Hiring Tax Debt Advisors, Inc. for Tempe, AZ Unfiled Tax Returns: A Comprehensive Guide

Introduction:

Managing your taxes can be a complex and overwhelming task, especially when faced with Tempe, AZ unfiled tax returns. When you find yourself in such a situation, seeking professional help becomes crucial to navigate through the intricacies of tax debt. In Tempe, Arizona, one notable company that specializes in tax debt relief is Tax Debt Advisors, Inc. In this blog post, we will explore the benefits of hiring Tax Debt Advisors, Inc. for unfiled tax returns in Tempe, AZ, and shed light on their expertise, services, and approach to resolving tax-related issues.

1. Understanding Tax Debt and Unfiled Tax Returns:

Before delving into the specifics of Tax Debt Advisors, Inc., let’s first grasp the significance of unfiled tax returns and tax debt. Unfiled tax returns refer to situations where an individual or business fails to submit their tax returns to the Internal Revenue Service (IRS) within the designated time frame. This can lead to a multitude of complications, such as penalties, interest charges, and even legal consequences.

2. The Importance of Professional Assistance:

When dealing with Tempe, AZ unfiled tax returns, seeking the assistance of a professional tax debt advisor is highly recommended. These experts possess the knowledge, experience, and understanding of tax laws and regulations to help individuals and businesses navigate their way out of tax debt and resolve their unfiled tax return issues efficiently.

3. Introducing Tax Debt Advisors, Inc.:

Tax Debt Advisors, Inc. is a reputable tax relief company based near Tempe, AZ. They specialize in assisting individuals and businesses facing tax debt problems, including unfiled tax returns. Their team of experienced tax professionals strives to provide personalized solutions to their clients’ tax-related issues, helping them regain financial stability and peace of mind.

4. Expertise and Services Provided:

Tax Debt Advisors, Inc. boasts a wide range of expertise and services tailored to address tax debt concerns. Some of the key services they offer include:

a) Tempe, AZ Unfiled Tax Return Assistance: Tax Debt Advisors, Inc. assists clients in resolving their unfiled tax return issues by guiding them through the process of filing outstanding tax returns accurately and efficiently. They understand the complexities involved and work diligently to ensure compliance with IRS requirements.

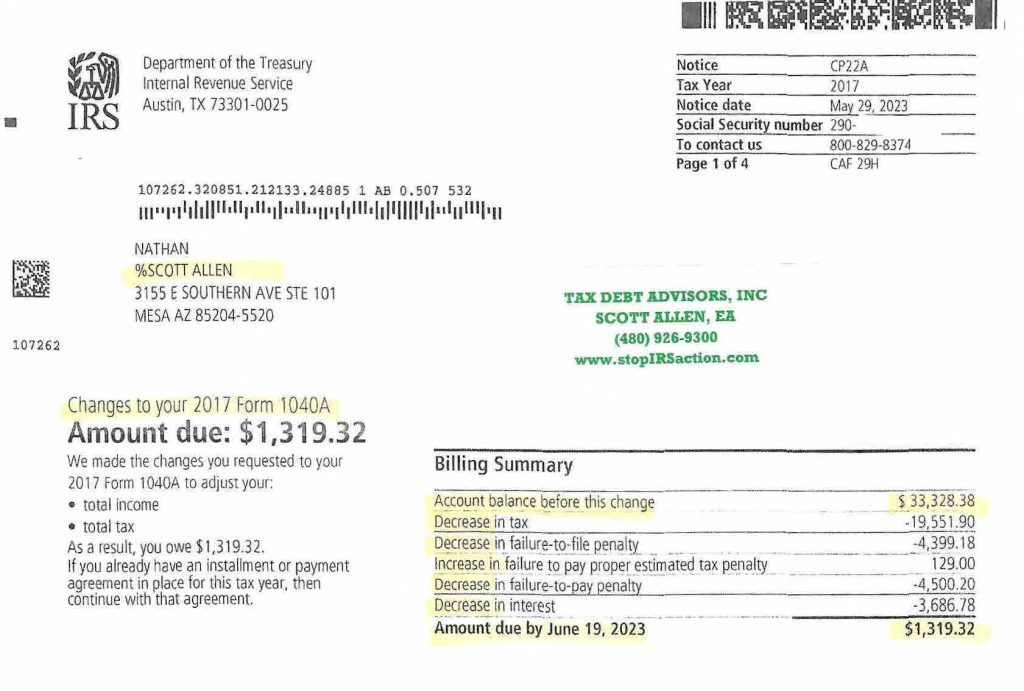

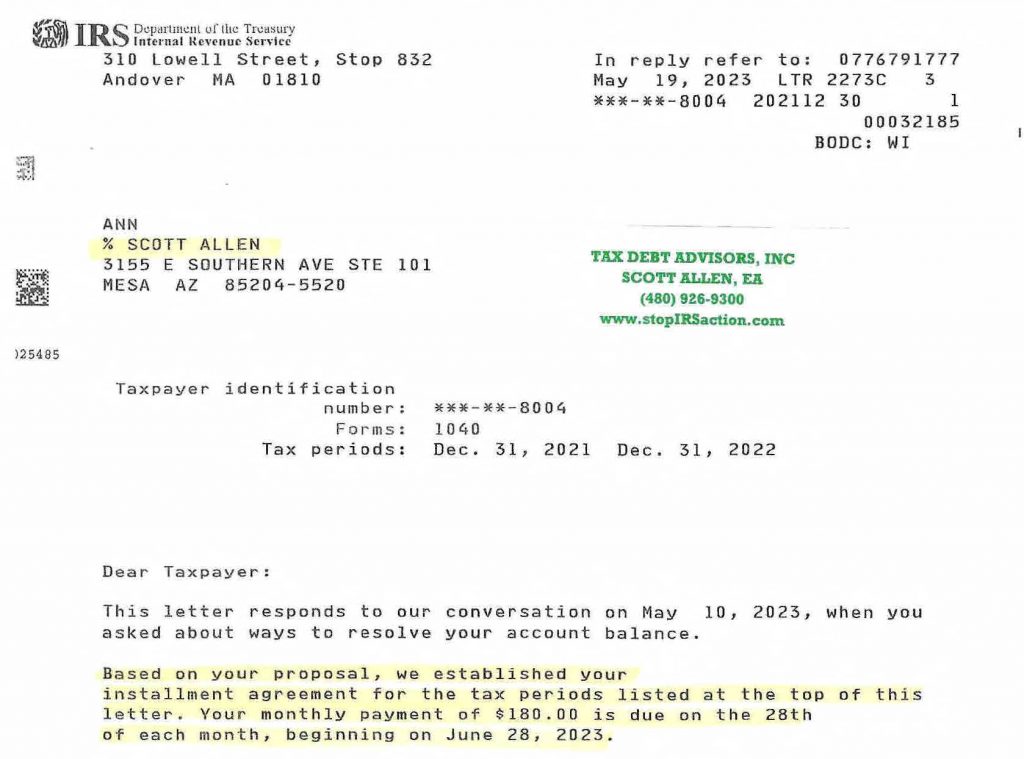

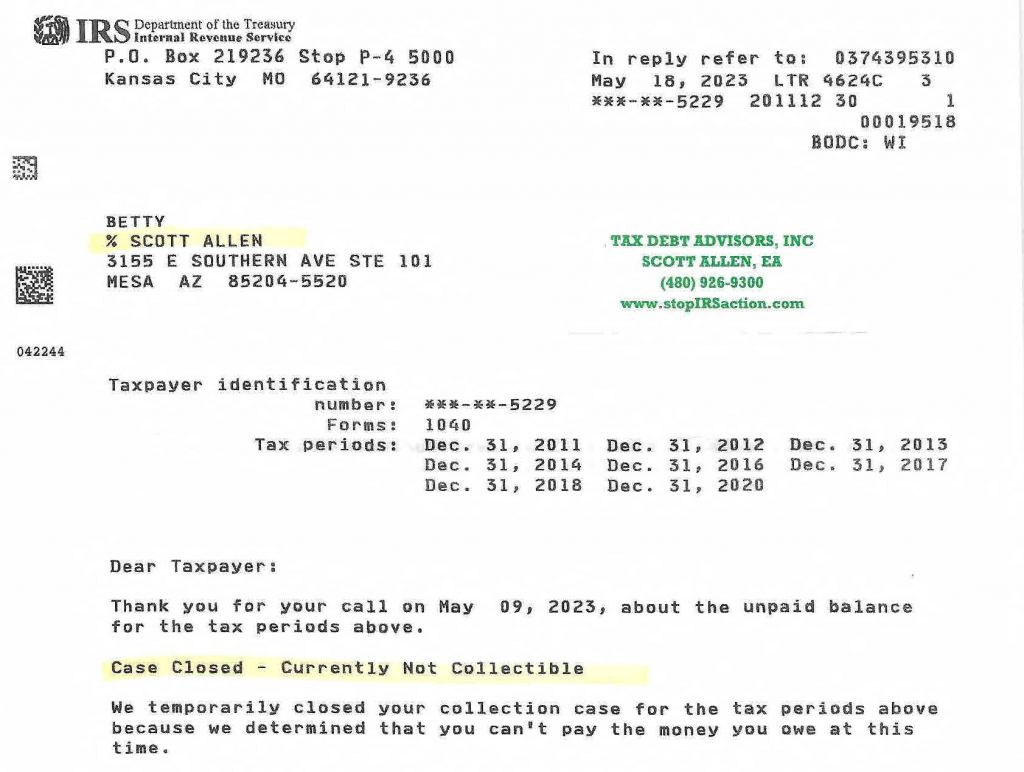

b) Tax Debt Settlement: The company helps individuals and businesses negotiate and settle their tax debts with the IRS. Their team of experts examines the unique financial circumstances of each client and devises a strategic plan to achieve the most favorable outcome possible, whether it be an installment agreement, an offer in compromise, or another suitable resolution option.

c) IRS Audit Representation: In the unfortunate event of an IRS audit, Tax Debt Advisors, Inc. provides professional representation to ensure the client’s rights are protected. Their experienced tax professionals navigate through the audit process, handle communication with the IRS, and work towards a fair and reasonable resolution.

d) Penalties and Interest Abatement: Tax Debt Advisors, Inc. also assists clients in reducing or eliminating penalties and interest charges imposed by the IRS. By leveraging their expertise and knowledge of tax laws, they pursue avenues for penalty abatement and interest reduction, potentially saving clients a substantial amount of money.

5. The Process of Hiring Tax Debt Advisors, Inc.:

To engage the services of Tax Debt Advisors, Inc., interested individuals and businesses can follow a straightforward process:

a) Initial Consultation: The first step involves scheduling an initial consultation with Tax Debt Advisors, Inc. During this meeting, clients can discuss their specific tax debt issues, including unfiled tax returns, and gain valuable insights into how the company can assist them.

b) Case Evaluation: After the initial consultation, Tax Debt Advisors, Inc. conducts a thorough case

evaluation. They examine the client’s financial situation, outstanding tax returns, and other relevant factors to devise a personalized plan of action.

c) Service Proposal: Following the case evaluation, the company presents a service proposal outlining the recommended strategies, associated costs, and potential outcomes. This proposal provides clients with a clear understanding of the steps involved and allows them to make an informed decision.

d) Implementation and Resolution: Once the client approves the service proposal, Tax Debt Advisors, Inc. commences the implementation phase. Their team of experts works diligently to resolve the tax debt issues, taking care of the necessary paperwork, negotiations with the IRS, and any other required actions.

6. The Benefits of Hiring Tax Debt Advisors, Inc.:

Engaging the services of Tax Debt Advisors, Inc. for unfiled tax returns in Tempe, AZ, offers several benefits, including:

a) Expertise and Experience: The company’s team of tax professionals possesses extensive knowledge and experience in dealing with tax debt and unfiled tax returns. They are well-versed in IRS regulations and can leverage their expertise to provide tailored solutions.

b) Tailored Solutions: Tax Debt Advisors, Inc. understands that each client’s situation is unique. Therefore, they craft personalized strategies to address their specific tax debt issues, ensuring the best possible outcome for their clients.

c) Reduced Stress and Time Savings: Handling unfiled tax returns and tax debt matters can be incredibly stressful and time-consuming. By hiring Tax Debt Advisors, Inc., individuals and businesses can alleviate this burden and focus on their core responsibilities while the professionals handle the complexities of tax resolution.

d) Improved Compliance and Legal Protection: By working with a reputable tax debt relief company, clients can ensure compliance with IRS regulations and protect themselves from potential legal consequences associated with unfiled tax returns.

Conclusion:

When faced with unfiled tax returns in Tempe, AZ, seeking professional assistance is essential to navigate the complexities of tax debt and find a viable resolution. Tax Debt Advisors, Inc. offers expertise, personalized solutions, and comprehensive services to help individuals and businesses overcome their tax-related challenges. By partnering with Tax Debt Advisors, Inc., clients can regain financial stability, achieve peace of mind, and move forward with confidence towards a more secure financial future. They can be reached at 480-926-9300