Phoenix AZ IRS Negotiation work

Phoenix AZ IRS Negotiation by Tax Debt Advisors, Inc

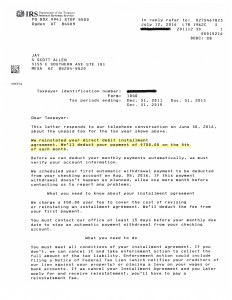

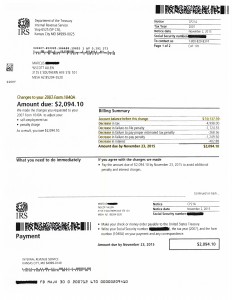

Jay was defaulting on his payment plan and needed a new Phoenix AZ IRS Negotiation done. His biggest worry was having the IRS file a federal tax lien against his credit. It is understood that on most payment plans with the IRS they will file a tax lien to protect their interest. There are some exceptions to that rule however. If you owe the IRS in total less then $50,000 you can prevent an IRS tax lien. Once a federal tax lien has been filed it cannot be removed until the debt is paid off in full, settled in an offer in compromise, or been on a payment plan and now owe less then $25,000.

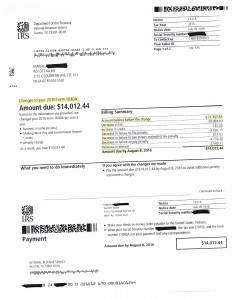

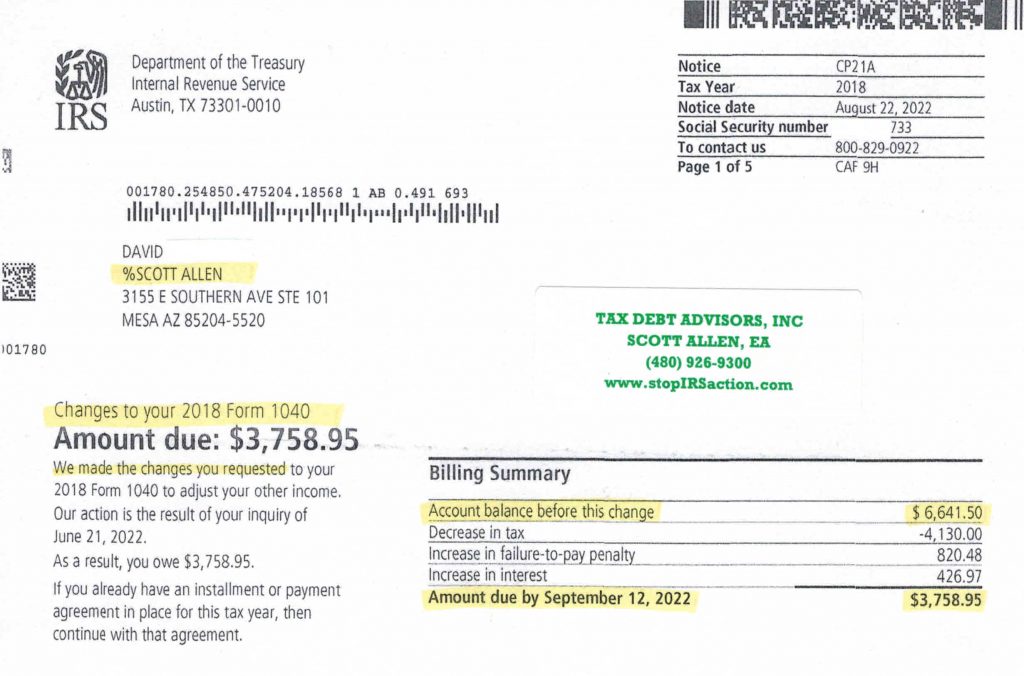

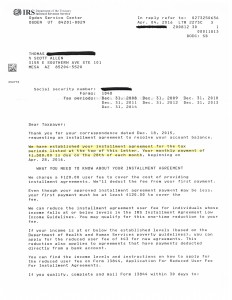

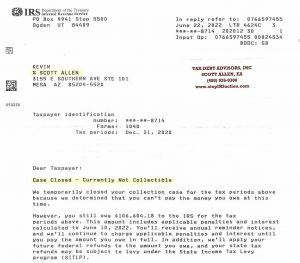

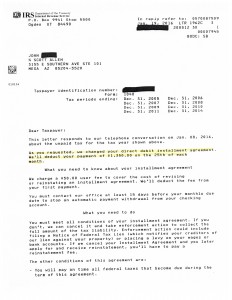

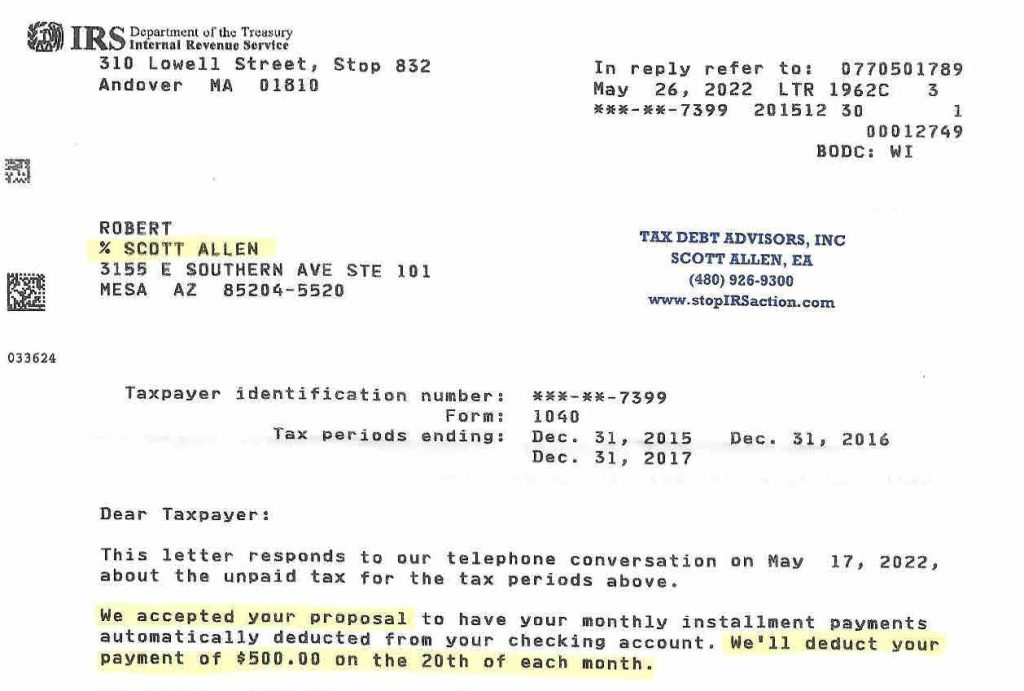

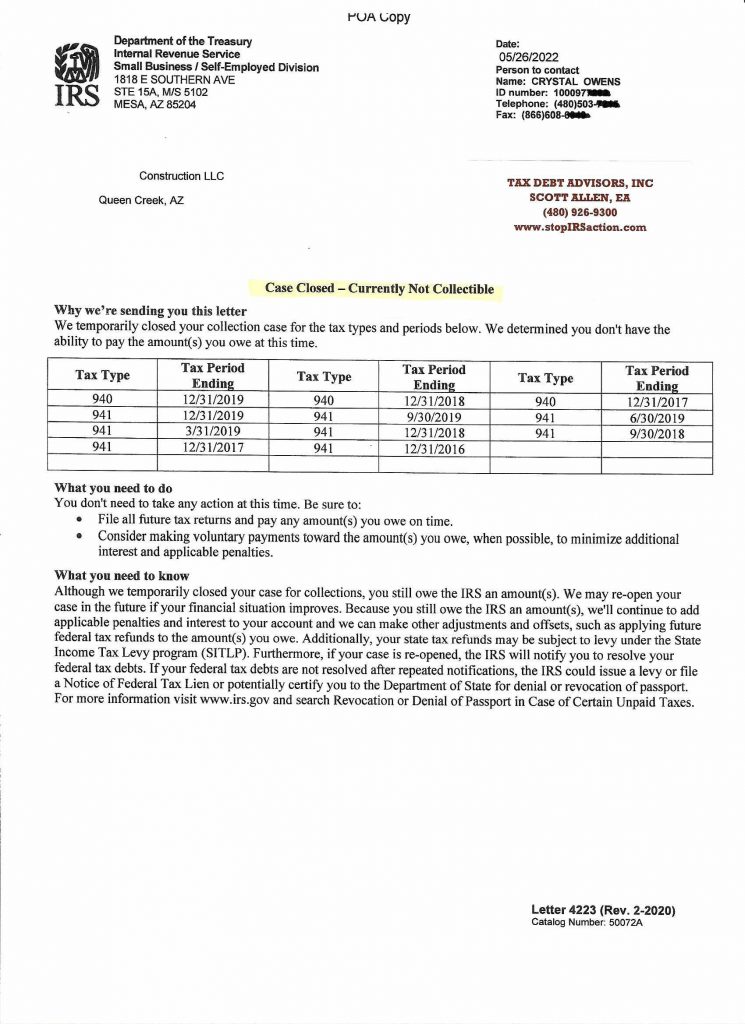

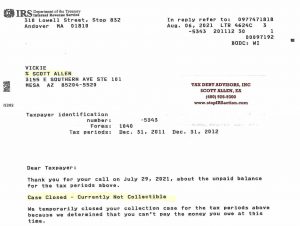

Because Jay had defaulted his installment arrangement with the IRS he was at risk to them placing a tax lien against him. However, with a proper strategy this could be avoided. This is exactly what Tax Debt Advisors did for him. Given Power of Attorney, Scott Allen EA contacted the IRS right away to hold off collection activity so time could be allowed to get the taxpayer back into compliance. Updating the financial information it was determined that they could get a new payment plan reestablished as a direct debit arrangement for $700 per month. At this amount the IRS did not file a federal tax lien and the taxpayers can continue on with their Phoenix AZ IRS negotiation.

Click on the picture below and see the actual settlement negotiated by Scott Allen EA for his client Jay.

If you would like to evaluate your settlement options with the IRS contact and meet with Scott Allen EA of Tax Debt Advisors. They are a local and family owned practice since 1977. That is over 44 years of successes.

More Phoenix AZ IRS Negotiation work

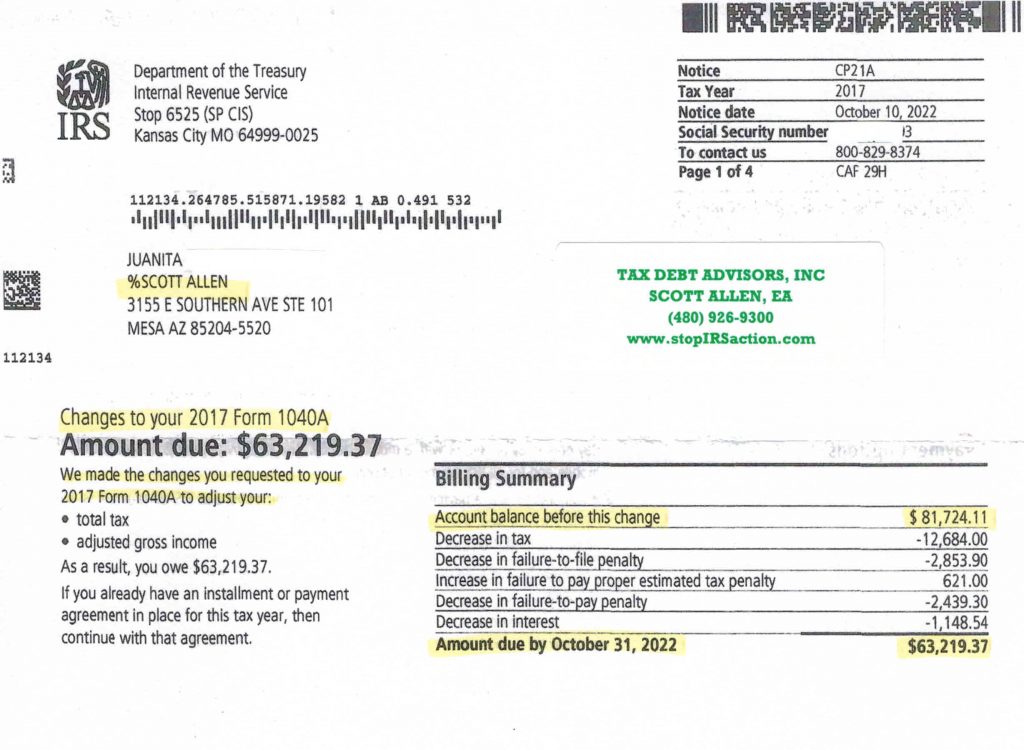

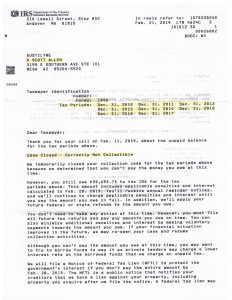

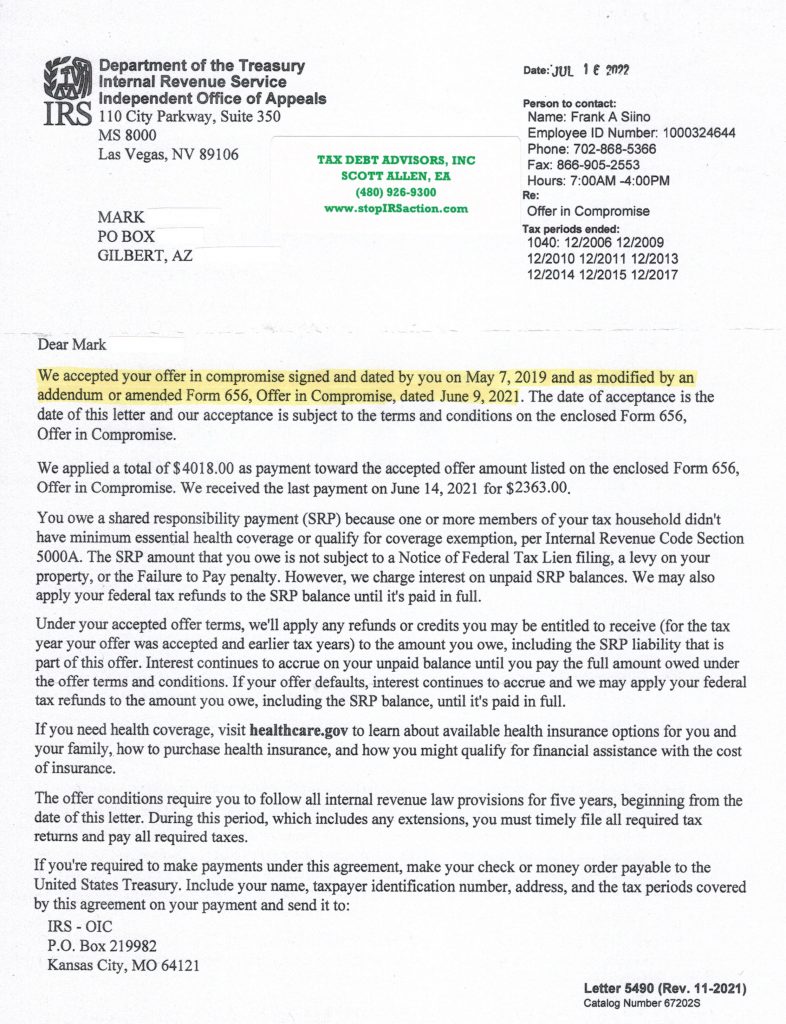

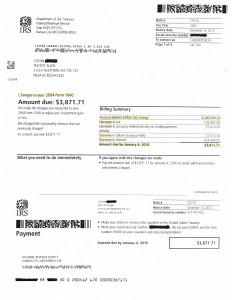

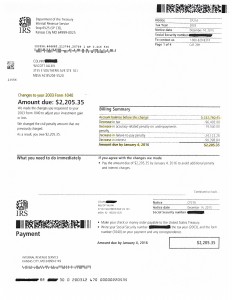

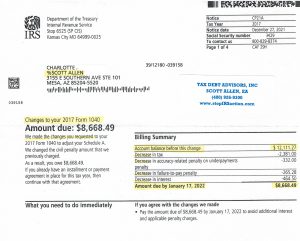

Juanita was given nearly an $82,000 tax bill from the IRS on her 2017 tax year. She realized she made good money that year being self employed but it wasn’t “that” good. Scott Allen EA was able to be her IRS power of attorney and research the matter in her behalf. When the IRS assessed her the $82,000 tax bill they didn’t incorporate any of her operating business expenses. With this being said, Scott was able to prepare and file a protest to the IRS’s decision and get a proper return accepted by the IRS. As you can see below $18,505 was removed from her tax bill. That includes the tax, interest and penalties.

Again, its not always safe to go at the IRS on your own. Scott Allen EA will always meet with you for a free initial consultation to see if he can be an asset to you in resolving your tax matter. Tax Debt Advisors, Inc has been doing Phoenix AZ IRS negotiation work for over 44 years.