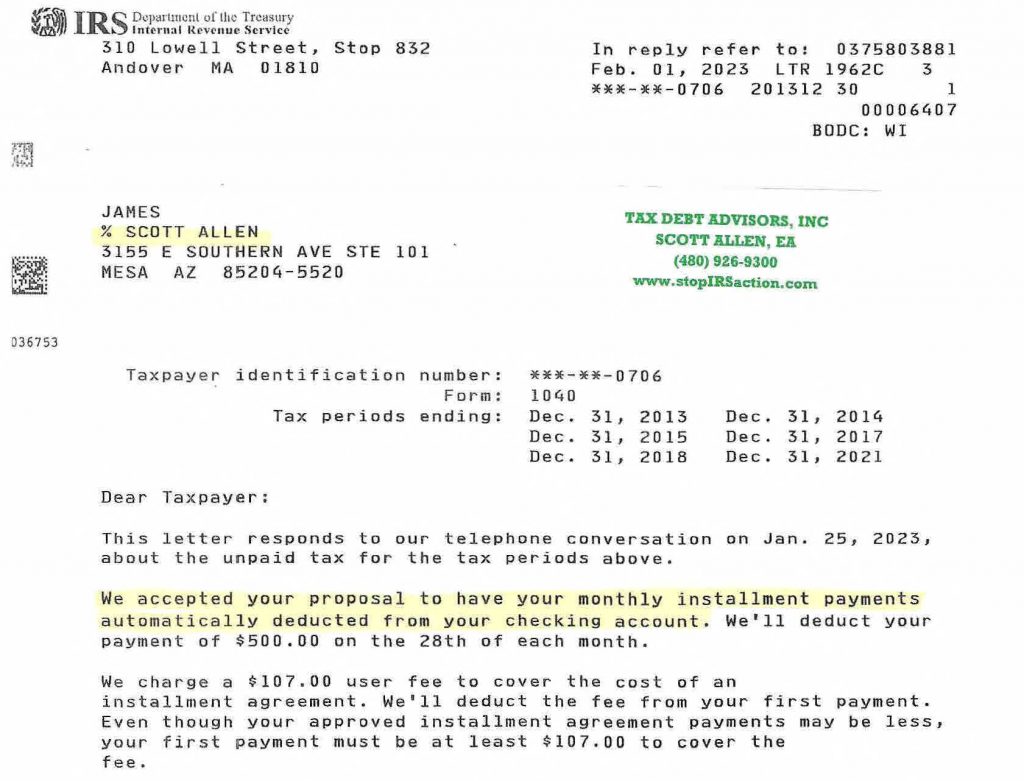

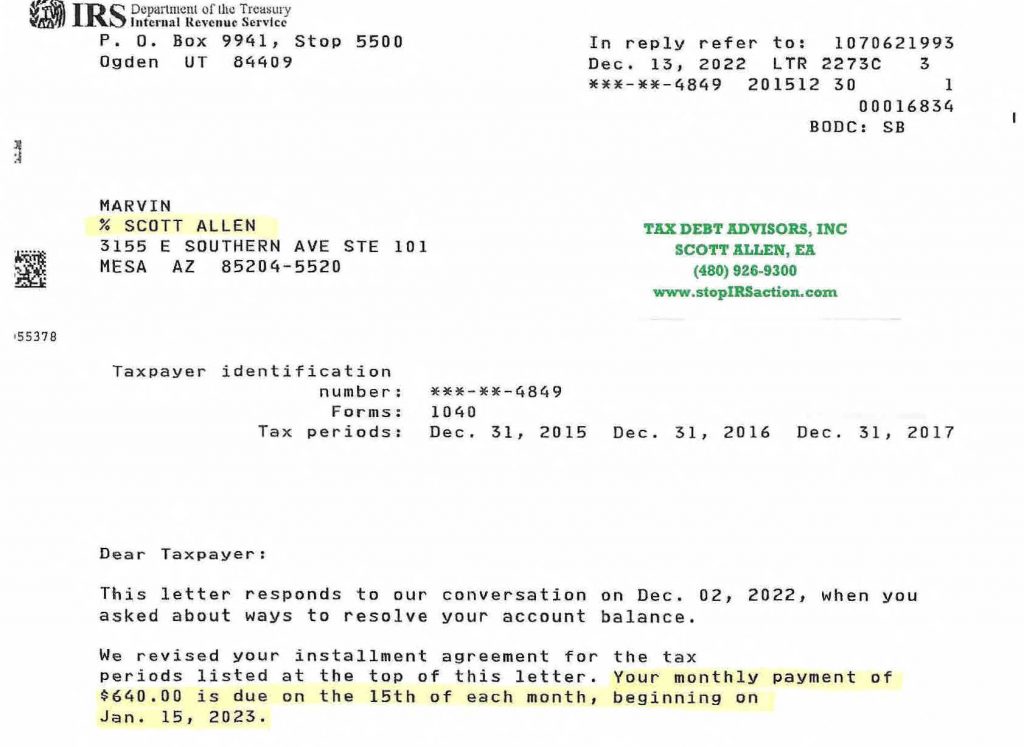

An IRS payment plan is an agreement between you and the IRS to pay off your debt over time. The IRS offers a variety of payment plans, each with its own terms and conditions. The most common type of payment plan is the Installment Agreement. With an Installment Agreement, you agree to pay a set amount each month until your debt is paid off in full.

How to qualify for an IRS payment plan

To qualify for an IRS payment plan, you must meet certain requirements. You must have filed all of your tax returns, and you must be able to afford the monthly payments. The IRS will also consider your income, expenses, and assets when determining whether to approve your request.

The benefits of hiring a tax debt relief company

Hiring a tax debt relief company can have many benefits. First, a tax debt relief company can help you understand your options and choose the right solution for your situation. Second, a tax debt relief company can negotiate with the IRS on your behalf. This can save you time and money. Third, a tax debt relief company can help you get your finances back on track.

Why choose Tax Debt Advisors, Inc.?

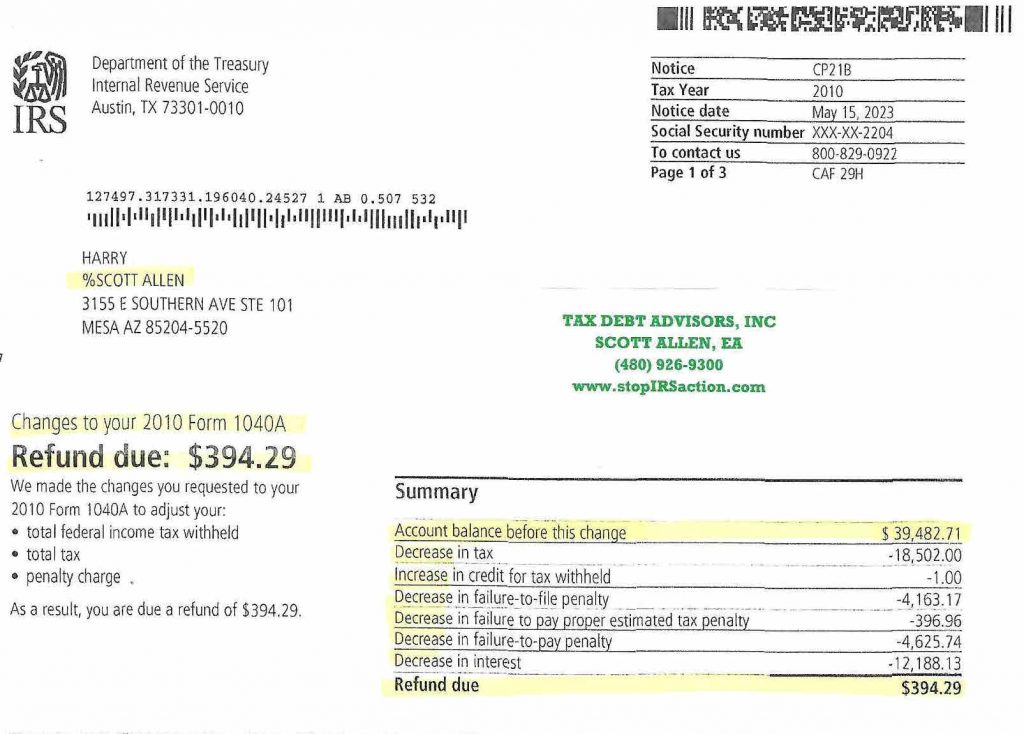

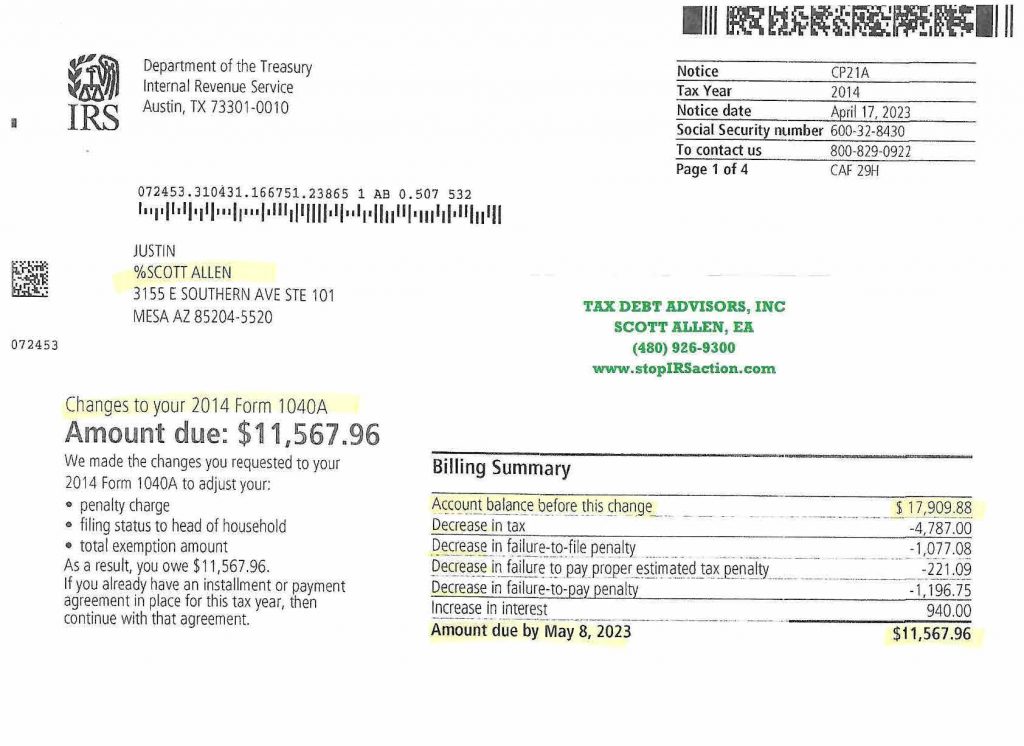

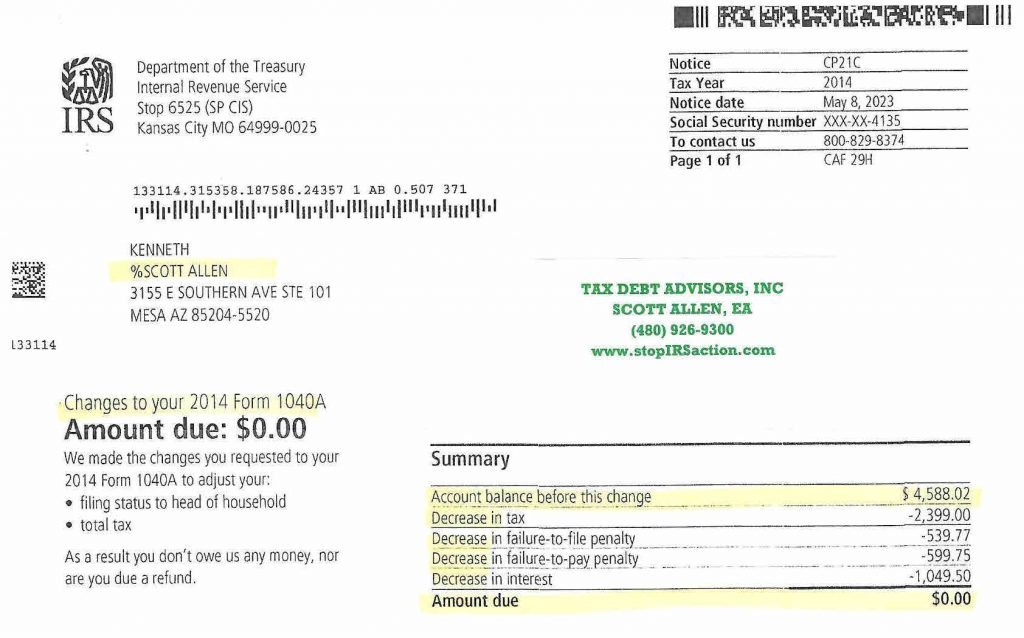

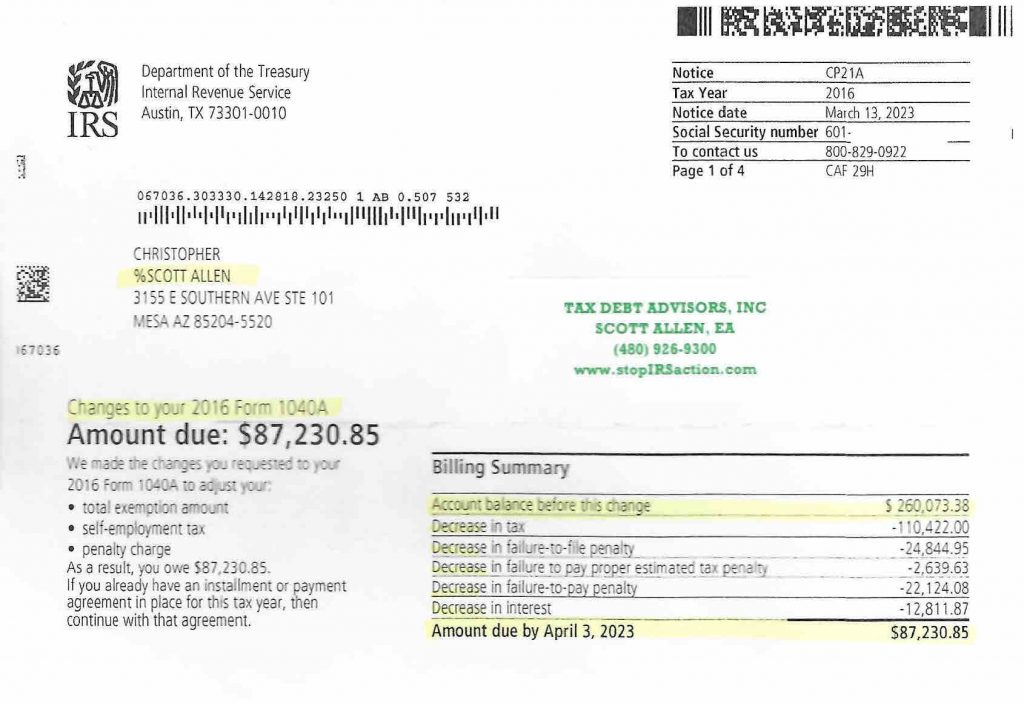

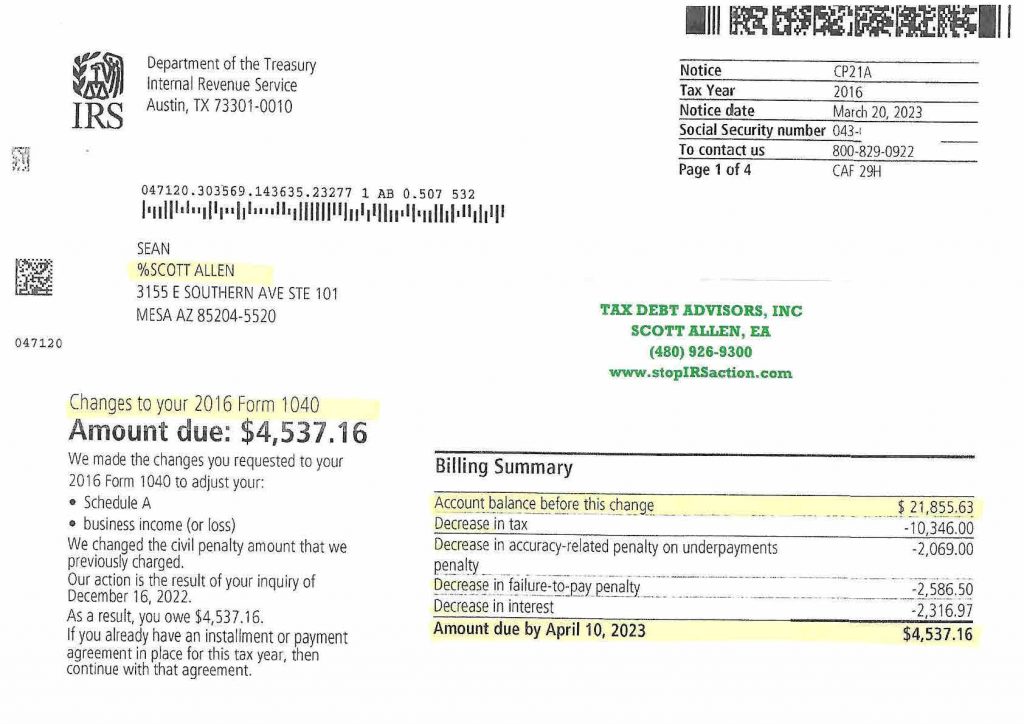

Tax Debt Advisors, Inc. is a leading tax debt relief company near Gilbert Arizona. They have helped thousands of clients get out of debt and get their lives back on track. Since 1977 Tax Debt Advisors, Inc has settled over 113,000 IRS debts for their clients. They offer a variety of services, including IRS payment plans, tax settlement, and tax levy removal.

They are committed to providing their clients with the best possible service. They understand that dealing with the IRS can be a stressful and overwhelming experience. That’s why they are there to help you every step of the way. They will work with you to find a solution that fits your needs and budget.

Contact us today

If you are struggling with unpaid taxes, don’t wait any longer. Contact Tax Debt Advisors, Inc. today for a free consultation. They can help you get back on track and get your life back to normal.

Testimonials

“I was so overwhelmed with my tax debt. I didn’t know where to turn. I was afraid of going to jail. But Tax Debt Advisors, Inc. helped me get everything taken care of. They were so patient and understanding. I would highly recommend them to anyone who is struggling with unpaid taxes.” – John J.

“I was so stressed out about my tax debt. I didn’t know how I was going to pay it off. But Tax Debt Advisors, Inc. came to the rescue. They negotiated with the IRS on my behalf and got me a payment plan that I can afford. I am so relieved and grateful.” – Jamie S.

Conclusion

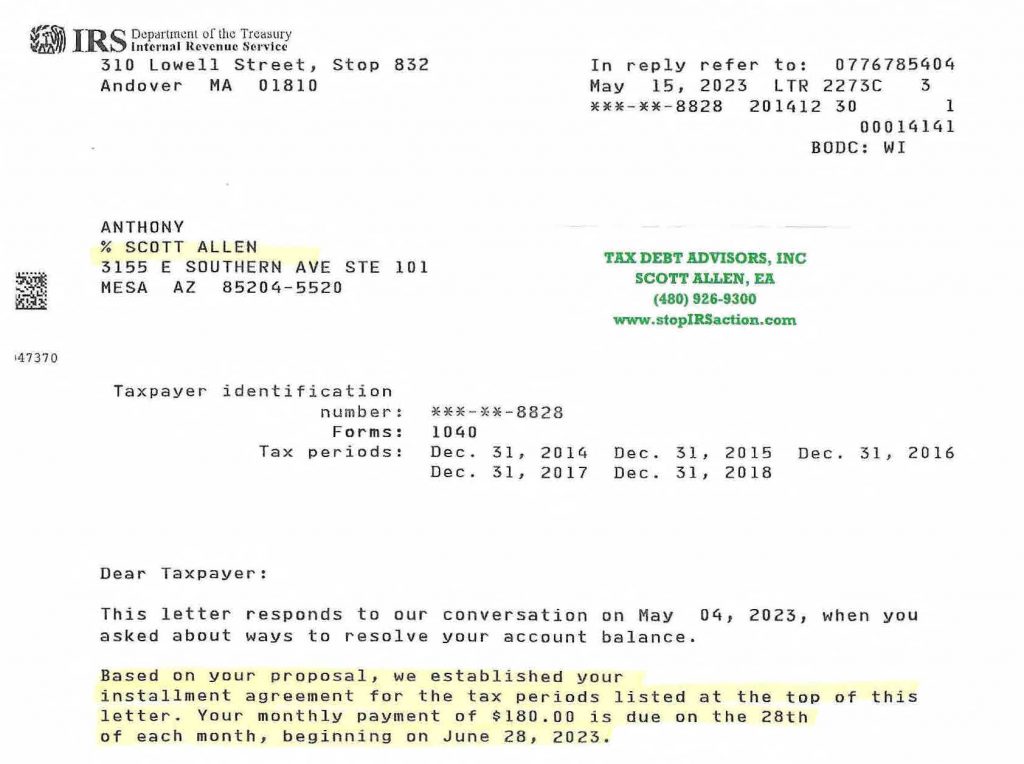

If you are struggling with unpaid taxes, don’t wait any longer. Contact Tax Debt Advisors, Inc. today for a free consultation. They can help you get back on track and get your life back to normal. See how Scott Allen EA of Tax Debt Advisors, Inc represented Anthony and negotiated five years of back taxes owed into one low monthly payment plan settlement.